Ricky Wen hosts the ES Trade Alerts service at ElliottWaveTrader.net, and also contributes his nightly KISS Report on the E-mini S&P 500 (ES) as well as educational posts to Avi's Market Alerts service.

Ricky Wen hosts the ES Trade Alerts service at ElliottWaveTrader.net, and also contributes his nightly KISS Report on the E-mini S&P 500 (ES) as well as educational posts to Avi's Market Alerts service.

Ricky is a full time trader and mentor who has been trading professionally since 2009, focusing on stock options and the ES futures. He is known for his mastery of candlesticks trading, moving averages, chart patterns and feedback loops. He has also developed his own proprietary Hourly Extreme Oversold/Overbought signals.

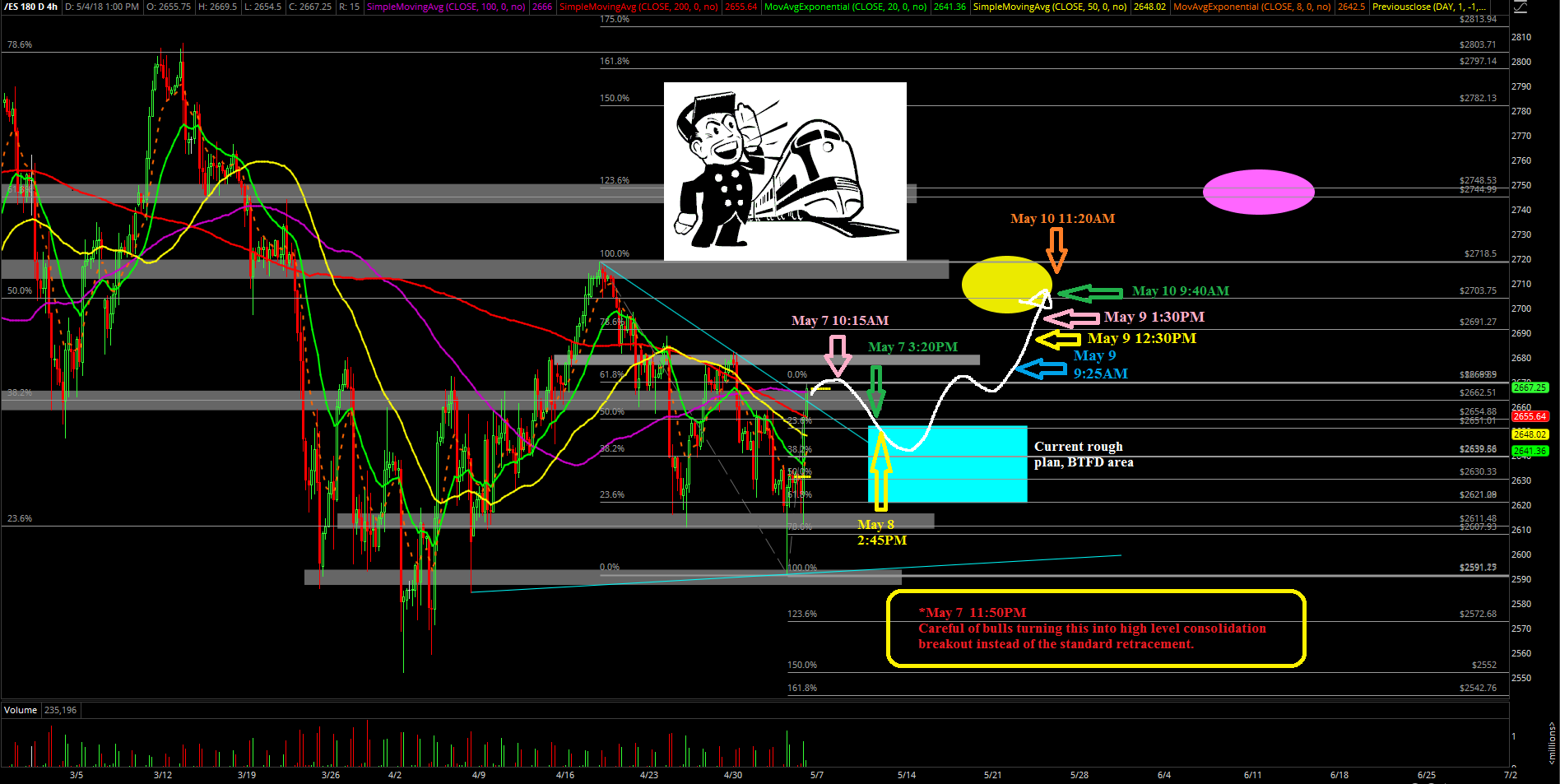

In his KISS report each Sunday evening, he includes a market projection for the week drawn in white, with an occasional "alt" projection in red. See example below of Ricky's white-line projection for the week of May 6, annotated later with the actual points the ES reached in mirroring the projection.

Ricky's articles have appeared on sites such as Nasdaq.com, Gold-Eagle, Money Show and others.

I live Finance. 80hrs a week corp finance. I trade as a hobby and in my opinion this is the best site in the world for someone to learn about markets... i rue the day when it is no more or its core is changed. there is NO BETTER SITE IN THE WORLD to get the off-cuff input/feedback/knowledge across ALL MARKETS like this site... Thank you to the analysts here who grind out thousands of charts each week."GibsonDog" - Trading Room

My faith in God and my faith in Avi and his team. God lead me to this service over 10 years ago. For a decade I have heard Avi point his bat at this very moment in time calling this S&P level. Though the years I have witnessed him point his bat months, even years before metals hit their highs and lows with almost perfect big picture accuracy. Against every other analysts opinion. I have seen him bullied relentlessly on his public articles on SA and stick to his guns and proven so correct with no one ever apologizing or admitting he called it."sdmavrick" - Seeking Alpha

My AUM has grown exponentially because of you and I can't thank you enough. My biggest regret is not signing up sooner! You've done more good than you will ever know."AAMilne" - Trading Room

I’ve subscribed for 5 years now and I have to say I see that you’ve been right on this the whole time. Who would’ve thought gold and silver would’ve rallied with rates this high for this long and the markets continued higher as well. Always thought your charts were good but always thought in the back of my mind that rate cuts and other news actually led. So now that I’ve admitted defeat u are free to gloat. Well deserved"Lil_G" - Seeking Alpha

I worked on trading desks at top investment banks for 10 years, then traded on my own for another 8. I've seen 100s of research from the best analysts in the business. Avi and EWT is the only one I'm willing to pay for right now."tzeyi" - Seeking Alpha

“I was 100% in equities and been killing it for 2 years, but I heeded your warning and took everything off the table. I've been cautiously trading your recommendations and now when everyone I know is getting wrecked, I'm still profiting. Thank you so much for what you do, my family and future are safe because of it.”"DoctorBeat" - Trading Room

This service has not only made me money in trades but equally important it got me out of the market before the meltdown."BigDaddyTuna" - Trading Room

"Your service and insight is phenomenal, and has definitely changed my outlook on the market. I’ve been actively working on recruiting new members to your service. It’ll save their financial life.""Bidking82" - Trading Room

"Today, I achieved my highest weekly profit ever ....I see this as a testament to the power of the guidance available here. I ignored all narratives and traded the charts with discipline. I set clear parameters for each trade, immediately placing OCO (One Cancels the Other) orders with both stops and limits. I made some adjustments as the charts evolved, but kept the orders in place, and allowed the process to unfold. Sincere thanks to all the analysts and members who help make this such an incredible community—especially Avi, Zac, Mike, Levi, and Garrett. I'm incredibly grateful!""Dre-" - Trading Room

CNBC had a stat this morning that over the last 20 years 86% of money managers/hedge funds have underperformed the market. They couldn't figure out why that’s the case given how 'smart' these people are. . . . I know my performance since joining the site has skyrocketed!"HenryH" - Trading Room

We use cookies to enhance your browsing experience and analyze our traffic. By clicking "Accept All" you consent to our use of cookies. Privacy Policy