Ongoing Tech Led Breakout While Equal Weighted Market Remains Unenthusiastic

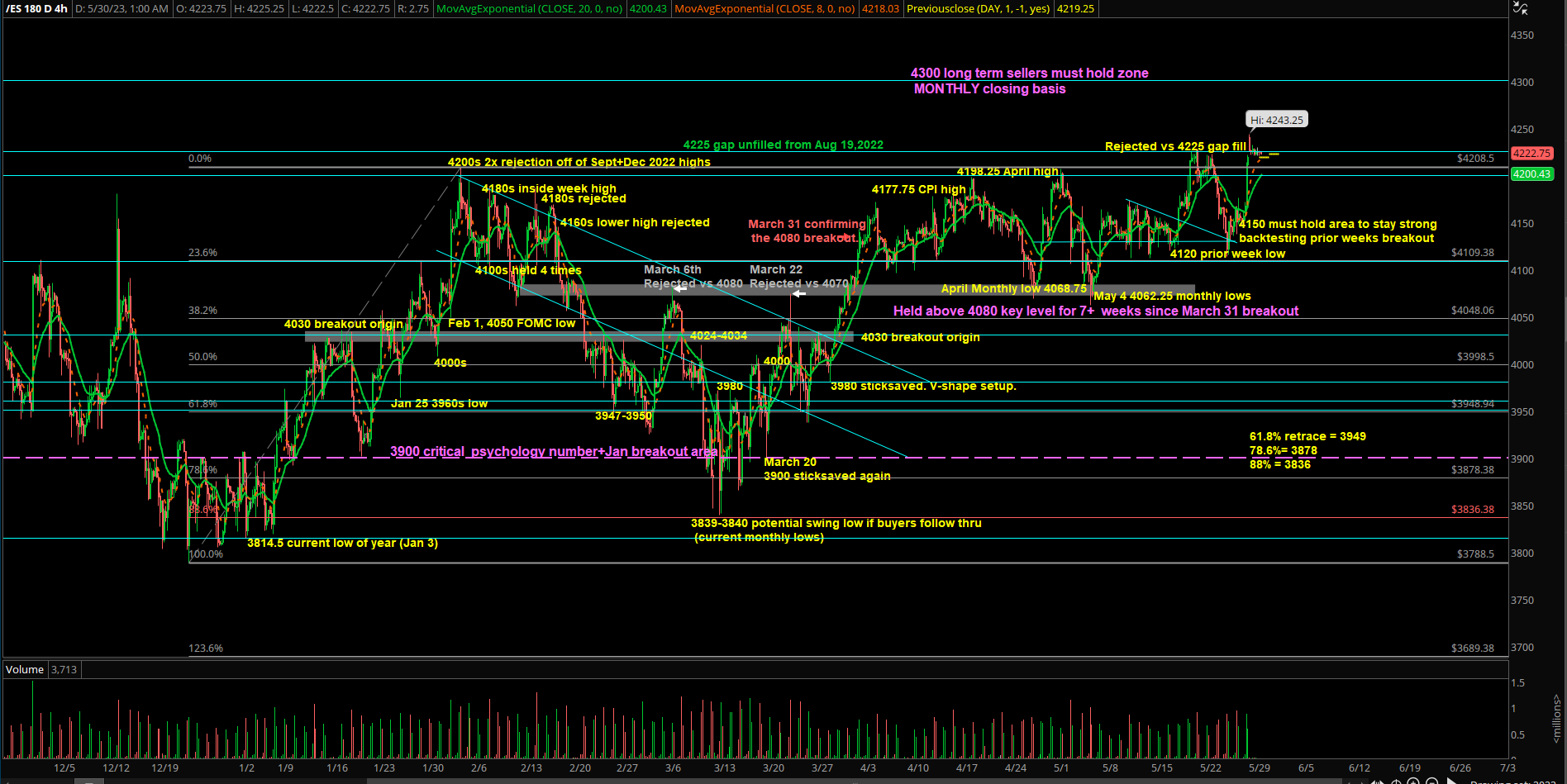

Here are our key weekly parameters going into May month end and first week of June. There's an ongoing breakout attempt at the ES 4200s Q1 high and trying to expand its target into 4300s (upper end of our approximately 13-month range).

Given this ongoing breakout attempt and context on ES, the price action now must hold above 4150 on a daily/weekly closing basis to continue higher towards 4300

Conversely, at this point, any daily/weekly closing basis below 4150 would be the first indication of breakout failure/bull trap. Then, it could open downside targets such as 4115/4080/4060s (April+May monthly lows area as a target for the sellers)

As of the weekend report, buyers continue to dominate over sellers, so you must know your timeframes and trade accordingly to the environment

Bonus: NQ 13950-14000 will be a key daily-weekly contention support zone moving forward, given the breakout acceleration mode from NQ/tech land.

Here are our intraday trading parameters for Tuesday's session: The main USA timing catalyst events for this shortened week will be Consumer Confidence on Tues, Chicago PMI +JOLTS on Weds, ADP Employment+Jobless claims+PMI+ISM on Thursday and NFP Friday, alongside the debt ceiling news feed. Overall, the latter half of the week seems more important.

The intermediate/long term bias remains down (since last year) when below ES 4200/4300, while short term is bullish, so it’s the same ongoing major battle between the timeframes. There's been a prolonged 8-week or so consolidation, so a massive expansion will eventually come.

If you recall the most significant part of last week: Wednesday May 24th ES poked below our key 4150 level intraday, but closed the day just above 4150. By end of week, ES closed at a new weekly high of 4219s. NQ closed at 14360s (new monthly high) cementing a +3.8% weekly performance.

Wednesday is the last day of the month, so the natural expectation is price action will be consolidating, back-filling, and parking the price around the monthly highs here to wrap up the month. Then, later this week paired with timing catalysts, expect more trend continuation towards 4300 if ongoing supports keep grinding higher and holding.

If RTH opens above or sustains ES 4200, we expect responsive buyers to defend this backfill area back to 4212/4225/4238/4250. Any break above 4238 could open up vertically acceleration mode into 4300 target.

If RTH opens below or sustains below 4200, be aware of a bigger retracement to 4180/4165/4150 where the latter was last week’s must hold level on a daily closing basis.

Any break below 4150 would put this current breakout in jeopardy and open a large bull trap.

Bonus: NQ 13950-14000 will be a key daily-weekly contention support zone moving forward, given the breakout acceleration mode from NQ/tech land.