Avi Gilburt is founder of ElliottWaveTrader.net, a live trading room and member forum focusing on Elliott Wave market analysis. Avi emphasizes a comprehensive reading of charts and wave counts that is free of personal bias or predisposition. He is particularly known for identifying a standardized method to trade waves 3-5 with extraordinary accuracy once waves 1 and 2 are in place. This method, which we call "Fibonacci Pinball," has been widely lauded and called "a powerful market tracking tool" and "nothing short of amazing."

Avi is an accountant and a lawyer by training. His education background includes his graduating college with dual accounting and economics majors, and he then passed all four parts of the CPA exam at once right after he graduated college. He then earned his Juris Doctorate in an advanced two and a half year program at the St. John’s School of Law in New York, where he graduated cum laude, and in the top 5% of his class. He then went onto the NYU School of Law for his masters of law in taxation (LL.M.).

Before retiring from his legal career, Avi was a partner and National Director at a major national firm. During his legal career, he spearheaded a number of acquisition transactions worth hundreds of millions to billions of dollars in value. So, clearly, Mr. Gilburt has a detailed understanding how businesses work and are valued.

Yet, when it came to learning how to accurately analyze the financial markets, Avi had to unlearn everything he learned in economics in order to maintain on the correct side of the market the great majority of the time. In fact, once he came to the realization that economics and geopolitics fail to assist in understanding how the market works, it allowed him to view financial markets from a more accurate perspective.

In September 2011, Avi co-founded ElliottWaveTrader.net in conjunction with Richard Hefter and AdviceTrade.

Since Avi began providing his analysis to the public, he has made some spectacular market calls which has earned him the reputation of being one of the best technical analysts in the world.As an example of some of his most notable astounding market calls, in July of 2011, he called for the USD to begin a multi-year rally from the 74 region to an ideal target of 103.53. In January of 2017, the DXY struck 103.82 and began a pullback expected by Avi.

As another example of one of his astounding calls, Avi called the top in the gold market during its parabolic phase in 2011, with an ideal target of $1,915. As we all know, gold hit a high of $1,921, and pulled back for over 4 years since that time. The night that gold hit its lows in December of 2015, Avi was telling his subscribers that he was on the phone with his broker buying a large order of physical gold, while he had been accumulating individual miner stocks that month, and had just opened the EWT Miners Portfolio to begin buying individual miners stocks due to his expectation of an impending low in the complex.

One of his most shocking calls in the stock market was his call in 2015 for the S&P500 to rally from the 1800SPX region to the 2600SPX region, whereas it would coincide with a “global melt-up” in many other assets. Moreover, he was banging on the table in November of 2016 that we were about to enter the most powerful phase of the rally to 2600SPX, and he strongly noted that it did not matter who won the 2016 election in the US, despite many believing that the market would “crash” if Trump would win the election. This was indeed a testament to the accuracy of the Fibonacci Pinball method that Avi developed.

View chart of Avi's 2016 SPX performance calls.

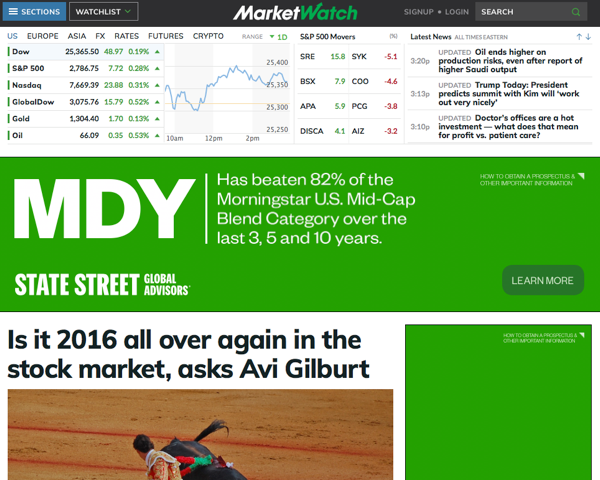

See Avi's article on MarketWatch from Jun 11, 2018 (in which he called for a year-end global melt-up) highlighted as the top home page headline that day.

See Avi's article on MarketWatch from Jun 11, 2018 (in which he called for a year-end global melt-up) highlighted as the top home page headline that day.

In 2020, Avi's charts missed the March 23 low in the S&P 500 by just 4 points, with his low-end target at 2187.90 while the index bottomed at 2191.86. Further, in February 2020, Avi outlined a short trade for members in the EEM in the 44-45 region with an ideal target below the 1.0 extension in the 31 region, which the EEM reached and then some.

Avi also called the bottom to the SPX back in October 2022, despite most market participants expecting the index to have head much lower at the time due to the worse than expected CPI report at the time. And he indicated at the time he was leaving the door open for the market to still be able to rally back to the 5000+ region before a multi-year bear market begins.

Avi is a popular speaker at financial forums and conferences in the U.S. and internationally, including The Money Show / Traders Expo, the New Orleans Investment Conference, and Prospectors & Developers Association of Canada (PDAC) Conference, and widely syndicated on sites including Seeking Alpha, Investing.com, Gold Eagle, Nasdaq.com, Barchart and more. His The Market Pinball Wizard service is consistently among the top 3 most popular services out of over 150 services on Seeking Alpha.

I live Finance. 80hrs a week corp finance. I trade as a hobby and in my opinion this is the best site in the world for someone to learn about markets... i rue the day when it is no more or its core is changed. there is NO BETTER SITE IN THE WORLD to get the off-cuff input/feedback/knowledge across ALL MARKETS like this site... Thank you to the analysts here who grind out thousands of charts each week."GibsonDog" - Trading Room

My faith in God and my faith in Avi and his team. God lead me to this service over 10 years ago. For a decade I have heard Avi point his bat at this very moment in time calling this S&P level. Though the years I have witnessed him point his bat months, even years before metals hit their highs and lows with almost perfect big picture accuracy. Against every other analysts opinion. I have seen him bullied relentlessly on his public articles on SA and stick to his guns and proven so correct with no one ever apologizing or admitting he called it."sdmavrick" - Seeking Alpha

My AUM has grown exponentially because of you and I can't thank you enough. My biggest regret is not signing up sooner! You've done more good than you will ever know."AAMilne" - Trading Room

I’ve subscribed for 5 years now and I have to say I see that you’ve been right on this the whole time. Who would’ve thought gold and silver would’ve rallied with rates this high for this long and the markets continued higher as well. Always thought your charts were good but always thought in the back of my mind that rate cuts and other news actually led. So now that I’ve admitted defeat u are free to gloat. Well deserved"Lil_G" - Seeking Alpha

I worked on trading desks at top investment banks for 10 years, then traded on my own for another 8. I've seen 100s of research from the best analysts in the business. Avi and EWT is the only one I'm willing to pay for right now."tzeyi" - Seeking Alpha

“I was 100% in equities and been killing it for 2 years, but I heeded your warning and took everything off the table. I've been cautiously trading your recommendations and now when everyone I know is getting wrecked, I'm still profiting. Thank you so much for what you do, my family and future are safe because of it.”"DoctorBeat" - Trading Room

This service has not only made me money in trades but equally important it got me out of the market before the meltdown."BigDaddyTuna" - Trading Room

"Your service and insight is phenomenal, and has definitely changed my outlook on the market. I’ve been actively working on recruiting new members to your service. It’ll save their financial life.""Bidking82" - Trading Room

"Today, I achieved my highest weekly profit ever ....I see this as a testament to the power of the guidance available here. I ignored all narratives and traded the charts with discipline. I set clear parameters for each trade, immediately placing OCO (One Cancels the Other) orders with both stops and limits. I made some adjustments as the charts evolved, but kept the orders in place, and allowed the process to unfold. Sincere thanks to all the analysts and members who help make this such an incredible community—especially Avi, Zac, Mike, Levi, and Garrett. I'm incredibly grateful!""Dre-" - Trading Room

CNBC had a stat this morning that over the last 20 years 86% of money managers/hedge funds have underperformed the market. They couldn't figure out why that’s the case given how 'smart' these people are. . . . I know my performance since joining the site has skyrocketed!"HenryH" - Trading Room

We use cookies to enhance your browsing experience and analyze our traffic. By clicking "Accept All" you consent to our use of cookies. Privacy Policy