The Basics of Fibonacci Pinball

I know many still seem to have a lot of questions regarding Fibonacci Pinball. I have described it several times on our webinars in the library, with examples, and I suggest you go there for further clarification. But, I wanted to also attempt to explain it in writing and with pictures (courtesy of Garrett) so that you are able to study it in written form.I also want to encourage you to view Garrett's slide show presentation on Fibonacci Pinball.

While I was learning Elliott Wave on my own, I was trying to obtain a more “track-able” and “tradable” understanding of the fractal nature of the markets. This is probably what many struggle with the most. Specifically, it is when we say that within a 5 wave move, each impulsive wave breaks down further into 5 waves each, with some waves becoming extended.

Well, after much analysis and observation, I identified a standardized method to trade waves 3-5, once waves 1 and 2 were in place. Now, remember that this is a standardized method that is a most common phenomenon in the market, but markets can and do vary from this standardized presentation. In fact, when we deal with commodities or the VXX, often, we see extensions that far surpass the standardized extensions I present here. But, again, this scenario is seen very often in the markets and individual stocks, so I believe it is worthwhile to have a basic understanding of this structure to build upon.

This is something that I observed within the Elliott Wave structure, and have adapted it to a trading methodology, which I lovingly call Fibonacci Pinball.

Since 3rd waves in the Elliott Wave structure are the strongest and most powerful of all the waves, it is the ideal wave to trade. Furthermore, since 3rd waves themselves have to be composed of 5 sub-waves, it helps us determine how we trade this structure in a relatively low risk manner. Let me explain.

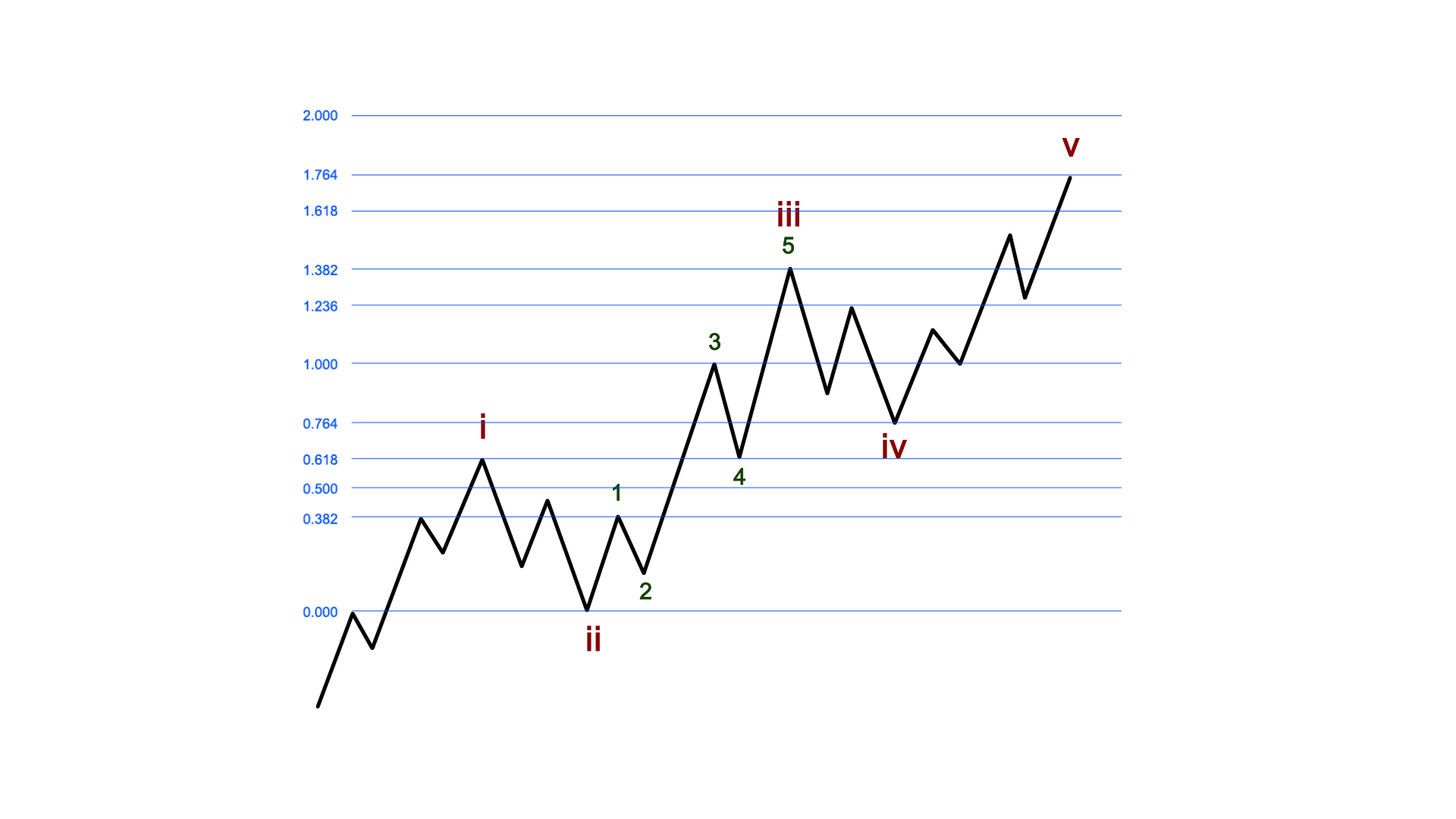

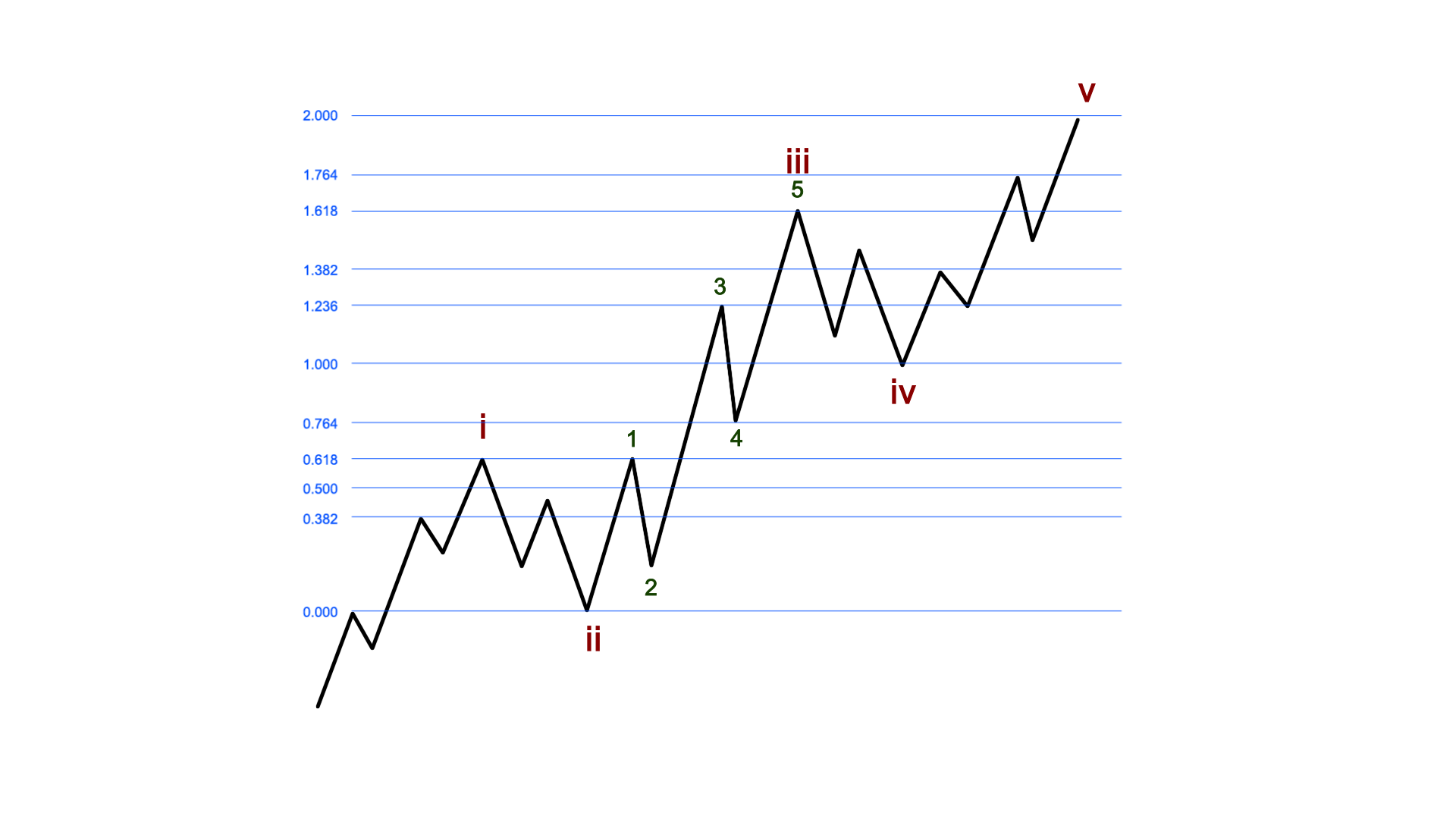

After the market or stock finds a bottom after a correction, it begins a new uptrend. Such uptrends take the form of a 5 wave Elliott Wave structure, as represented by the two attached charts. And, since I hope most of you can count to 5, the general chart does not need much explanation.

However, what I do want to point out is that each of the impulsive waves – waves 1, 3 and 5 – are all comprised of 5 waves each, and waves 2 and 4 are comprised of 3 waves each. So effectively, each impulsive wave can be further broken down to a 5 wave structure ad-infinitim. This is what we mean by the fact that the market is fractal in nature. It means that the patterns are self-similar at all different degrees of scale.

Now, since wave 3 is subdivided into 5 waves, and once we have waves 1 and 2 in place, it makes trading the rest of waves 3, 4 and 5 relatively easy to prognosticate in a standard impulsive wave. This is what I refer to as Fibonacci Pinball.

Allow me to explain. Once waves 1 and 2 are set up, we then set up our Fibonacci extension based upon those two waves. Since wave 3 subdivides into 5 waves, we can use the Fibonacci extensions to provide guidance as to how wave 3 will now develop.

Wave 1 within roman numeral wave iii will often target the .382 or .618 extension. We will then see a pullback for wave 2 to the .500 or .618 retracement region of wave 1. From this point, the market will usually target either the 1.00 extension for wave 3 of roman numeral iii, or as high as the 1.236 extension. We will then see a pullback towards either the .618 extension or the .764 extension, depending upon which extension the market targeted for wave 3 of roman numeral iii.

Depending upon if the wave 3 targets the 1.236 or 1.00 extension, if the market were to break down below the .764 extension or .618 extension, respectively, about 70% of the time, this is the early indication that the impulsive pattern up will ultimately fail and that the market will be coming down hard and moving below where the move began. It is the early indication of the failure of a potential 5 wave impulsive set up.

But, assuming that the market maintains support at the .764 or .618 extension, it then moves up to the 1.618 or 1.382 extensions to complete all of roman numeral wave iii. From this point, the market will usually pullback in a roman numeral wave iv back to the 1.00 extension, and then begin a final 5th wave rally to target either the 1.764 or 2.00 extension to complete the 5 wave pattern.

Now, of course, this is simply a standard framework within which we track an impulsive wave through waves 3, 4 and 5. There can be further extensions beyond the 1.618 extension that wave 3 will target, which will most likely change the targets for waves 4 and 5. But, the purpose of this exercise is to provide you with a framework through which you can track most moves for any stock, market or commodity a great majority of the time.

What makes this method so valuable is that it provides natural stops on the way up to lock in gains as each phase completes its upward trajectory.

For example, once roman numeral waves i and ii complete, and you begin wave iii, your stop is placed just under roman number wave ii. Our entry is usually for wave ii, or sometimes we will wait as long as wave 2 of roman numeral wave iii if we are a little more uncertain of the pattern.

As waves 1 and 2 within roman numeral wave iii complete, you then move your stop up below wave 2. As 3 of roman numeral wave iii proceeds to the 1.236 extension, you would then move your stops up just under the .618 extension, and as wave 5 of roman numeral wave iii moves towards the 1.618 extension, you should most likely take your profit, or, at a minimum, move your stop up just below the 1.00 extension.

What you are doing with this methodology is moving stops up continually to lock in gains, while still allowing the market to continue within its bullish trend.

The reason that I say that you should consider taking your profit at the end of wave 3 is because wave 4 is notorious for burning time in a long consolidation. This will clearly erode some of the time value you have in options that you may trade. And, since your target is the 1.00 extension lower, you can always re-enter when it gets closer to the target, but you will not lose any of the significant time factor within the options pricing.

These are some of the basics of Fibonacci Pinball, and when you are able to master these basics, you will be amazed at how accurately you can predict and trade many market moves.