Market Outlook, July 18: The Hunt For Yield Is On!

Summary

- Don't Fight the Fed: They Got Your Back!

- Inflation is snowballing: Up 5.4% Year-on-Year.

- What is Happening to the Treasury Markets?

- The technical situation.

- The Hunt for Yield is Set to Accelerate.

Market Outlook, July 18: The Hunt For Yield Is On!

During the past week, the equity markets have been drifting sideways, with the S&P 500 closing 0.5% lower for the week. As noted in my previous market outlooks, summers are usually quiet with very few players around. Most investors and traders are on holiday, so it would seem that watching the markets closely is more about killing time during this period. This bodes perfectly well for us as income investors, because time is on our side. We keep collecting our dividend paychecks without worrying about market gyrations!

The good news is that the markets remain near their all-time highs, and we keep seeing each and every dip being bought by investors, with plenty of liquidity around. We remain in a major uptrend from a technical perspective, and this is the most important point to watch right now, given that the macroeconomic fundamentals are perfect for equities today.

Don't Fight the Fed: They Got Your Back!

Another piece of great news is that Fed Chairman Powell remains as dovish as ever in the face of rising inflation. Mr. Powell did concede to the House Financial Services Committee that inflation has been "higher than we've expected and a little bit more persistent than we had expected and hoped." But Mr. Powell is not willing to do anything about inflation, and will continue to support the economy and the stock markets as we have been seeing over the past 13 years. These are some of the dovish notes from Mr. Powell's testimony on the semiannual Monetary Policy Report to Congress:

Conditions in the labor market have continued to improve, but there is still a long way to go... The pandemic-induced declines in employment last year were largest for workers with lower wages and for African Americans and Hispanics. Despite substantial improvements for all racial and ethnic groups, the hardest-hit groups still have the most ground left to regain..... At our June meeting, the FOMC kept the federal funds rate near zero and maintained the pace of our asset purchases. These measures, along with our strong guidance on interest rates and on our balance sheet, will ensure that monetary policy will continue to deliver powerful support to the economy until the recovery is complete. We continue to expect that it will be appropriate to maintain the current target range for the federal funds rate until labor market conditions have reached levels consistent with the Committee's assessment of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time..... In addition, we are continuing to increase our holdings of Treasury securities and agency mortgage-backed securities at least at their current pace until substantial further progress has been made toward our maximum-employment and price-stability goals. These purchases have materially eased financial conditions and are providing substantial support to the economy...."

Put simply, the Fed does not wish to rock the economy or the markets. They view that the risks of derailing the economic recovery far outweigh inflation risks. So Mr. Powell (and the Fed) have got our backs as equity investors. The Fed's playbook is going to be the same: support equities each time they dip just as the Fed has done for the last 13 years. This is great news for us as equity investors!

In the Meantime, Inflation Is Snowballing: Up 5.4% Year-on-Year

With almost 50% of Americans fully vaccinated, business restrictions are ending rapidly, and the demand for goods and services is quickly outpacing the ability of businesses to keep up.

The consumer price index ('CPI') rose 5.4% in June 2021 compared to the same period last year, the highest 12-month rate since August 2008. Excluding volatile items such as food and energy, the so-called core CPI rose 4.5% from June 2020, its largest advance since November 1991!

The U.S. Department of Labor reported that the retail price of used cars and trucks rose 10.5% in June amid a severe supply shortage of vehicles. While this contributed to a third of the rise of the overall index, shoppers also saw higher costs for food, energy, gasoline, airline fares, and apparel.

This inflation continues to burn hot, fueled by an increased willingness from consumers to pay higher prices, trillions of dollars in federal pandemic relief, and ample household savings. This means your buying power is shrinking, and conventional sources for yield are failing to provide you with adequate returns. Moreover, the Fed continues to support the economic recovery by keeping interest rates low and maintaining liquidity through its purchase of Treasury and mortgage bonds. The conventional fixed-income securities are of no use for the foreseeable future.

This past week, we have seen more notable figures come out saying that inflation is more than "transitory". Larry Fink of Blackrock said he expects inflation to be systematic. While many argue that inflation is "transitory", the Fed's definition of "transitory" has changed from a couple of months to 6-9 months today. More importantly, The New York Fed released its monthly "Survey of Consumer Expectations" this week, and expectations for inflation over the next year surged to the highest level (4.8%) in the history of the survey. A 4.8% inflation expectation for next year is enormous and shows how much inflation is already anchored in the system, contrary to what the Fed keeps telling us.

What Is Happening to the Treasury Markets?

The treasury markets remain a major influencer for the markets, especially for some of our picks relating to commodities and that are interest-rate sensitive like mREITs, but this is unlikely to last. Here is a look at the 10-year Treasury rate year-to-date which has dipped significantly in the past two weeks:

Source: CNBC

Source: CNBC

The recent movements go against the grain of what you might have learned in Econ-101. The "book" says that in an inflationary environment, long-term treasury yields will go up. When the economy is anticipated to grow, yields should be higher. Treasuries are often looked at as a measure of future economic strength. Rising yields are said to indicate that the economy will be stronger in the future. Declining yields are said to indicate that the economy will be weaker.

We must always be careful when using such broad generalizations. While "usually" the book is right, treasury yields are only one measure out of many. When we do our macro-analysis in our "Market Update", we are looking at many measures at the same time in order to reach an accurate conclusion.

Consider the news just in the past few weeks:

- Inflation pushes to multi-decade highs as explained above.

- Banks like Goldman Sachs (GS) and JP Morgan (JPM) started earnings season on the right foot. JPM CEO Jamie Dimon noted that consumers "remain exceptionally strong as the economic outlook continues to improve". Usually earnings of banks are the best indicator of the economic outlook, and they all point to a booming economy.

- Retail sales for June grew much more than most analysts expected.

- We are seeing substantial "M&A" (mergers and acquisitions) activity, which is one great sign that financially strong companies are looking to expand and are willing to invest. This is a common sign of economic strength.

- The stock market continues to push to all-time highs, with a "bubble of liquidity" still on the sidelines.

So clearly, the macro economic conditions paint a totally different picture of what the Treasury yields are telling us.

So Why Are Treasury Yields Shrinking?

Unless every indicator is wrong, treasury buyers today are investing at negative real yields. In other words, if you invest $1,000 in 10-year treasuries today at a 1.3% yield, in 10-years, your buying power will be less than $1,000 after adjusting for inflation, and collecting your interest. Who are all these treasury buyers? Are there really a lot of investors out there who fear an economic slowdown?

The answer is excess liquidity as I have been highlighting in my market outlooks. The Federal Reserve and the US government have injected an unprecedented amount of liquidity into the financial system. Banks are overflowing with more cash than they know what to do with. So much so that they are lending money to the Federal Reserve at near-zero interest rates.

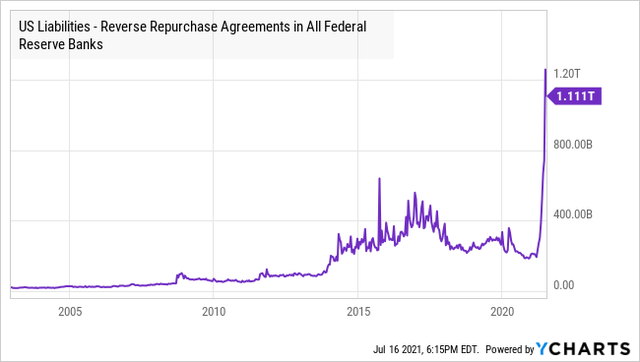

The Federal Reserve uses the "repo" market to control short-term interest rates. A repo is an agreement where the borrower sells collateral to the lender, with an agreement to repurchase it later at a slightly higher price. The Fed uses repos where it is "the lender" to inject liquidity into the financial system. Banks will borrow from the Fed, and the Fed is involved with near-infinite money to ensure that overnight borrowing rates remain very low. If the Fed wants rates lower, it lends more. "Reverse repos" are the opposite, and the Fed is the borrower. Borrowing from banks and removing liquidity from the system. "Reverse repos" have shot up to all-time highs.

This is a powerful indication that large institutions like banks and insurance companies are flush with more cash than they need. With so much cash, they are willing to earn the 0.05% interest that repos are currently paying. Even at these record rates, reverse repos only represent a fraction of the liquidity in the system.

The Fed is continuing to expand liquidity by continuing large asset purchases, buying treasuries, and MBS (Mortgage Backed Securities). So even as there are indications that liquidity is already excessive, the Fed has yet to take even the first small step of reducing asset purchases. Adding more liquidity to the system with one hand while the other struggles to remove it. Institutions overflowing with cash are parking it anywhere they can. With repos yielding only 0.05%, moving into treasuries is the next step. After all, compared to 0.05% in the repo market, 1.3% from treasuries is a huge return. This high demand for places to park excess cash (or liquidity) is what is driving treasuries prices higher, and their yields lower.

The glut of liquidity is driving treasury rates down as conservative institutions like banks have far more cash than they can use. Declining treasuries is not an indication that banks view the economy as slowing down, it is a symptom of them having more cash than they need.

The Hunt for Yield Is Set to Accelerate

This bull market is all about excess liquidity pouring into both stocks and bonds. Investors are chasing yield to park this excess liquidity.

"Falling Treasury yields" are extremely bullish for equities in general and for dividend stocks in particular. One big reason is that long-term bond yields offer much lower yields than stocks, with the S&P 500 and Dow Indexes carrying forward yields of 2-3% along with potential for capital appreciation. The HDO portfolio is of prime importance for yield hunters, with our overall portfolio yield of +7%.

The reality is that growing investor demand for cash returns will result in more money pouring into high dividend stocks, pushing prices higher as opportunities become more scarce. This is even more great news for us as income investors!

The Technical Situation

As stated above, this market has both momentum and a massive uptrend line as well. When the S&P 500 breaks above the 4400 level, we are likely to see the 4500 level rather soon, and then the 4600 level. I expect we will reach the 4600 level over the next 6 to 12 months.

However, with the trading being this thin, it makes the markets prone to choppiness. I would not exclude the possibility of a market pullback in the magnitude of 5%. The 4200 level should offer good support.

However, I expect that any pullback, even a more severe one, will be very short-lived, and that investors will "buy the dip" as they have done over the past several months. I would not recommend trying to trade (or time) this market. It will be difficult to catch a pullback, and will probably result in missed opportunities.

Personally, I am fully invested. I am not worried about any volatility ahead. I am happy to keep holding our dividend stocks for the long term and collect my income, and will remain doing so as long as the outlook for equities and dividend stocks remains as bright as ever.

Bottom Line

We are in a "Goldilocks Scenario" for equities in general, and for dividend stocks in particular.

- The economy is seeing a supercharged recovery.

- Consumers are confident and spending money with retail spending surpassing all estimates by a wide margin.

- Short-term interest rates remain near zero, and the Fed has no intention to hike them over the next two years, even in the face of inflation.

- Just this week, the Fed confirmed that they will keep supporting the economic recovery through their various tools. They’ve got the backs of investors as they have done over the past 13 years.

- Bank earnings are soaring, which paints an even brighter picture about the state of the economy.

- Mergers and acquisitions are also soaring, as companies are flooded with liquidity.

- And one of the most important factors driving equity higher is the "bubble of cash" still on the sidelines waiting to be invested. At the end of the day, it is liquidity that is driving equity higher, and there is plenty of it around.

The bottom line is that we will be heading to an overheating economy over the next two years, while inflationary pressures will continue to increase. This is exactly where we have positioned our portfolio: Into economically sensitive stocks and sectors that are set to surge as the economy overheats, and at the same time, inflation protection exposure to help preserve the purchasing power of our portfolio, and even benefiting from it to make us more money. Importantly, the hunt for yield is on and set to accelerate, resulting in higher prices across our portfolio!

I am very excited about the prospects of our portfolio over the next 24 months, and we are set to continue to deliver much higher returns than the general indexes, in addition to the steady and recurrent income that we need for our retirement and spending needs.

Note: Our "Best Picks of the Week" report will be posted tomorrow on Monday. Stay tuned!

= = = =

Have a great Sunday!

Rida Morwa