Market Analysis for Aug 24th, 2021

Market Outlook: Investors Buy The Dip, Again!

Summary

- A roller-coaster week, with "value hunters" buying the dip on Friday.

- The markets closed above their support levels which is a bullish signal.

- I discuss the reasons that triggered the volatility this week.

- I also discuss the prospects of a 10% general market pullback.

It was a roller-coaster week for the market, with several down days, but the good news is that the markets saw investors buying the dip once again on Friday, and we are back above all technical support levels, which is very bullish. The S&P 500 recovered most of its losses, closing down only 0.55% for the week.

What happened?

First, the month of August is a "low volume" month for trading, and any small or big news can create significant market volatility. There are 3 main "news" worth mentioning and commenting on that shook the markets this week.

- Retail sales were down 1.1% last month.

- The rapid spread of the Delta variant.

- The Federal Reserve released its minutes from the July meeting, which show a deeply divided Fed contributing to uncertainty. Will the Fed taper this year? Next year? Quickly? Slowly? The minutes showed far more uncertainty within the Fed than was projected in their press release.

Let's look at each of these 3 factors and share my views from an investment perspective.

1- Retail Sales: The Consumer Health

"Retail sales" is one of the most important figures I look for when I assess the health of the U.S. economy. This is because the U.S. economy is a consumer driven one with household consumption accounting for nearly three-quarters of total GDP growth. So when you see that retail sales were down 1% in July, you need to have a closer look.

If we dig deeper into the data, the drop was mainly related to auto sales which were down by 3.9%. This was due to lack of cars to sell as manufacturers struggle to make new ones due to the scarcity of microchips. The good news is that consumer spending looks to be very healthy. Spending at bars and restaurants was up by 38.4% compared to July 2020. The picture looks even better if you look at the figures from Mastercard: Their sales at bars and restaurants were up by 61% and jewelry purchases by 80%!

2- The Delta Variant

Fears of a new economic slowdown caused by the Delta variant played a strong role early in the week. Particularly with China responding to Delta with renewed lockdowns.

Despite many lockdowns we are seeing across the globe, Dr. Anthony Fauci keeps reiterating that the U.S. will not see lockdowns like the ones seen in 2020. One of the sentences he keeps repeating.

A sufficient percentage of Americans have now been vaccinated to avoid lockdowns".

Vaccines are widely available, and the U.S. is prepared to administer 3rd vaccine doses or boosters for those who wish to keep the economy going strong. This is great news for pure U.S. companies, or companies that generate the vast majority of their revenues in the United States, such as Business Development Companies (or BDCs), the vast majority of U.S. listed Midstream and Property REIT companies. This is also why our portfolio is overweight these stocks and sectors.

3- The Fed: Taper Tantrum? Non-Taper Tantrum?

"Tapering" is when the Fed reduces the amount of treasuries or agency MBS that it has been buying every month. Currently, it is buying $120 billion/month in treasuries and MBS.

The Fed's minutes from their last meeting were released on Wednesday, and the market promptly sold off and continued selling off through half of Thursday. The minutes show a deeply divided Fed, with no consensus. "Various" participants suggest that tapering should start later this year, "several" argued that tapering shouldn't be considered until next year.

Our reading of the minutes:

- The Fed is clearly divided on whether inflation is "transitory" or not. The dovish members of the Fed want to keep supporting the continuation of accommodative policies, including tapering until employment returns to pre-COVID levels. Fed Chair Jerome Powell falls into this camp.

- Any tapering the Fed does will be announced in advance, it will be done slowly.

The market responded negatively, and the 10-year Treasury rallied, with the 10-year rate falling from 1.29% to 1.24% after the minutes were released. Some were comparing the market drop this week to the "taper tantrum" that occurred in 2013. In 2013, Treasury rates shot up and the market dropped after the Fed announced a plan to taper. Last week was actually the opposite, rates fell and the market did too. Call it a "non-taper tantrum"!

Usually, when a "taper tantrum" happens, investors view that the Fed stopping asset purchases will reduce demand for Treasuries. Clearly, the treasury market interpreted the Fed's minutes as a sign that tapering is not actually going to start anytime soon. The markets are right, there isn't enough support among the Fed to rush tapering, and the impacts of Delta will create a further pause.

What is most interesting to note is that recently, the Fed's priority has shifted from "inflation" being one of their primary items on the agenda to now being "COVID variant" mode. For example, Fed Chairman Powell was as dovish as ever, stating that:

The recovery isn’t complete. The Covid pandemic is still casting a shadow on economic activity. It is still very much with us. We can’t, you know, we can’t declare victory yet on that”.

This means that tapering is likely to be even slower than the markets expect, which is even more bullish for equities in the longer term.

Bullish on Oil and Gas Stocks

The U.S. dollar index continued strengthening since the beginning of August, as the Federal Reserve discusses tapering of bond purchases down the road. The uncertainties of the COVID-19 delta variant outbreaks and the strengthening dollar have added pressure to commodity prices.

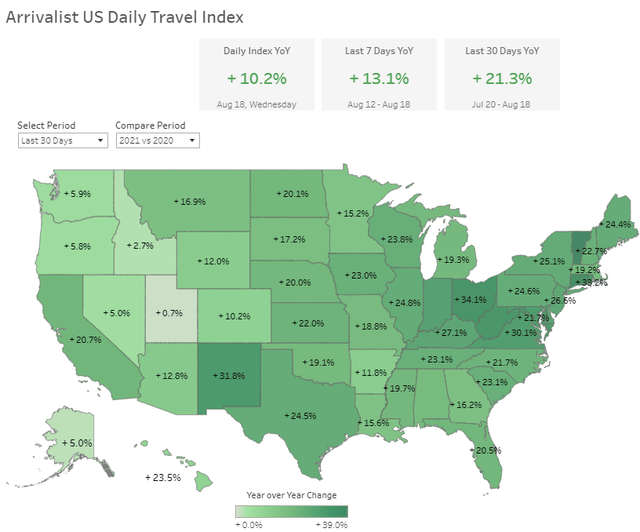

Crude oil experienced a 7% decline this week, with the ICE Brent falling below $66 per barrel on Friday and WTI prices dropping to $63 per barrel. But the fundamentals for the oil industry remain solid. The transportation sector being the largest consumer of crude oil in the U.S. continues to project strength. Last year, transportation almost came to a standstill, causing a brief period of negative oil prices. The situation is different now. Looking at the 30-day national average road travel volumes, we see 21% higher YoY change vs. 2020.

Data Source: arrivalist.com

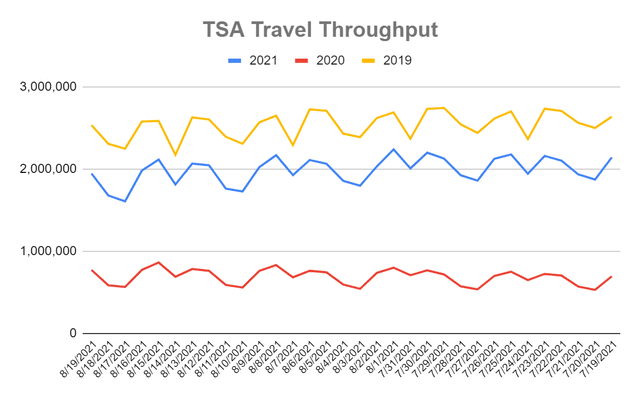

Looking at the 30-day air travel volume, we see that passenger throughput remains 188% above 2020 levels and just 20% below the same period in 2019.

Source: tsa.gov

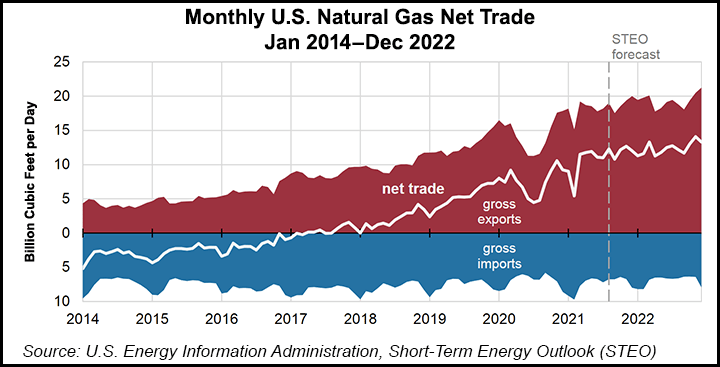

Natural gas is also about 7% lower from its 52-week high price earlier this month, despite high global demand for commodities as the pandemic eases and worldwide economic activity rebounds. We see robust demand from Europe and Asia for U.S. liquefied natural gas ('LNG') and record levels of pipeline deliveries to Mexico. As a result, the EIA’s 2021 outlook for natural gas is very bullish, with U.S. gas exports projected to exceed imports by an average of 11.0 Bcf/d in 2021 (up 50% YoY)

Source: naturalgasintel.com

Most importantly, oil above $60 is very profitable for the industry, and gas prices remain close to decade highs. Strong demand in the U.S. will provide a stable floor for prices and set up another run-up in the sector when demand returns overseas.

We remain firmly bullish for the oil and gas sector, particularly on our midstream names in the model portfolio - Enterprise Products Partners (EPD) yield 8.3%, and Antero Midstream (AM) yield 10.1%. Any price declines present fantastic buying opportunities to lock in high yields.

The Bubble of Cash Gets Larger

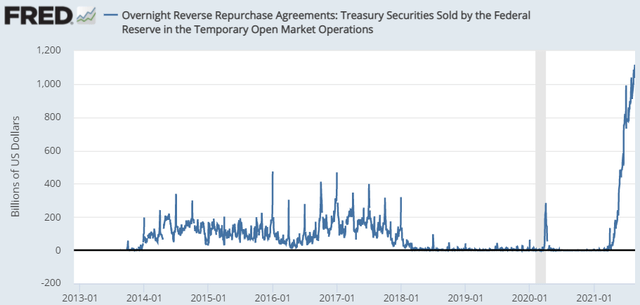

For investors, this means that the 10-year Treasury is likely to remain low. There is even a possibility of it going lower as international demand rises and the liquidity in the U.S. financial system continues to build higher.

Even as the Fed pumps in liquidity with one hand by buying treasuries and agency MBS, it is borrowing using "reverse repurchase agreements" in the overnight market. Institutions have excess funds that there is nothing better to do with than to lend in the overnight market at an annualized interest rate of 0.02%. The amount that the Fed is borrowing has surged above $1.1 trillion, which historically, is off the charts.

Source: St. Louis Fed

The Bubble of Cash we have been talking about for months is getting larger. Since June, the amount that institutions are lending to the Fed has doubled. The sheer amount of liquidity is bullish for corporate debt, especially high-yield corporate debt like high-yield bonds and CLOs (collateralized loan obligations).

The winners are picks exposed to credit risk like:

PIMCO funds:

- PIMCO Corporate & Income Opportunity Fund (PTY), yield 7.4%.

- PIMCO Dynamic Credit and Mortgage Income Fund (PCI), yield 9.4%.

- PIMCO Dynamic Income Opportunities Fund (PDO), yield 6.7%

CLO funds:

- Oxford Lane Capital Corp (OXLC), yield 11.5%.

- Eagle Point Credit Co, Inc. (ECC), yield 8.6%.

- XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT), yield 9.9%.

BDCs like:

- Ares Capital Corporation (ARCC), yield 8.3%.

- Capital Southwest Corp (CSWC), yield 8.3%.

- Owl Rock Capital Corp (ORCC), yield 8.6%.

- Saratoga Investment Corp (SAR), yield 6.6%.

And our newest addition Ares Commercial Real Estate (ACRE), yield 9.2%.

All of these picks are exposed to "credit risk" meaning that they do best when few borrowers default. When liquidity is this high, it is much easier for borrowers to refinance, which keeps defaults low.

For "agency" mREITs like AGNC Investment Corp (AGNC) yield 8.9%, and Annaly (NLY) yield 10.3%, it is mixed. They actively borrow in the repo market, so the very low rates mean that their debt cost is very low. That is a big plus for continued earnings. However, it is a challenging environment for managing their "book value". The treasury and mortgage markets will remain hyper-focused on every word from the Fed, and the reactions will not always be predictable and might not go in the same direction. So while the environment is hands down fantastic from a cash-flow and dividend safety perspective, book values could be subject to a spike up or a spike down depending upon what is said at the Jackson Hole Symposium and how the bond markets "read the tea leaves". Given the strong outlook over the next few years, any sell-off in these 2 mortgage REITs is a buying opportunity.

Meanwhile, as the Fed sits around debating, inflation is continuing to push forward.

Employers Fighting Over Limited Labor Pool

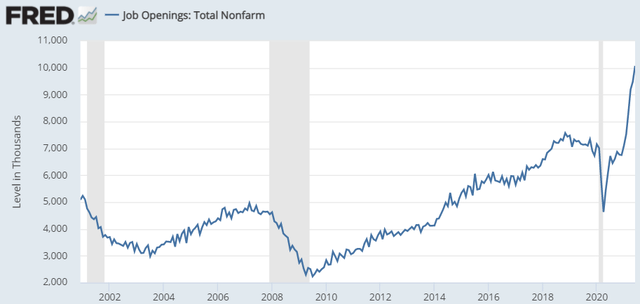

Ironically, one of the things the Fed is waiting for to start tightening policies is "full-employment". As we have noted in prior Market Outlooks, employers are begging for employees. The number of job openings is at an all-time high.

Source: St. Louis Fed

And not a "slightly higher" all-time high, the number of job openings is blowing away all records.

MetLife (MET) is one of the latest major corporations to announce significant raises. They are increasing the minimum wage from $15/hour to $20/hour. They join many other major corporations including Chipotle (CMG) which raised wages to $15/hour, McDonalds (MCD) raising wages at corporate locations by an average of 10%, Target (TGT), Costco (COST) and Amazon (AMZN) have all completed or announced significant pay raises over the past year.

Some are using the slowdown we have seen in some commodities to dismiss inflation as "transitory". This ignores the substantial and lasting, impact that rising wages will have. Wage inflation is just beginning and is not yet being reflected in inflation measurements like CPI and PCI.

Rising wages impact inflation in two ways: The most obvious is that the company has higher expenses, and raising prices is a natural way to compensate. This impact can be seen relatively quickly if a company raises wages and prices at the same time.

The second is more indirect. Employees making more money are likely to spend more money. Rising demand creates inflationary pressure on everything from raw materials to wages for other companies that look to expand their workforce to meet the new demand. Since these are secondary impacts, there is going to be a delay. Wage inflation is happening in a very meaningful way right now, and it will be 6-12 months before we start seeing the full impact in inflation measurements.

The Technical Situation

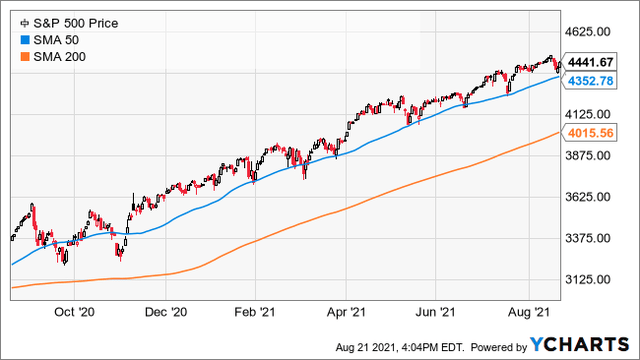

The markets initially fell during the week by 2.5% from their all-time highs and saw a nice recovery on Friday. As I have been highlighting in most of my market outlooks recently, the pullbacks are likely to be shallow and short-lived. In fact, during the course of the week, we did not even get close to the 50-day moving average support level for the S&P 500 index, but rather barely broke down below the 20-day moving average and bounced back significantly up on Friday, forming a "hammer signal" on the chart, which is a bullish sign. There remains a lot of buying pressure underneath all support levels, and gives us confidence about this bull market.

The 50-day moving average for the S&P 500 index has been very reliable and has acted as strong support for the index since November 2020 (or for 10 months straight so far). Please see the blue line below representing the 50-day moving average, compared to the orange line representing the 200-day moving average.

For this reason, I continue to believe that the 4300 level will act as strong support for the index in case of any further pullbacks, which is close to where this moving average lies today.

To the upside, the next target for the S&P 500 index is at the 4500 level, which I expect that we will reach very soon. Following that, the 4600 level is likely to follow over the next 6 months or even earlier.

We remain in a powerful uptrend fueled by excess liquidity, cheap money, strong earnings, lack of investment opportunities (other than the equity markets and real estate), and a cheap Fed. Inflation fears are also playing in favor of investors, and few want to keep cash idle in the bank, losing out to increasingly high inflation pressures. The future is very bright for equity investors, and especially for high yield investors, as the hunt for yield accelerates!

How about a 10% Market Correction?

History has taught us over the decades that the markets see a market correction (or about 10% pullback) on average once a year, even during a strong bull market like the one we are in today. We have not pulled back anywhere close to 10% since the beginning of the market rally in March 2020, so at some point in time, we are set to see a 10% correction. While we always need to keep this in mind, we should never let these rules dictate our investment strategy.

- For those who were waiting for this 10% pullback to happen, the S&P 500 index returned 14.4% over the past 6 months (or exactly one year after the bull market started), it never happened, although it was due. So for those who remained long (buy and hold), a 10% correction would still be a 4.4% gain.

- The markets may shoot up another 5% to 10% before we see this 10% correction happen. So it makes no sense to time this market.

- Going back to history and since the year 1974, following a market correction of 10% or more, the S&P 500 index has risen an average of more than 8% one month after a market correction bottom, and more than 24% one year later. So market corrections tend to be short-lived.

While it is very difficult to predict when a correction is going to happen, I would not expect it to happen soon, simply because excess liquidity is so high today. Currently, M2 money supply is $5 trillion higher than it was before the pandemic; there is just tremendous liquidity sitting there.

And when we do see a market correction, it is likely to be very short-lived with a swift recovery. If that happens, it is best to keep your calm and not to sell your positions. We remain in a secular bull market supported by strong economic fundamentals, low interest rates, plenty of liquidity, and with the Fed having your back as an investor. Knowledge is power, and riding the storm while you collect your dividends is the key to success. You only sell if the outlook is bleak which is definitely not the case today.

The Bottom Line

The Delta Variant has resulted in economic growth concerns with some countries having lockdowns and limiting population movements. Governments across the globe are now re-assessing their fiscal and monetary policies in order to keep their economic growth intact. This will play in favor of the equity markets as I fully expect that governments will continue their loose policies and inject liquidity in the markets through various forms such as government spending, asset repurchases, low interest rates, grants, loan forbearances, etc. Fed Chair Powell already hinted that his primary concern now is the COVID variant and not inflation.

This is great news for equities.

- This means that liquidity will remain plenty and will keep cheap money flowing into the markets.

- Cheap money will also support red-hot economic recovery.

Therefore I expect economic growth to re-accelerate in the 4th quarter into the year 2022. Investors who are focused on value stocks and economically sensitive stocks are set to benefit the most as we put the virus behind us. The fact that these sectors pulled back recently creates a further opportunity to buy the dip.

We have positioned our portfolio to benefit from both:

- A rebounding economy through "economically sensitive stocks" with their earnings strongly correlated to the recovery of the U.S. economy.

- Higher inflation through "inflation resilient stocks".

Our portfolio will not perfectly correlate with the S&P 500 or Nasdaq, and we don't want it to. Our goal is to strongly outperform them over the long term while we collect our big recurrent income.

Over the past two months or so, the market has turned a blind eye to inflation. Yet inflation is happening and it is only a question of time before rates rise as well. As investors, we must look forward and position ourselves for what will happen in the future, not drive in the rear-view mirror. We take a medium-term outlook (12 to 24 months) on the markets in order to be ahead of the crowd in both good and bad times, and I am excited about the prospects of our dividend stocks!

I like it when we see dips like this week, I like to buy. In fact, I added more RQI (RQI), OXCL (OXLC), XFLT (XFLT), ARCC (ARCC), ORCC (ORCC) to my retirement portfolio on Thursday and Friday. Such pullbacks are opportunities to invest at lower prices for solid stocks. Prices don't go anywhere in a straight line, and August tends to be a more volatile than average month. When you see red, it is an opportunity. There is a ton of liquidity ready to pour into equities, dips will be brief, and the future is bright. The tail of the bull market is going to be an extremely profitable time for investors who look forward!

If you want full access to our Model Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Dividend Opportunities.

Note: Our "Weekly Picks" report will be posted tomorrow – Monday morning. Stay tuned!

Have a great Sunday.

Rida MORWA