Were The Bitcoin Spot ETFs A Big Flop?

The trading week that started on January 8 was a big week for Bitcoin. After years of applications being rejected by the SEC, and one important lawsuit that the SEC lost, no fewer than eleven spot Bitcoin ETFs were launched.

On Thursday, January 11, they all began trading. But despite the pronouncements by many in the Bitcoin community that spot ETFs would launch Bitcoin northward, it appears that the launch marked at least a short-term top.

The price action was so red that some called the launch a flop. As you can see from my Tweet on December 20, this action did not surprise me. While I gave many potential scenarios, my main point was that we cannot look at such an event as causative for any price action. Action would take the course that fits the sentiment at the time of launch. The bullish fervor fervor into the launch makes the pullback a reasonable outcome.

Now that this event is behind us, we’re going to take a look at Bitcoin as a follow-up to my article on October 28 of last year. I am still bullish despite this pullback, but I see a couple of paths that should lead to $125K.

I am also going to give an early evaluation of the new ETFs. I have traded GBTC up until their launch. However, GBTC was an inferior product for US investors. Now we have some better options. While it is too early to pick a winner amongst the eleven, I will give you the process by which I will evaluate them.

Spot ETFs vs. Closed-end funds and Future ETFs

A few of you may start by asking what the big deal is with a spot ETF. So let’s start with a primer on why a spot ETF is a better option for retailer investors, compared to the previously available products on the US market: closed-end funds and futures ETFs.

Spot ETFs have a mechanism, executed by registered market makers, by which the share float is expanded and contracted to make sure that the value of the shares peg to the net asset value (NAV) of the underlying held by the fund.

GBTC, before it was converted to a spot ETF, was a closed-end trust fund. The share float expanded only, in confined windows where institutions were issued shares in return for Bitcoin. But on any trading day, the float was set, and so the NAV was unmanaged.

For the first six years of its life, GBTC traded at a premium to NAV. But in mid-2021, it moved to a discount. It dropped to as low as a 48% discount before it started to climb back to par when it was converted to an ETF on January 11. For me, as someone who focuses on gaining an edge in Bitcoin’s price action, that edge didn’t always translate to GBTC. It never perfectly correlated to Bitcoin.

Future ETFs like BITO are not based on Bitcoin, but on the Bitcoin futures contracts that trade on the Chicago Mercantile (CME). While those contracts track Bitcoin rather closely, the need for the fund to roll futures contracts led to what is called roll decay, which is an invisible tax on investors on top of the fund’s management fee.

In short, the most direct tracking of Bitcoin exposure via an ETF can be found in a spot ETF. It should track the underlying perfectly, less management fees, as long as the fund’s market makers are doing their job. This is the fairest method of exposure available via normal brokerage accounts.

I will avoid discussing why it took so long for the SEC to approve these products, despite their superiority to previously existing products. That would take a whole article, and the topic is well covered elsewhere.

Making Decisions

So, which ETF is the best amongst the set that has been launched? Well, it’s too early to tell, but I will share what I care about in choosing a fund.

1. Low fees are important: In this regard, most of the eleven have extremely low fees except GBTC. It lowered its management fee to 1.5% from 2.0%. The rest are as follows: Hashdex (DEFI) 0.9%, Franklin (EZBC) 0.29%, VanEck (HOD)L 0.25%, iShares (IBIT) 0.25%, Valkyrie (BRRR) 0.49%, Investco Galaxy (BTCO) 0.29%, Wisdomtree (BTCW) 0.3%, Fidelity (FBTC) 0.25%, ARK 21 Shares (ARKB) 0.21%, Bitwise (BITB) 0.2%.

Honestly, anything under 0.4% on this list is a little like splitting hairs. This is a set of funds with very low fees. But you might be more of a penny-pincher than I am.

2. Liquidity is key: As an active trader, I care about tight spreads. I have been able to watch all the funds. But I have watched ARKB, BITW, and FBTC rather closely, and the spreads range between 2 cents and 5 cents. That’s pretty good.

3. Watch custodial risk: I like the idea of spreading my risk amongst a few custodians of the funds’ Bitcoin. Obviously, Coinbase is the big winner in this ETF release. It is the custodian for eight of the funds. That makes it hard to spread risk. But Fidelity is providing their own custody. VanEck is using Gemini, and Hashdex is using BitGo.

4. Support crypto natives: Having traded and invested in the crypto space for some time, I want to support companies that have shown a history of being pro-crypto. That’s why I appreciate the track record of Grayscale, Fidelity, VanEck, ARK and Bitwise. I remain skeptical of the intentions of Blackrock, the issuer of the iShares fund (IBIT).

5. Options help: I am not aware of options being issued on any of the funds. But because I use options to speculate, hedge, and create income, I want to trade funds with options. I expect options will be released down the road, and I may adjust my holdings to use them as tools.

In light of these values, I have taken positions in ARKB, FBTC, and BITB, although I may switch that in due course. By adding Gemini, I am considering switching one of these funds to VanEck to spread custody beyond Coinbase and Fidelity.

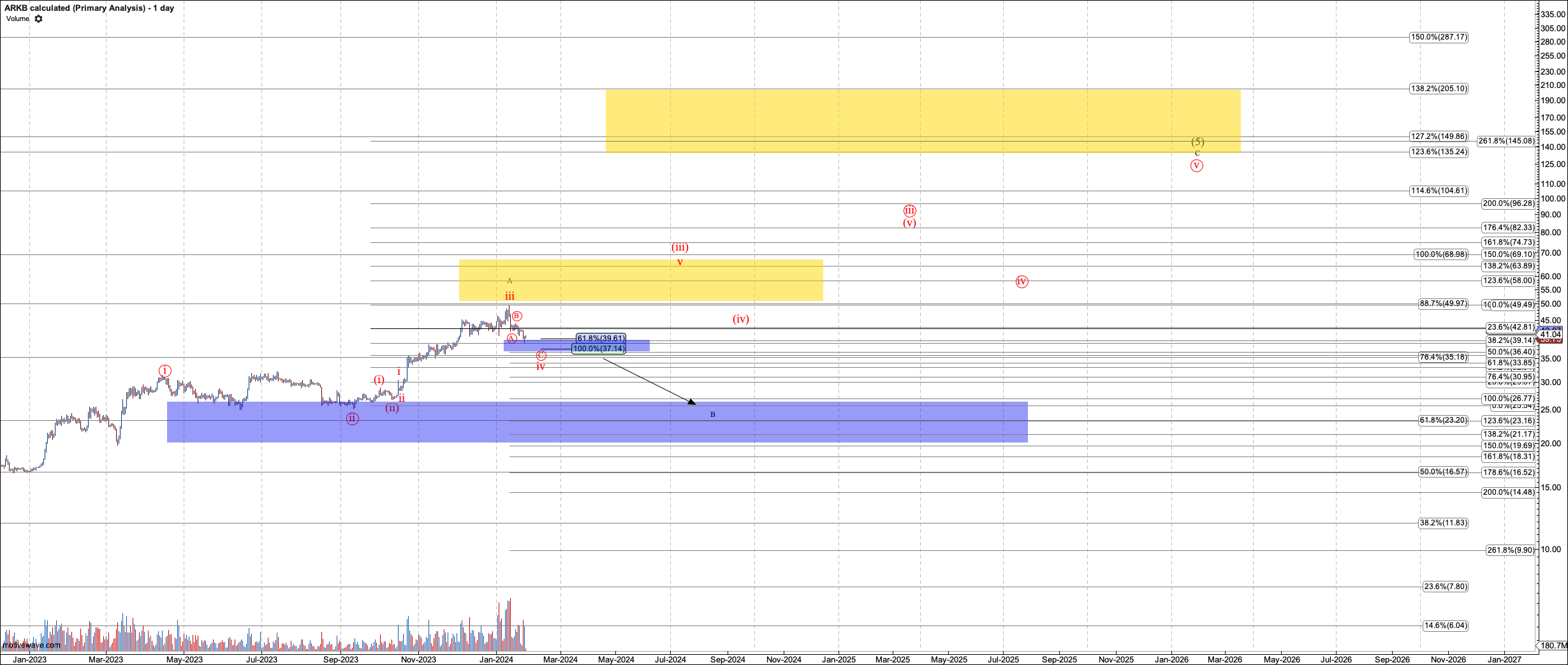

I have built a long-term chart for ARKB by calculating from Bitcoin. Each share is roughly equal .0001004 Bitcoin. So I can easily divide Bitcoin by 1,000 to indicate key support and target levels. I will show that chart below.

Did the ETFs End the Bull Run?

Now that we’ve looked closely at the information we have on the funds, we have to ask if this event was destructive to Bitcoin’s bullish cycle. Many have blamed the ETFs for the somewhat violent pullback over the last two weeks.

But what I see is a chart that needed a pullback within the context of a strong bull market. And as stated, there was much fervor surrounding the event. When everyone is bullish about news, often the news seems to send the market against the crowd.

Others have blamed the liquidations of the Grayscale ETF (GBTC) with its demonstrably high fee. While it has suffered much from liquidation, the net inflows across the eleven funds were positive. Since we are going down, I suppose the crowd must blame the bad and ignore the good.

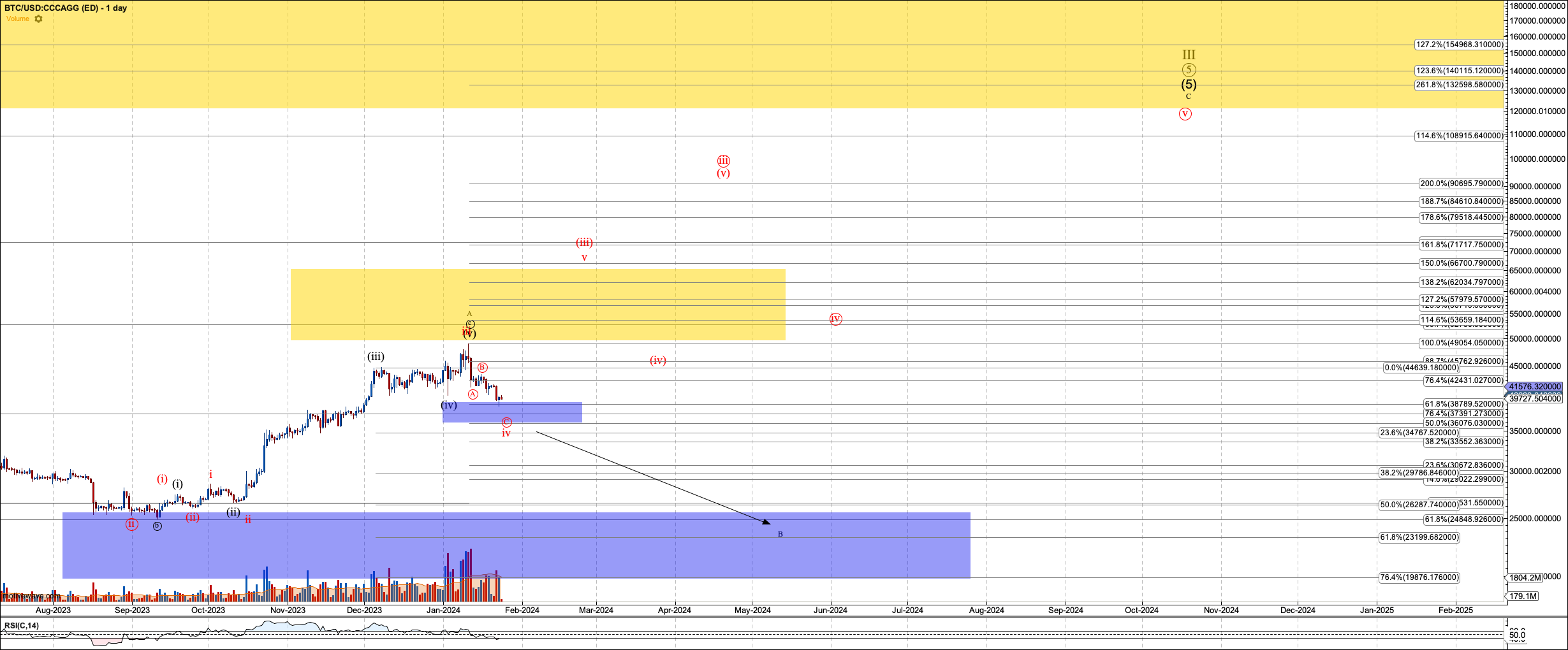

So let’s take a look at the Bitcoin chart. First, I will say that this pullback does nothing to change my view that Bitcoin is trying to reach $125K. It takes a break below $19K to change that view, and I doubt we will get there until this run is over.

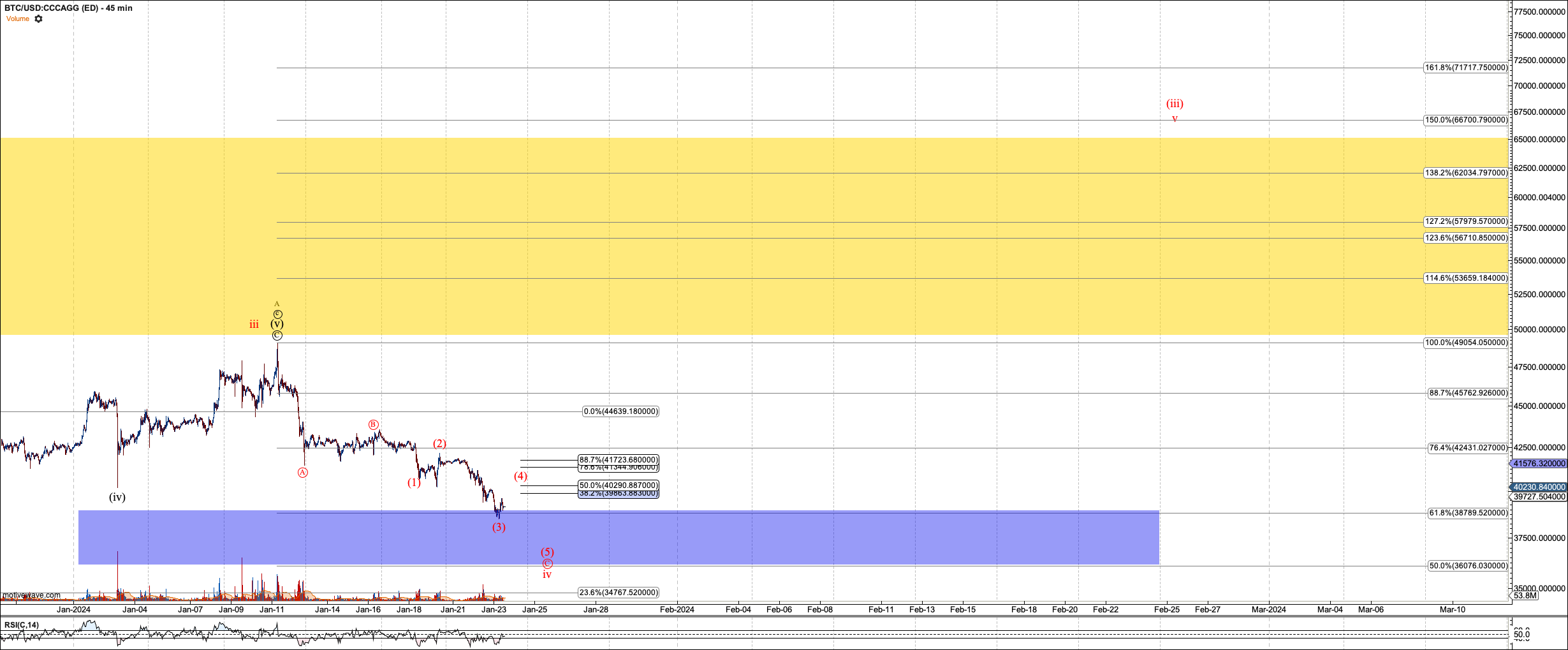

Second, if you recall from October’s article, I wanted to see five waves form under $42K, or the chart might warn of a more corrective structure to come. Unfortunately, it appears Bitcoin needed to hit nearly $50K to form five waves. This more corrective structure is called out in my black A-B-C with the B wave becoming a potentially deep pullback.

I often say the black count is primary; red, my alternative. However, what’s more important is understanding the pivot between the two. Those pivots are great entries for trades with a tight stop. And risk opens up below them.

In this case, the pivot between the black and red count is $36K. And since the ETF launch, the market is seemingly hunting that level. The question is, will it stop? I will give the more direct move to $125K in red the benefit of the doubt until $36K breaks.

To my eyes, if Bitcoin holds $36K and breaks over $65K, the black count will lose much potential.

But if the black count does take hold, I have two key levels below to watch: $27K and $19K. You can imagine what will happen to Bitcoin if it drops to $27K. Most will consider this bull market over. But we’ve seen many similar percentile drops in past Bitcoin cycles. How quickly our memories of market history fade!

Before we conclude, I wanted to present my Ark 21 Shares ETF chart (ARKB) calculated from Bitcoin. It’s very nice that it holds nearly a clean 0.0001 Bitcoin. We can apply what I stated above for Bitcoin with that multiplier.

It closed on January 22 at $39.87. In this bull market, I expect it will hit $125, unless, of course, Bitcoin hits $125K outside of regular trading hours. Provided ARKB holds $36, it can take the more direct path in red to $125. But if $36 breaks, we will watch for it to hold $27 and $19 below.

Conclusion

If you have avoided the crypto market due to its steep learning curve, you now have the keys to exposure, provided you know how to buy a stock share. You might consider making it a part of your portfolio before the current bullish cycle is over, likely in the $125K region.

While I have not settled on one ETF, my favorites are FBTC, BITW, and ARKB, based on evaluating liquidity, fees, custodial risk, and whether the issuer has historically supported the crypto industry. I have positions in all of them and may add HODL to spread my custodial risk more broadly.

But now that we have this out of the way, Bitcoin is working on a correction. The depth of this correction is not yet known, but we have a few levels to watch, and we have to consider adding to our positions during this bullish cycle.