Bitcoin Has Started Its Push Toward $100K

Against a background of economic uncertainty, a hawkish Fed, and soft markets in bonds and equities, it seems to me that most pundits and macros-oriented analysts have been bearish on crypto. As a prolific consumer of crypto podcasts, I marveled at the number of hosts that recently called the crypto market a bear market. At least, up until last week.

How many would say that equities were in a bear market if they spent most of their time 30–100% above the prior year’s close? Yet that is where Bitcoin has spent the latter half of 2023 to date. I guess crypto investors are too much accustomed to returns in multiples of three to ten.

My colleague Jason Appel posted an article in August that suggested a major breakout in Bitcoin was likely. Bitcoin had to work up to that breakout and we had to be patient for four months. But finally, this past Monday, October 23, Bitcoin broke the reins of its previous 2023 high at $31,800. It tacked on nearly 10% that day in a major breakout.

Is this the beginning of our long-expected move to $100K? Or are Bitcoin traders and investors destined for a return to the low, range-bound action we have seen over the last few months? Or, worse, will this breakout turn into a fakeout and a return to the bear market?

Before we jump in, I give you my usual warning. In my view, the Elliott Wave theory, my primary analysis tool, is best used as a means of establishing risk versus reward. As a full-time trader, I accept a certain amount of very controlled losses. To that effect, if a key level I consider to be critical is breached, my view of the market changes. I am then likely to adjust my position or plan.

A Bearish Mention

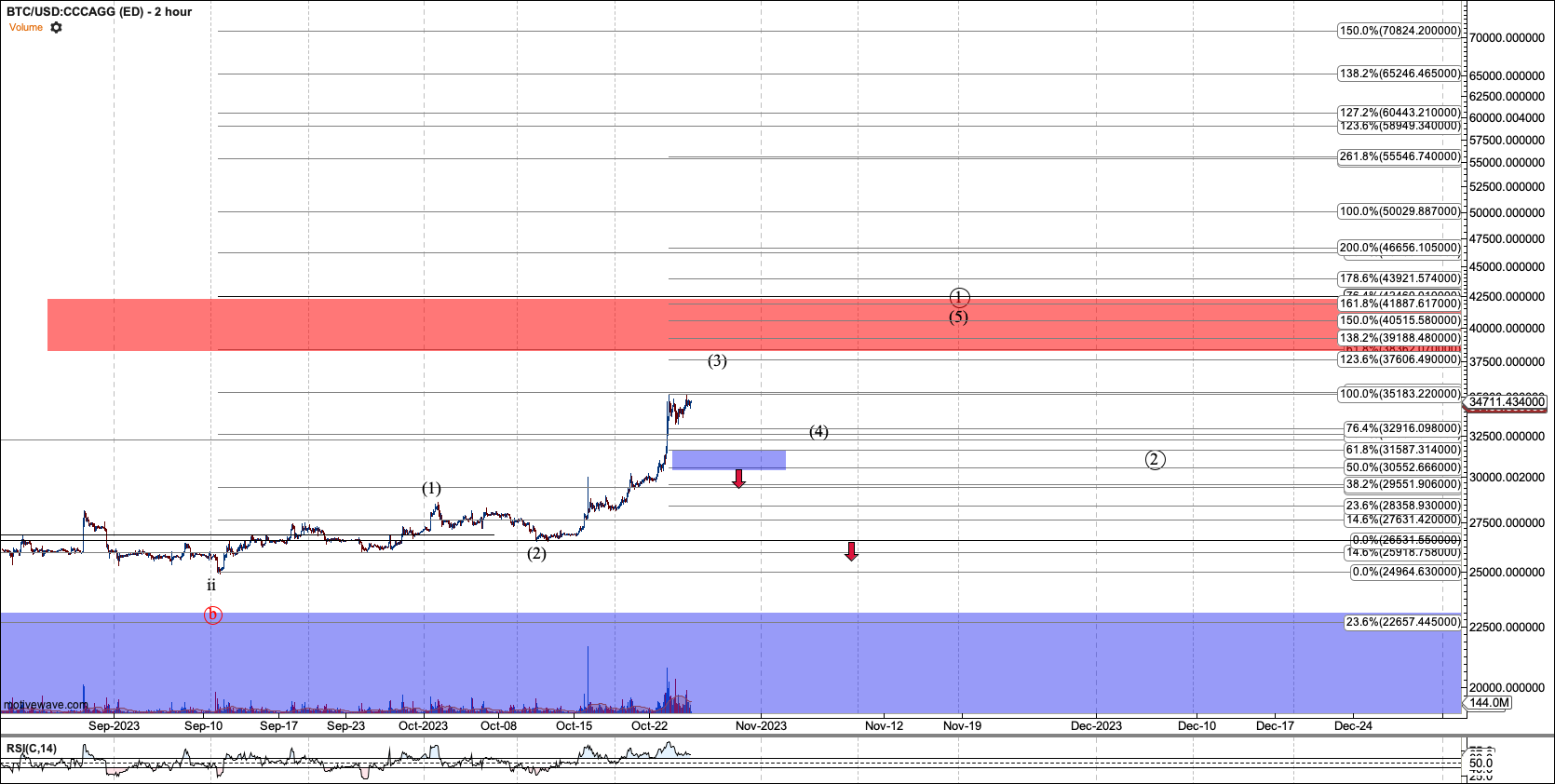

Let’s get the ‘bear-talk’ out of the way first. Every trader of breakouts knows that some breakouts fail. I see the chances of this one failing as slim. But regardless of how price structure forms from here, if Bitcoin breaches $26,530 it should return to its six-month consolidation. Further, it could easily slip through the bottom of the range at $25K. If it were to do so, that would not mean that Bitcoin was back in its 2022 bear market. But it would open the door to challenging $18,900, which, if breached, would bring the bear back.

On top of $26,530, I want to see Bitcoin fill in five waves before it breaks $42K, and hold $30,600 if it starts its fourth wave from its current price of $34,500. Breaking $30,600 would be an early warning that price will collapse, until the five waves in circle-1 are completed. For those inclined to trade more tightly, this is a level you can watch.

I lean bullish. But I am faithful to tell you where the bears will take hold, so you can measure your risk.

The Bullish Paths

Let’s assume that the bears have given up the ghost and Bitcoin is free to run. Again, this is my leaning.

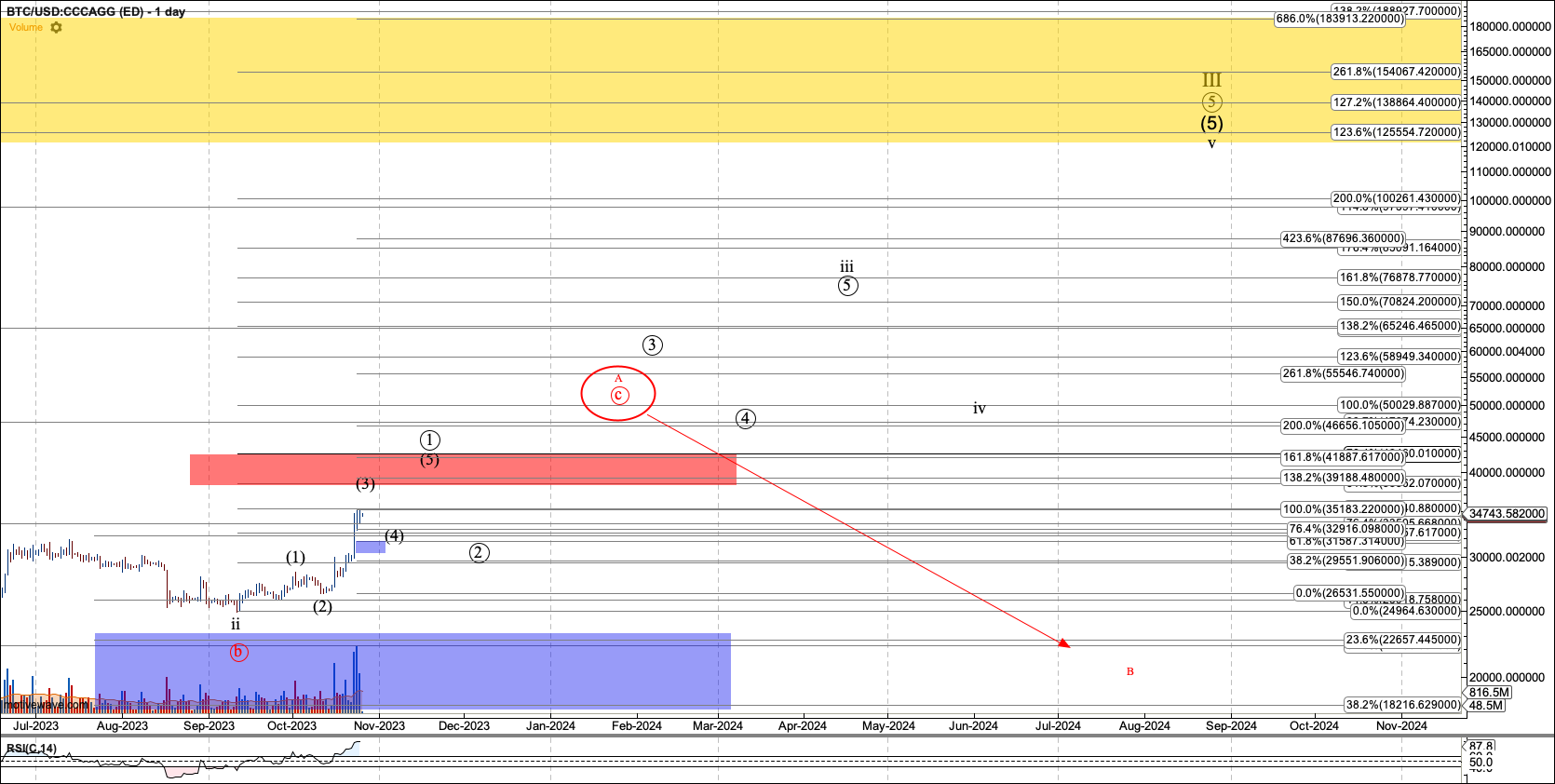

I am watching two paths towards $100K+. The first is a direct impulse toward $100K and ideally stretches to $125K. But first, as mentioned above, Bitcoin should form five waves under $42K. After that it should pull back to the mid to low $27Ks before it gives us a more decisive breakout from the higher low at circle-2. That should start a very rapid ascent in wave-iii to $80K+ before the final major consolidation in wave iv. That wave iv may take four months, just as wave ii did before the final push to $100K.

The second path I am watching is an ABC structure, shown in red on my chart. This is based on my view that the five-wave structure that started off the 2018 low, and is working on its final move higher, is an ending diagonal. This is a debatable view. But I will have confirmation of this potential if Bitcoin breaks over $42K without finishing five waves. That would make it likely that we see an A-wave top in the $50K region. In that event, as long as Bitcoin holds the $19K region, it should make a final push as a C-wave to $100–125K.

What about the coming halving?

I don’t watch the halving cycles to help with my decision-making. (Halvings are when the Bitcoin rewards to miners are cut in half, as determined by Bitcoin’s code, roughly every four years. These cycles have corresponded to significant price rises for Bitcoin.) I develop my trading strategies off hundreds of data points. We’ve had only three halving cycles. But it does seem that this scenario lines up well with the next halving event, which will be in mid-2024.

In Conclusion

To wrap this up, we’ve been looking for six-figure Bitcoin prices for a long time. While Bitcoin has not made haste to fulfill our expectation, it has not invalidated this view. 2023 has given us a slow-moving bull market, with much time spent tracking sideways. It has been so slow that many voices in the crypto space have called it a bear market. If the Bitcoin breakout on October 23 sustains, that discussion should be put to rest as Bitcoin continues higher into the end of the year, and perhaps to $100K in 2024.