Pathward Financial (CASH) Plays Pinball

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

There is a generation ahead that soon may not recognize the reference to Pinball. For the purposes of this piece though we will assume that this was one of those memories from your own past. You easily and fondly recall the seemingly random bounces and pops of the pinball against the bumpers and how your round of play would inevitably arrive at its end.

In your times playing pinball, did you ever come across someone that had seemed to have simply mastered the randomness? It appeared that they could continue on for what appeared to be hours of nearly free play. A Pinball Master.

Pinball For Stocks

I want to share with you the origins of what we have come to know as Fibonacci Pinball. Avi Gilburt has published articles regarding how it came to be of such great use to himself and thousands more. “The Basics Of Fibonacci Pinball” available at Elliott Wave Trader in the Help section describes in great detail the beginnings. Here is a brief segment of that account:

“While I was learning Elliott Wave on my own, I was trying to obtain a more ‘track-able’ and ‘tradable’ understanding of the fractal nature of the markets. This is probably what many struggle with the most. Specifically, it is when we say that within a 5 wave move, each impulsive wave breaks down further into 5 waves each, with some waves becoming extended.

Well, after much analysis and observation, I identified a standardized method to trade waves 3-5, once waves 1 and 2 were in place. Now, remember that this is a standardized method that is a most common phenomenon in the market, but markets can and do vary from this standardized presentation. In fact, when we deal with commodities or the VXX, often, we see extensions that far surpass the standardized extensions I present here. But, again, this scenario is seen very often in the markets and individual stocks, so I believe it is worthwhile to have a basic understanding of this structure to build upon.

This is something that I observed within the Elliott Wave structure, and have adapted it to a trading methodology, which I lovingly call Fibonacci Pinball.” - Avi Gilburt

(CASH) Plays Pinball

Not all stocks or indexes will have clear Pinball setups. As well, not all setups that appear to have Pinball parameters will play out as drawn up. However, with that preamble stated, these setups do seem to generate higher probability outcomes with better predictability.

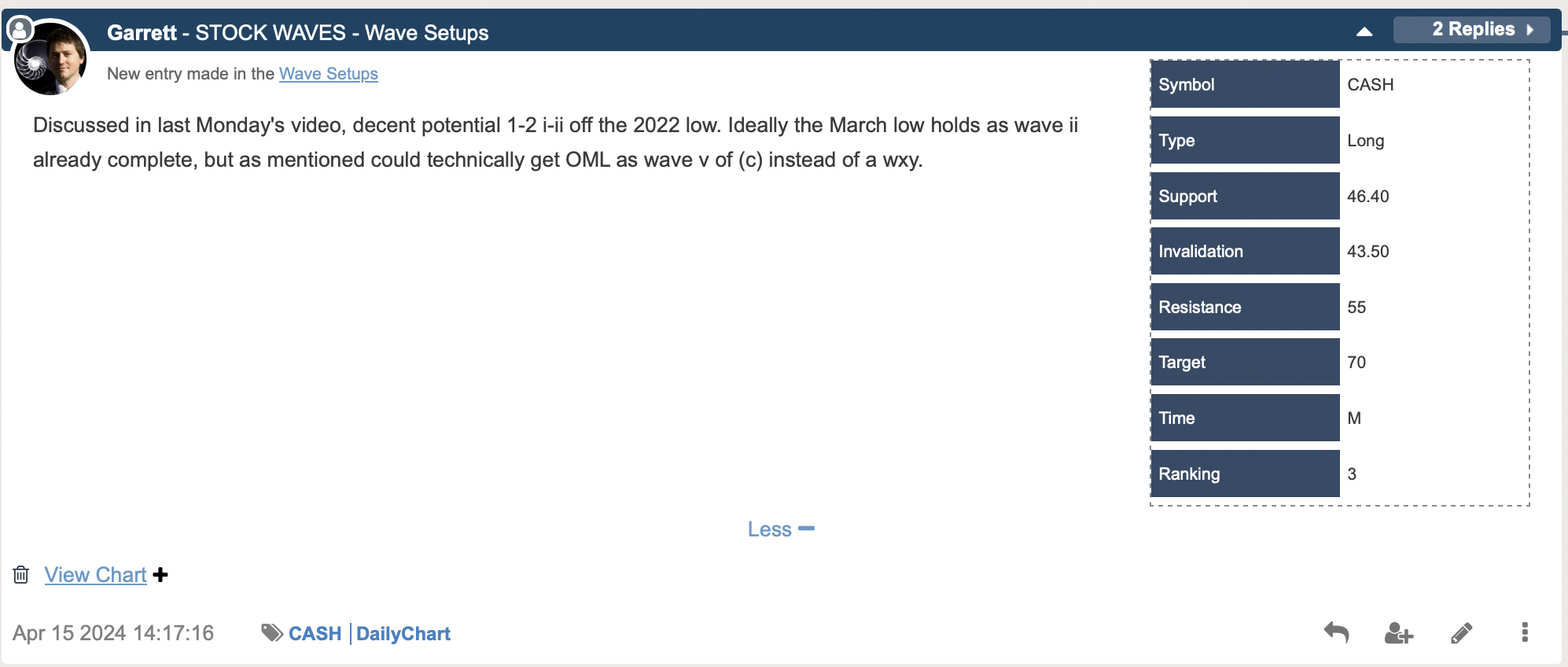

We have such a setup present in (CASH). In fact, we have this as an on-going Wave Setup for members in StockWaves. Here is the original post from last year, believe it or not.

Garrett was able to identify that the structure of price was nearing, or had already completed, a bit of a complex corrective pattern and then would likely rally into 2025. What has been the case since that original setup was shared?

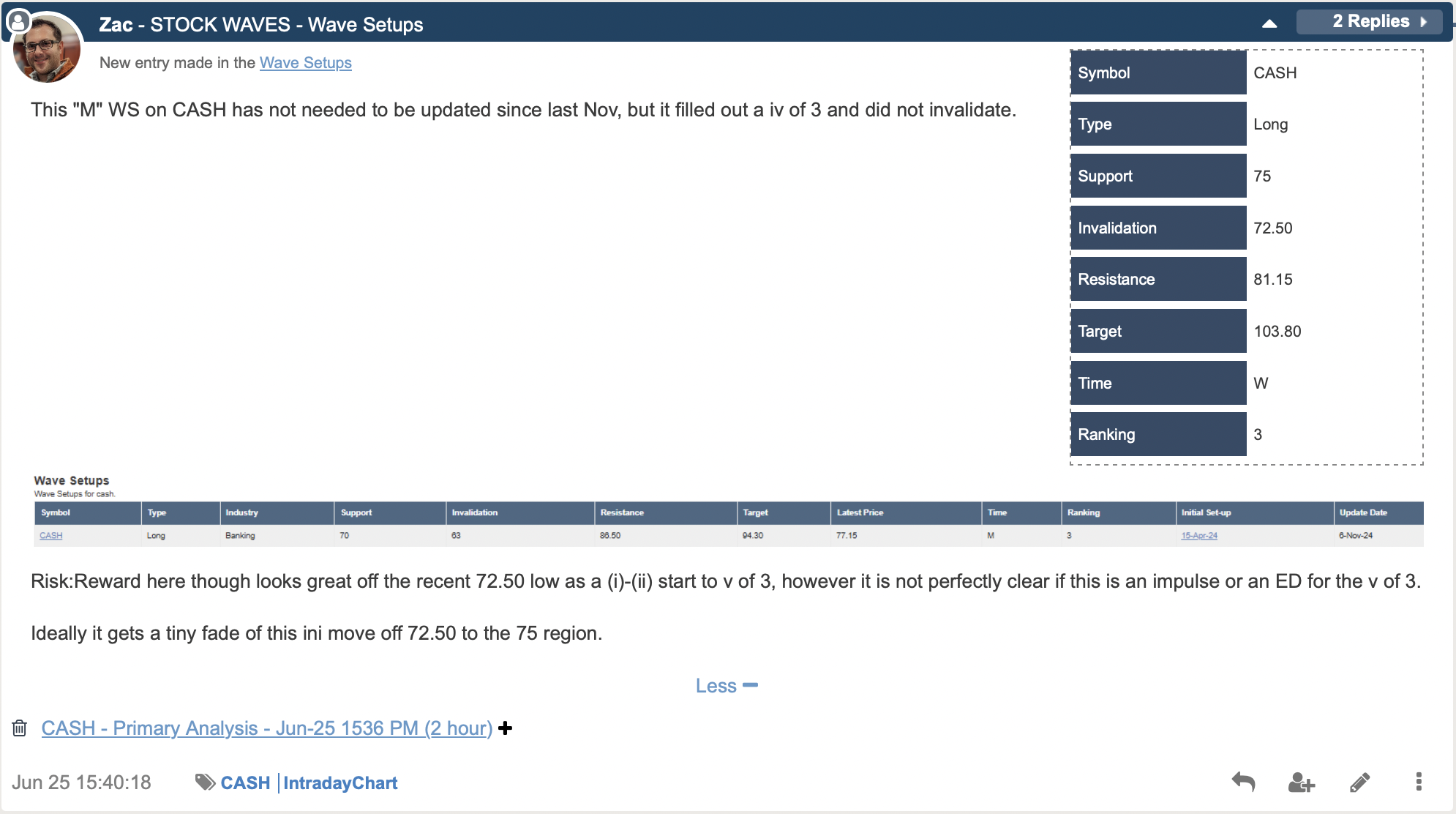

As stocks in the Wave Setups table strike important regions they are updated accordingly. Zac posted one just a few days ago for (CASH).

You can readily see how key price levels are refreshed with the new data as it fills in the chart. Not all Wave Setups will perform as projected at their onset. However, we will know when they need adjustment and even when they might invalidate.

The Third Wave

In stocks and indexes the third wave in a five wave sequence is typically the strongest in amplitude when compared to waves one and five (this can differ in commodities). If a trader/investor is looking for the highest probability setups, then seeking out the charts with a wave 1 rally, a wave 2 corrective structure and a proceeding lesser degree wave ‘i’ and wave ‘ii’ structure is the ticket.

Used colloquially in our trading room, it would simply be a 1-2, i-ii setup. Why is this ideal? It’s a risk versus reward calculation. Third waves normally project to the 1.618 extension of the prior wave 1-2 structure. And the setup would invalidate with a move below either the lesser degree wave ‘ii’ or the larger wave 2.

Many times this can present as a 1:4 or even higher risk:reward setup. Please keep in mind that proper risk management is still a must. As well, we view the markets from a probabilistic standpoint. The highest probability path ‘should’ play out but does not always.

We have this 1-2, i-ii setup already in motion for (CASH) stock. And it appears that it will play out for the higher targets mentioned in the Wave Setup table shared above. We also know when we would turn more cautious and where this scenario invalidates.

Do You Have A System In Place?

Those who have experience forged by time in the markets will tell you that it's imperative to have a system of sorts in place. You need to be able to define how much you are willing to risk vs. how much gain is likely. Those who survive across the decades in the greatest game on earth will also inform you that the preservation of capital is paramount.

While there are multiple manners of doing this, we have found Fibonacci Pinball to be a tool of immense utility for traders and investors alike.

Nearly all successful traders/investors that we survey have some sort of a system that helps them structure their work.

Conclusion

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.