Market Analysis for Sep 21st, 2021

Despite this week’s market volatility, the market remains near all-time highs. The S&P is only down 3% from all-time highs, which confirms we remain in a strong secular bull market. This market is supported by strong technicals and a sea of liquidity. The main reason for the volatility last week is due to the new proposed tax hikes, Delta, fears of stagflation, and the possibility of Fed Tapering before year-end. I believe that all those will prove to be short-term distractions, and the strong bull market will resume sooner rather than later.

Many investors are over-reactive. Responding to fears of things like stagflation, then rushing out when it doesn't happen right away. Constantly running around and not getting anywhere. Today, I want to discuss portfolio management, what the risk of stagflation means, and the best way to handle the current market.

Managing Your Portfolio

Have you ever crafted or seen something crafted from metal? This process is not a snap of your fingers, and it's magically done. It takes time and dedication to flux out all the impurities and craft a strong and stable item. Metal too brittle will crumble under pressure. At the same time, a metal that is too soft will not withstand blows and maintain its form and purpose. Likewise, crafting your portfolio involves adjusting it as needed to the current markets.

Our Model Portfolio is extremely well-positioned to benefit from inflation and rising long-term interest rates. Long-time members remember that we eased into this position through a series of buys for over a year. We didn't just wake up one day, decide that inflation was a risk, and sell everything to move entirely into inflation-resistant picks. We identified the threat long before it happened and made small changes. We were buying here, selling there, with our inflation outlook in mind.

We tested our thesis along the way to ensure that the data we were seeing continued to support our macro-view. This is the best way to manage your portfolio. Avoid dramatic changes, and buy into opportunities that fit your short and medium-term outlooks.

We want to be like a metal worker forging a masterpiece.

Today, I want to discuss the next risk on the horizon. It is not necessary to rush out and adjust your entire portfolio. Doing so would be decidedly negative. My goal is to let you know what the "big picture" looks like – the ideas that are running through our heads at High Dividend Investing (HDI) at ElliottWaveTrader.net when we are deciding which stocks we want to buy and which we want to sell.

You have probably heard the term "stagflation" a lot in the past week. It is a risk, and it is one that I believe is inevitable. I want to discuss what stagflation is, what caused it in the past, why I believe it is likely to happen again, and crucially, why it will not happen right now.

In this liquidity-driven market, we will see some downturns, but they will not last. The market will fear something like stagflation for a minute and then investors will buy the dip. I do not recommend trying to trade these swings as they will fill in fast. Personally, I am not selling anything on the upswings and have been adding on the dips.

As investors, it is crucial that we don't get "too smart". A recession is coming. A recession is always coming. But you don't prepare for the next blizzard by laying down salt on the roads in July. That rusts your car early, and the salt is long gone by the time you actually need it. I see many investors making this mistake. At HDI, we recognize that the stagflation blizzard is coming, but we also recognize that it is still summer.

Risks of Stagflation

Last week, we hinted at the risk of "stagflation". Stagflation is a situation whereby inflation becomes much higher than economic growth. It is a combination of high inflation, high unemployment, and stagnant demand. In a typical inflationary environment, prices go up, and prices going up spurs more economic activity, and actual production increases. In a "stagflation" environment, prices go up, but economic activity stagnates. In other words, prices go up, but demand and production do not.

This combination of inflation with limited to no economic growth is widely viewed as a negative for most assets. Bond prices go down as interest rates rise. Asset valuations come down, and many companies suffer as they cannot generate sufficient growth to make up for rising prices.

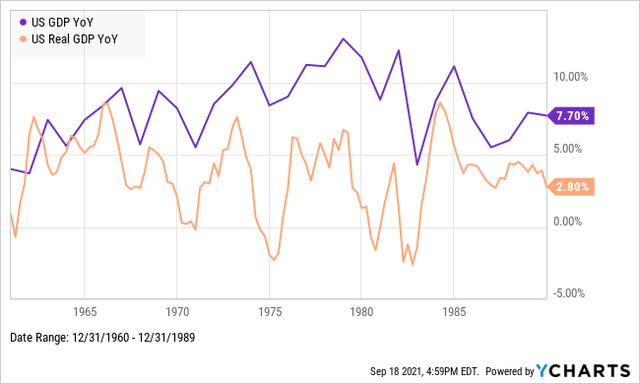

Stagflation was last seen in the 1970s to the early 1980s. Stagflation was not recognized as possible until the 1970s. Even though GDP was growing, "real GDP", which is adjusted for price changes (inflation or deflation), was down. Here is a look at GDP vs. Real GDP from 1960-1990:

Note that in the 1970s, real GDP was negative even as GDP was growing well above 5% annually. This was due to high inflation rates, which exceeded GDP growth.

What Causes Stagflation?

What is essential to recognize is that stagflation is "unnatural", that is, in an enclosed, undisturbed, laissez-faire economy, stagflation is impossible. When prices go up, production should increase.

Well, the reality is that the economy is not enclosed, it is often disturbed, and laissez-faire went out the window a few hundred years ago if it ever truly existed at all. The economy is subject to various external forces that disrupt the supply and demand dynamics of the economy. What can cause stagflation?

1. External Supply-Side Price Increases/Supply Restrictions

When prices go up for any particular commodity or product, economic theory says that either the supply should go up as businesses have more incentive to create it, or that demand should come down as the end consumer finds alternatives or decides to live without the product.

Well, what happens when you have a product that has no ready alternative, is essential, and has a physically limited supply? In the 1970s, oil prices were blamed for stagflation because prices skyrocketed, up 1100% in a decade.

Political issues caused the shortage in the Middle East and embargoes. This created a "perfect storm", as oil impacts the price of everything. Without resolving the political issues, there were few alternatives for the market to pursue. Oil production can't be replaced overnight. Oil prices skyrocketed and pulled the prices of essentially everything with it.

2. Labor Pressures

For many companies, labor is one of their highest expenses. This makes them susceptible to disruptions in the labor market. As the cost of living rises, employees become restless and demand higher wages, which forces further price increases. This can become a vicious cycle, with wages driving inflation, driving demand for higher wages. The '70s were characterized by increasing tensions between employers and unions. Employers were often unable (or unwilling) to provide the wages demanded and becoming increasingly aggressive at busting up unions. A big part of the eventual solution was compensation packages that provided more value in benefits than cash up front.

3. An Unwilling Fed

The '70s were characterized by a very dovish Fed that took too little action to control inflation. The Fed followed a "Stop and Go" policy – raising rates, and then when unemployment spiked cutting them again. Inflation never got under control, as the Fed was not willing to raise rates high enough for long enough until Paul Volcker took the helm and was willing to do whatever it took to control inflation.

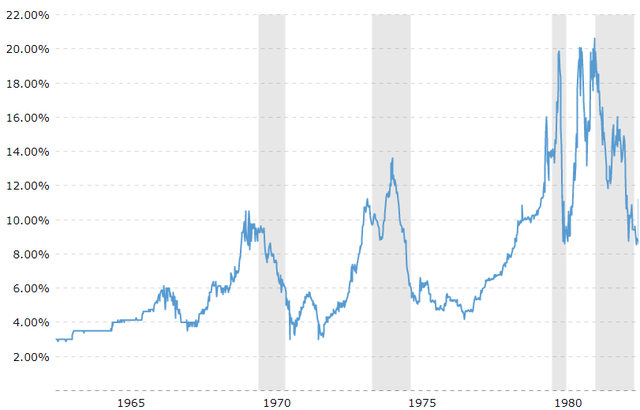

Source: Macrotrends.com

When we compare the movement of the Federal Funds Rate to inflation, we can see that the Fed was chasing inflation. Each wave of inflation was higher than the prior one, and the Fed raising rates in response helped but was insufficient to fully regain control.

What the Fed lacked was a willingness to follow through. When economic weakness was seen, the Fed reversed course and cut rates. As a result, just when inflation was coming back down, it would head back up.

History has taught us that inflation can be nipped in the bud quickly, however once it is going, it takes much more to slow it down. This is a lesson that was well taken by the Fed over the past 40 years – with the Fed willing to pounce quickly on any sign of inflation. In the 1970s, the Fed was unwilling to commit to a policy that likely led to recession. The result was that they got both: inflation and recession. Otherwise known as stagflation.

When I look at today's Fed, there is no doubt that it is fundamentally different than what we have seen since the 1980s. Instead of pouncing on inflation and nipping it in the bud, even at the expense of a recession as we saw in 2008, today's Fed is choosing to willfully ignore evidence of inflation. They are avoiding raising rates out of the fear that doing so would cause a recession. This materially increases the risk that we will see both inflation and a recession.

Is Stagflation On The Way?

Yes.

But not today.

I am often asked, "how should I position my portfolio for the next recession." Well, you shouldn't. It is too early. In investing, acting too early is often worse than not acting at all.

Predicting what will happen is always much easier than predicting when. Many predicted the housing collapse, but far more lost their shirts shorting mortgages than those that made bundles of money and got a Hollywood movie. Why? They shorted too early.

Investors often want to "be prepared", under the illusion that being prepared will spare them the pain of a recession. The reality is that you will frequently lose more preparing for a recession early than you will lose during a recession.

It is good to be mindful of the risks lurking in the future. It is not good to worry about them. Worry is the interest paid on debt before it is due.

Let's look at why I believe stagflation is inevitable and why I think it is not happening soon.

1 - The Internet Is No Longer Deflationary

For the past 20 years, the U.S. has avoided significant inflation. Globalization has played a substantial role in that. Our world is smaller today, and we saw the rise of the Internet reaching its full promise. Labor has been relatively cheap overseas and is increasingly accessible for small businesses and the American consumer.

This has been a substantial deflationary force. That is changing. The lines between the "online" and "real" world are becoming increasingly blurry as Walmart (WMT) sees itself as a direct competitor with Amazon (AMZN). WMT has been forced to compete online, and AMZN has been increasing its physical "brick and mortar" presence. If anything, COVID accelerated the already existing trend, forcing many companies to reevaluate their online strategies. At the same time, many "internet native" brands look for additional physical outlets in an increasingly competitive marketplace.

The result? The deflationary pressures of the internet might be a thing of the past. Inflation is hitting the internet, according to Adobe Digital Insights.

Categories that once had a minor presence in e-commerce are now becoming staples, with unprecedented pricing trends that no longer hold down overall inflation,” Adobe Digital Insights lead analyst Vivek Pandya said. “We are entering new territory.”

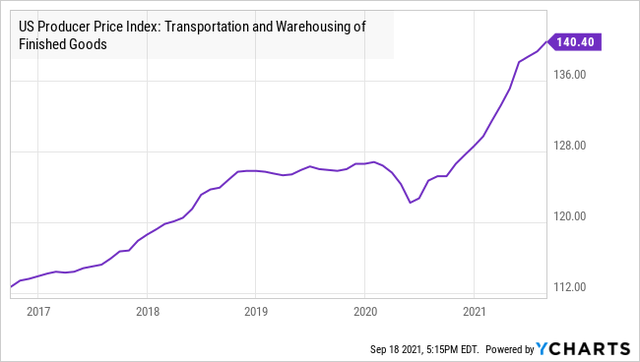

This is exacerbated by the escalating cost of shipping and warehousing. Once the cheapest space to rent and among the simplest structures, industrial warehouses were cookie-cutter unsophisticated buildings that were easily replaceable.

In modern-day logistics, where companies race to have products available and to the consumer's doorstep with days (if not hours), warehouses are increasingly sophisticated, in demand, and expensive.

Transportation and warehousing costs are skyrocketing—up over 12% over the past year.

There was a day when AMZN took advantage of how cheap industrial property and industrial rents were, recognizing that customers would pay a premium for speed. Now, everyone and their brother is doing it, and the demand for shipping and storage is exceeding the supply. Prices have to go up to match that reality. This will drive inflation, but not necessarily growth.

2 - Where Did The Worker Go?

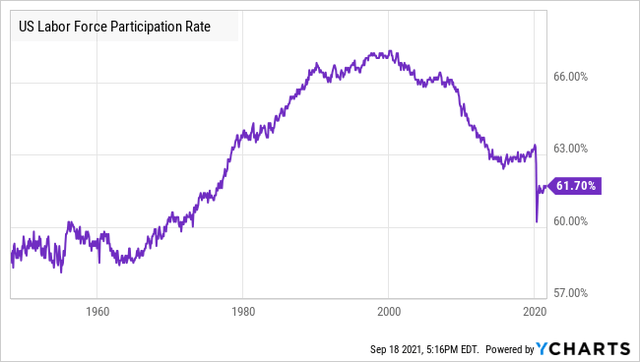

In the U.S., the labor force grew until about the year 2000, and since then has shrunk at a steady pace as modernization required fewer but often more skilled employees. It leveled off around 63% and even trended up in recent years as many industries were facing tight labor markets. As job openings trended up, the labor force participation rate started to perk up.

With COVID, what was a smooth trend down, became a dramatic drop. Many employees have yet to return to work. It is not entirely clear that they intend to return to work.

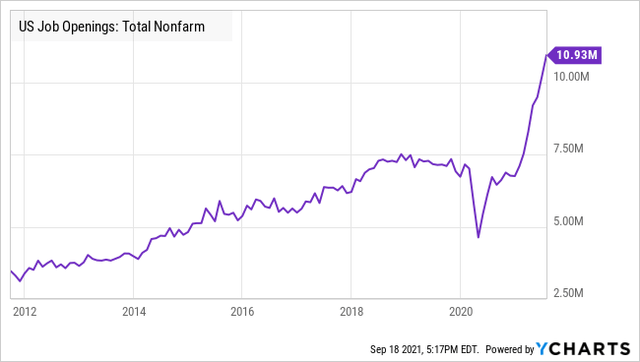

One thing is clear, there are jobs to be had if people are willing to take them. We have covered this extensively in recent weeks, and even as employers are becoming increasingly generous with their offers, job openings have been climbing to all-time highs.

Note that in the 1970s, we saw a significant increase in labor-force participation. In large part, this was due to inflation. Employers offering better compensation and an increase in families that were forced to rely on a dual income as opposed to a single-income supporting the whole family persuaded or forced people to find jobs. Today, employers will be forced to continue increasing wages and prices of their end product until they get the employees they need.

3 - The Fed

Today's Fed is extremely dovish. Certainly the most dovish we have seen since the '70s. Powell has routinely stated that an interest rate increase will not happen until inflation is sustained above 2% for a period of time. Powell has criticized recent Fed practices as being unable to reach the 2% target because they raised too early.

It is not a secret, this Fed has explicitly stated it is willing to let inflation "run hot". History tells us that every time inflation has run hot and the Fed fails to nip it in the bud, it goes from "running hot" to "running wild". The Fed is not going to act pre-emptively, it is not concerned about inflation, and it will allow inflation to run.

4 - So What Is Preventing "Stagflation"?

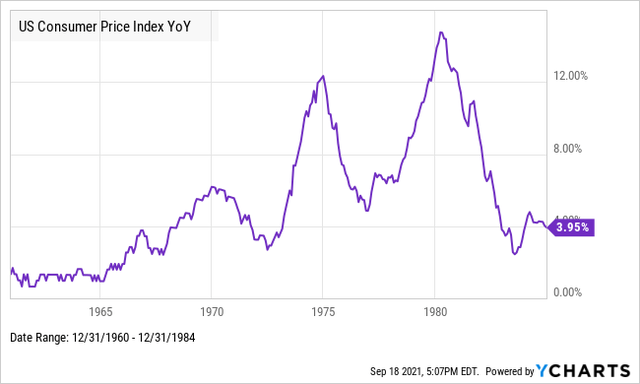

I have covered extensively why inflation will take place. But remember, stagflation has two requirements - inflation and a lack of growth. Inflation is coming, and if we look at the inflation charts, our period today is more similar to something in the mid-'60s. Inflation is heating up, but it is not yet out of control. In the coming years, we likely see inflation cool-off a little bit as some of the more short-term impacts like supply-chain issues work themselves out.

Meanwhile, there is growth. Companies are sitting on large amounts of liquidity that they are eager to put to work. They are looking to expand, grab market share, and innovate. Right now, for most businesses, the most significant hurdle in the way is labor.

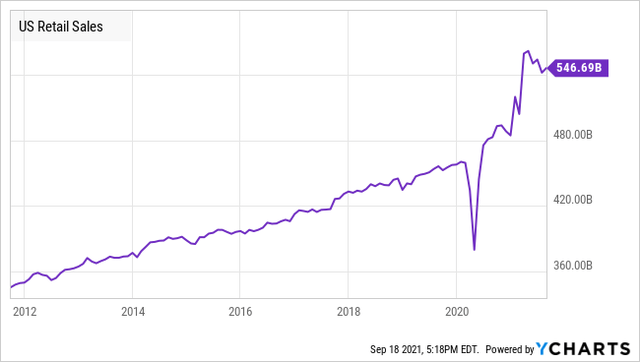

There is plenty of capital to be invested, debt is easily accessible, and consumer demand remains high. U.S. retail sales surprised many in August, rising over July despite Delta.

When we look at the big picture, we can see that retail sales are a lot higher than they were pre-COVID.

During the Financial Crisis, it took over three years for retail sales to recover to prior highs.

For now, we are entering a period where inflation will be high, but growth will remain high as well. Eventually, that growth will ebb, and that is where the danger of stagflation will become real. The most likely scenario is that inflation continues building, and the Fed raises rates entirely too late. This could cause a recession before inflation is under control.

This is a risk we will keep our eyes on and will ensure that we ease our portfolio into position as appropriate.

Technicals

The market exhibited some weakness throughout the week, with the S&P 500 closing slightly below its 50-day moving average. Over the past year, we have seen the S&P touch the 50-day average once every couple of months, and it has consistently served as solid support. Last week, it closed slightly below the moving average, which we have seen three times. In all cases, it rebounded to new highs within a week.

I have been discussing the Bubble of Liquidity, and this market reaction is a prime example. Weakness in equities is quickly met with investors looking to "buy the dip", with the breach of the 50-day moving average seen as a buy signal for many market participants. There is a very high probability that this will happen again.

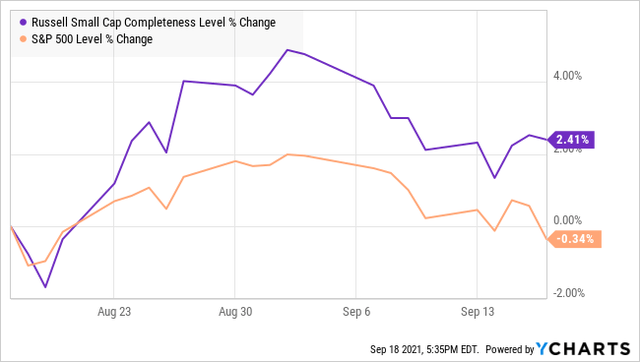

The Russell Small Cap Completeness Index, which measures small to medium businesses by excluding S&P 500 companies, recovered quickly from the dip and ended the week slightly up.

Over the past month, small caps have been outperforming as they did early in the year before pulling back and underperforming in June/July. The strength of these smaller businesses is a good sign for the macro-economy. The American Consumer is doing very well, there is a ton of liquidity, and small to medium-sized companies are growing despite the challenging labor environment and Delta.

The Russell is often a leading indicator of the other indexes and it is very positive that it recovered and closed up on Friday. I expect the S&P will rebound sooner rather than later, and I also expect that small-caps have turned the corner from an underperforming summer and will go back to outperforming the S&P as they did early in the year. This is a liquidity-driven market and the bull market has a long way to run.

Market Drivers

As we head into the fourth quarter, the significant drivers of the market will be:

- Liquidity: Liquidity has been the primary driver of the market for the past year. This is set to continue. While the Fed has been discussing tapering, it is very likely that it will continue to postpone it. The Fed is focused on the jobs market and will be more cautious with the impacts of Delta. The Fed is meeting on Wednesday, which will be a point of volatility for the markets. Our base case is that the Fed will reiterate what it has said before and choose to continue focusing on jobs and talking down inflation, kicking the tapering ball down the road again. Tapering will continue to be delayed, though there is a small chance that the Fed takes another small step forward and provides a framework for eventual tapering.

- Recovery: In early August, Delta dominated the news and was foremost in the minds of investors. Delta appears to have peaked in terms of the number of cases in the U.S., with the 7-day moving average of positive tests dropping roughly 10% from 165k to 148k. While COVID will remain politically contentious and a favorite story for the news, the genuine concerns of the market as far as a new round of shutdowns will diminish as long as case counts remain flat to down. REITs, BDCs, and other stocks that are sensitive to COVID restrictions will rally as these fears recede.

- Inflation: The inflation trade was robust in February-June, and then the market bought the Fed's "transitory" inflation story hook, line, and sinker. Despite a slowdown in August's CPI report, inflation-sensitive picks are perking up. Other inflation indicators suggest that inflation will accelerate again. As this acceleration is confirmed, inflation-sensitive picks will outperform.

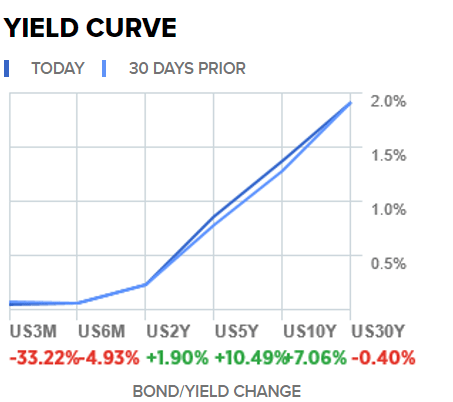

- Interest Rates: The interest rate curve is starting to steepen again. Treasuries will remain relatively low as the Fed continues to be an active buyer. However, the Fed was also bought back in March with the 10-year went above 1.7%. There is room for long-term rates to rise despite the Fed. Even as the sheer amount of liquidity in the system provides a tailwind for Treasuries, the recovery, inflation, and the threat of tapering will provide headwinds forcing rates up anyway.

Source: CNBC

A gradual steepening of the curve is ideal for agency mREITs like AGNC Investment (AGNC) yielding 9.0%, Annaly Capital (NLY) yielding 10.2%, and Dynex Capital (DX) a non-HDI pick, yielding 8.9%.

Conclusion

Over the past week, you have likely seen a lot of talk of stagflation. This is driven by the realization from the market that inflation is more than "transitory", combined with the belief that Delta will materially impact GDP growth. What is transitory is any impact from Delta. The American people are pushing forward despite Delta. They are going to the movies, they are going out to eat, they are still shopping. Businesses are much better prepared and are willing to adapt to evolving government guidelines and mandates.

Inflation is happening, and inflation is going to continue to accelerate. However, growth is still strong. Companies are looking to expand, consumers are looking to buy, and demand continues to drive the economy. The largest barrier for many companies right now is labor. That is a problem that money can fix. The combination of rising wages and inflation will be the carrot and the stick that will encourage, or even force, people back into the labor force.

Stagflation is coming, it isn't coming tomorrow. Today, we want our portfolios positioned to take advantage of the next step, which is inflation and growth. Prices are going up, and many companies are well-positioned to take advantage of it. We have spent the past year positioning our portfolio explicitly with those conditions in mind.

In the coming years, you will see me talking more about stagflation in these weekly updates. Rest assured, it is something we are keeping our eyes on, it is something I consider with each and every trade HDI makes. We will be prepared for it.

We won't be melting down our masterpiece in a panic. We will adjust it over time and be prepared. Just as you have come to expect from my team and me with our Model Portfolio.

I am personally not selling any of my dividend stocks. I have been taking advantage of the dip adding to resilient stocks such as agency mREITs AGNC and NLY. Plus adding some of the highest yielding picks OXLC and ECC which are set to thrive in a highly liquid and high growth environment.

This is a liquidity-driven bull market that is set to continue. We will see various fears crop up and any dips from those fears will be short-lived. Stay focused on your income, building it a dollar at a time, and you will find that your portfolio is ready for any event. Providing you a large source of cash flow that can be redirected into the best opportunities of the moment. Yes, stagflation is coming, but equities are continuing to rise and are very resilient for now. The summer sun is beating down, and now is the time to enjoy it!

HDI, described as the #1 service for income investors and retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.