Market Outlook: Investors Buy Every Dip

Summary

-Following the pullback earlier this week, investors once again bought the dip.

-The reason HDI stocks have been resilient.

-Inflation is still going higher, and why the Fed is not willing to do anything about it.

-Notes about rising Treasury yields and the soaring U.S. dollar.

-Why this bull market is set to continue strong. Big upside coming.

Market Outlook: Investors Buy Every Dip. Big Upside Coming Soon

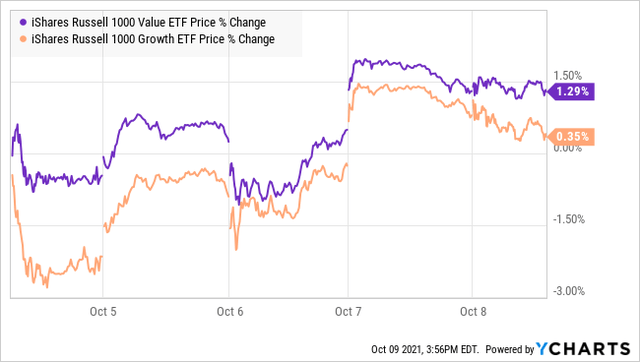

The highlight for the week was high volatility as a result of the rout in technology stocks. Early in the week, it was brutal. I have repeatedly been warning to minimize exposure to growth and tech stocks. The reason is that these stocks and sectors carry lofty valuations compared to value stocks.

Last week illustrated a trend that I expect will accelerate, with value stocks outperforming growth stocks. Value stocks had a smaller dip and a stronger rebound as seen by comparing the Russell 1000 Growth to the Russell 1000 Value index.

Growth and technology are extremely sensitive to higher interest rates because they are valued based on expected future earnings instead of today's earnings. As the Treasury Yields went higher, future money became less valuable, and we saw a decline in the sector. This is why we saw value stocks slow down over the summer as Treasury Yields fell. With Treasury Yields on the rise, the rotation from growth stocks to value stocks is back in motion.

By Tuesday, before the market recovered, the bigger losers were large tech stocks and notably FAANG stocks, including Apple (AAPL), Google (GOOG), and Facebook (FB). In fact, on Tuesday of this week, Amazon (AMZN) had provided negative returns for investors since the beginning of the year.

We are in official "market correction" in the tech-heavy Nasdaq index, as the rotation to value builds. Though even with a tough week, investors once again bought the dip and the Nasdaq was up 0.22%. The S&P 500 ended the week up 0.79%, thanks to higher exposure to Value stocks.

The market recovery: We got some great news on Wednesday and Thursday, where investors bought the huge dip, and we saw a huge reversal in the indexes from 1.5%+ negative to positive territory. This recorded the Biggest Reversal in the markets since last February, which confirms my views that smart investors still keep buying every dip!

We need to keep in mind that tapering by the Fed is already priced into the markets and that there remains a massive amount of liquidity in the financial system. For these reasons, the markets are set to go higher, and the downside risk is limited. Even among growth stocks that are seeing negative conditions, we will continue to see investors buying the dip.

It was notable this week that the HDO stock picks have been resilient and saw less price volatility due to our positioning which is heavy in "Value" stocks that benefit from rising inflation and rising Treasury rates.

The Reason Why Our Stocks have Been Resilient?

- Since the beginning of the year, I have been warning of higher long-term interest rates. Inflation pressure will result in long-term interest rates heading higher while short-term interest rates remain low. The 10-year Treasury yield closed at 1.60%, its highest level since June 2021. At the same time, short-term rates have remained near zero. This rising rate spread is very bullish for many of our stocks.

- We have been targeting "value stocks" and cyclical stocks that can weather both inflation and higher interest rates. Our value and cyclical stocks are set to strongly outperform in the current environment. Cyclical stocks can easily pass higher inflation costs to their customers. At the same time, smaller-cap value stocks have historically done very well during the first phases of rising long-term interest rates.

- The vast majority of our positions are "pure American companies". What I refer to as "Pure American" are these companies that produce the vast majority, or 100% of their income in the United States. These make them "safe heaven" stocks as they are not impacted by the turbulence happening in the foreign markets. Our international exposure is primarily in the EU and the UK. Notably, the clampdown in China on their largest companies causing the collapse of the Evergrande and others to come has little direct impact on our holdings.

- Last but not least, we have added several commodity-related stocks to help us gain from higher inflation and protect our asset base. We moved into these positions very early in the game, since the beginning of 2021. While some commodities have been in consolidation mode due to global growth concerns from investors, this is set to be temporary. The U.S. and the global economy are both heading to an overheating economy, and commodities have only one way to go, which is up. I expect a lot more upside as we head into 2022 and beyond.

I am very excited about the prospects of our portfolio over the next two years. Many laughed when we started positioning our portfolios to benefit from higher inflation last year. Higher inflation will be good for our positions and it is going to continue.

According to Fed Chair Powell and other Global Central Bankers, inflation is set to continue strong through 2022. I am happy to see that these officials are starting to admit that inflation will be with us for much longer than their initial projections. even as they change the definition of "transitory" from a few months to several years. They keep raising their future inflation target every few months, and I fully expect that their inflation projections will rise significantly as we close the year 2021.

The Fed and Global Central Bankers are NOT willing to do anything to fight inflation.

Should the Fed or other Global Central Bankers wished to fight inflation, they would have started to hike interest rates already, even if slightly. But they still refuse to commit to a date to do so, and they are sticking to their claims that inflation is transitory. This is despite mounting evidence that inflation is soaring and here to stay. For the past 12 months, inflation has reached 4.3% in August using the Fed's preferred "PCE" measure and that number will continue to increase.

This means that many workers, investors, and retirees have lost significant purchasing power this past year and have seen the value of their savings dwindle. Remember, inflation is indirect taxation (and a very painful one) that mostly impacts the poor, the middle class, and retirees. It also significantly affects those who are sitting on large cash amounts in their savings accounts. This is the worst time to keep cash in the banks, including savings accounts, money markets, and CDs. You are getting negative returns after taking into account the impact of inflation. In fact, many dividend investors who attempt the "dividend growth" strategy are seeing negative returns as their yields are well under 4%!

Cash is trash and should be put to work. I personally keep only enough cash to cover my expected spending for the next six months and some emergency funds. Other than that, I am investing every penny I have in dividend stocks. Note that investing in real estate is also another great option to diversify for those with the ability and means to do so – helping protect you against the devastating impact of inflation.

The Situation of the US Dollar and Fed Interest Rates

The U.S. dollar has soared relative to other currencies, and I believe that it is currently overbought. The markets are factoring in a hike in the Fed's target interest rate in the middle or end of 2022. This is highly unlikely, and Mr. Market is wrong here. The Fed will not start hiking rates before 2023 and probably at a slow pace with long intervals in between. A very small hike at the end of 2022 is a diminishing possibility as this is the most cautious and dovish Fed I have ever witnessed.

In my opinion, the dip in the Euro and other major currencies such as the Japanese Yen present a buying opportunity. I have mixed feelings about the British Pound in the short and medium-term due to considerable Brexit uncertainties and lack of proper planning by the British Government. I am most bullish on the Euro. This is bullish for our picks which have exposure to Europe and carry a portion of their assets in Euros, such as W.P. Carey (WPC) yielding 5.6%, Realty Income (O) yielding 4.2%, and Medical Properties Trust (MPW) yielding 5.7%

Remember, the Fed is quite happy with inflation, and they will not be planning to ruin this party too soon. The Fed is focused on the jobs report, which with the labor force participation rate remaining very low, jobs will continue to be unfilled resulting in "low" job numbers.

The situation with the 10-Year Treasury Yield

Inflation is putting pressure on long-term interest rates and, notably, the 10-year Treasury yields. The vast majority of inflation we see today is not transitory. Steven Mnuchin, former U.S. Treasury secretary, warned this week at the Bloomberg Invest Global virtual conference:

I do worry that this will be ongoing inflation, and we could easily end up with 3.5% 10-year Treasuries, which again just increases the cost of the national debt and creates budget issues,”

Inflation is now anchored in the system and will remain with us for many years to come. I fully expect that long-term Treasury Yields will continue to see upward pressure due to ongoing inflation pressures. This is why investors must be positioned into stocks that will benefit from rising long-term interest rates and widening yield spreads between short-term (Fed rates) and longer-term rates.

It is no surprise that wealthy Americans are fleeing Treasuries with their holdings today at a 17 year low. Not only do Treasuries offer negative real returns (inflation-adjusted), but holding long-term Treasuries is set to result in a huge dent in one's portfolio. As interest rates go up, Treasury prices tumble.

Deliveries, Inventories, Lack of Goods Will Continue to be a Major Problem through the year 2022

Material shortages have been a significant disruptor of the availability of goods and inventories in 2021, and I fully expect that it will continue and may worsen next year. While the big headline news is that a booming economy following COVID-19, many are discounting that the lack of people willing to go to work is the biggest problem.

The 55+ demographic has declined the most in the labor-force participation metric. Many experienced workers have opted to retire early, and are not returning to work. This not only creates a head-count shortage, more importantly, it creates an experience shortage. Businesses are struggling to find enough people, and it only hurts more when they lose experienced workers.

With inflation soaring, it makes little sense for many to return to work, as wages (although they have increased) have not kept up with the soaring inflation. This is quite a vicious cycle. Companies have to pay higher wages to get more staff on board, which contributes to higher inflation. At the same time, higher inflation "eats away" the purchasing power of these workers. As time passes, this keeps further pressure on inflation. Companies are paying more money for less-experienced workers, and that is destined to reduce efficiency.

At the same time, governments across the globe are on a "spending spree," not only contributing to higher inflation but putting more bottlenecks and pressure on the availability of workers, which makes it much harder to replenish inventories and further lack of goods and supplies. We see unprecedented neglect by Central Bankers and Government about higher inflation!

As I have been stating in most of my "weekly outlooks", I am confident that there is a clear agenda on the part of these officials to let inflation run high and hot to reduce the level of their excessive national debts, which has become unmanageable.

Allowing inflation to run high devalues the levels of debt and increases GDP, making their Debt/GDP ratio much lower and much more manageable. Importantly, governments do not have to impose higher taxes by letting inflation run hot, which would be viewed as very unpopular. The easiest way is to let inflation take care of the problem. This way, they will not look like the "bad guys", hiking taxes and upsetting a large portion of the population.

As stated above, the unfortunate result is that it is primarily the poor, and those who are on a fixed income (such as retirees and those preparing for retirement) are the most impacted by the indirect tax of the "inflation monster". This will result in a higher "wealth gap" between the rich and the poor, a policy that these governments claim that they want to fight by distributing wealth more equally. The bottom line is that they are doing the exact opposite!

Don't Underestimate the Power of "Excess Liquidity"

I have been discussing the Bubble of Liquidity, and the market continues to demonstrate the power of this bubble. Weakness in equities is quickly met with investors looking to "buy the dip", with the breach of the 50-day moving average seen as a buy signal for many market participants. We are currently below the 50-day simple moving average by the largest amount since late October/early November 2020.

The last time this happened, the market surged nearly 12% in the coming month. With the strength we saw ending the week, we are likely to see a strong surge up again.

This is a liquidity-driven bull market that is set to continue. We will see various fears like the debt-ceiling debate last week and Evergrande the week before. Any dips from those fears will be short-lived as money gets pumped into equities. Stay focused on your income, building it a dollar at a time, and you will find that your portfolio is ready for any event. Providing you a large source of cash flow that can be redirected into the best opportunities of the moment.

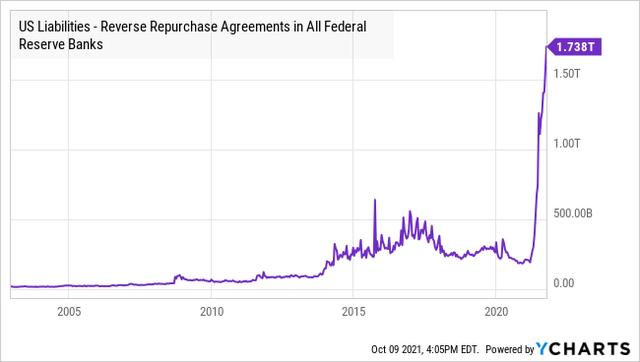

As we head into the fourth quarter, liquidity will continue to be the most significant driver in the market. "Reverse Repurchase agreements" are short-term borrowings where the Federal Reserve Banks are the borrowers at extremely low interest rates (around 0.05%). This is a tangible illustration of the amount of excess liquidity in the system that banks are willing to lend at such low rates. Repurchase agreements went from all-time highs early in 2021, to being completely off the charts:

Despite $1.7 trillion in excess cash that banks are willing to lend to the Federal Reserve at near 0% interest rates, the Federal Reserve continues to pump more money into the system with regular treasury and MBS purchases.

This is also why "tapering" is not a big deal. "Tapering" means the Fed will slow down purchases of treasuries and MBS, with the target of ending purchases completely in 6-8 months. This purchasing directly leads to excess cash in the financial system. The bucket is already overflowing to the tune of $1.7 trillion, it is safe to turn off the tap. With a weak jobs report, it is likely that the Fed will remain dovish and will kick the tapering can down the road another month at their next meeting. If they choose to proceed with tapering anyway it won't have a material impact as there is already tons of cash.

With so much "cash still on the sidelines" and more to come with "projects" financed by governments, plus asset purchases continuing (even if they slow due to "tapering") this cash bubble is only set to get larger.

The hunt for yield has already started since last year, and it is only set to accelerate. This is excellent news for our solid dividend stocks, which will continue to see higher demand and higher stock prices. I expect big capital gains in addition to our recurrent income going forward!

Technical Situation

We remain in a very strong bull market due to extremely high levels of liquidity in the system and because investors know that the Fed has got their backs. Over the past 10+ years, we have learned that the last thing that the Fed wants is a market crash that may result in a recession. They are not willing to take the slightest risk in this respect because a recession will not only be very painful but much more costly than pumping new liquidity into the system. Every market correction gets the Fed worried, and we see them suddenly change their tone to a more dovish one to support the markets.

With the markets proving to be so resilient, I expect to see new all-time highs very soon. However, higher than average volatility is likely to remain with us for some time, which is great as it creates some excellent buying opportunities.

I expect that the S&P 500 index will reach the 4600 level (or 4.7% higher from here) in the next 3 to 6 months, possibly even sooner. My target is at the 4900 level by the end of the year 2022 (or 11.5% higher from here).

On the downside, the 4250 has proven to be a significant support level, and I expect it to hold well in case of any bad news that would cause a pullback. I view that every pullback to be a buying opportunity!

Note that the last quarter of the year has historically been the strongest, and I expect to see the same this year. Investors will adjust to a more bullish tone as we head towards the Christmas holiday season. The rotation to value is likely to gain more steam and value stocks will outperform growth stocks.

Conclusion

I remain very bullish on equities for the next 16 months to 24 months. It is only a matter of time for the markets to go much much higher, with my longer-term target for the S&P 500 index up 11.5% from here. Our "Model Portfolio" picks have strongly outperformed all market indexes, including both the S&P and Nasdaq indexes, and I am confident that we will continue to outperform strongly.

Remember that cash is trash, and you need to put your hard-earned savings to work to preserve your purchasing power and even beat inflation!

Note: If you are planning to celebrate Christmas or Hanukkah, I suggest that you start preparing your shopping list and hit the markets soon. Supply disruptions will continue and will get worse during the holidays season due to high demand.

Have a great Sunday!

= = = =

For our Newest Members: Don't forget to check when your Next Dividend Paycheck is coming!

I wake up every day excited looking forward to my next paycheck! To do so, I take a look at:

- Our "Dividend Tracker" to see when I will be collecting my next dividend paycheck from common stock or baby bonds,

- Or at our "Preferred Stock Dividend Tracker" to check out when my next preferred dividend will hit my account. (In our Preferred Stock Portfolio - columns O thru W. Upcoming ex-div dates are highlighted in green).

Both of the above tables are part of our "Model Portfolio spreadsheet" and can be found in separate tabs. (The links change every month as we update our portfolio). Users of the HDI Portfolio Tracker also get dividend data reported for their HDI holdings, on the far right of Tab2.

I am happier to collect the income rather than to game the markets. Time is always by my side!