Market Outlook: Fed Behind Yield Curve, And Is The Opposite Of 'Hawkish'

Summary

- The Federal Reserve is well behind the yield curve.

- There is more noise about raising rates, and the Fed will likely hike a few times this year, but is it really "hawkish"?

- Inflation is already out of control, and the Fed has no intention of being aggressive enough to control it.

- We explore why the expected three hikes to 0.75% will not be meaningful. Even 4-5 hikes would not make a material impact at this point.

- Growth stocks are being hammered in the market, Value stocks are outperforming. We expect this will continue throughout 2022.

Market Outlook: Fed Behind Yield Curve, And Is The Opposite Of 'Hawkish'

Everyone is worried that the Fed is getting hawkish in order to fight inflation rather than tolerating it.

In 2021 the CPI (Consumer Price Index) increased 7%, the fastest annual increase since 1981, and the PPI (Producer Price Index) which measures inflation for producers increased 9.7%. Worse, inflation "slowed down" in December primarily due to the price of crude oil dipping 16.5% – a decline that has reversed as oil has surged back over $80. The writing on the wall could not be more clear: Inflation is substantial, and it isn't going to magically go away on its own.

Historically, investors have come to expect that the Fed faced with inflation like this would respond with huge increases in the target rate. Since the "Volcker" Fed of the early '80s, the Fed has aggressively raised rates at the first hint of inflation. Now, everyone expects the Fed to make a "Hawkish pivot" to deal with inflation. Investors are freaking out. We are seeing significant volatility in all major indices, but is the Fed really hawkish? Let us have a look at the facts:

Inflation Target Revamp:

Back in December 2020 (or about a year ago), the Fed was aiming at a median two-year inflation forecast for inflation to remain below 2%. Today, the Fed is targeting an inflation rate of 2.3%. The Fed target inflation is higher than it was 2 years ago! The reason for this is because of a framework revamp whereby the Fed made two major changes.

The first is a change in tolerating inflation above 2%. Historically, the Fed started fighting inflation as soon as it approached its 2% target. It raised early and often to prevent inflation from going above 2%. The new policy statement says:

In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time."

In theory, it makes sense right? If you want to average 2% inflation and you have several years at 1.5-1.75%, then you can let inflation run a little hot and be over 2% for a bit. However, apparently, the Fed doesn't understand averages. After one year of 4.5% inflation, we would think that a Fed seeking an "average" of 2% would then seek to be below 2% for a number of years. To have an average of 2% inflation over 10 years, inflation will need to average 1.72% for the next 9 years. Yet the Fed expects its policy to lead to an inflation rate of 2.2% for 2022, 2.2% for 2023, and 2.1% for 2024. If achieved, that would be an average inflation rate of 2.73% over 4 years. In other words, the Fed's stated plan is for inflation to be well above its stated target.

Unemployment Target:

Also back in December 2020 the Fed was targeting unemployment of 4.2% (at a time when it was at 6.7%). Now, the Fed is aiming at an unemployment rate of 3.5%. This is despite a very tight market and soaring wages. This means that demand for workers is going to increase in a very tight labor market, which will further contribute to inflation pressures.

Instead of focusing solely on employment numbers, the new goal is described as "a broad-based and inclusive goal that is not directly measurable and changes over time". What does that mean? Well, depends on the day. Powell has described "full employment" as being a "range of factors" and has said the Fed will have to make a "judgment call" on when it has been reached.

Historically the Fed relied primarily on headline numbers like the unemployment rate. When it got low, the Fed started hiking the target rate to prevent inflation. Under the new framework, they will not raise interest rates simply because unemployment rates fall below a level that is estimated to fuel price pressures. This is an important turn away from a consensus that had guided central bank policy since the 1980s.

With the Fed's new emphasis on "maximum employment" being more "inclusive", it is the ultimate moving goal post. Would we buy stock in a company with such a vague and immeasurable "goal"? No.

On a relative basis, compared to a year ago, the Fed's inflation and unemployment targets are more dovish for the year 2022 than the year 2021.

Getty Images

Why Hiking Interest Rates Won't Work

If we take the Fed's projections at face value, they expect that raising the target rate less than 1% will be sufficient to get inflation under control. The Fed is trying to sell the story that slightly higher interest rates will curb inflation, however, that story is flawed for many reasons:

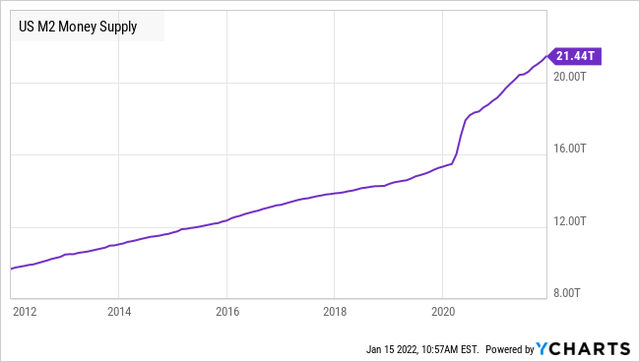

1) The Glut in Demand Inflation: As noted in a recent article entitled "Inflation and the Great Supply Lie", we are currently seeing global supply shortages that are the result of a "demand shock" (or a glut in demand) rather than a COVID issue. Simply put, the economy is flooded with cash after the Fed and Government pumped more liquidity into the system during the pandemic period. After COVID, the M2 money supply spiked, bank liquidity spiked, consumer checking accounts spiked, corporate cash spiked, and corporate cap-ex spiked. This isn't a coincidence, they are all related.

There is more money in consumers' pockets, more money in corporate pockets, and more money in banks' pockets. When there is more money, people spend it. What has materially changed today is that consumer demand is much higher than before, making corporate demand higher and supply is only low relative to the new, much higher, demand.

In order to meet this new demand, supply chains need to be expanded to be larger than they have ever been. This requires new investments. Hiking interest rates controls inflation by reducing demand by making capital more expensive. Yet the demand already exists, it is too late to reduce it. Therefore, the Fed interest rate hikes will not resolve the supply chain problems, but will actually make them worse. Suppliers will have to struggle to hike their prices as their cost of debt rises due to higher interest rates. They will have to think twice about increasing production because they will be unsure if they can pass higher prices to the end consumer. Meanwhile, the backlog of demand will continue to grow.

In order to have a chance of reducing inflation, an interest hike would have to be substantial enough to reduce already existing demand. The longer that demand is allowed to build, the more aggressive that rate hikes will need to be. A hike to 0.75% on the target rate might have been enough if implemented last year, but today, the Fed would have to consider a long-term rate target of 3.5-4% within the next few years to have any hope of reducing demand.

2) Labor Force Inflation: The labor-force participation rate remains well short of what it was pre-COVID. The result is 11 million unfilled positions versus 5.7 million people looking for work. So far, wage inflation has been a minimal factor in reported inflation metrics. This is because inflation metrics all look backward - CPI and PCE are telling us what inflation already happened, not what inflation will happen. We've already seen companies competing aggressively and increasing wages for new hires. With new hires getting higher wages than existing employees, companies will be forced to increase wages throughout their workforce in 2022, or risk losing existing employees. Throughout 2022, rising wages will become a key force for rising inflation.

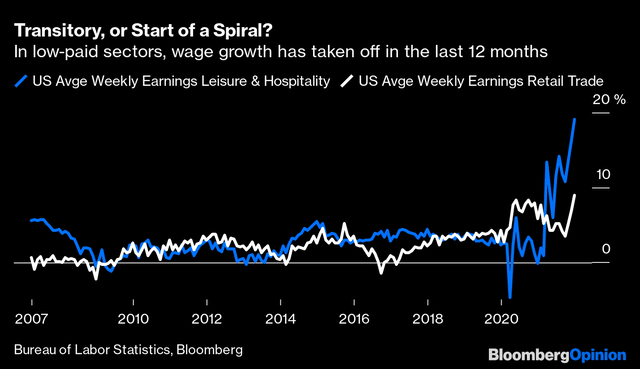

Last week's data on average weekly earnings show that wages in the leisure and hospitality and retail sectors have suddenly shot up, after a decade when they have barely budged:

Over the past 12 months, average hourly earnings have increased by 4.7%. Yet with low-wage sectors taking off with double-digit growth, wages in higher-paying jobs will be forced to increase as well. As employees advance in their careers, they expect their incomes to climb. As they take on jobs that require more experience, skill, education, and have more responsibility, they expect to be compensated. This domino effect doesn't happen all at once, rather it is something we would expect to work its way through the economy over many months or even years.

The labor force is so tight and hiking interest rates by 0.75% will neither bring on more workers nor will it suppress demand for them. Many of the workers who have left the labor force are in the 55+ group. They retired, with no intention of ever coming back. This leaves employers with two challenges:

- A smaller workforce in a time of rising demand leads to more intense competition among employers.

- A significant lack of skilled employees, since those who left were employees with the most years of experience. This "skill gap" means that employers will have to invest more in developing their workforce, and ultimately, there is no amount of money that can replace the benefits of experience through time.

In the meantime, the Fed has taken a view that the Phillips curve theory is dead, which is a big flaw. The Phillips theory takes a view that unemployment and inflation have an inverse relationship. Today, the Fed believes that higher employment is no longer an important factor in driving inflation higher, that there has been a lower correlation the past two decades.

However, this Fed misses the point that in the past decades, the weaker link between unemployment and inflation depended on taking pre-emptive rate hikes to fight inflation. Unfortunately, this is a policy that it has now abandoned. Instead, this Fed has committed to keeping a loose monetary policy until what they believe is "maximum employment" has been reached. They have set a target for the natural rate of unemployment being at 3.5% as stated in a previous FOMC meeting.

A tight labor market, such as the high number of unfilled jobs and rising wages, should offer a hint that we have already hit full employment, so the natural rate of unemployment is clearly above the 3.5% target level. The Fed is flawed by having such a low target that will inevitably drive inflation to be much higher than its estimates.

Under-estimating the natural rate of unemployment will lead to severe policy mistakes. We have seen this happen in the past, such as during the "Great Inflation Crisis" of the late 1960s and 1970s where the Fed assumed that the natural rate of unemployment was around 4% when later evidence demonstrated it should be a couple of percentage points higher.

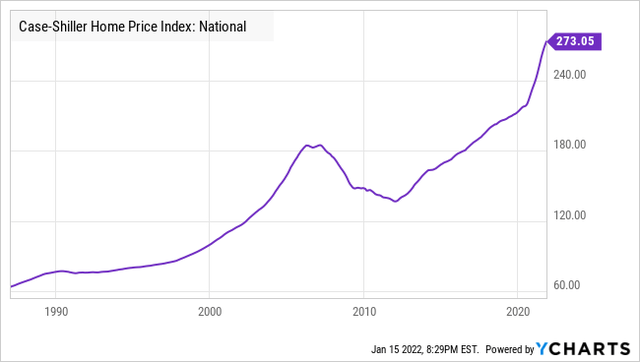

3) Rent Inflation: Third, slightly higher interest rates will not impact the soaring demand for homes, and their subsequent price surge. This is important because higher cost of housing (both rent and home prices) is also an important force driving inflation higher. Demand for homes today has little to do with interest rates and a lot to do with excess liquidity in the system. Even with a 0.75% increase in the target rate, mortgage rates will remain well below 2019 levels and remain close to historic lows.

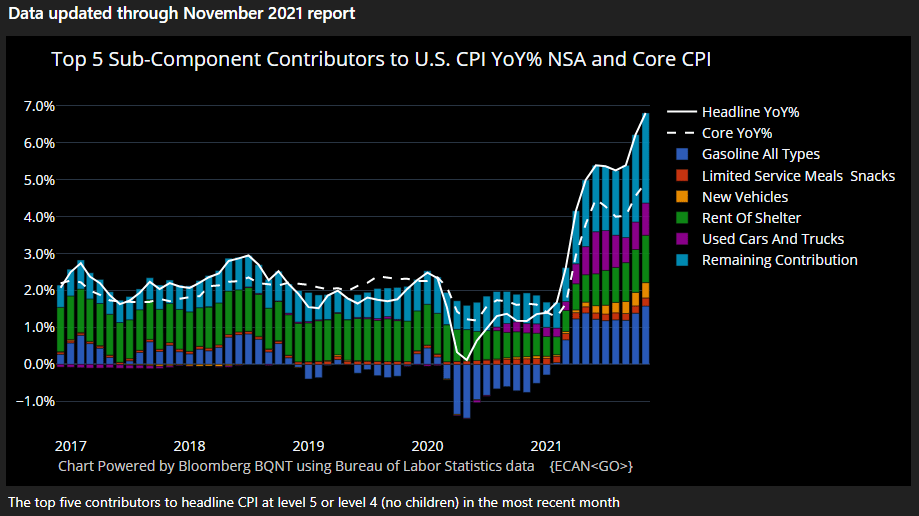

Rent is an important factor to keep an eye on because it makes up a significant portion of the 'Consumer Price Index'. By November 2021, rents were contributing more than any other single inflation force, except for gasoline as we can see from the chart below.

Bloomberg

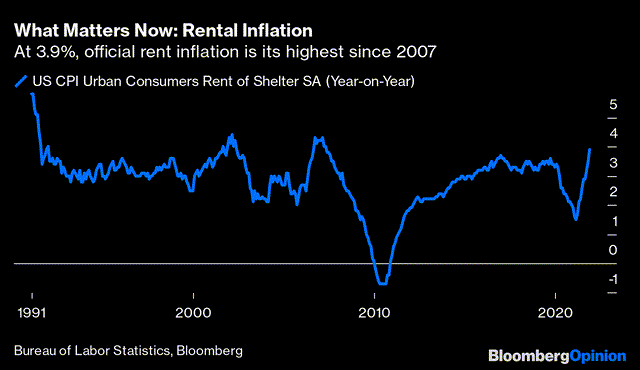

The growing impact of rents as a major inflation factor (shown in green above) is due to dynamics following the pandemic; we saw rents slow down in early 2020, and then rebound to their highest rate of increase since 2007:

Bloomberg

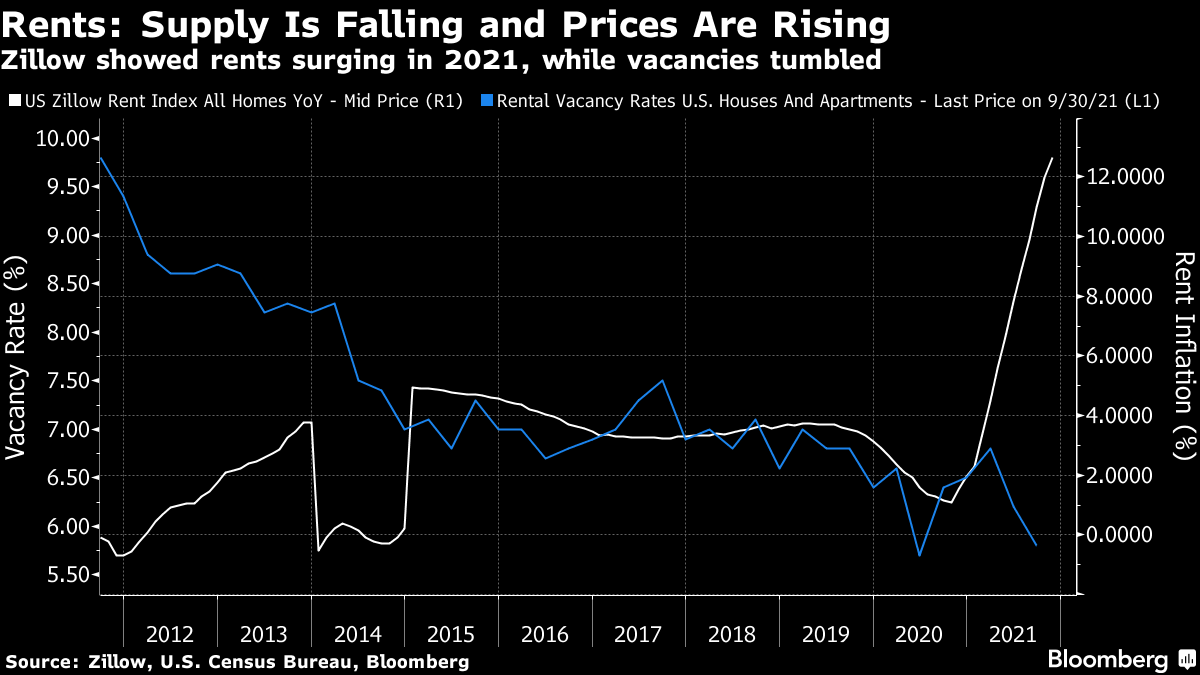

There is very good reason to expect rents to rise further. Supply is falling while demand is soaring. Higher rental inflation in 2022 is coming for sure. As vacancies are pushing historic lows, rent growth absolutely skyrocketed in 2021.

Zillow

Government measures like CPI and the Fed's PCE measures are slow to reflect this increase because they use old data and many participants in the survey are under 1-year contracts. If their rent renews in January, then their rent in December 2021 reflects what market rents were in December 2020. It isn't until January 2022 that their higher rent will be reflected in government metrics. With rent increasing much more rapidly in the second half of 2021 than the first half, it will be late 2022 before that higher rent is reflected in government metrics. It takes approximately 18 months from the time that rent goes up, to the time that it is fully reflected in CPI or PCE inflation measures.

Rent is just trying to catch up with home prices, which have slowed down to "only" an annualized pace of 12% growth/year. Which is still the fastest pace since 2005.

End Result: The Fed has a big flaw in its approach to tackling inflation. The problem today is not just an interest rate problem, but rather a "liquidity problem" (or a bubble of liquidity in the system). The Fed has so far given no indication whatsoever to withdraw liquidity from the system which is the ONLY effective way to tackle inflation. The Fed's proposed plan of increasing the target rate by 0.75% is too little, and entirely too late to have any meaningful benefit. It is like fighting a fire, your fire extinguisher might work great when the fire is small and contained, but now that half the house is up in flames, it is too late to do any good.

The Fed's actions (and inactions) are increasing the risk that inflation, which is already running well above its target, is already out of control.

The bottom line is:

- The Fed's inflation target is higher than it was a year ago.

- The Fed's unemployment target is lower than it was a year ago.

- The Fed is behind the yield curve and acting too slowly to catch up to the "neutral interest rate".

- The Fed is ignoring the bubble of liquidity in the system, which is the main reason for the inflationary problems today.

We can conclude that the Fed's policy stance is actually much more dovish (and accommodative) than it was a year ago!

Alamy.com

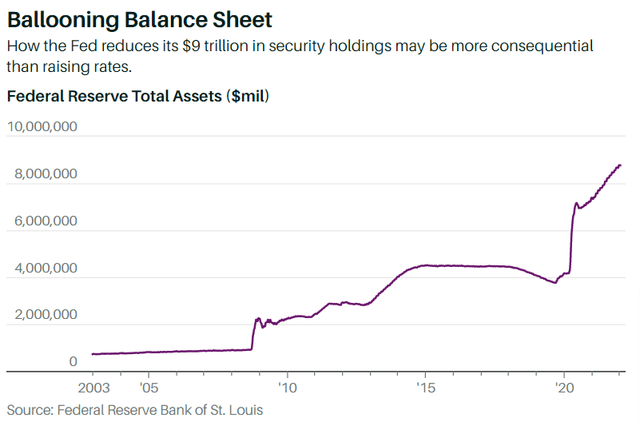

What Really Matters is How the Fed Handles Its $9 Trillion in Assets

If the Fed was serious about tackling inflation, it is not through interest rate hikes, but by tackling its ever-expanding balance sheet.

The Fed owns about a third of the Treasury and mortgage markets, and long-term interest rates (or the 10-year Treasury Yields) won’t really rise until the Fed’s footprint diminishes. Rate increases on their own would thus be ineffective if bond markets aren’t speaking for themselves and adjusting accordingly.

Pay attention to this: Would you invest in a 10-year treasury that is yielding less than 2% when inflation is running around 7%? Only a few would.

The Fed needs to reduce the size of its balance sheet. By doing so, it will withdraw liquidity from the system, which is the needed tool to fight inflation. But instead, the Fed is still expanding its balance sheet!

The problem is that unraveling the Fed's balance sheet will not be easy. The last time they tried to actually reduce assets in 2018, the plan was quickly reversed, and by 2019 the Fed was actually increasing its balance sheet again even before COVID. The Fed was pursuing a Dovish easing policy even before there was a crisis!

Why is the Fed Acting So Dovish in the Face of High Inflation and a Tight Labor Force?

1- New Fed Policy Framework: The Fed has realized a long time ago that the U.S. economy is a fragile one, especially in the face of an ever declining birth rate in the U.S. and globally. If you recall, one of the main drivers of economic growth is population growth, because population growth brings more workers with little inflationary impact. Today, lower birth rate growth, and an aging population, are a big drag to the economy. This is why the Fed has changed its inflation target rate from a maximum of 2% to allow inflation to overshoot to "an average of 2%" over the long term. By doing so, the Fed has a good cushion to avoid an economic recession.

2- Avoid a Market Crash: The Fed has learned since the "great financial crisis" of the year 2008, that any stock market crash, or a housing crash, will result in a very painful recession. Should we see a recession from a market or housing crash, the Fed will have to pump even more money into the system to save the economy. So it will be very costly, and more costly than having the economy overheat.

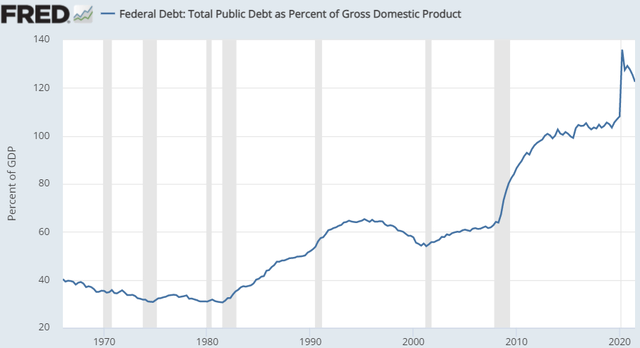

3- Inflation is the Government's friend: As I keep highlighting in many of my market outlooks, inflation resolves many problems for the Fed and the Government. The Federal Government has trillions in debt and the only practical way to deal with it is to deplete it through inflation.

The Government is very comfortable letting inflation run at 3-6%. Why?

The U.S. Government has run up a ton of debt. As a percentage of GDP, the Federal debt is now over 120%. The cost of COVID alone was several times higher than the cost of WWII in today's dollar terms.

St. Louis Fed

Dealing with debt is always politically unpopular. Raising taxes in a meaningful way and cutting spending are political hot-buttons that are sure to upset a large number of constituents. While inflation is not politically popular either, it is something where the blame can be spread around. The Government can have the imagery of "fighting inflation" without actually reducing it. We already see politicians blaming "corporate greed", highlighting the positive aspects for voters like higher wages and even directly sending cash to voters.

The ultimate objective is deflating the mounting government debt. Printing money and keeping interest rates artificially low is the only way the Fed and Government can deal with the huge national debt. It is also the only viable option to deplete the bubble of bank "junk" loans, and that of the private sector, without avoiding a new "financial crisis".

4- Political Motivation: As you recall back in November 2021, President Biden needed to appoint a new Fed Chair, and had the choice to keep Jerome Powell, or replace him with Lael Brainard. For sure, Biden preferred a most dovish Fed Chair - and one that he can influence - because no president likes to go down in history as the "president who caused a great global recession" due to a hawkish Fed. If a new Fed errs on the wrong side of interest rates, it will push us into a painful and lengthy recession. So it comes as no surprise that Powell would carry a favor to the Biden administration during the long process of reappointing him for a second term as Fed chair.

While on Tuesday you may have heard Powell speaking like a hawk about hiking rates even more than 0.75% in 2022, you need to keep in mind that Powell is facing the Senate for his confirmation as a Fed Chair in February. In order to be confirmed, Powell (a Republican) needs to secure bipartisan support. With quite a few on this committee having criticized Powell for his extra-dovish stance, he needs to act like a "hawk" to secure the nomination. Interestingly, Powell was also seen as being a "clear hawk" in his first confirmation hearing, and has gone on to preside over one of the strongest dovish turns in the Fed's history. So I am taking his hawkish stand with a "grain of salt". He is acting like a hawk today, but when it comes to actions, he will remain the most dovish of doves.

We can expect the Federal Reserve to maintain a relatively loose monetary policy. Raises will be small, and at the slightest hint of weakness, the Fed will do an about-face. Just like it did in 2019 when the markets reacted poorly to the last hike in 2018.

Getty Images

Knee Jerk Reaction

It is not surprising that the markets have been volatile in the past few weeks. Historically, interest rate hike announcements have resulted in knee-jerk reactions by investors. However in today's market, with so much liquidity in the system and little alternative to equities to get returns, investors are likely to keep buying the dips. This is exactly what we saw this week when the market's pullback was met with strong investor buying. I expect this phenomenon to continue through the year 2022.

Best Stocks and Sectors to Fight Inflation Headwinds

An inflation backdrop can be a headwind when it comes to stock performance for two reasons:

- Stocks that are valued based on future growth prospects, or growth stocks, tend to underperform during periods of inflation. The reason is that valuations of such stocks are based on the present value of future earnings. As inflation (and interest rates) rise, the present value of future earnings automatically declines. There is an inverse relationship between interest rates and growth stock valuations.

- Based on historic data, investors have been less willing to pay a premium on valuation when inflation volatility was elevated, as is the case today. A higher macro volatility will make higher valuations less likely.

At the end of the day, it is earnings that matter when it comes to price appreciation, especially when we are in an inflationary environment. In our case today, the key to winning is to invest in stocks and sectors that can use rising prices to their advantage.

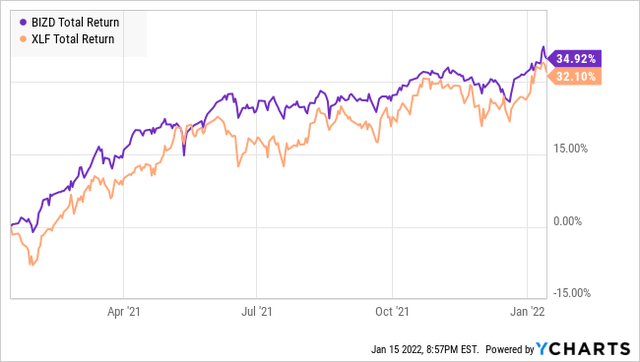

The best relative performance when inflation is accelerating are cyclicals, more specifically energy, material stocks, industrials, and financials (including BDCs and CLOs). This is actually playing out today. The financials represented by the Financials Sector ETF (XLF), and BDCs represented by the BDC ETF (BIZD) have been soaring in the past month and trading at their 52-week highs.

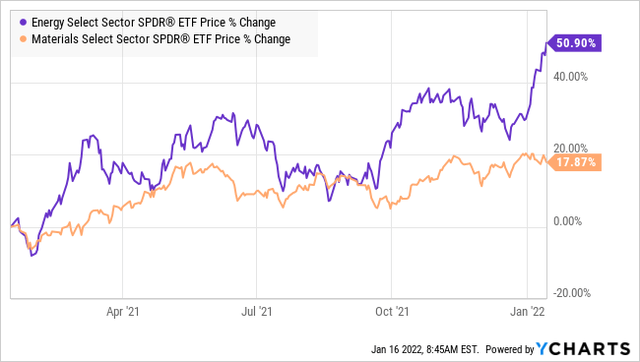

Of the cyclical sectors where the relationship was significant, oil & exploration, metals & mining, and transport were three of the industries that benefited the most from accelerating inflation. Also as depicted in the chart below, the materials sector (XLB) and the oil sector (XLE) have also rallied and are trading at their 52-week highs.

Even with higher prices today, I expect to see higher earnings for both sectors during the year 2022, and they should continue to reward investors.

Furthermore, solid higher quality value stocks, which are cheap today, are set to benefit from rising inflation. This is particularly true for smaller cap value stocks, similar to the ones that we hold in the HDI core portfolio. As we have been seeing in the past few weeks, a rotation from growth to value is underway, and it is only at the beginning of its cycle. Expect smaller cap value stocks to continue to outperform for the next 12 to 24 months.

The takeaway for investors is this: Inflation can be a headwind for the broader market, but it can also be a tailwind for the right stocks.

Getty Images

Conclusion

I remain bullish on equities for the year 2022 for the following reasons:

- GDP growth will be above its long-term averages. This is because the effect of ultra-accommodative monetary and fiscal policies will continue to filter through, despite tapering and no new fiscal packages.

- Equity markets continue to benefit from better-than-expected revenues with profits as economic growth provides a strong fundamental backdrop.

- The rotation from growth to value stocks is still early in its life cycle and should continue throughout 2022. Cyclicals, higher quality, high free cash flow, Value, dividend, and Small-cap segments will outperform relative to the broader market.

- Strong aggregate demand, elevated inflation, wage growth, and supply shortages are, to a degree, still expanding elements that underpin the macro backdrop.

At HDI, while we keep focused on the long view and grow our income, as an investor, it is critical that you are aware of the major macroeconomic forces that impact the markets so that you can make informed decisions. This is why I write these "Market Outlooks" to share with you the big picture as it evolves. Keeping an eye on the big picture helps us make adjustments to our portfolio as needed, in a planned and methodical manner.

The key to winning in 2022 is to be invested in the right stocks and sectors, which makes the HDI portfolio primed for superior returns for the next 12 to 24 months at least. Do not worry about any market volatility that we may experience during the year. Long-term investors are set to be very well rewarded.

Have a great Sunday!

Rida MORWA