Here Are Two Of Our Top Five Dividend Growth Picks For 2023

How were your returns in 2022? Did you hit your goals?

When 2022 started, there was a lot of optimism. Most were predicting that the market would end the year up. Despite the initial rough start, many continued to predict a rally in the second half. It didn't happen.

The Federal Reserve hiked the Target Rate at the fastest pace since Volcker. The market indexes fell throughout 2022, with both the S&P 500 and the Nasdaq booking their largest calendar year losses since 2008.

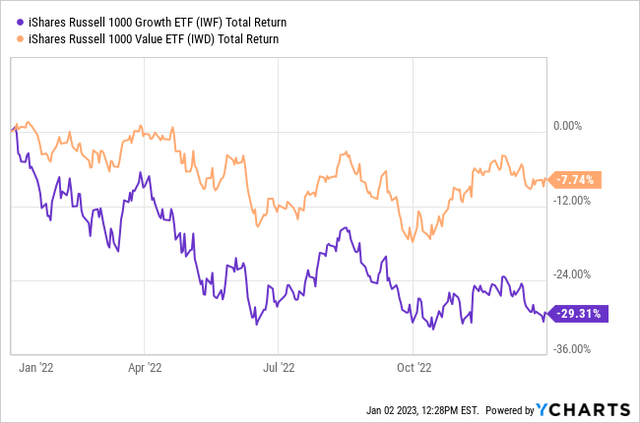

The theme for HDI going into 2022 was that "Value" stocks would outperform "Growth" stocks. A prediction that played out in an overwhelming fashion.

Yet, even with "outperformance", the reality is that most stocks in the market ended the year down in price. Outside of a few pockets of strength, like oil and gas, stocks of all kinds felt downward pressure.

I hit my goals. Many members hit their goals. This is because our goals were to achieve a certain income level; for income goals, 2022 was a fantastic year.

Even as the bear raged in the market, our income was growing. We saw dozens and dozens of dividend hikes and enjoyed 15 supplemental/special dividends above and beyond the recurring "regular" dividends we expected.

You see, even while investors were in a bearish mood, the companies we invested in continued to generate cash flow and shared that cash flow with us through dividends.

This is why, at HDI, we focus on the dividends. We value our portfolio by the income it generates, not by the amount we can sell it for today. Prices change every day that the market is open. It doesn't matter. Our returns come from identifying investments that will generate higher earnings and will maintain or increase their dividends.

So as we begin the New Year, the HDI team has highlighted five picks that are generating high yields today and that are top contenders to raise their dividends in 2023, regardless of what the market or the Fed does.

Pick #1: PDO - Yield 11.5%

PIMCO Dynamic Income Opportunities Fund (PDO) is an early favorite to payout a substantial special dividend in 2023. Many investors were surprised when PDO increased its monthly dividend in July and followed that up with a $0.96 special dividend in December.

It is no secret that 2022 was a terrible year for bonds. In fact, it was the worst year in modern history. As a fund that invests in bonds, PDO was hardly exempt from the pain. PDO's price and its NAV fell significantly. Yet, even as prices fell, PDO paid out an increasing dividend.

The reason is that lower bond prices increase forward returns for bond investors. At maturity, bonds pay back the face value. Whether the investor bought the bond for $80 or $120, they receive $100 at maturity. Therefore, it is better for a bond investor to buy at $80!

If prices are falling because of concerns that borrowers will not repay at par, that is one thing. Yet the prices falling in 2022 had much more to do with the Fed hiking interest rates than concerns that borrowers won't repay. As of November 30th, PDO's average bond was priced at $82.51, providing a lot of upsides as borrowers repay at $100.

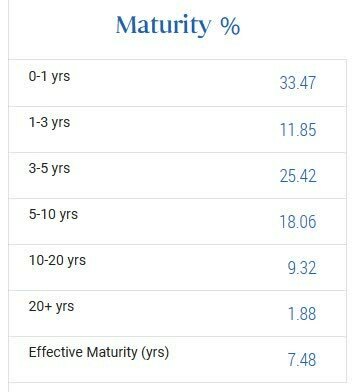

PDO has approximately 1/3rd of its portfolio maturing within a year. Those bonds will be repaid at maturity and reinvested into higher-yielding opportunities.

PIMCO

Many are expecting the Fed to pivot in 2023. At the very least, the Fed will likely stop hiking, reducing the headwinds on PDO's NAV.

2023 will be a great year for PDO to increase its income, reinvesting at the highest yields seen in decades. It also has the potential to experience a significant rebound in NAV and price as borrowers repay at par.

Pick #2: ARCC - Yield 10.4%

Ares Capital (ARCC) is one of the largest and highest-quality BDCs (Business Development Corporations). BDCs service the "middle market", businesses that are large enough to benefit from taking on debt but are not publicly traded.

ARCC's business model is to take out fixed-rate debt and make senior secured floating-rate loans to private companies. ARCC approaches lending as an investment, often taking an equity position in the borrower. This provides ARCC with the benefit of a senior debt position which provides a predictable income, and also a senior position if the company defaults. At the same time, ARCC holds an equity position, which provides significant upside potential.

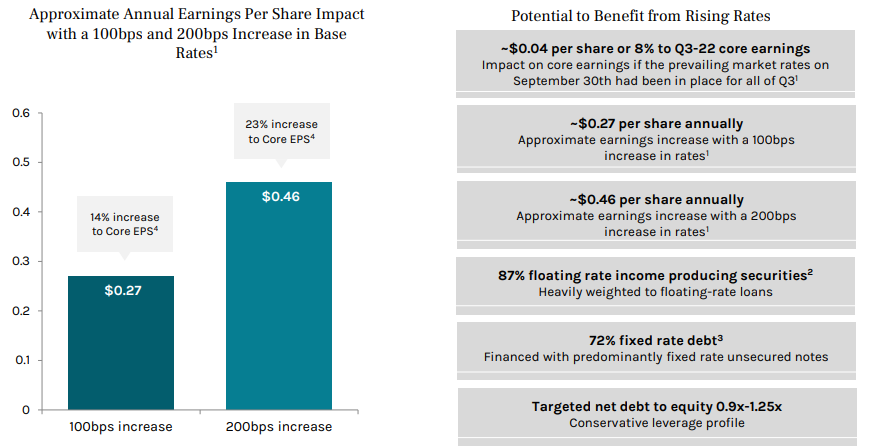

2022 was a great year for ARCC as it hiked its regular dividend three times. In Q4 2022, ARCC's dividend was 20% higher than it was in Q4 2021. Additionally, ARCC started paying out a $0.03 supplemental dividend. The primary drivers of these hikes were increased scale and rising interest rates.

In 2023, these tailwinds will continue as the Fed is anticipated to continue hiking in the year's first half. LIBOR is already up 140 bps since September, which implies an increase of well over $0.27/share in ARCC's earnings.

ARCC Q4 2022 Equity Presentation

The benefit of rising interest rates goes straight to ARCC's bottom line and will drive higher dividends in 2023. ARCC will increase the regular dividend to the extent that management believes the increase is sustainable long-term. They will payout supplemental dividends as high-interest rates cause more temporary profits.

With such a positive outlook for dividends, you might expect ARCC to trade at a high valuation. Instead, ARCC is trading very close to its $18.56 NAV, when historically, we expect it to trade at a 10-15% premium to NAV.

Buy for the dividends, hold for the capital gains.

Picks #3-5:

As for the remaining picks, you can find them in our live HDI room at ElliottWaveTrader. Sign up today for HDI, where you’ll also access our Model Portfolio, filled with Common Equity, Preferred Stock, and Bond picks, targeting yields of 8-10%, and receive continuous updates and alerts.