Coinbase is Overdue for Upside

I have been tracking Coinbase (COIN) closely in a public article series that I began in 2025. In my article dated May 2025, I was looking for an important top, which proved prescient.

Coinbase investors would have done well to heed my warnings, as COIN lost nearly 70% of its value between its all-time high in June 2026 and its recent low. Since that article, my October and December updates have tracked the corrective machinations that follow an important top, when analysis becomes more nuanced and complex. Nevertheless, I identified several important points where shorting was prudent, and a few of my personal trades performed well.

Now, I write this article to suggest that COIN may be poised for a rally. It is too early to say whether it is ready for new all-time highs, although that remains possible. Regardless, I view the reward-to-risk as favoring the long side.

Terrible Earnings

Before getting into the charts, I want to address sentiment. As I have stated in many past articles, bottoms often form during the worst news, and tops tend to form when headlines are most bullish. Bitcoin provides a clear example. It hit a major bottom in 2023 during the collapse of the FTX exchange, which led to the imprisonment of its founder, Sam Bankman-Fried. It later topped during the period when the Trump administration rolled back some of the prior administration’s anti-crypto regulations.

COIN may have just experienced that type of “worst news.” Its 4Q 2025 earnings marked the first quarterly loss since 2023 — an extreme loss of $2.49 per share. You have to go back three years to find a comparable result. Yet the stock rallied approximately 16% on the day, with heavy volume. The media painted the earnings release as 'terrible', and if you weren't watching charts, you wouldn't know it rallied.

There was certainly a lot to like in the report. I listened to the earnings call, and to my ears, the Coinbase team seems to be executing well. Notably, there was solid growth in the derivatives business, helped in part by the Deribit acquisition, along with healthy subscriber growth and continued movement toward an “anything exchange,” similar to Robinhood. Perhaps most encouraging for investors was the $1.7B in common stock repurchases, which erased the net dilution created by stock-based compensation.

One could argue that the earnings drop was expected, given weaker crypto prices, and COIN executives said as much on the call. However, crypto prices have yet to show a meaningful reversal, suggesting similar earnings pressure could persist until the broader market improves. Even so, investors brushed that aside and bought the hot knife.

Stretched Downside

In my previous articles, I was looking for a tradeable bottom in the $200 zone. Instead of reversing there, the price stretched to $140. As measured by the daily RSI, COIN has never been as oversold as it was at this recent low.

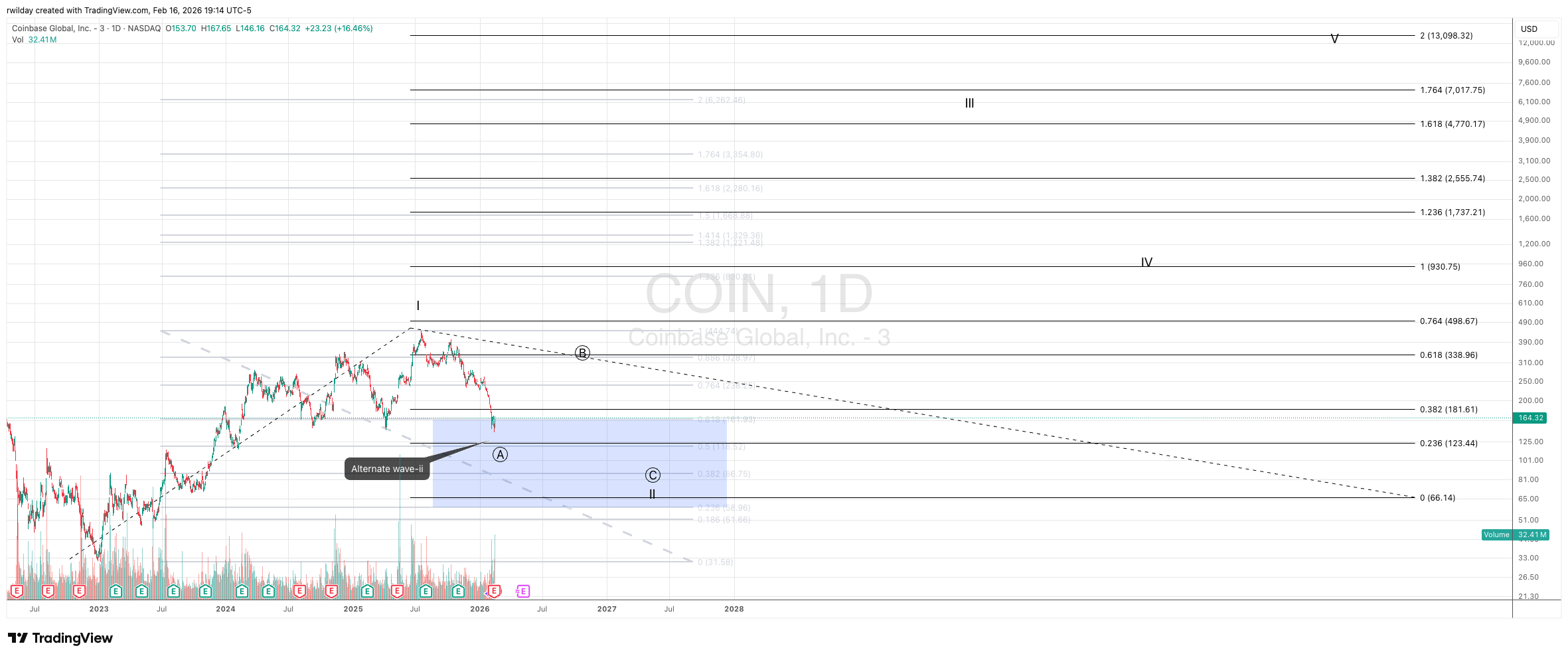

That downward stretch also altered the Elliott Wave structure as I see it. Where I had been looking for a five-wave A wave into $200, the structure evolved into a larger ABC, with an unusually small B wave. This reflects a fearful market, as sellers quickly distrusted the B wave and used it to exit before it could fully develop.

That fear left COIN extremely extended and moving with immense velocity. Most of the decline from its 2025 high occurred in the last four weeks, amounting to roughly a 50% drop. Unfortunately, I cannot yet say that selling is complete. After morphing into this aggressive ABC pattern, the C wave appears incomplete and likely needs a fifth wave toward the $125 region. The current rally is likely a fourth wave unless it pushes through $192 in a clear five-wave structure.

Early End to a Long-Term Bear?

More significant than the rapid decline into deeply oversold territory is the fact that COIN has already retraced into its long-term support zone. Wave twos typically retrace between 38.3% and 76.4% of wave one, in log terms. For COIN, those retraces produces a wide range between $58 and $164. This means the stock has already satisfied its expected minimum retracement. It may probe deeper into that range unless it breaks above $192. Such a break would signal an early ending.

My longer-term projections for COIN, as it progresses through its third, fourth, and fifth waves, suggest that it could one day reach as high as $14K, barring stock splits. While that target is likely decades away, the start of a third wave would begin a period of immense price appreciation.

For me to conclude that primary wave three has begun, I would need to see an impulsive rally above $288. Failing to reach that level — or reaching it in corrective fashion — would suggest that wave two either extends much deeper or continues to range sideways above $58.

Regardless, COIN appears due for a sizeable rally. Even if that rally is only a B wave, my primary view, it should reach at least $205 and more likely $236–274. Occasionally, the B wave of wave twos exceeds wave one. A move toward $590 is not impossible in that context. However, the structure would likely be corrective, setting up a potential trap before another bear-market leg lower.

Conclusion

As always, this article is not financial advice. As evidenced by both recent price movement and my forward projections — whether for a major bull run or an ongoing bear retracement — COIN is clearly a high-beta stock. Nevertheless, it warrants consideration if you fully internalize its risk.

I have been buying some COIN at these levels and would prefer even lower prices before adding further. However, I liken this trade to catching a hot knife. I follow a few key tactical principles when taking such setups:

I do not use leverage, whether through margin or leveraged ETFs. I do not use options until a higher low forms that provides a clear stop. The exception is selling puts when I intend to be assigned. I risk no more than 1% of my capital. Since the market has not yet provided a confirmed low from which to measure risk to a stop, that 1% applies to overall account exposure rather than stop-based risk.

These rules help keep me out of trouble when buying something out of the dumpster, no matter how promising the company may be. I do not have a crystal ball. Anticipating an important low is one thing; seeing the market confirm it is another.