Coinbase's Last Leg - Market Analysis for May 25th, 2025

Introduction: Bitcoin’s April Reversal

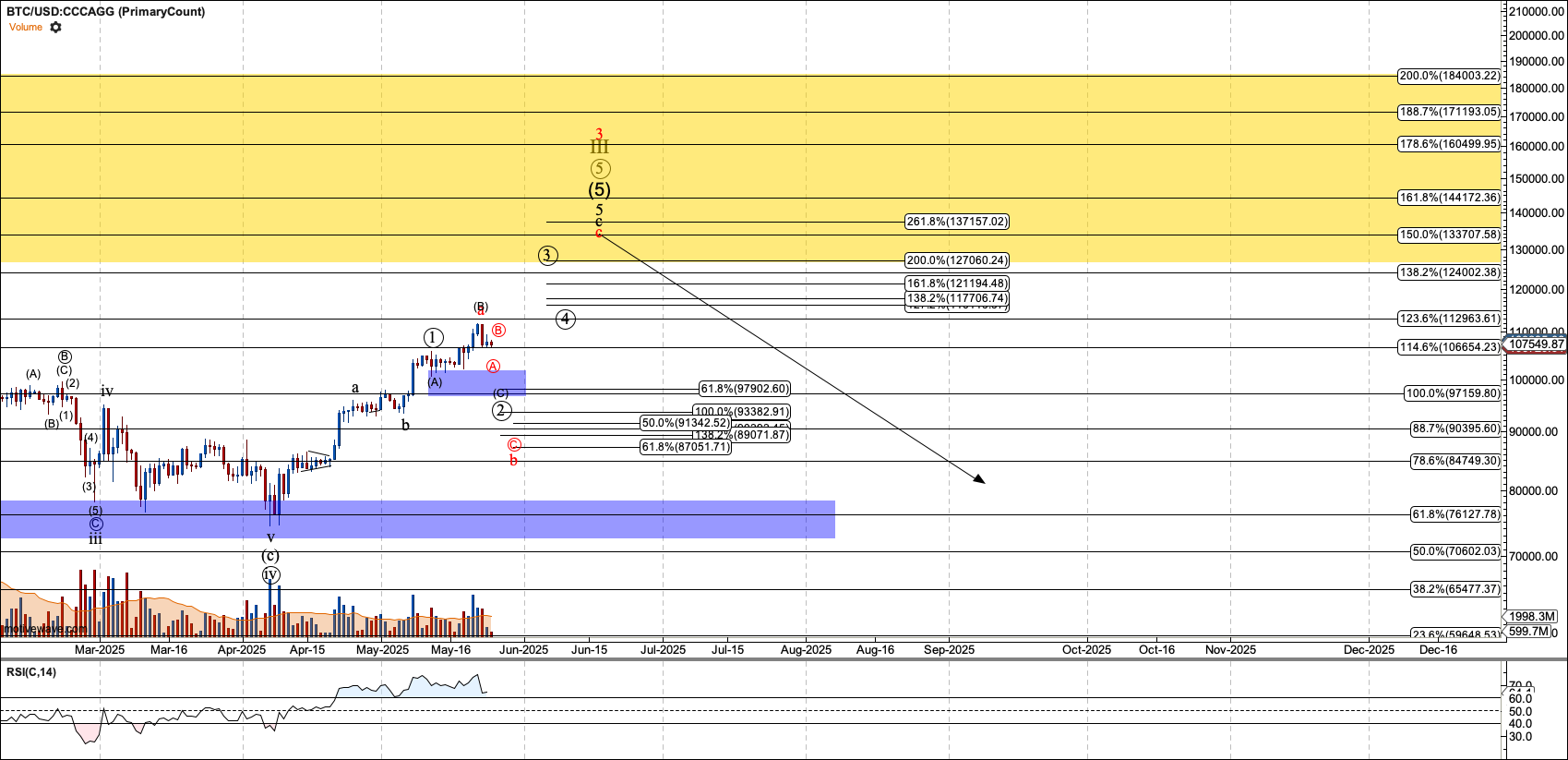

In my March 14th article, I highlighted the potential for a significant low in Bitcoin, setting the stage for the final leg of this bull market. That low materialized in early April at $74,500. Since then, Bitcoin has surged past $111,000, marking a robust rally of nearly 50%.

This move has set Bitcoin up to hit my long-term target at $125K. As of writing, a pullback has started that can easily take Bitcoin back below $90K. However, I expect that to be yet another opportunity to ride the final wave in Bitcoin before a bear market commences.

The final leg in Bitcoin will also stir the final moves in many crypto-related assets. I will use this article to discuss what I see coming for the price structure of Coinbase (COIN), an important player in crypto trading in the US and around the globe.

Coinbase, Pillar of the US Crypto Market

Coinbase is the only publicly traded cryptocurrency exchange in the United States. Operating in the US, particularly as a publicly traded entity, requires Coinbase to stay compliant with US regulations. That forces more transparency than is found in many international crypto trading outfits. Founded in 2012, it has grown to serve over 108 million users across more than 100 countries.

Recently, under the leadership of CEO Brian Armstrong, Coinbase has pushed into traditional financial spaces. Particularly, Coinbase provides much of the custody of Bitcoin for the spot ETFs that hit the market as a group in January 2024. And notably, it launched 24/7 Bitcoin and Ethereum futures trading through its CFTC-regulated subsidiary, Coinbase Derivatives LLC, providing U.S. traders with continuous access to crypto futures markets. In addition to providing futures for crypto prices, this effort has led to the launch of micro contracts in commodities including crude oil, gold, silver, and natural gas.

In order to bolster its derivatives offerings, in early May, Coinbase announced a $2.9 billion acquisition of Deribit, the world's leading crypto options exchange. Deribit supports $30 billion in open interest in crypto options. This acquisition positions Coinbase as a dominant player in the global crypto derivatives market.

Time for Caution?

Recently, Coinbase disclosed a cyberattack involving bribed overseas contractors who accessed sensitive customer data, including names, contact details, and partial Social Security numbers. Although no funds were directly stolen, it allowed hackers to launch targeted phishing campaigns. The breach affected nearly 70,000 customers and is expected to cost the company between $180 million and $400 million in remediation efforts.

The announcement of the breach led to a 7.2% drop in Coinbase's stock price. The company has since taken steps to enhance its security measures, including terminating the involved contractors, cooperating with law enforcement, and offering a $20 million reward for information leading to the perpetrators' arrest.

COIN is Looking Upward

The recent security breach and stock drop have done little to shake Coinbase’s strong performance since it bottomed in April of this year. Coinbase's stock mirrored Bitcoin's trajectory, bottoming in early April alongside the cryptocurrency's low. Based on wave structure analysis similar to that applied to Bitcoin, I have a price target of $400 for Coinbase.

Zooming out to the daily chart, I am looking for Coinbase to complete a leading diagonal when it tops near $400. That diagonal started in January 2023, roughly corresponding to Bitcoin’s cyclical bottom in the $15,500 region.

After reaching $400, COIN should start wave-2, which can take Coinbase back to the $50’s. That drop seems to roughly correspond to Bitcoin entering a long bear market after $125K.

Zooming in, the (a) wave of circle-v is nearing completion. I’d rather see one more push to $300 before wave-(b) starts. However, if it breaks below $230, I will need to count (a) complete already. Wave-(b) can drop into the $180 region. And from there, it should start its final climb of 2025 to $400.

Summary

In summary, Coinbase continues to solidify its position as a leader in the cryptocurrency space through strategic initiatives like the acquisition of Deribit and the launch of 24/7 futures trading. And it has become a leader in providing custody services to traditional financial companies.

Just as Bitcoin has rallied since January 2023, so has Coinbase increased by 10-fold since that time. And just as Bitcoin should put in an important top at $125K, Coinbase is due for a similar degree top at $400.

Despite being closer to the end than the beginning of this cyclical move, watching for a bottom in (b) of circle-iv will allow nimble swing traders to grab a bit more profit before it tops.