Coinbase (COIN) is Pushing Against Its Old High

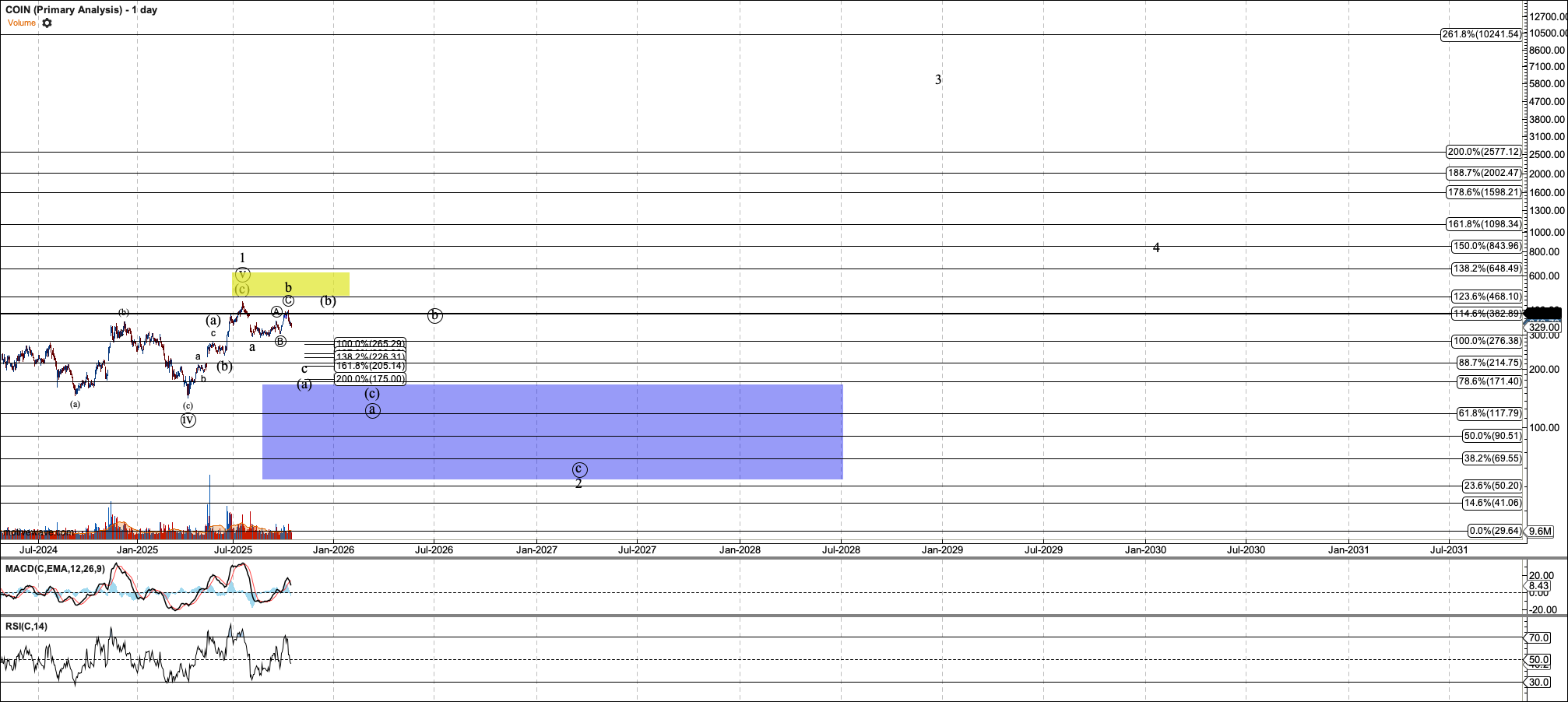

On September 8th, I wrote the second article in this series, suggesting that COIN had likely put in an important high and begun a substantial correction. That correction could last for a year or more and, in an extreme case, correct its price by as much as 80%.

Since that article, COIN has run higher — but not unexpectedly. I was looking for a B-wave rally. In Elliott Wave parlance, a B wave is the wave that briefly reverses or corrects an ongoing, larger-degree correction. They are usually three-wave structures, and sometimes triangles. The A and C waves do the work of bringing the asset’s price down, while B bucks that trend — to the frustration of both longs and shorts.

Since my original review, COIN has pushed nearly to an all-time high — to $402 versus its highest print of $444.65. It is not uncommon for B waves to briefly breach all-time highs before a C wave takes hold, sinking price back into earlier ranges and continuing the correction. However, this B wave pushed to the limit of what I expected, making a fresh read of the structure warranted.

Further, in between writing that previous article and this one, I tweeted on September 25 that it appeared COIN had topped. At the time, I took on a position in put options, which profit from downward prices, and bought shares to hedge the position and scalp any upside. You can see that tweet here. It took roughly seven days for the market to prove me wrong — a reminder of how difficult hunting for a B-wave top can be.

But I write today on the back of another potential top in B. If this one — which topped at $402 so far — does not hold, then COIN should put in a higher all-time high.

B-Wave Almost Maxed Out

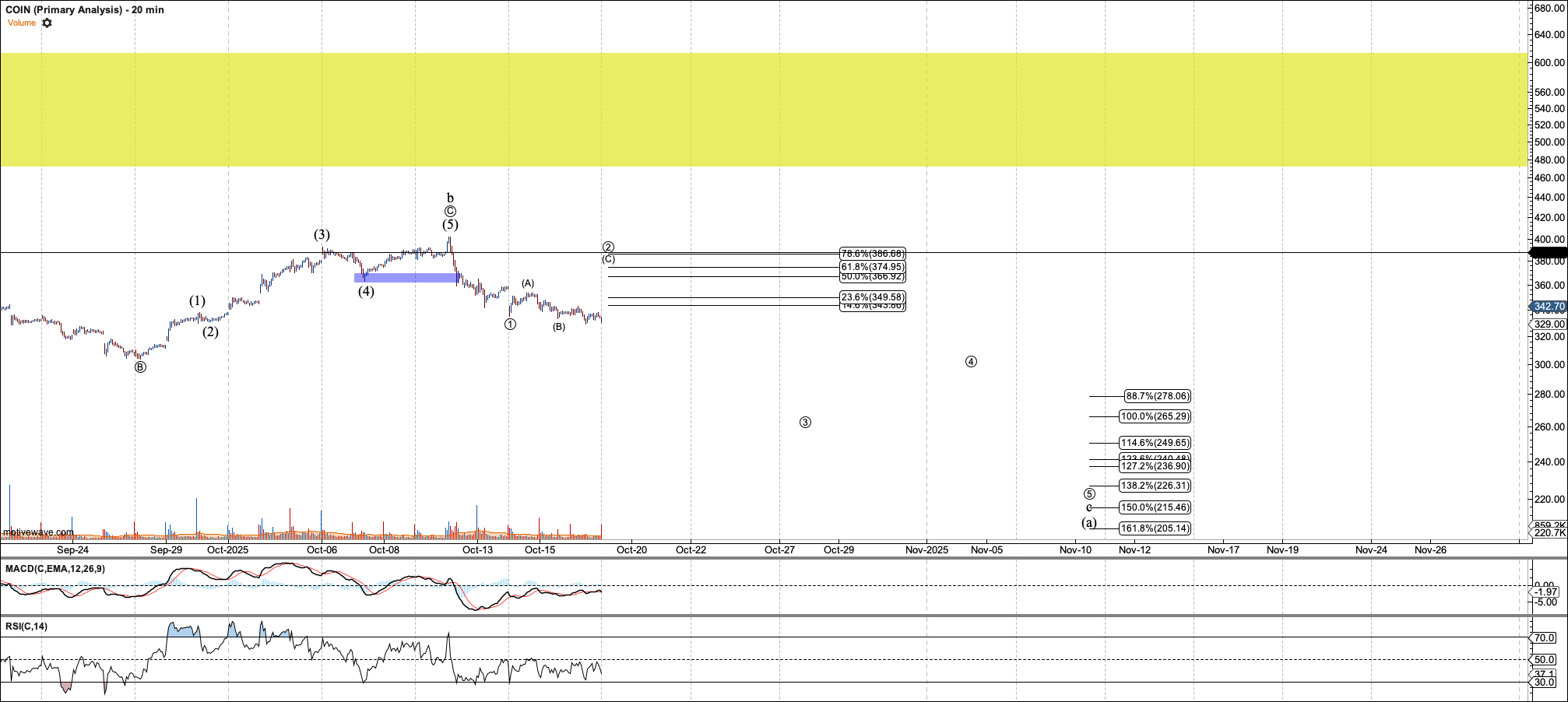

In the earlier article, I had laid out a scenario in which the B wave (as part of a larger corrective pattern) would rally only to a lower-high zone, likely in the high $300s to low $400s, before resuming its decline. The rally so far met the high end of my expectations.

I am writing this article after a strong decline that occurred alongside a major drop in Bitcoin and other cryptocurrencies on Friday, October 10th. I see the probability that this is our B-wave top as high. Here’s what I am looking for to confirm that this top will hold.

Firstly, there’s a saying — whose origin I cannot recall — that “markets don’t ring a bell at the top.” However, the local top formed last Friday came with a strong move. That move retraced nearly 50% of the B-wave’s peak-to-trough move — from $402 down to $291.50. As of this writing, it has come off Friday’s lows and is sitting around $343.80 and change. This is the first indication of a top.

I am now looking for COIN to hover in this region after completing what looks like five waves down off $402. After the first wave down, we should see a corrective pullback up that ideally stays under $386. That rally is marked as circle-2 on my chart below. If that level holds, the next move should be a strong decline in wave C, targeting between $265 and $225.

Ideally, the move back to the mid-$200s is only the first leg of this major correction. I don’t yet know whether this correction will simply range between $400 and $200 over the next year or more, or if it will go deeper toward my lower $50 support. That level may seem outlandish right now — but do not markets often find ways to shake our expectations? You can expect more articles on COIN in the coming months as this correction develops.

Have Fundamentals Declined?

I make no small effort to remind readers that I do not trade based on fundamentals. I focus on price structure, using Elliott Wave and other technical methods. Yet, in the previous article, I discussed the business and regulatory tailwinds that COIN has behind it — most importantly, a U.S. executive branch that is favorable to its industry. So why would it top now?

Sometimes the charts reveal problems in a company ahead of time. Other times, a company simply needs to correct after an immense rally to a sky-high valuation. COIN’s valuation is rich but not outlandish for a company in crypto or tech. Net income has dropped in the most recent quarter-over-quarter measure, but it’s too early to call that a trend.

As of now, I see no reason for this decline other than that COIN completed the structure I was looking for over the last year. Granted, I only have a small indication that the correction I’m expecting has begun — but it’s a start.

Conclusion

It has not been easy to call for a correction in COIN, both because the company has much in its favor and because tracking B-wave structures is inherently challenging. It has come well off the lows where I first indicated that a long-term top may be in, and it pushed to the upper edge of the rally expected within an ongoing correction. It also faked me out on the last potential top. Yet, it seems that — for now — the correction is back on.

As always, note that this article is not advice. As of this writing, I am long put options to gain from this decline and hold long shares to hedge the puts and capitalize on scalping small reversals. This is a reprise of the position I held at the last potential top. However, I reserve the right to change my mind if what I’m looking for is invalidated, which, as of now, would be a sustained move above the October 10th high at $402.