Coinbase Likely Formed a Long-Term Top

[Public Article]

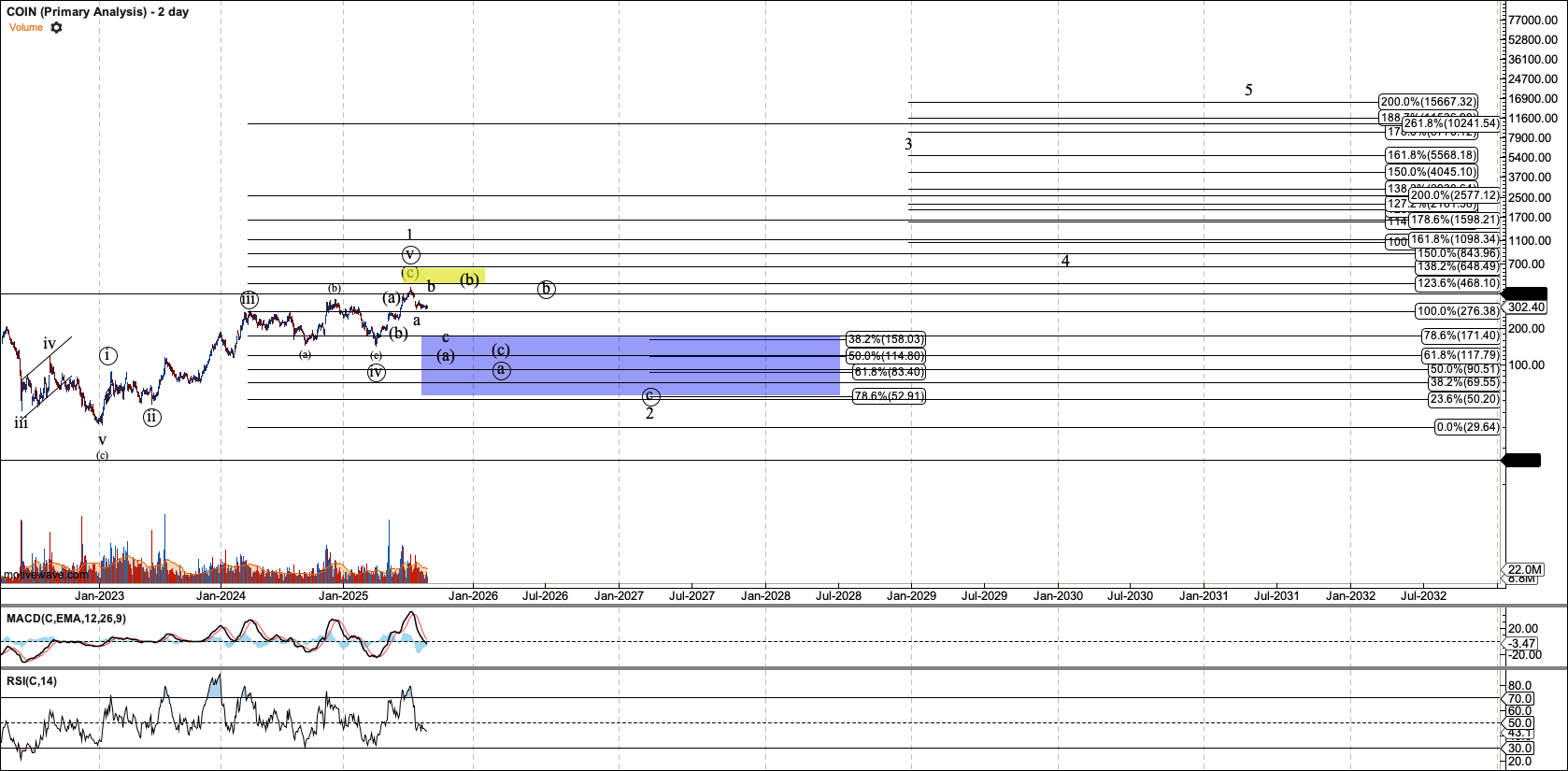

In May, I wrote an article about Coinbase (COIN), which was trading in the mid-$200s at the time. I suggested it could climb toward $400 in the months ahead, a price that might mark a major top. While I intentionally left the timing open, I did give a price. On July 25, COIN peaked at $444.65, which now appears to have been the top. Bitcoin also came within a few hundred dollars of my target discussed in that same article, though I will cover that separately. Today, let’s focus on COIN.

The Tide Turns for Crypto in the US

This potential top in COIN comes on the back of much good news for Coinbase and the rest of the crypto industry in the United States. In particular, the Trump administration has stated that the United States should be the ‘crypto capital of the world’. That statement was followed by the reversal of the Biden administration’s fight against the industry. As two examples, the previous administration used the FDIC to hamper the banking industry’s work with crypto companies, and it used the SEC to take enforcement action against the industry. Both of those practices have ended under Trump’s leadership.

Coinbase’s Expanded Offering

Coinbase, in particular, has received approval from the Commodity and Futures Trading Commission (CFTC) to become a futures clearing firm and list crypto-based futures, as well as futures in commodities like gold, silver, natural gas, and crude oil.

Even more demonstrable regarding the shift in US policy is Coinbase’s recent approval to list perpetual futures, or “Perps”, which are futures without an expiration date. The crypto industry created them, but they have remained a feature of the crypto market beyond US borders until this approval.

Coinbase’s stock appreciation since its 2023 low has come with healthy financial growth. Revenue grew from $2.9B to $6.7B, and profit from $2.5B to $5.6B. But market tops often come with the best news. Watching price structure helps us know when to be cautious, even though everything we hear sounds bright.

COIN Takes a Dive

As of writing, COIN is over 30% from its July high, trading for $302. Although it barely retraced much of the 14x growth in COIN from its all-time low, that fall is attention-worthy. COIN announced its latest quarterly earnings on July 31, 2025, which precipitated much of the decline. Apparently, despite a big surprise in net profit, a decline in crypto trading volume, and a slight revenue miss, left investors were disappointed.

The impulsive move down from my long-term target is enough to suggest a top is in. However, further confirmation comes in at $191. Below that level, I have further confirmation that the structure from COIN’s all-time low at $31 is complete.

That structure is a leading diagonal with five waves off that low, indicated as wave-1. The bright side to the wave-2 that may be in process is that those with patience can accumulate a stock before a major third wave. Third waves are where an asset makes its most powerful advance. However, for those who bought near the top, it will be difficult. This wave-2 in COIN has support at $50. I do not know whether it will go that low. It might be a year or more before the price structure indicates how low it is likely to go. But looking at this wave-2 from here requires preparation.

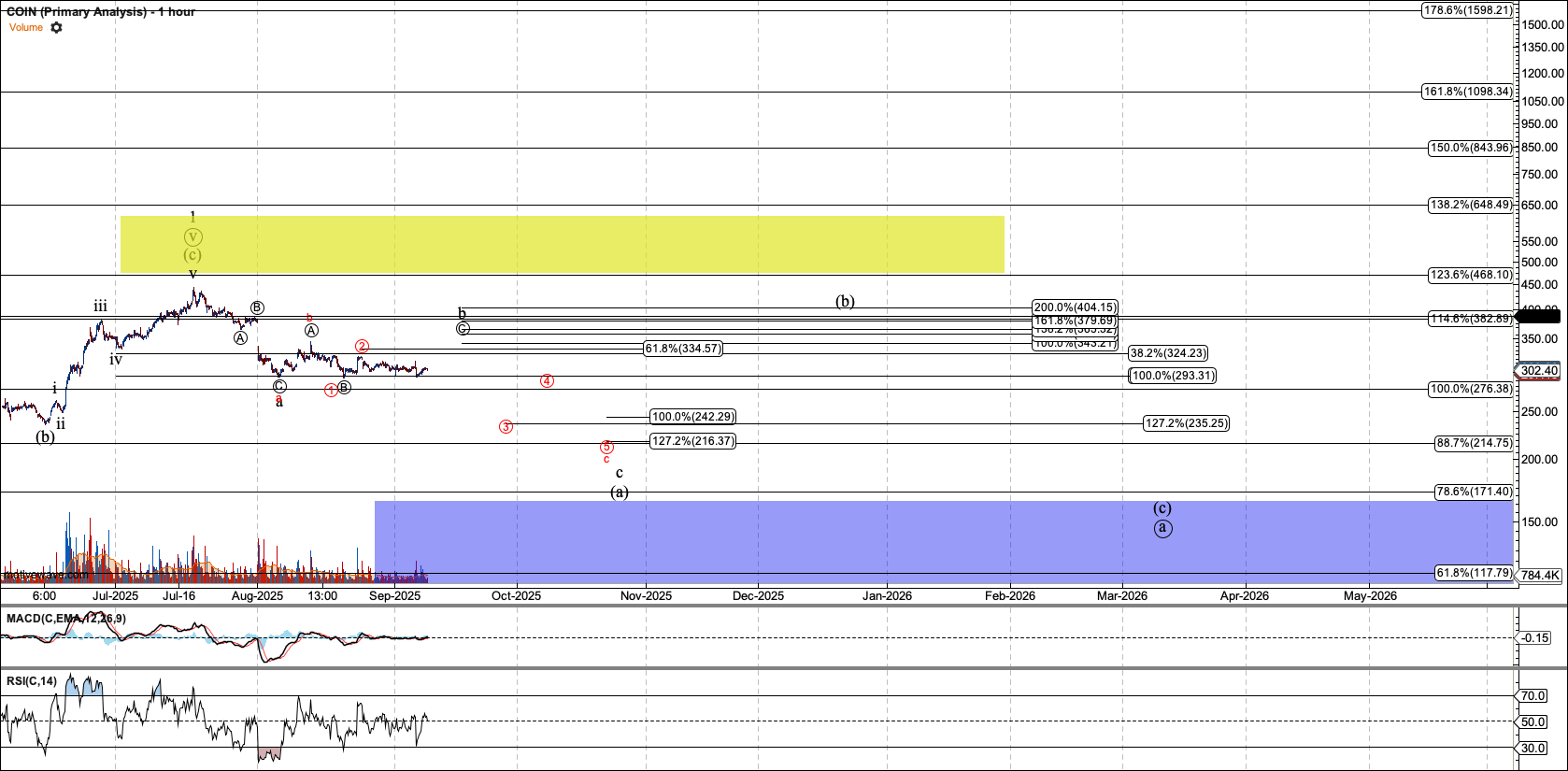

Zooming in further, I see two potentials for the coming weeks and months. Since falling into the low $300s, I was looking for the completion of a-wave of the larger (a). Ideally, COIN would be able to stage a corrective rally back to the high $300s / low $400s before pushing downward into the $160–$170 region. However, at this point, that rally has not materialized. Instead, price has hovered over the $290s. Should COIN continue to weaken and break $290, odds swing in favour of a more direct move to $160.

Conclusion

In conclusion, Coinbase appears to have completed a strong first move, marked by its rise from $31 to $444 and bolstered by regulatory wins, strong financial growth, and a supportive political shift in the US. Yet, as history often reminds us, market tops tend to arrive on the heels of the best news. COIN’s recent reversal fits that mold. Whether its rollover slows with a corrective rally, or slides more directly toward the $160 region, the larger wave structure suggests we are entering a pivotal wave-2 retracement. For investors with patience and discipline, this coming decline may present the kind of rare long-term opportunity that only follows major tops. In the meantime, holders may need to prepare for winter.