Market Analysis for Sep 27th, 2021

Last week, we advised that investors shouldn't panic about market volatility. As we started the week, the technical situation was weak and the weekend news about the risk of a real-estate collapse in China caused the markets to open with a race down – dipping below the 50-day moving average then quickly recovered the following day.

While it appeared that this news might finally spark a "correction" (the market being down 10%+ from peak), we published an alert on Monday urging members to not panic, hold tight and buy the dip. Noting that liquidity would "reign supreme", we wrote:

As mentioned before, I do not recommend trying to sell and buy back in this market. The Bubble of Liquidity means that the market will be very biased towards going up. One of the main impacts of this situation is that it likely takes tapering off the table at Wednesday's Fed meeting. The Fed will remain dovish and continue pumping liquidity into the financial system. The Bubble of Liquidity is going to get larger, and we have already seen how bullish that is for equities.

In fact, the S&P 500 bottomed out near 4300, only a little over 5% down from the peak. The free fall on Monday was cut short and the dip was being bought up by Tuesday with the S&P getting back above 4400 by Thursday. The Fed announced a tentative timeline for tapering and reinforced that rates will not be raised until late 2022 at the earliest. This confirmed that this Fed remains incredibly dovish and is not willing to risk the economic recovery or a stock market crash.

The bottom line, the market proved its resilience and this is due to the combination of factors that we have been discussing for many months now. The Bubble of Liquidity means there is plenty of cash ready to buy any dips, low interest rates ensure that equities remain relatively attractive, inflation is picking up, the economy is "running hot", and accommodative monetary policy is not going away.

There will be some news events that could cause more sell-offs similar to Monday's. We might even see that 10% correction if the right combination of "bad" news hits. However, any significant dip is an opportunity to buy. The underlying bullish tailwinds are incredibly strong, and will not be derailed by the news cycle. Dips will happen, and they will fill in very quickly.

Bubble Of Liquidity

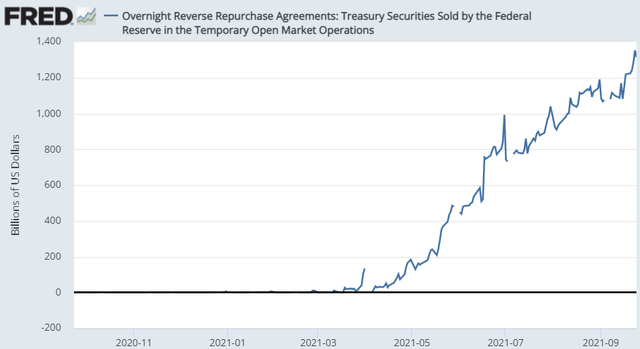

Back in June, you might remember I highlighted the "overnight reverse repurchase agreements" volume that the Federal Reserve was making. At that time, the volume had risen to over $700 billion, an unprecedented amount that dwarfed prior records of under $500 billion.

Repo volume has continued to climb, and is now north of $1.3 trillion.

Source: St. Louis Fed

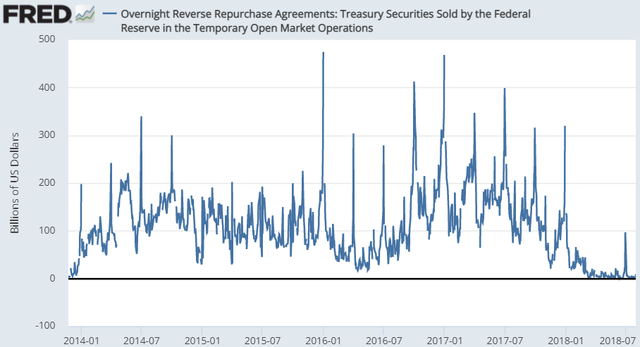

For comparison, here is what volume looked like from 2014 to 2018, which prior to 2021, was a record-breaking time for reverse repo volumes.

Source: St. Louis Fed

Note that the volume remained under $500 billion, and when it did spike up, it was for a day or two. The day-to-day demand was usually under $200 billion. Since August 10th, demand for reverse repos has been over $1 trillion every single night.

What is a "reverse repo" and what does this tell us?

A reverse repo is an agreement from the Federal Reserve to borrow cash from a qualified institution like a bank or money-market mutual fund overnight. The institution parks the cash, and gets it back the next day. It is a super-low-risk place to park cash for a very short period.

For banks, lending money to the Fed is a move of last resort. The interest rate is around 0.05% annually. Doing almost anything with the cash is going to provide a higher return.

In short, this is a visual representation of the sheer amount of liquidity in the financial system. Institutions are shipping $1.3 trillion to the Federal Reserve each night, at nominal interest rates. Note that with inflation, they are realizing a sizable negative return on these funds.

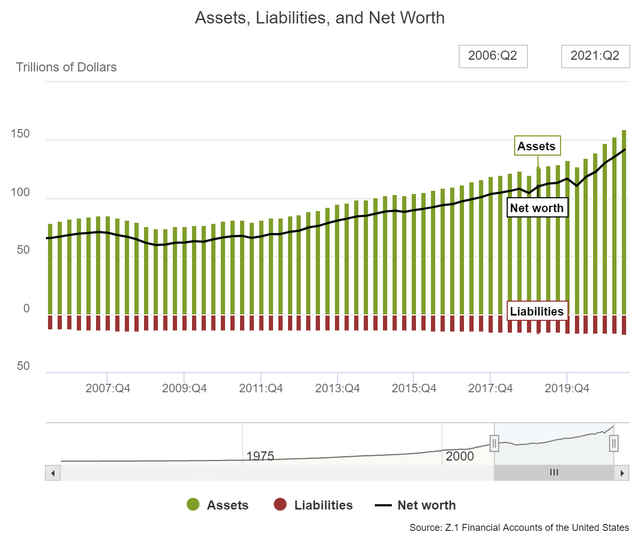

The Bubble of Cash is not only with institutions. Household net worth is increasing at a rapid pace:

Source: Federal Reserve

At $17.1 trillion, cash deposits for households are not only at a record high, but they are also the highest as a percentage of annual personal disposable income at 94.86%. Additionally, people are investing directly into the stock market more than ever, with just under $30.5 trillion invested directly in stocks. This is 45% higher than in Q4 2019. While debt has climbed as well, it remains lower as a percentage of disposable personal income than it was pre-COVID.

Inflation Is Structural

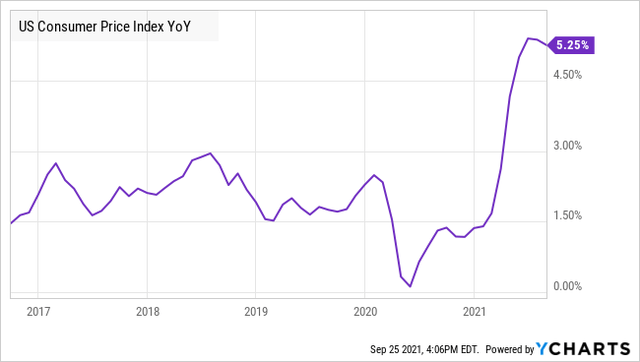

The big news last week was that the Consumer Price Index slowed down and was "only" up 5.25% year over year.

The Delta variant appears to have slowed some things down in August, however inflation is still going strong. This shouldn't be a surprise, and there are numerous factors that will continue driving it up.

1. The Consumer Is Strong.

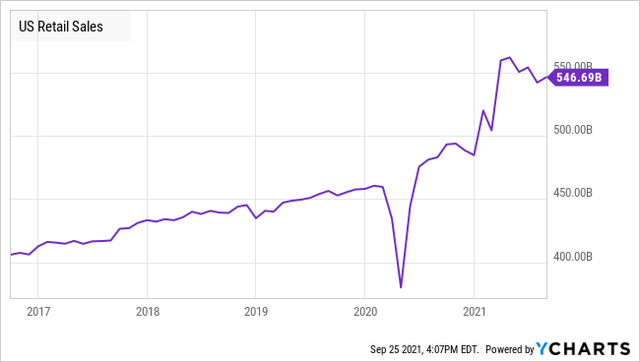

Retail sales are up, as consumers flock back to stores, households have strong finances and debt is cheap.

Even though inflation is high, demand has continued to rise despite higher prices. What happens when demand goes up as prices climb? Prices climb even higher. Note that these price increases persist even if the "cost-push inflation" (inflation caused by rising input prices for businesses) subsides. After all, if you raise prices and are selling at a higher volume than before, why would you cut them if your costs go down?

2. Wages Are Going Up

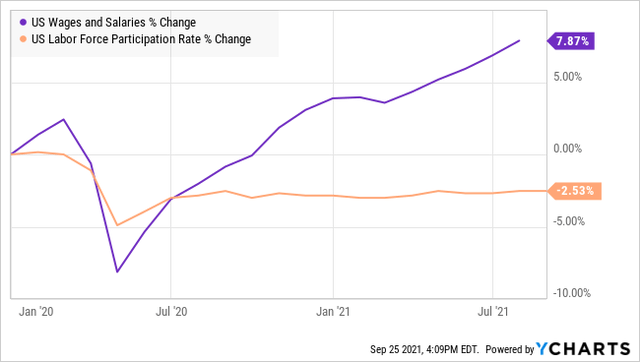

This is a topic we have discussed extensively over the past few months. Wages are rising, and the evidence suggests that they will continue to rise at a faster pace. Through the first half of 2021, wages and salaries are up 7.87% since January 2020.

Despite rising wages, the number of unfilled job openings continues to hit new highs. What happens when prices rise, but the supply fails to meet demand? The price goes up even more. In the job market, prices for labor are rising, and so far, the supply of workers has failed to meet the demand. The participation rate remains relatively flat since July 2020. Wages will have to go up even more in Q4 to persuade workers to come back.

3. The Role of Shortages

"Shortages" generally carry a very abrupt impact on price. Usually seen in things like commodities, food, and energy where demand is inelastic and supply cannot quickly be increased.

We are seeing this in natural gas [NG], for example, where there are below-average reserves in the U.S., while Europe and Asia are nearing a crisis. Some estimates are that NG prices could exceed $100 in Europe and $6 in the U.S. if there is a cold snap this winter.

Record high NG prices are already wreaking havoc in Europe. Many companies in Europe have reduced, or even stopped, the production of steel, fertilizer, and glass due to the high costs of NG.

The ripple effect is huge, and not always immediately obvious. Sure, less production of steel, fertilizer, and glass will cause prices of those products to go up around the world due to lower supply and less competition from European-based companies. The collateral damage extends further. Food processors in the UK are facing a crisis because they are unable to get supplies of CO2, a by-product of fertilizer production. Last week, the UK government stepped in and cut a deal with CF Industries (CF) to resume operations in order to ensure enough CO2 production to meet the needs of food processors.

High NG prices caused a reduction in fertilizer supply, raising the cost of fertilizer and causing another shortage in CO2 which threatened a shortage of meat, vacuum-packed food, soda, and even beer!

This is just one of the dozens, if not hundreds, of real-life examples playing out across the economy. We live in an incredibly complex economy where many of the products we use are made from the by-products of other factories. The NG shortage is not going to be resolved soon and could become greatly exacerbated if the winter is cold. This will impact more than just your electric bill, it will impact the prices of hundreds of everyday products. Remember, inflation in the 1970s was kicked off by the price of oil.

The Fed Doesn't Care

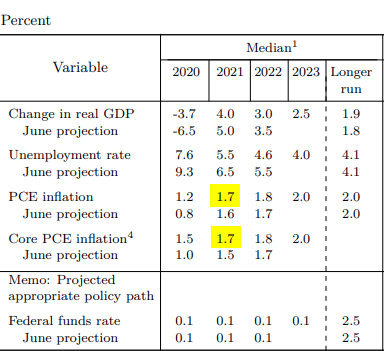

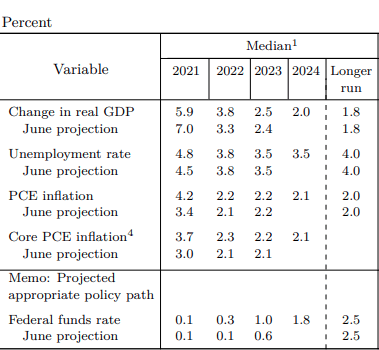

The Fed is inching towards admitting that "transitory" inflation is transiting for quite some time. At its latest meeting, the Fed increased its outlook on 2021 core PCE inflation from 3.0% to 3.7% and 2022 inflation upward again to 2.3% core inflation. Which is higher than the Fed's long-term target of 2%. In fact, the Fed projects that core PCE inflation will remain above its 2% target through 2024, even if it raises the Federal Funds rate to 1.8%!

Source: Federal Reserve Economic Projection - Sept. 2021

Source: Federal Reserve Economic Projection - Sept. 2021

Not that we put much weight on Fed projections. They were miserably wrong at this time last year, projecting inflation in 2021 would only be 1.7%.

Source: Federal Reserve Economic Projection - Sept. 2020

Fortunately, we took the Fed's projections with a hearty laugh and warned members of upcoming inflation. Is the Fed incompetent, or are they intentionally lowballing, hoping to contain inflation by managing expectations?

Yet, despite the Fed's own projections that inflation will remain above its 2% goal for at least 4 years, it continues to maintain that inflation is due to "transitory factors".

As far as action, it has been broadly reported that the Fed might begin "tapering" as soon as its November meeting. "Tapering" is slowing down the number of purchases of treasuries and agency MBS. Note that it is only slowing down purchases. It does not expect to actually stop purchases until the middle of next year. This means the Bubble of Liquidity will continue to grow. Any rate increase will remain completely off the table until tapering is complete.

The big Bubble of Liquidity we discussed above? The Fed confirmed on Wednesday that it will keep growing until at least the middle of next year. And inflation? The Fed intends to do absolutely nothing about it until late next year, even though its long-term projections are that inflation will be above its own target.

For investors, this means that the equity markets are going to continue to be propelled forward by the Bubble of Liquidity, a hot economy, and the lack of Fed action on inflation. Dips will continue to fill in much more quickly than you might expect.

"Bad" News: Potential Catalysts

No amount of liquidity can prevent "bad" news. Like we saw last week, "bad" news in the news cycle can cause some market volatility, but the excess liquidity ensures that the market will remain resilient.

Over the past couple of months, we have seen the market respond to Delta, which did have a real impact on some businesses, but failed to derail the market. Let's look at some potential "bad news" catalysts that might be coming up. If any of these cause a market pull-back I will consider it a buying opportunity:

1 - Evergrande

We saw the market panic over Evergrande, a Chinese real-estate company. However, it quickly recovered even though Evergrande failed to make its bond payments due on Thursday. The market fell more on the rumor than it did on the news. With Evergrande's bonds trading under $0.30 on the dollar, Evergrande's debt is clearly priced for bankruptcy. Why does anyone care? The real concern is whether Evergrande is large enough to bring down the rest of the Chinese economy with it.

The Chinese government exerts much more direct control over the economy than most other countries, and nobody knows what it will do. On a global scale, China is both a huge importer and a huge exporter. So any disruption of the Chinese economy could threaten to impact imports through declining demand, exports through declining supply, and could disrupt the many businesses that conduct business with Chinese companies.

The market fairly quickly shrugged off the actual missed payment because most analysts have dismissed the early storyline that this is comparable to the Lehman Brothers collapse in the U.S. The market believes that the Chinese government can, and will, contain the damage.

We hold minimal exposure to China, so we do not see any imminent risk to our portfolio from direct impacts. However, Evergrande could be a source of future news events. If so, we will buy the "sympathy" dip with U.S.-centric companies like U.S. REITs and BDCs.

2 - The Debt Ceiling

In the next couple of weeks, we will see news about the U.S. "debt ceiling" coming up. Since the news media loves a politically polarizing story, we can expect the news to be dramatic, partisan, and quick to trumpet the end of the world. The debt ceiling is a limit on what the U.S. Treasury can borrow for working funds. Oddly, the debt ceiling does nothing to stop Congress from ordering money to be spent. So as the Treasury carries out instructions to spend money from Congress, it faces the reality that Congress ordered more spending than the debt ceiling will allow. Congress then has to pass new legislation to raise the debt ceiling or "suspend" it.

Well, nothing brings out partisanship like a good old-fashioned debate over fiscal discipline. Never mind that the spending the Treasury is doing was directed by last year’s Congress. The Democrats want some Republicans on board with raising the debt ceiling, while the Republicans want the political imagery of the Democrats raising it alone so they can place the full blame for the immense U.S. debt on them. Each side doing their best to make the other side look like the one without any fiscal discipline.

You will see some horror stories of what would happen if the ceiling isn't raised and the U.S. defaults on its debt payments. That would, in fact, be devastating to the economy for the entire world. Apocalyptic even. That's why it won't happen. To the extent that the debt ceiling debate impacts the markets, it is an easy buying opportunity. I won't be surprised if they literally wait for the last day. After all, political grandstanding requires every minute of TV time you can get.

3 - Government Shutdown

A government shutdown is a much more likely possibility. While related, it is a different issue. Congress is required to pass a budget for the government to be allowed to spend money.

The failure to pass a budget causes a "shutdown", which causes many government agencies to furlough workers. "Essential" workers keep working, and historically they receive their pay when the shutdown ends. A shutdown doesn't "save" any money, it simply delays it.

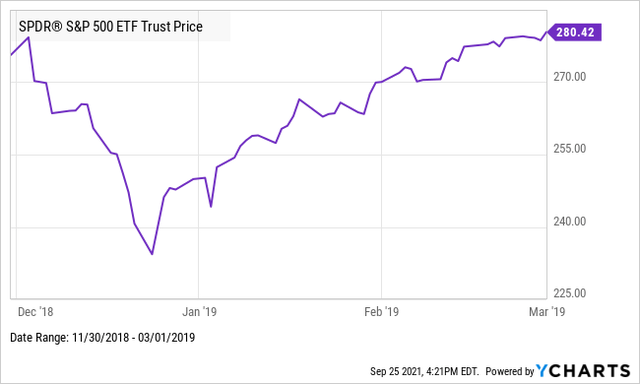

The U.S. has seen numerous government shutdowns. The longest shutdown in history was from December 28th, 2018 to January 25th, 2019. It was a wonderful buying opportunity.

Technicals

After coming into the week with downward momentum, the S&P 500 filled in the dip and closed above its 50-day moving average.

We can expect some volatility risks from the news events described above, but overall we can expect any dips to fill in quickly and for the market to remain biased towards moving up. Make sure you have your shopping list on hand so you know what you want to buy on any dip!

The S&P 500 is on track to reach the 4600 level (up 3.2%) by year-end. After that, I expect clear sailing to 4800 (up 7.7%) within six months. The bullish tailwinds remain strong and the 50-day moving average should remain an escalating floor. Breaks below it will remain rare and will be excellent buying opportunities as the dip will fill in sooner rather than later.

This is a liquidity-driven market, and the Fed has said it will be the middle of 2022 before it will stop pumping up the bubble.

What To Buy

Personally, I really like CLOs, as the Bubble of Liquidity is ensuring that defaults are minimal. Funds like OXLC, ECC, and XFLT are going to continue to have incredibly high cash flow as defaults remain well below expectations.

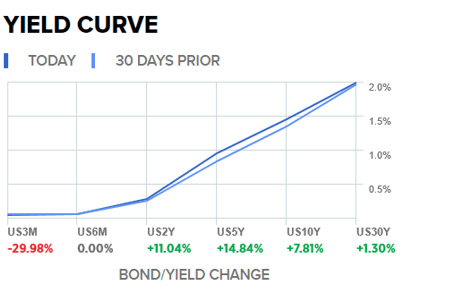

In the near future, I am also very bullish on agency mREITs like AGNC, NLY, and DX. These companies benefit from a steepening curve. The tailwinds driving 10-year Treasuries are dissipating. COVID cases are falling, inflation expectations are rising, the economy is heating up and businesses are expanding. Rates will be held back from climbing too quickly due to the sheer amount of liquidity in the system, but overall they should continue weakening. Agency mREITs and other financials are the big winners as the curve gets steeper. AGNC will be reporting Q3 earnings at the end of October.

Source: Yield Curve CNBC

Additionally, natural gas is shaping up to have a barn-burner year. After a few tough years, this is an opportunity for these companies to make bank and repair their balance sheets. Companies like AM and EPD are picks in our portfolio that will benefit.

As a reminder, we suggest keeping 35-40% of your overall portfolio in fixed-income. Baby bonds, preferred, and fixed-income funds will help reduce the overall volatility of your portfolio and generate reliable income. Keep an eye out for any dips in fixed-income to build these positions.

Conclusion

I hear from many investors who get tempted to trade this market. After all, they have positions with large capital gains that they can "lock-in" and then hope for a dip to occur from some news item like Evergrande or a government shutdown. This is something I avoid in a market as bullish as this one.

There is no assurance that a dip will happen at all, and in this market, dips are brief. Are you going to sell and then "buy the dip" for a 2-3% drop? That carries a huge risk that the market might go up 4-5% before it drops 2-3% and you're "buying the dip" at a higher price than you sold!

Don't fight the market. The bull market is pushing ahead at full speed and like any stampeding bull, it isn't letting little things like barriers, hurdles or fences get in its way. It is pushing straight through with only a minor slowdown.

As investors, the Fed has our backs and the mountain of liquidity is continuing to grow. This is the most dovish Fed I have witnessed in many decades and that means there remains a lot of upside for equities over the next 24 months.

Personally, I am not selling or lightening up on any of my positions. On any dip, I'll have a week or two of dividends to deploy and will do so quickly. Don't try to get "too cute". Focus on your income. If you can make a swap that increases your income, go for it! But don't sell your valuable income-producing assets in exchange for cash. Cash will be less valuable tomorrow, income-producing assets will be worth more.

HDI, described as the #1 service for income investors and retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.