Market Analysis for Jul 9th, 2021

Sharing some of Ricky's Best In Breed Setups (ongoing performance + LIS) with educational links below

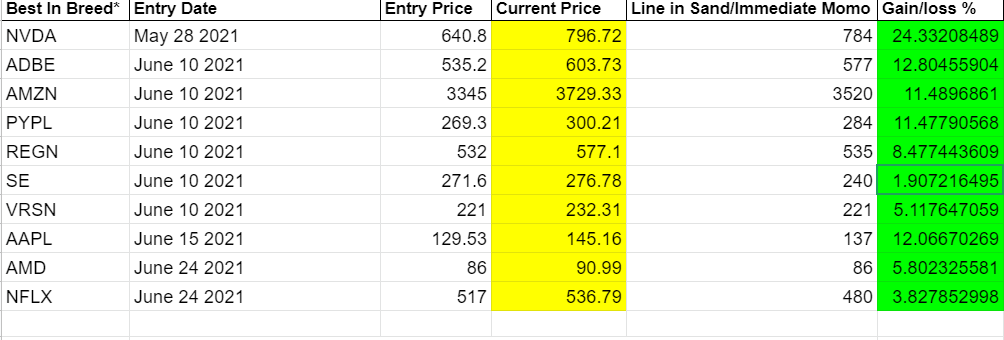

- NVDA + 24%

- ADBE 12%

- AMZN +11%

- PYPL +11%

- REGN +8%

- SE +1.9%

- VRSN +5%

- AAPL +12%

- AMD +6%

- NFLX + 4%

No big surprises on the recent Nasdaq performance because this type of flows rotation into NQ/tech/megacaps/large caps in general was expected as the setups told us over the past several weeks/months before the acceleration move.

In general, tech was expected to lead with outperformance/easier to generate alpha due to the context/setup/stats/seasonality as it offered a great way to get more exposure into the USA markets. The risk to reward was very attractive at the time.

Now, market is obviously top-heavy and dominated by the very same megacaps+large caps with the current grind up and shallow dips posture. The usual...racket up stops vs the appropraite timeframe, and enjoy the slow and steady lazy river approach...which remains king until the music stops and we start playing musical chairs.

I've made a few educational links available to the main room +twitter here for free. By sharing this, I'm hoping you are able to understand, learn, do homework, dissect and optimize for future in regards to momentum+trend following:

May 28th NVDA at 640, breakout the vertical acceleration

https://www.elliottwavetrader.net/p/analysis/202105287013803.html

June 10th ADBE AMZN PYPL REGN SE VRSN before the breakouts

https://www.elliottwavetrader.net/p/analysis/202106107037868.html

June 15th AAPL at 129, before the breakout

https://www.elliottwavetrader.net/p/analysis/202106157044815.html

July 7th Line in sand, top-heavy market

https://www.elliottwavetrader.net/p/analysis/202107077089483.html