In this Education section we share articles and videos by our analysts to help you better understand Elliott

Wave analysis, plus their suggested outside readings and a glossary of wave terminology important to know on

the site. The Articles page is highlighted by Garrett Patten's

Elliott Wave Education: Basic Analytics

and Avi Gilburt's 6-Part Elliott Wave Intro Series.

The Glossary page includes a list of common abbreviations used in our Trading Room in addition to definitions

of key Elliott Wave terms. For more information on our service and using the Trading Room, please see our

Getting Started section.

In this Education section we share articles and videos by our analysts to help you better understand Elliott

Wave analysis, plus their suggested outside readings and a glossary of wave terminology important to know on

the site. The Articles page is highlighted by Garrett Patten's

Elliott Wave Education: Basic Analytics

and Avi Gilburt's 6-Part Elliott Wave Intro Series.

The Glossary page includes a list of common abbreviations used in our Trading Room in addition to definitions

of key Elliott Wave terms. For more information on our service and using the Trading Room, please see our

Getting Started section.

Elliott Wave theory understands that public sentiment and mass psychology moves in 5 waves within a primary trend, and 3 waves in a counter-trend. Once a 5 wave move in public sentiment is completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply a natural cause of events in the human psyche, and not the operative effect from some form of “news.”

In fact, the former Chairman of the Federal Reserve, Alan Greenspan, understood this fact well. During his tenure, in several hearings in front of the Joint Economic Committee, Mr. Greenspan noted that the idea that the Fed can prevent recessions is a "puzzling notion" . . . Rather, the stock market is “driven by human psychology” and “waves of optimism and pessimism.”

This concept is inherent in the aggregate actions of individuals. Based upon these concepts, it is clear that man's progress and regression does not take the form of a straight line, nor does it occur randomly in nature. Rather, it progresses in 3 steps forward, with two steps back within the primary trend.

This is the basis of the Elliott Wave theory. This mass form of progress and regression seems to be hard wired deep within the psyche all living creatures, and that is what we have come to know today as the “herding principle,” which is what gives the Elliott Wave theory its ultimate power.

This theory has been proven time and time again throughout history. This is the basis behind the Elliott Wave, which is enhanced through the concept of Phi ; the Golden Ratio. These concepts have been understood by Plato, Pythagoras, Bernoulli, DaVinci and Newton. Historic structures have been built by architects of famous Greek structures, such as the Parthenon, and even as far back as the architects of the Great Pyramid of Giza in Egypt, who recorded their knowledge of Phi as the building block for all man nearly 5,000 years ago.

For a more detailed understanding of this concept and application, I highly suggest reading Elliott Wave Principle, by Frost & Prechter.

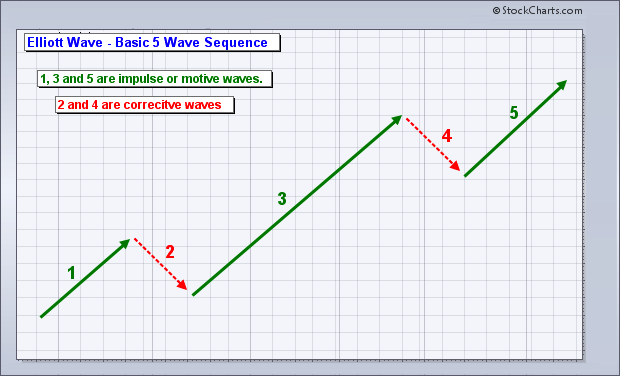

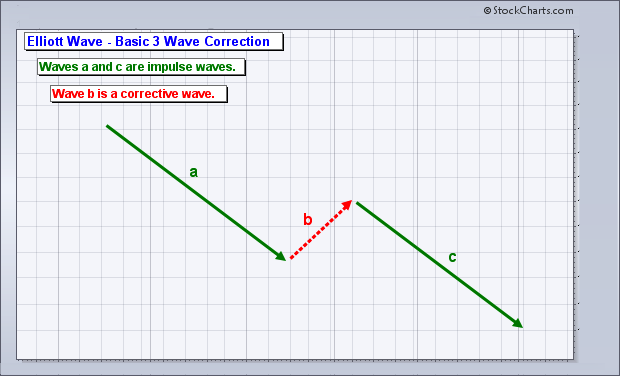

A move in the direction of the trend is considered an “impulsive” move, and will constitute 5 waves in the primary direction. A count-trend move is considered a “corrective” move, and constitutes 3 waves, which are counter to the primary direction.

Even within the impulsive 5-wave move, waves 1, 3 and 5 move in the direction of the primary trend, and waves 2 and 4 will be counter-trends in the opposite direction.

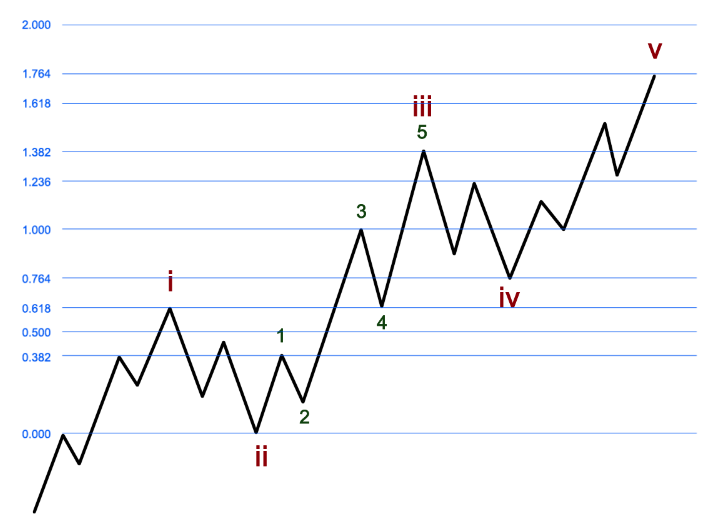

Since the market is “fractal” in nature, these impulsive and corrective movements of the market are occurring at all degrees and in all time frames. That means that the smaller components, or sub-waves, have the same basic shape, form, and pattern as the larger components.

When following impulsive or corrective counts, Fibonacci calculations of extensions and retracements, based upon Phi (The Golden Ratio), are essential when following a 5 wave or 3 wave move.

In effect, a 5 wave move usually moves in the direction of the trend, while hitting Fibonacci levels and reacting. For example, the standard Wave 1 will extend to the .382 or .618 extension of the entire move. It then pulls back in a Wave 2, generally to the .500 or .618 retracement level of the Wave 1. It is then followed by a 3rd wave that subdivides, and this is where an Elliottician makes the distinction between an impulsive 5 wave move or a 3 wave corrective move.

This is something I lovingly call “Fibonacci Pinball.” Ultimately, the way that we know that a movement within the market is going to be a 5 wave move as opposed to a 3 wave move happens during the potential Wave 3.

See Avi's article, "The Basics of Fibonacci Pinball." Also view Garrett's slide show presentation on Fibonacci Pinball.

A standard 3 wave corrective move usually has a first wave (a-wave) that is equal to the third wave (c-wave). During a CORRECTIVE c –wave, the market will move up to the 100% extension of the a-wave, which means that the a-wave and c-wave will often be equal in length. If it is a corrective move, then the market will reverse in the other direction and not find a lower support in order to continue in the same direction.

However, in a Wave 3 within a 5 wave move, the market targets the same 100% extension for the first 3 waves, however, the pullback, after hitting the 100% extension, usually finds support around the .618 extension. It then turns and proceeds to break through the 100% extension level to complete a Wave 3, usually well beyond the 100% extension at 1.382 or 1.618 extensions of Wave 1, or even much further, such as those that we have recently experienced in the market at the 2.618 or even 3.00 extensions. After it completes the Wave 3, the Wave 4 pullback usually finds support at this 100% extension level again (what people deem a “re-test” of the break out level), and then turns back up to complete the 5th wave.

I live Finance. 80hrs a week corp finance. I trade as a hobby and in my opinion this is the best site in the world for someone to learn about markets... i rue the day when it is no more or its core is changed. there is NO BETTER SITE IN THE WORLD to get the off-cuff input/feedback/knowledge across ALL MARKETS like this site... Thank you to the analysts here who grind out thousands of charts each week."GibsonDog" - Trading Room

My faith in God and my faith in Avi and his team. God lead me to this service over 10 years ago. For a decade I have heard Avi point his bat at this very moment in time calling this S&P level. Though the years I have witnessed him point his bat months, even years before metals hit their highs and lows with almost perfect big picture accuracy. Against every other analysts opinion. I have seen him bullied relentlessly on his public articles on SA and stick to his guns and proven so correct with no one ever apologizing or admitting he called it."sdmavrick" - Seeking Alpha

My AUM has grown exponentially because of you and I can't thank you enough. My biggest regret is not signing up sooner! You've done more good than you will ever know."AAMilne" - Trading Room

I’ve subscribed for 5 years now and I have to say I see that you’ve been right on this the whole time. Who would’ve thought gold and silver would’ve rallied with rates this high for this long and the markets continued higher as well. Always thought your charts were good but always thought in the back of my mind that rate cuts and other news actually led. So now that I’ve admitted defeat u are free to gloat. Well deserved"Lil_G" - Seeking Alpha

I worked on trading desks at top investment banks for 10 years, then traded on my own for another 8. I've seen 100s of research from the best analysts in the business. Avi and EWT is the only one I'm willing to pay for right now."tzeyi" - Seeking Alpha

“I was 100% in equities and been killing it for 2 years, but I heeded your warning and took everything off the table. I've been cautiously trading your recommendations and now when everyone I know is getting wrecked, I'm still profiting. Thank you so much for what you do, my family and future are safe because of it.”"DoctorBeat" - Trading Room

This service has not only made me money in trades but equally important it got me out of the market before the meltdown."BigDaddyTuna" - Trading Room

"Your service and insight is phenomenal, and has definitely changed my outlook on the market. I’ve been actively working on recruiting new members to your service. It’ll save their financial life.""Bidking82" - Trading Room

"Today, I achieved my highest weekly profit ever ....I see this as a testament to the power of the guidance available here. I ignored all narratives and traded the charts with discipline. I set clear parameters for each trade, immediately placing OCO (One Cancels the Other) orders with both stops and limits. I made some adjustments as the charts evolved, but kept the orders in place, and allowed the process to unfold. Sincere thanks to all the analysts and members who help make this such an incredible community—especially Avi, Zac, Mike, Levi, and Garrett. I'm incredibly grateful!""Dre-" - Trading Room

CNBC had a stat this morning that over the last 20 years 86% of money managers/hedge funds have underperformed the market. They couldn't figure out why that’s the case given how 'smart' these people are. . . . I know my performance since joining the site has skyrocketed!"HenryH" - Trading Room

We use cookies to enhance your browsing experience and analyze our traffic. By clicking "Accept All" you consent to our use of cookies. Privacy Policy

We use cookies to enhance your browsing experience and analyze our traffic. By clicking "Accept All" you consent to our use of cookies. Privacy Policy