NZD/USD Rallies in Defiance of Reserve Bank of New Zealand Rates Cut

On Thursday morning in an effort to curb a slowing growth outlook The Reserve Bank of New Zealand announced that they were cutting interest rates by 25 basis points to 3.0 percent. Reserve Bank Governor Graeme Wheeler further stated that “While the currency depreciation will provide support to the export and import competing sectors, further depreciation is necessary given the weakness in export commodity prices.” Despite this rate cut announcement we saw the New Zealand dollar immediately rally on this news 70 pips or 1.3%.

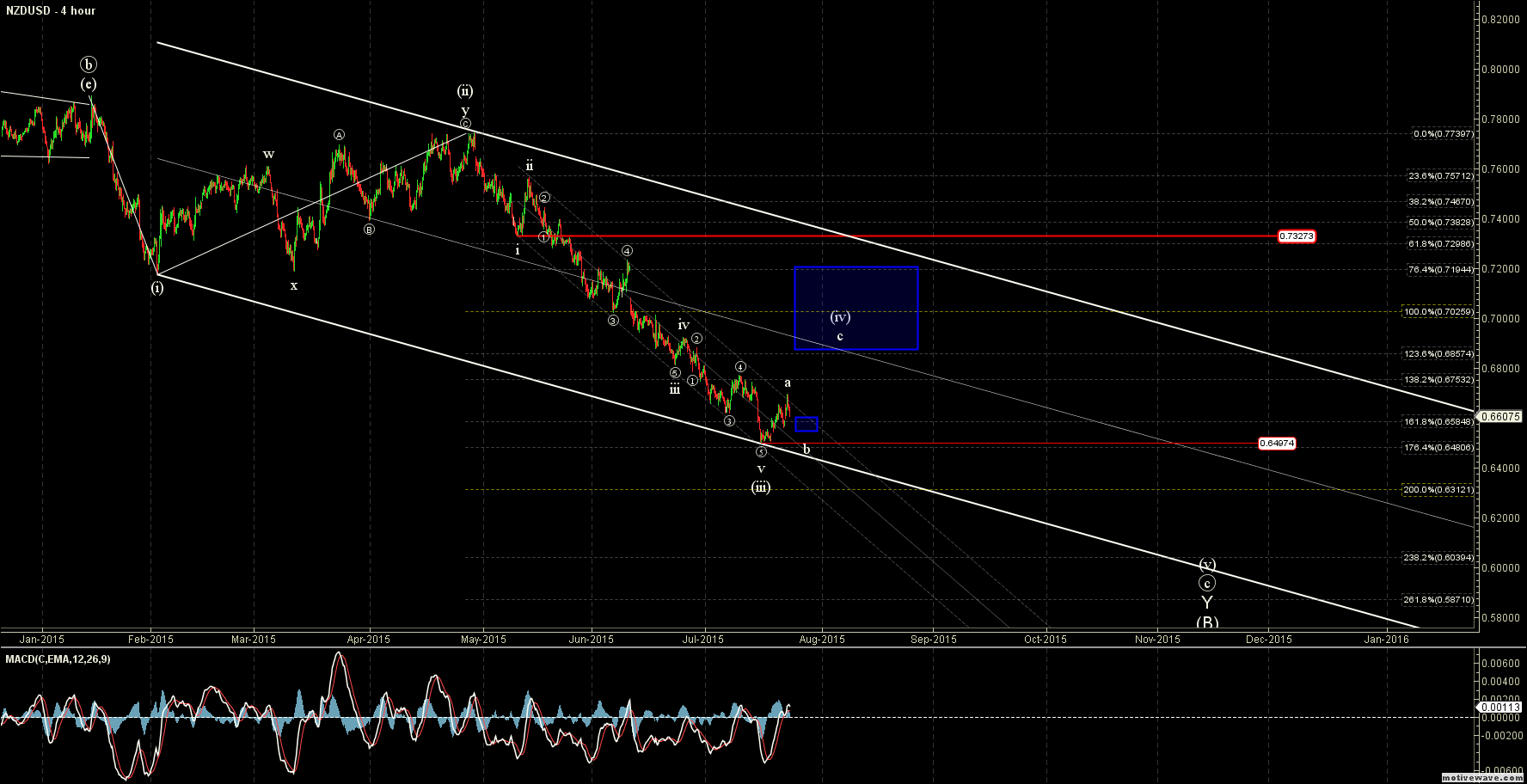

While this reaction may have come as a surprise to many, our members at ElliottWaveTrader.net had been warned well in advance that a rise in the New Zealand Dollar was likely forthcoming as we had called for the local bottom to be struck on this pair at the 0.6480 level 2 days prior to the July 15th bottom. As it turned out, this 0.6480 level was just 17 pips over the actual bottom of 0.6497 and was called for when the pair was still trading 240 pips over the final bottom. Now that the rate decision is behind us, the question is what is next for this pair?

The fundamentals would suggest that the expected continued easing by the RBNZ will result in a further weakness the NZDUSD. While my intermediate term analysis does support this case for further weakness, we may, however, see a continued near-term rally in the NZDUSD prior to dropping back down to new lows. We now look to the same Elliott Wave analysis that allowed us to provide the targets for the local bottom to help us determine the upside targets for a move higher as well as the levels that would invalidate the setup for this near term move higher.

This initial move off of the 0.6497 low has already run into channel resistance and retreated back down just under the 38.2% retrace as of this writing. I have labeled the top of this move up as wave a as dictated by our Elliott Wave analysis. Any retracement down off of the highs should ultimately hold over the 0.6544 support level which would then be labeled as wave b. As long as this support level holds then I am looking to for a strong move into the 0.6857 - 0.71944 range over the next several months. Alternatively, should this pair be unable to hold over the 0.6497 level, then it is suggestive that our wave (iii) is extending lower and we would look toward the next Fibonacci target for support which comes in at 0.6312.

Once we top in our wave (iv), we will then be looking to make one final low in this pair, which should occur sometime in the end of 2015 or early part of 2016. After that we could see a very strong multi-year rally of this pair, potentially even eclipsing the July 2011 highs.