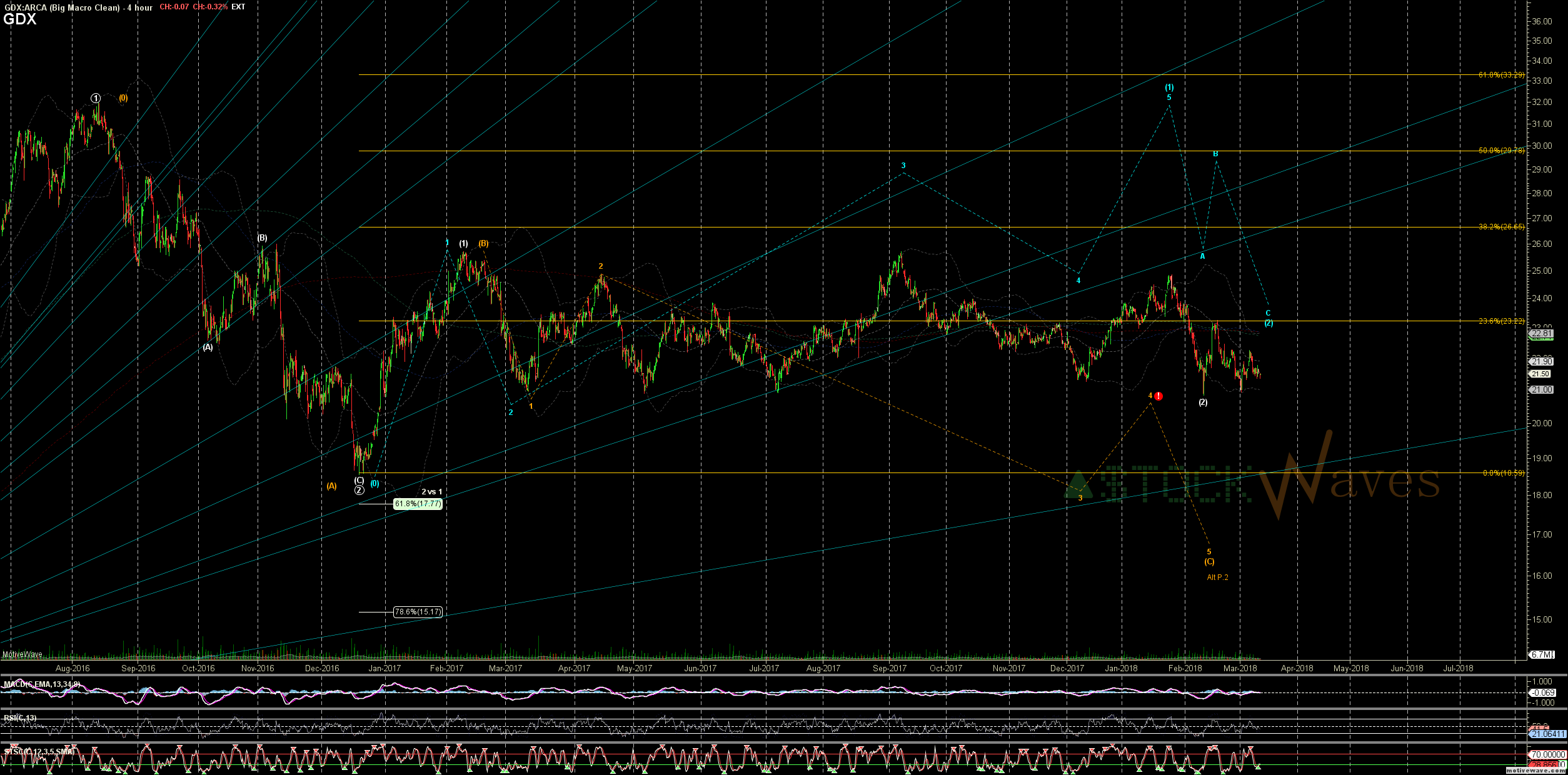

GDX still caught in Tug-of-War

We have and IDEAL structure as circle i-ii in gold off the recent Dec low, in a VERY nested P.1-P.2-(1)-(2)-i-ii pattern.

We are looking for confirmation of the start of (i) of circle iii and based on price action which so far looks only corrective* the best case is a larger LD for (i) trying to form.

There is room for a more complex circle ii retrace in GC to test the 1300 or 1285 support levels but certainly not needed. But any break of 1315 again make that very likely.

GDX is struggling to "build" a similar LD off the March 1 low, but as I have said before I think it is more helpful to look at the collection of many individual names separated into "factions" rather than GDX alone that has been the victim of the tug-of-war between the two main camps.

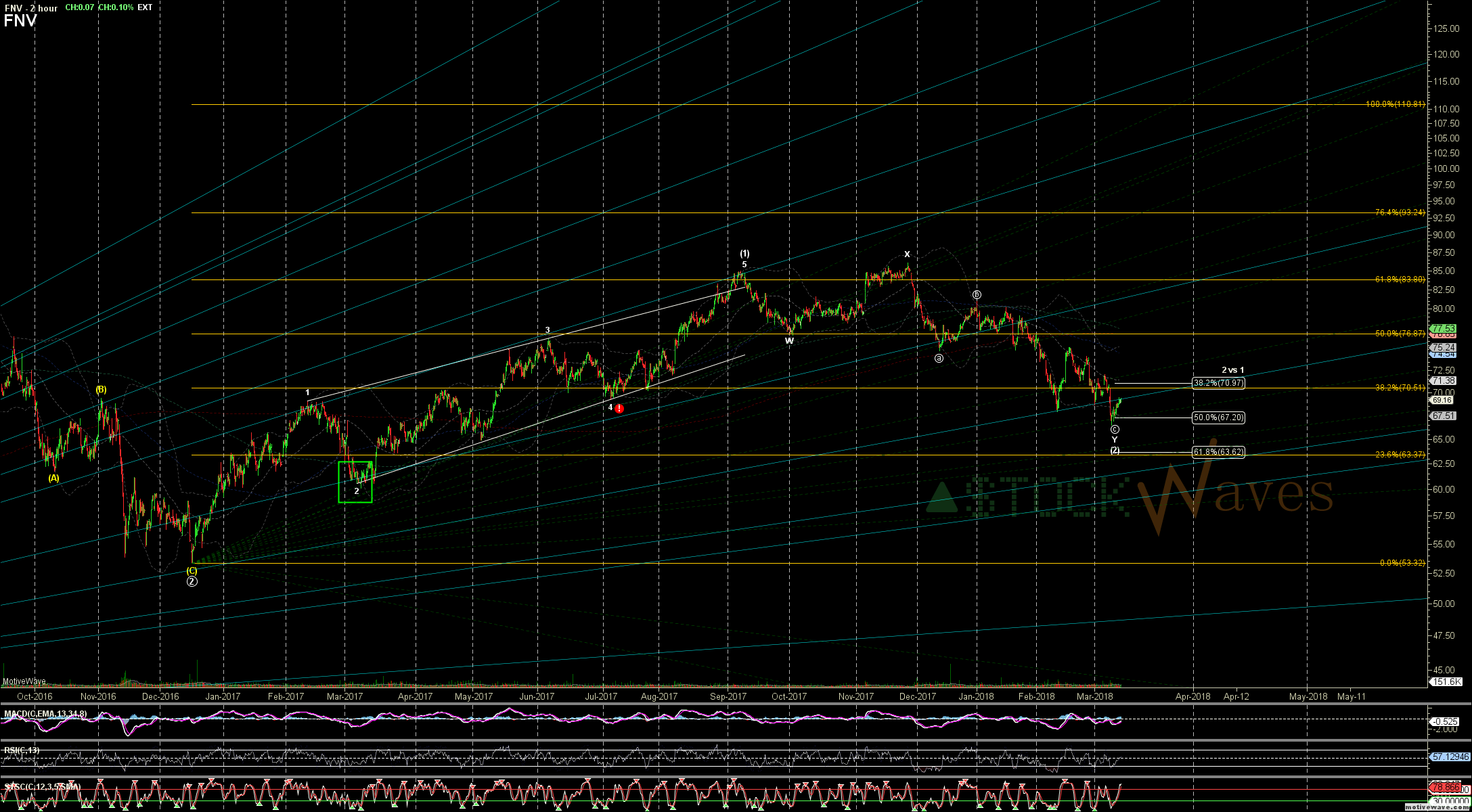

You have names like ABX that are starting to show nice initial signs of wave 1 of (1) starting off more recent bottoms to P.2, and then names like FNV and GOLD that are showing signs of start 1 of (3) of P.3 off more recent bottoms as (2).

*Previous bullish moves have also started with corrective looking moves. (Jan 2016, Dec 2016, even the micro off Dec 2017 was spotty at first)