Bears might need new tires.

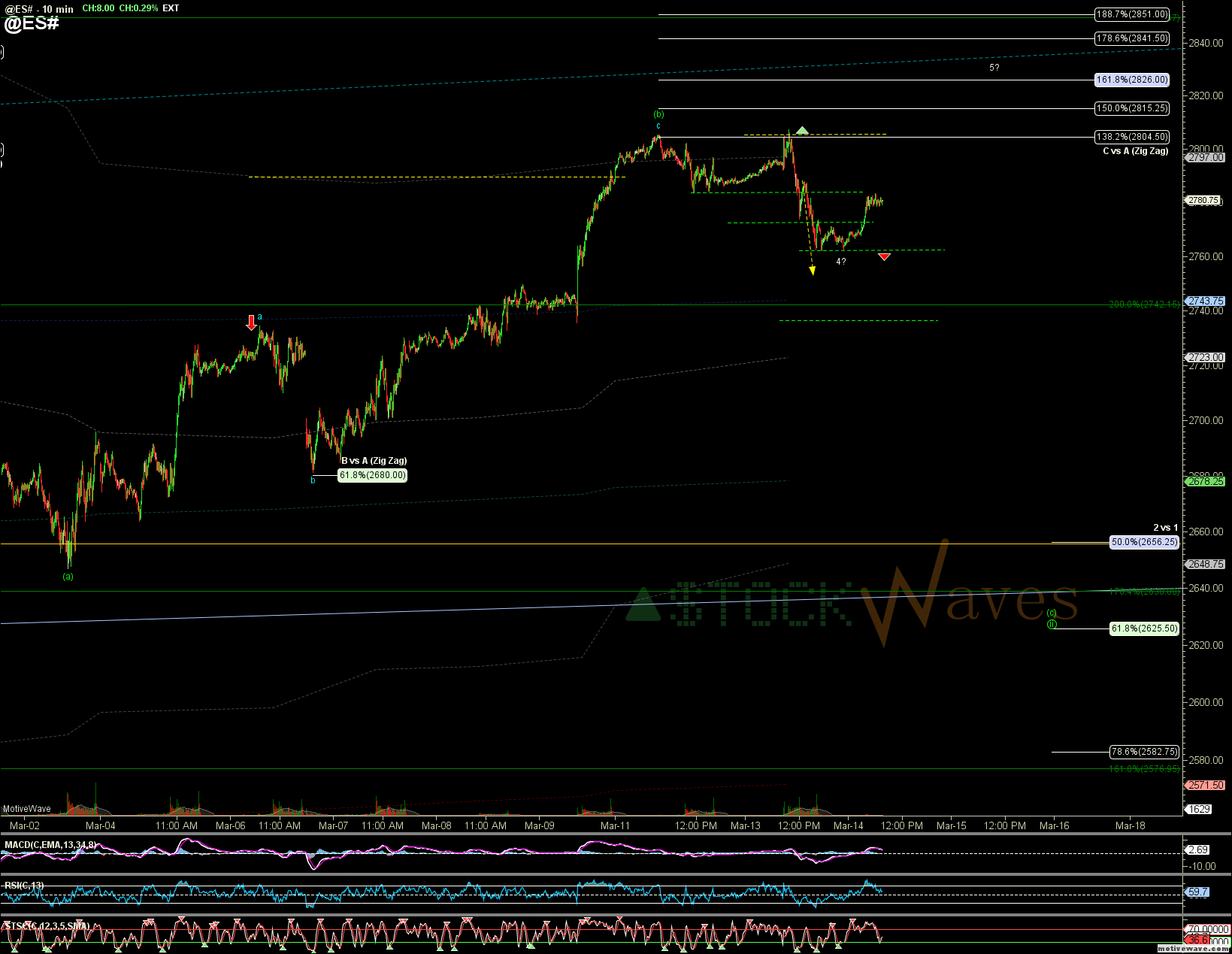

ES seems to be stubbornly holding 2762. Allowing for an attempt at a micro 5 of c up toward 2822 in SPX (even tho the micro 4th came a little deep).

I have not moved my circle b over yet but am certainly still considering that count as Garrett has shown. I did change my abc of 4 to yellow as the internal structure of 4 has become clouded. I am following both that potential as well as the green (c) of a circle ii implying the potential that Feb was ALL of 4. Since these are both looking for a top to hold in the 2820s and then >6% of potential downside that is enough overlap that for most trading it should not make a difference... the pattern if clearly completing a green (c) should start to show that into the 2680 region... if it seems like the heart of am impulse then <2500 is still very possible...

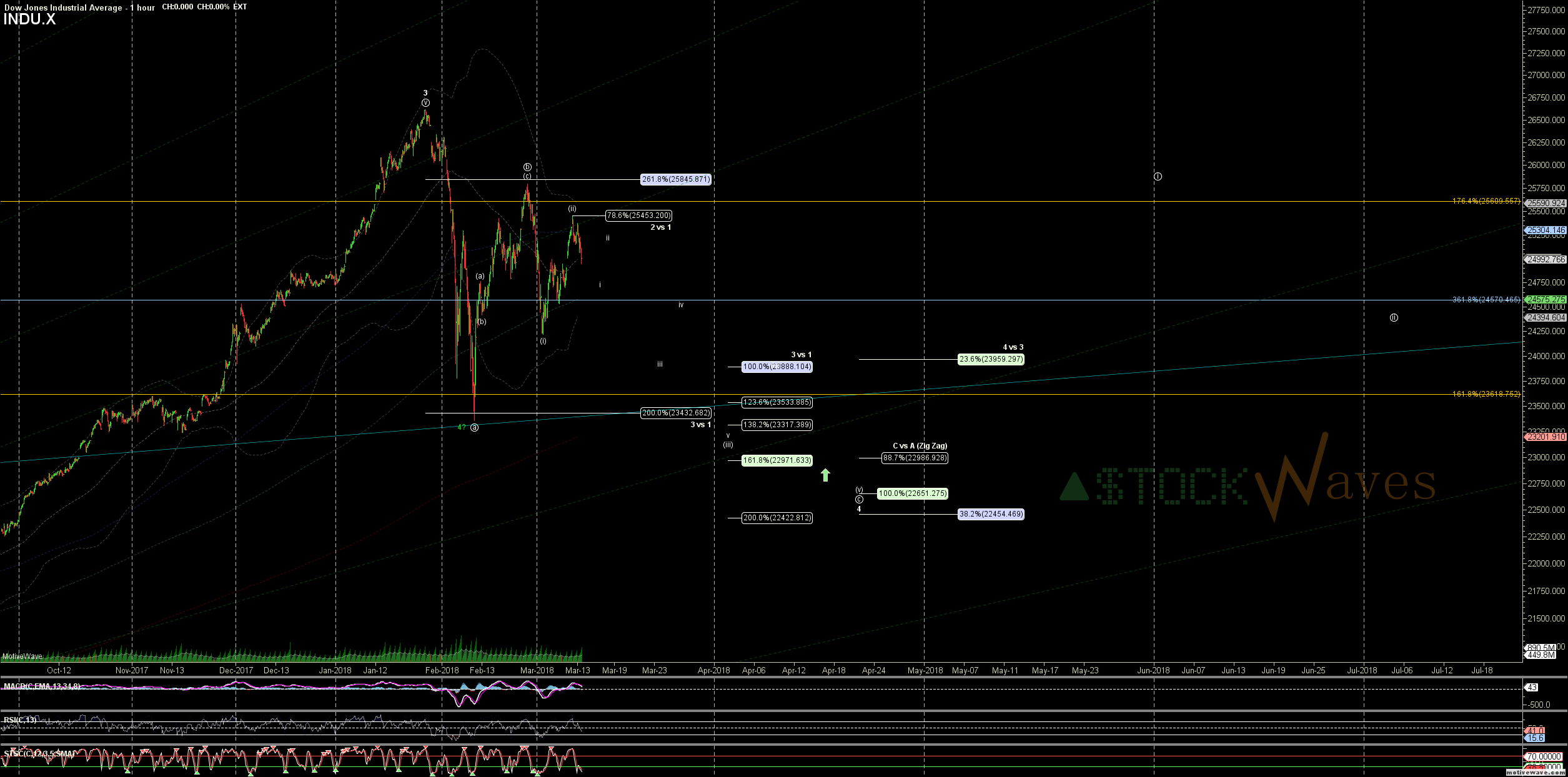

The DOW also strongly argues for more attempts at its' c wave of 4 down...

Many sector charts and ind stocks still argue for more of the c of 4, but they may be able to get closer to their ideal targets in-line with just a green (c) in SPX/ES... so we will be watching for this in StockWaves and looking for some entries.

*Not shown but also being considered is a triangle if this is still just a more complex and stretched circle b wave... again the triangle would mean that we are still in Minor 4 but that the Feb low will hold w/ c of a tri holding ~2600, d ~2750, & e ~2725... likely well into April. Again I do not feel like there is any detriment to trading to consider this since it too is looking for a top between here and 2820s and down side of at least "green (c)" but would be a 3-wave structure.... if/when I put this on the chart it will be purple ![]() .

.