Your Fortune Favors Solana

Enter Ethereum

Since Ethereum entered the crypto scene in 2015, it has been the king of smart contract platforms. It was not the first smart contract platform. However, the adoption of the platform led the Ethereum token value to become second to Bitcoin in market capitalization in 2017. It has rarely dropped from that place since. And despite the great expansion in the number of smart contract platforms since the explosive growth in crypto prices in 2017, Ether has consistently led in decentralized app activity and assets held on chain or Total Value Locked (TVL).

Solana Takes a Swing

It was not until Solana (SOL) came on the scene in 2020 that we had a serious competitor to Ethereum. Solana has a long way to go to match Ether’s on-chain activity and TVL. As of writing, Coin Gecko says TVL is roughly 13% of Ethereum’s, and it stands in second place. On-chain volume is often second to Ethereum, although other chains like Tron and Binance Smart Chain compete as well. However, Solana’s price has appreciated 10x that of Ethereum since crypto’s cyclical low in early 2023. That suggests that sentiment has favored it as an investment.

The crypto space has always been a tribal one. Crypto projects and their corresponding tokens gain a fanbase that defends their projects to the bitter end, sometimes to their financial detriment. The rise of Solana’s popularity—and its price appreciation, while Ethereum’s price has made little progress in two years—has earned Solana much vitriol from the Ether Tribe.

Since its creation, Ether has struggled with the cost of transactions and scalability. The speed of transactions on the main chain and the cost for users to transact, called “gas”, has been a user experience concern. However, arguably, the cost of gas also acts as a drag on Ether’s token value, as higher Ether costs lower the network's usability.

Solana has made headway by being much faster than Ether: up to 65,000 transactions per second (TPS), compared to Ethereum’s 50. The user experience is snappier; transactions are also cheaper. While writing this article, I could load a transaction on the Solana chain for 3 cents. Loading a similar transaction on Ether was 85 cents. And I wrote this article on a Sunday, when the Ether network is often less congested.

Ether has handled its scalability issues through level 2 platforms that are faster and cheaper to interact with. However, that makes the experience confusing, especially as other level 1 platforms, like Binance Smart Chain and Avalanche, use an Ethereum-addressing schema. I have found it hard to track at times whether I was interacting with an Ethereum level 2 or another level 1.

Solana Isn’t Free of Issues

When the Solana network first started, it was plagued with instability issues. It was often down for hours while developers fixed issues. It is still down occasionally, but as an active user of both Solana and Ethereum networks, I find Solana reasonably stable. Still, Solana receives much criticism for being more centralized with fewer validators than the Ethereum network. That also allows a smaller footprint of attack, which brings concerns for its security.

Since the design of anything involves trade-offs, it appears fair to say that Solana traded some level of security for speed and ease of use. I’m sure a Solana fan might challenge that, and I admit this statement is above my pay grade. I can only say I prefer using the Solana network.

But despite my preference, what I trade and invest in is based on price structure. I am a technical trader, and that guides over 90% of my criteria when clicking the buy button. So, next, I will compare them from the price structure standpoint.

Ethereum’s Price is Losing Ground

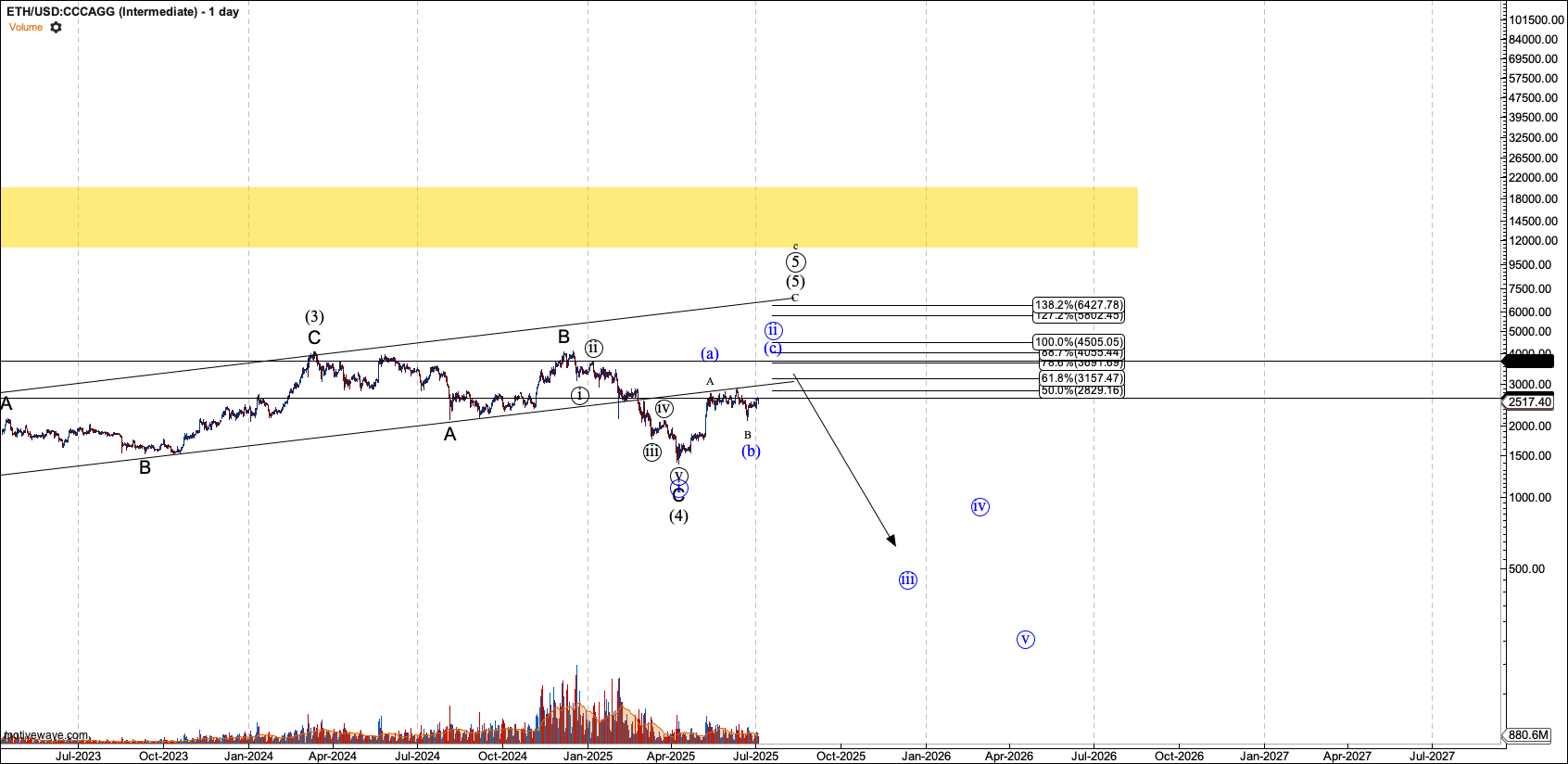

In May of 2024, I expressed a bearish view of Ether based on its behavior versus Bitcoin. I buy altcoins when I perceive that they’ll outperform Bitcoin. That is necessary, as the relative beta of altcoins versus Bitcoin is high. Declines, when Bitcoin declines, tend to be more severe. When I wrote that article last year, I saw the likelihood that Ether’s underperformance would be pervasive. I also said I was going to get relatively flat with respect to Ether exposure. Since then, I have held only a trace amount to interact with the network. That call proved true as the ETHBTC pair has dropped over 50%. And Ether in US Dollar basis is down over 30%, while Bitcoin has climbed roughly 5%.

Unfortunately, since that article was written, Ethereum broke below a key level of $1520 in five waves. At the time of writing, I did not expect that Ethereum was in such bad shape that it would signal a potential end of this bullish cycle. That means it may not take out its 2021 all-time any time soon.

The potential for reaching $6K is slim, a far cry from my original target of $10K+, but only if it breaks above $4100. Until then, I view such a target as improbable. Instead, while Bitcoin finishes this bull market, likely in the $125K region, I expect Ether to range below its 2024 high, then start a decline to as low as $80 when Bitcoin starts a bearish move.

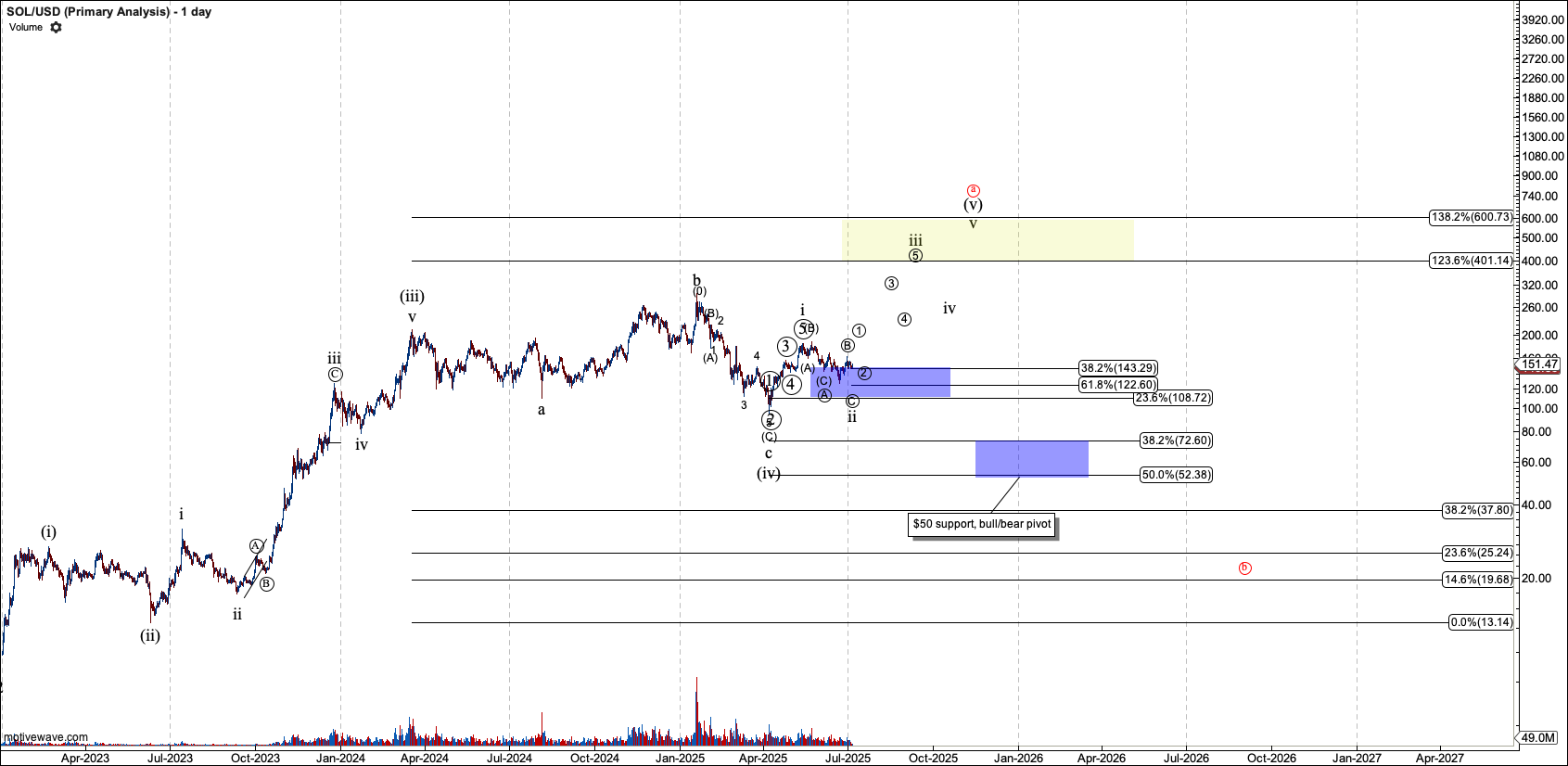

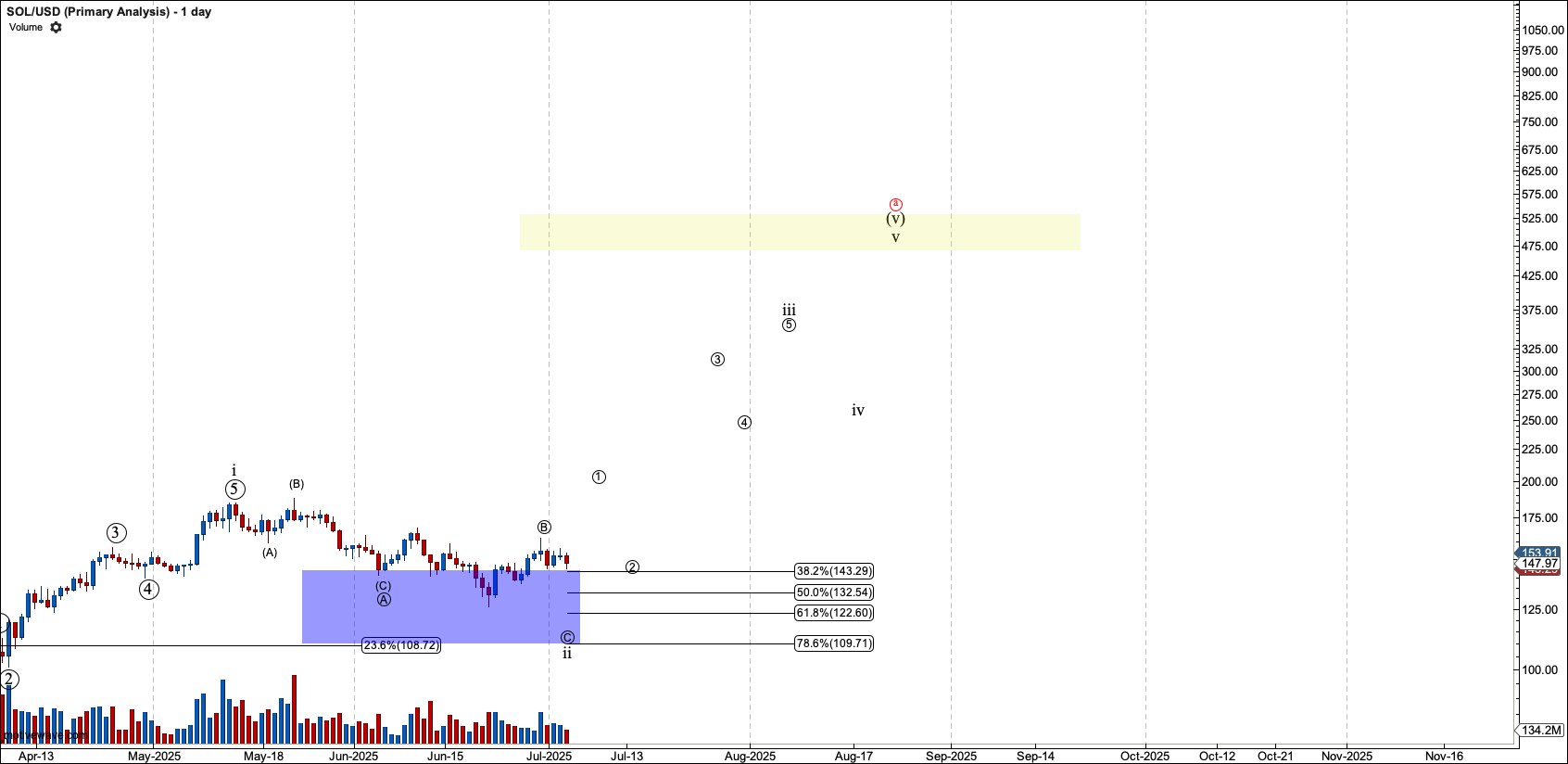

Solana is Set Up to Push Higher

My view of Solana is quite different. Firstly, I view the easy money as having been made in the second half of 2023, when it pushed through a third wave of its 2023 low. However, I do see more gains to come as long as this crypto bull market continues, and as long as Solana is over $50. That level is support for wave-(iv), which Solana seems to have completed in April at $95. However, if it wants to enlarge that wave with deeper price action, $50 will need to hold.

So far, it seems wave-(iv) will hold, and SOL is forming a key A-B setup to complete wave-(v). Support for wave-b is $109. SOL does look likely to put in a bottom close to that level unless it first breaks over $185. Either way, wave-(v) should reach between $400–$500. That is a gain of between 100% and 200% from here. Probabilistically, I see Ether unlikely to get more than 60% unless it breaks over $4100.

Before I conclude, I will remind you that I live by strong opinions, loosely held. My method of analysis indicates important levels, where I must change my view. That is how I manage risk when my own money is involved.

Conclusion

I will leave the technical debates about the merits of Ethereum and Solana to the developers. But with respect to a shootout for price, it appears fortune lies with Solana. Ether is most likely going to continue in a range until this bull ends, while I expect Solana to at least double as long as it is over $109. I have traded and used the Ether network for many years since it first arrived on the scene in 2015. However, when my money is on the line, I am not nostalgic. And I cannot be tribal.

The view I have shared here pertains only to the current bullish cycle in crypto and only as long as the levels I discuss hold. The crypto market is ever-changing, and a new level one smart contract may arrive, giving both Ether and Solana a run for their money. The crypto ecosystem tends to change drastically with every bull and bear cycle. Perhaps in the next cycle, Ethereum’s issues will have been fixed, and Solana will fade into history. I cannot say. I only trade what is in front of my eyes now.