Your Cash Is Trash: 2 Big Dividends That Won't Stop Growing

Your Cash Is Trash: 2 Big Dividends That Won't Stop Growing

We love cash, don't we? Greenbacks. Bucks. Benjamins. The almighty dollar. We have a lot of nicknames for cash and whatever we call it, we want more!

The issue is that when inflation is rearing its head, cash is no longer almighty or powerful. It is trash. Inflation is the erosion of the value of your cash. Each dollar becomes less effective as inflation works against it. Whether you go to the gas station, grocery store, or even the dollar store, you find that your dollar buys less.

Fortunately, you can preserve your money's value and even make inflation work in your favor. How? By putting it to work. By investing your cash into assets with real scarcity, you will see that their dollar value increases faster than inflation. The more dollars chasing the same few assets, means those same assets are "worth more".

One such real asset is real estate. It may come as a surprise to many of you, but land just isn't being made anymore. We have a limited supply of it available and a growing number of uses for it. Another real asset is commodities - gold, silver, oil, gas, copper, etc. - these assets enjoy a standalone value due to their usefulness in the building blocks of society and being limited by how much we have mined from the earth.

When inflation comes knocking, cash loses its value. Real assets gain value.

Additionally, high-yielding stocks can help you beat inflation. As rates rise, low-yielding stocks often see selling pressure while higher-yielding stocks gain new buyers, this pushes their prices higher, and they provide you excellent income now. This provides an option to reinvest dividends, growing your income at a pace faster than inflation.

Let's take a look at a couple of picks that provide exposure to real assets, will benefit directly from inflation, and provide investors with high, growing dividends.

Pick #1: WPC - Yield 5.4%

W. P. Carey Inc. (WPC) is a "triple-net" REIT, investing in a diverse array of real estate across the world. The beauty of the "triple-net" lease is that it makes most of the property-level management and expenses the responsibility of the tenant.

Triple-net leases have become a favorite for investors because it creates a very scalable investment model. WPC owns over 1250 properties, worth tens of billions, with over 150 million square feet of rentable space in the U.S. and Europe. How many employees does WPC have? Only 188 as of their 10-K.

Additionally, since the landlord does not need to micromanage at the property level, the leases allow for a lot of diversity.

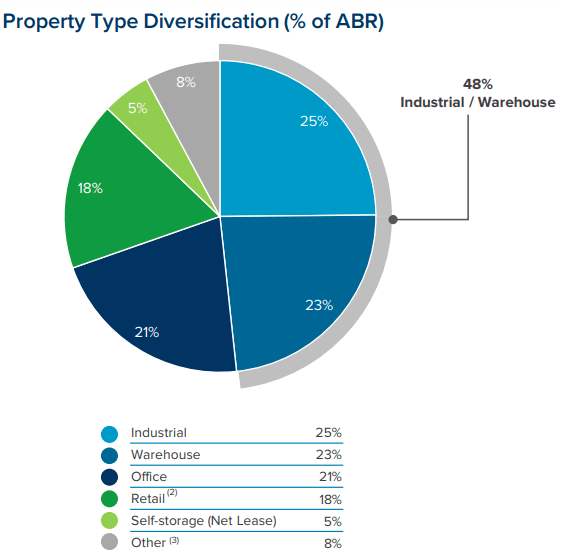

Source: WPC Q2 2021 Investor Presentation

Source: WPC Q2 2021 Investor Presentation

WPC owns industrial real estate, warehouses, office space, retail, and even self-storage properties. By being exposed to a variety of property types, WPC can mitigate the impact of sector-specific issues. For example, during COVID, retail struggled, but industrial and warehouse space thrived.

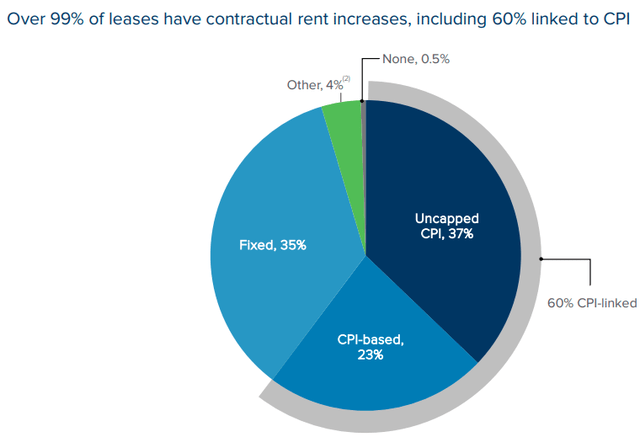

With inflation picking up, WPC is a fantastic option as an inflation hedge. Real estate values are often an inflation hedge on their own. Additionally, because WPC uses long-term leases, over 99% of the leases have automatic "escalators", which increase rent at regular intervals.

Source: WPC Q2 2021 Investor Presentation

Source: WPC Q2 2021 Investor Presentation

For WPC, 60% of their leases are linked to CPI. So when CPI is going up, the rent increases will be larger.

Going into 2022, WPC has a lot of tailwinds.

- WPC obtained cheap debt, including $425 million in 2.25% Senior Notes due 2033 and €525 million in 0.950% Senior Notes due 2030. Lower interest expense goes straight to the bottom line.

- WPC has been acquiring properties hand over fist. WPC expects to acquire $1.5-$2.0 billion in new properties, this will grow earnings per share and eventually the dividend.

- Rising inflation will cause rents to increase more quickly, driving same-store results higher.

- With little responsibility for property-level expenses and few employees, WPC will not see a material increase in expenses from inflation.

- Property values are likely to increase, which will provide WPC flexibility in the future to realize gains, borrow against, or hold.

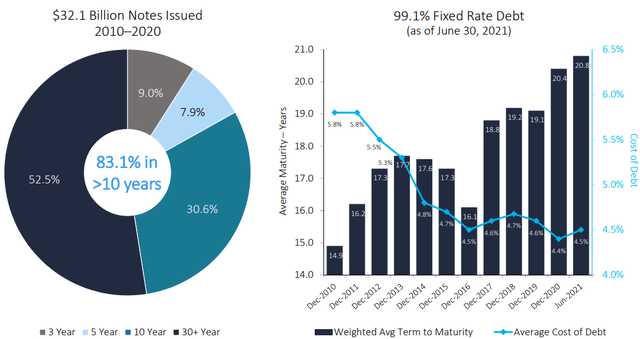

In recent weeks, WPC's price has come down. This can be explained by interest rates moving up. Since REITs borrow a lot of money, rising rates mean rising interest expenses. However, the market is ignoring the reality that WPC refinanced all of its near-term debt in February. Taking advantage of historically low-interest rates to refinance out 9 and 12 years. WPC has no bonds maturing until 2024, so the costs of rising interest rates will not be realized for many years.

What WPC will realize next year and in 2023, is rising rents from inflation and higher earnings from the investments they are making in 2021.

This "knee-jerk" trade that Wall Street has of selling REITs when interest rates rise has historically created buying opportunities. With WPC, this is definitely an opportunity to top-off your positions before rising earnings, and larger-than-average dividend raises "surprise" the market.

Pick #2: EPD - Yield 7.3%

Enterprise Products Partners (EPD) is a diversified MLP that is benefiting from inflation in energy. EPD is preparing to take advantage of investment opportunities recently flexing its investment-grade balance sheet, issuing $1 billion in new 3.30% Notes due 2053. That is right, 32-year money with a 3.30% coupon!

EPD is continuing its efforts to refinance debt and extend its average maturity.

Source: EPD Investor Deck August 17, 2021

Source: EPD Investor Deck August 17, 2021

In the energy sector, things can get turbulent. You have to "expect the unexpected", and this type of balance sheet management is why EPD is one of the best midstream MLPs in business. It is why EPD has been able to raise its distribution every single year for 22 years, which included several periods where peers failed and were forced to cut distributions.

EPD is "self-funding" meaning that they do not need to tap the equity markets to raise capital for new projects. Instead, they have been funding CapEx and expansion through cash flow while paying a generous distribution and frequently buying back units.

EPD is one of the few MLPs that you can hold with confidence through the tough times. EPD has been through recessions, oil crashes, periods of high-government regulation, periods of deregulation, and whatever was thrown at it, continued to reward investors with rising distributions. It doesn't hurt that management has a lot of skin in the game owning approximately 32% of the common units!

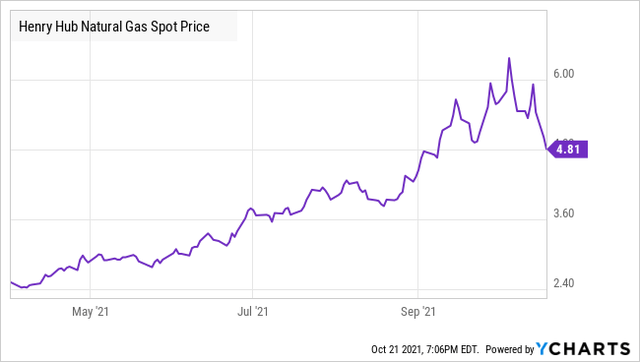

We have been discussing the strong fundamentals for Natural Gas and Natural Gas Liquids. Supply is low, and demand is high, as the world goes into winter with low levels of reserves. There is a risk of shortages across the globe.

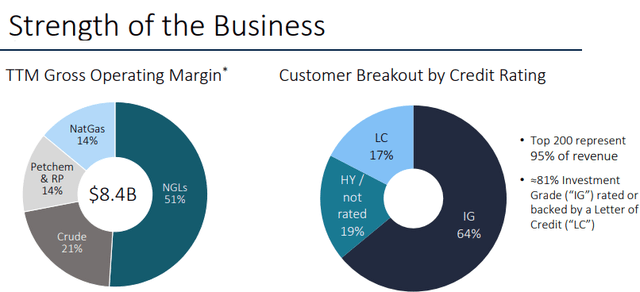

EPD is one way to take advantage of the coming bubble, with 65% of its business in NG or NGLs.

Source: EPD Investors Deck August 17, 2021

Source: EPD Investors Deck August 17, 2021

The world is going to be relying on the U.S. to pickup production, and EPD will be there to transport it.

EPD is a reliable dividend raiser in any environment. With strong tailwinds propelling NG, the outlook is very strong for 2022.

Note: EPD is a limited partnership and issues a K-1 tax form.

Conclusion

I don't like letting good things go to waste. My cash shouldn't go to waste for an illusion of strength, when it is really losing value every day. This is one major reason I remain fully invested in the market. I receive generous dividends from my holdings which are rapidly redeployed into the market and invested in the best opportunities at the time.

Right now, there are strong levels of inflation present and no action at the Federal Reserve to curb it. This makes buying real asset-backed investments the best use of my cash. Now it's tied to scarce assets that have tangible value outside of the full faith and promise of the United States government - the same government minting fresh dollars and driving inflation.

The beauty of a portfolio yielding over 7% with various dividend growing securities is that it allows you to beat inflation on yield alone. You have the ability to reinvest dividends as you wish, enabling rapid growth of your income stream. When you invest in picks like WPC and EPD, you gain the additional benefit of owning companies that will see profits rise because of inflation.

Retirement is a time of excitement and relaxation all mixed together. I don't want that enjoyment to be wrecked by forgetting that when inflation comes knocking, cash is trash. I keep my cash working and earning me more income.

This way the retirement party can keep on going without inflation being a party wrecker.

HDI, described as the #1 service for income investors and retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.