Window for OML is closing fast.

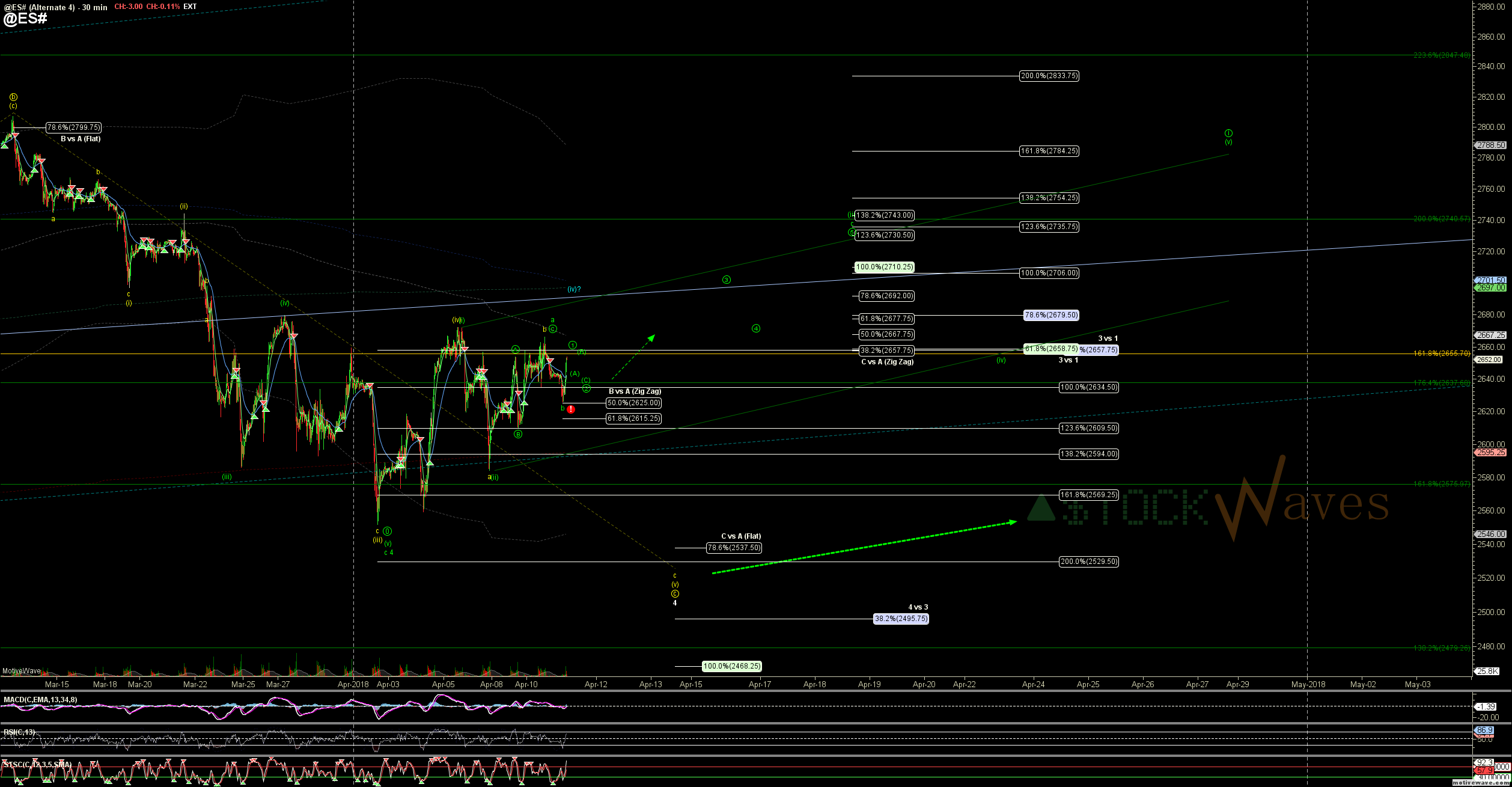

The price action off the 2625 support in ES that held pre-market this morning is giving an EDGE to the green LD count as the start of i of 5 off the April low.

This relies on a RUNNING FLAT completing 4 with a more muting ED for circle c failing to make a nominal new low under the Feb "a" wave. As well an LD can be a choppy and difficult pattern to trade and a difficult pattern to RELY on until it is further along.

That said the push past 2651 (resistance for the yellow micro 2 AND a clear sub-micro (5)th off the 2625 low) makes more of a green c targeting 2710-2737 more likely and this #PirateNinja fits perfectly as a (iii) of an LD for circle wave i.

Ideal support is 2640s for the micro 2 of green c and a break of 2625 now should break down to a new low in the 2530s.

This should not change the targets for 5 of (5) of P.3 into the 3300s, it just starts the same circle i a bit early.

*Another alt that I am keeping in the back of my mind is that April 6 was a "truncated" bottom for (v) of c of 4, the ONLY difference as this allows for a regular impulse for circle i, but same target region and the micro 1-2 off 2625 LOD does not change.