Will The Bears Make A Stand?

When the market bottomed in early February, we set our sights on a rally to take us back to at least the 2727SPX region. Once we got to the 2727 region, I noted that the easy part of this move up has likely been done, and it will get much more difficult from that time on. My preference was to see a more protracted wave (4) take us back down to the lows struck in February, and potentially even a bit lower.

For those that read my analysis carefully, you would understand that I was quite skeptical that a one and a half year 3rd wave would be corrected by a week and a half long 4th wave pullback. That is not typical of what we normally see, despite the size of the drop. So, while the drop did hit the top of our target region for wave (4) within 3 points, I expected a more protracted correction from a timing perspective.

For this reason, I stood aside from the market action once we struck 2727, as I wanted to see how the market would resolve within this region. And, as we came into this week, I noted last weekend that a rally can take us as high as the 2765-70SPX region before we see the next bigger turn down. And, the market even slightly exceeded that upper limit a bit on Friday.

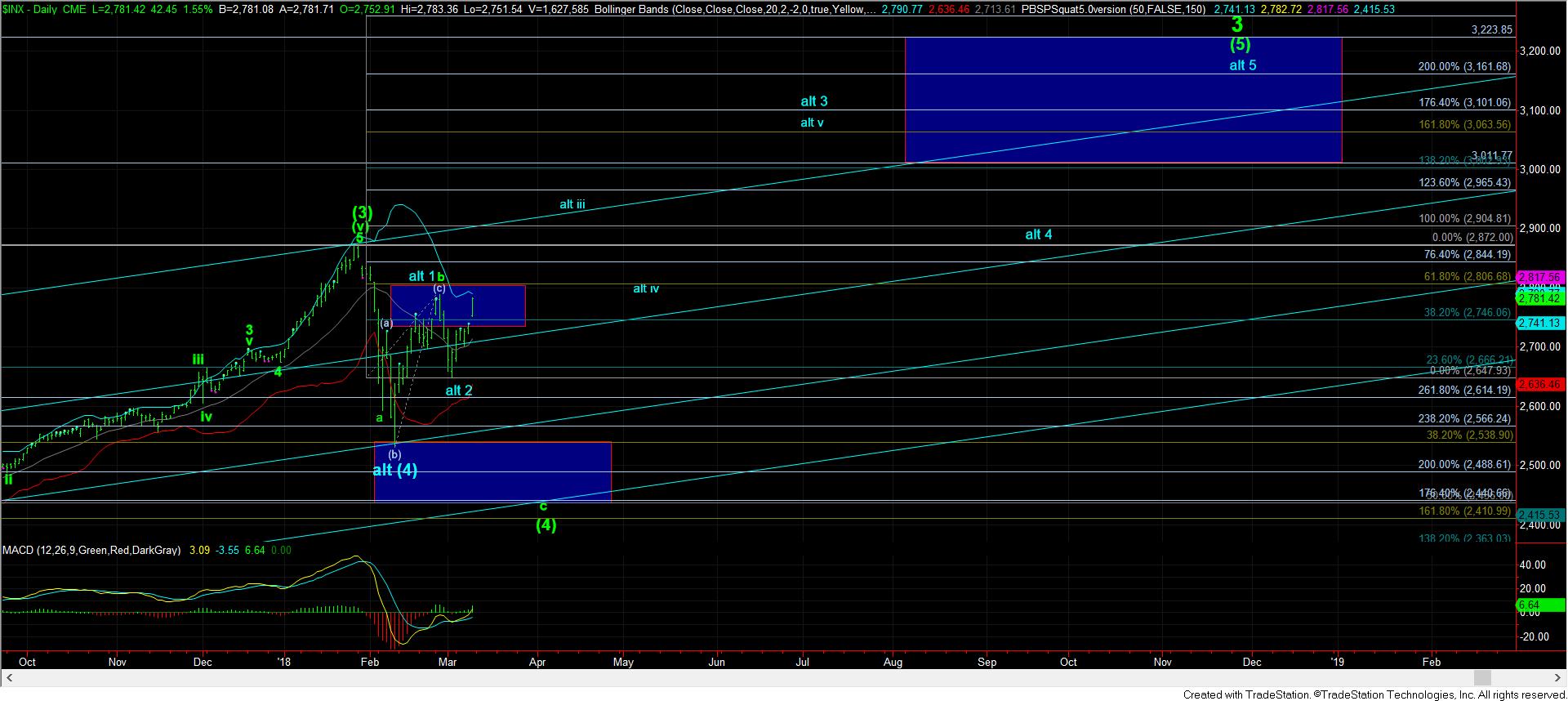

As we stand today, the bears still have a shot at taking this market back down towards the 2600SPX region, and potentially as low as the 2440SPX region. But, in order to maintain that strong potential, they need to hold the 2787SPX region. That is where the yellow a=c resistance suggests is key to keeping the pressure to the downside.

However, if the bulls are able to push through that resistance, they can turn this market bullish once again, as long as there is no break back below 2754SPX. A break out over 2787, with no break back below 2754SPX can begin the rally towards 3000+, as shown in blue on the attached daily chart. In fact, where we left off on Friday, the 2754SPX region should not see a sustained break from this point forth if the market is truly going to break out in a big way.

So, while my long-term expectations continue to look for a 5th wave rally to the 3011-3223SPX region to complete wave (5) of 3 off the 2009 lows, I expected to see a more protracted wave (4) take shape before we begin that rally in earnest. And while I have been sitting on the sidelines on the long side since we struck the 2727SPX region from the February lows, the only way I can consider moving back in on the long side is if the market sees a strong break out in the coming week through 2787, and does not break below 2754SPX region from this point forth. And, should we continue a break out, then I will continue to move up support.

But, its now the bulls job to prove we are heading to 3000+ sooner than I had initially expected by maintaining this market over 2754SPX in the coming weeks. Otherwise, the bears can push it much lower should we see a sustained break of 2754SPX.