Wild Day In Metals

I think we all now realize that the steps the metals market takes over the coming days will tell us if we have a deeper pullback, or if we are getting ready to break out sooner rather than later.

So, let’s start with the clearest of the patterns, and that is silver.

Silver rallied in a 5th wave today, and topped within 14 cents of our resistance level of 31.73. Moreover, I even went into a 1-minute chart to see the structure of the decline from today’s high, and unfortunately, it can count as a poor 5-wave structure. So, it was not a clear 3-wave decline, so I am forced to continue to track the yellow count moving forward.

The main point we should take away today is that since we have struck the upper target box I outlined this afternoon for wave [2], there is potential that it may be done. But, in order to make this our primary count, we MUST see a 5-wave rally begin off today’s pullback low. If that is not what we see, and the market rallies correctively, then we will have to track both counts and see how the next decline thereafter takes shape. So, a corrective rally will still leave us hanging as to which count will take hold in the coming week or two.

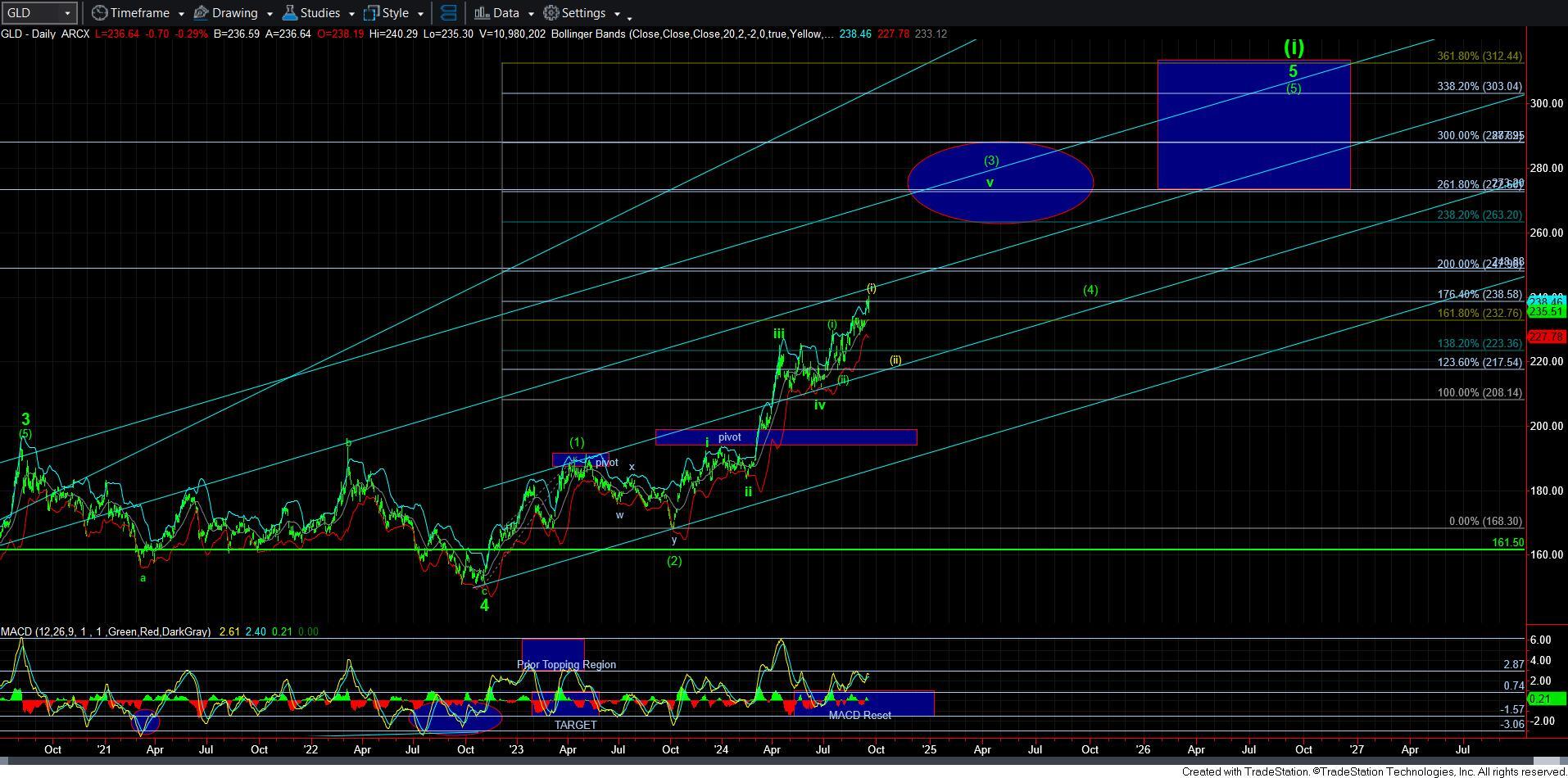

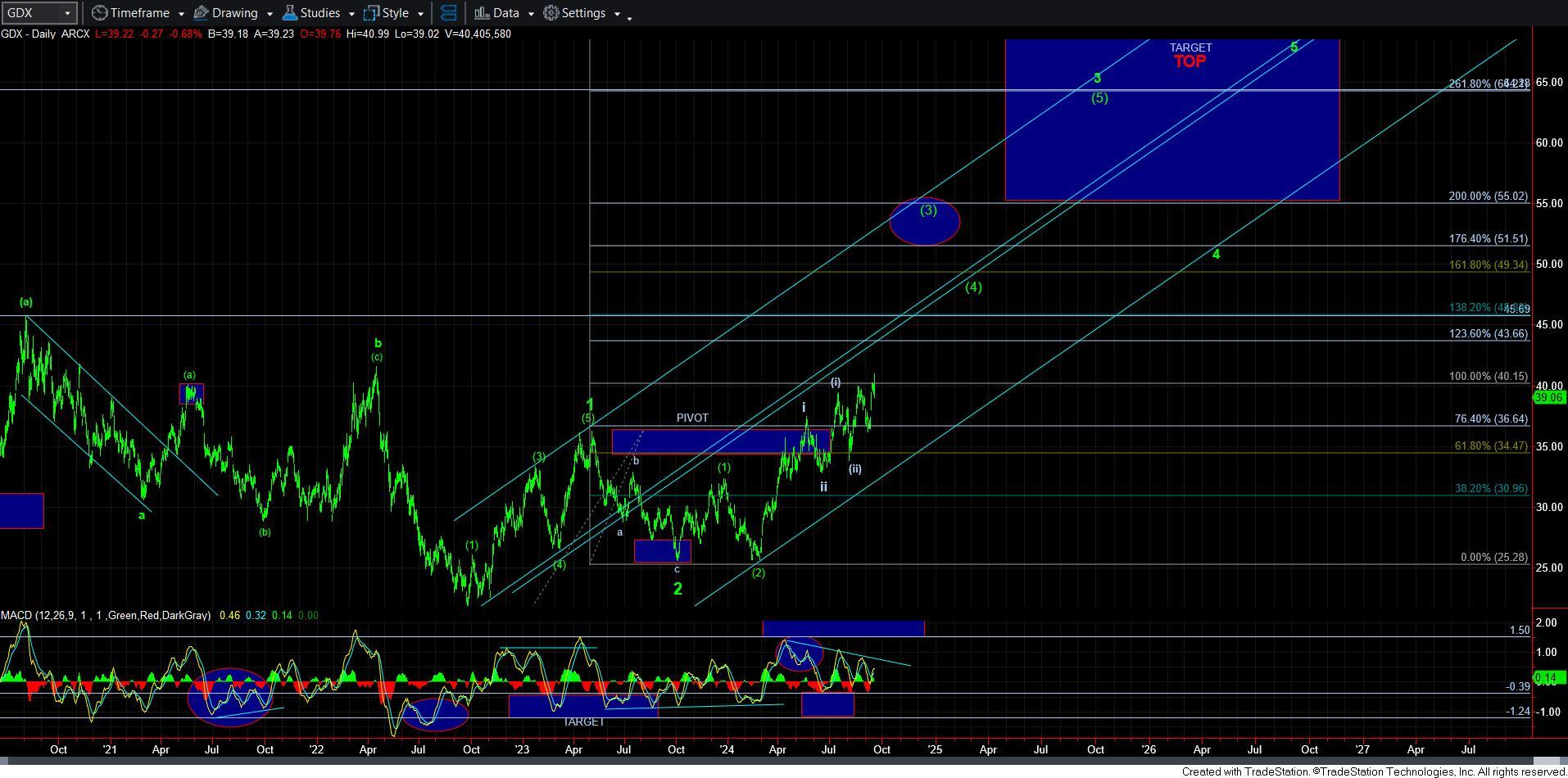

Again, since GDX and GLD are not nearly clear enough for me to provide a high confidence micro structure – as I have discussed many times before, I am leaving those paths as unchanged, and will be following silver and NEM for our clues.

As far as NEM is concerned, I outlined a pivot/resistance box this morning, which had to have been overcome in order for me to confidently be viewing NEM as breaking out in the heart of its 3rd wave, and pointing us to 65, and potentially even higher. But, that resistance is EXACTLY where the market topped in the afternoon. That leaves me in the exact same posture as silver, with the bigger c-wave of wave [ii] in yellow still very much alive.

So, what this all means is that we are going to be watching silver and NEM quite closely over the coming week. Moreover, it also means that should all 3 charts take out today’s high, that likely places us in the heart of what is likely going to be a strong rally in GDX and silver, and gold may lag due to it likely being within an ending diagonal structure.