When Going Against the Trend use the Chicago Voting Method.

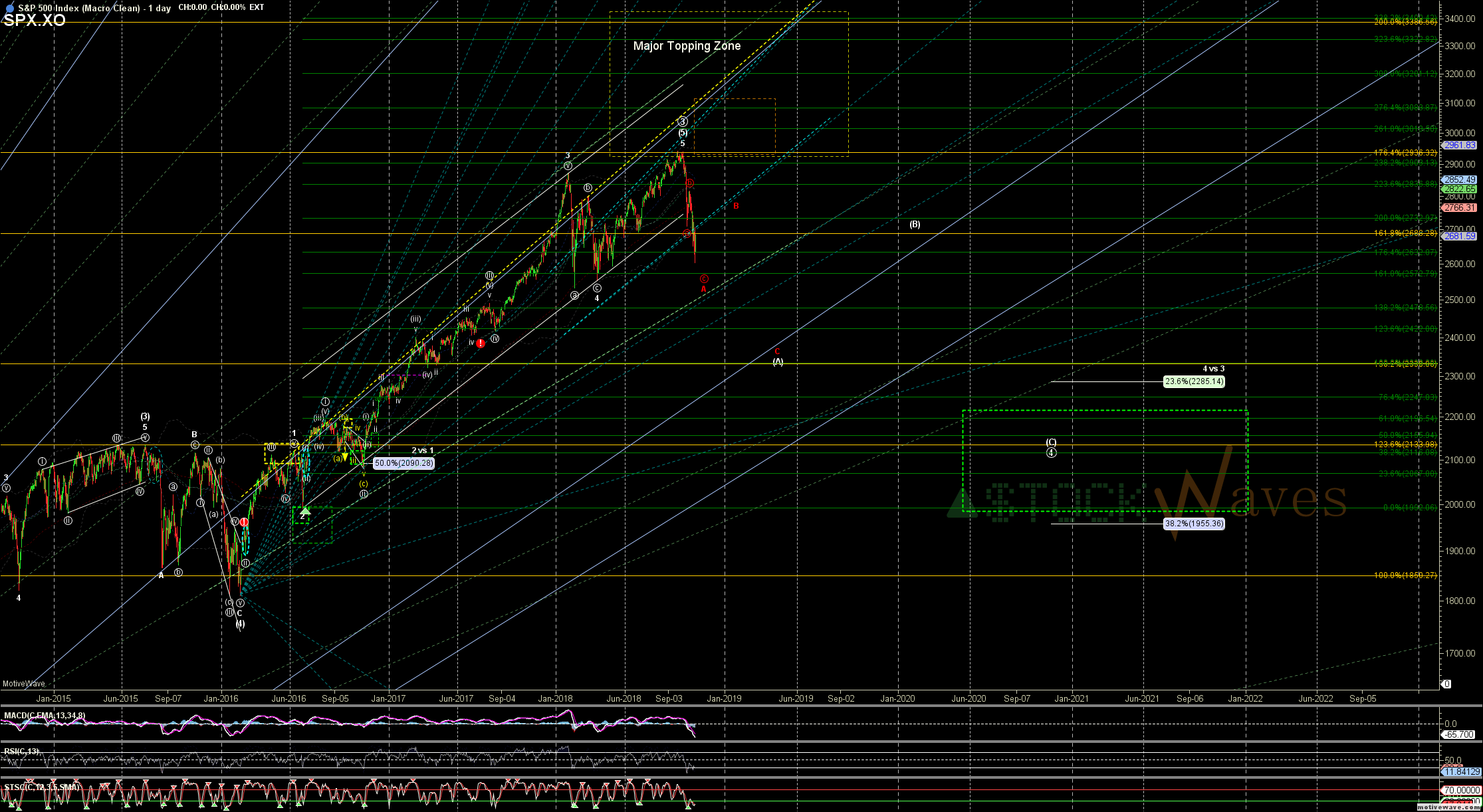

I would not at all be surprised by a pretty DEEP "(b)" wave soon.

If this micro 5 of c of "(a)" stretches just a bit more to the 100% for c then the 61.8% retrace for (b) will be ~2645, but a deeper drop toward 2627 would create nice IHS symmetry and mimic several other recent bottoms.

It is important to note that this CAN count as just the alt (iv) of the circle c down in a "slightly" larger ED to complete the same red A wave. The patter should perfectly over-lap the "(b)" wave potential, but rather than a "(b)' that could be blue a of a (v)th that would likely stretch the c of A down to the 123.6% extension in the 2550 region.

For all intents and purposes the market has initiated a larger correction at Primary degree. This is NOT the time to get heroic and go all in RELYing on follow-through to higher "B" wave bounce targets. Holding any corrective consolidation at Fib support DOES present opportunities to SCALP but care should be taken to mitigate risk and I think #ChicagoVoting* method for profit taking is apropos.

*Early & Often