What's The Most Likely Next Trade?

The large intraday moves in the market were expected this week. In fact, I told our members a month ago to expect to see it in the first week of October. What’s the most likely “next trade”?

We're bearish inclined, though our primary multi-week view is neutral, with support at 426-430 in the SPDR S&P 500 ETF (SPY) and resistance at 440-444s.

In metals we booked a few more profits in yesterday in our Trading Note. It's time to return to the sidelines and re-assess, as odds have increased at another shot at September lows (or worse). GDX support is 30, resistance 32.

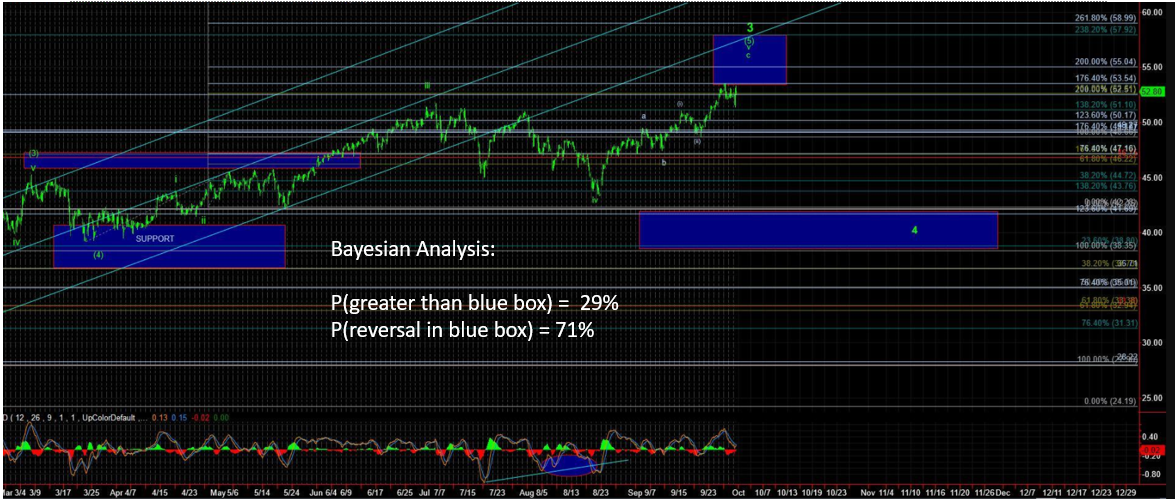

In oil, our BTS (Bayesian Timing System) has been on top of oil in 2021, as we patiently await the next tradable setup. Not chasing the USO higher over the last 48 hours was the smartest thing to do. Support is 48-49, resistance 50-52s.

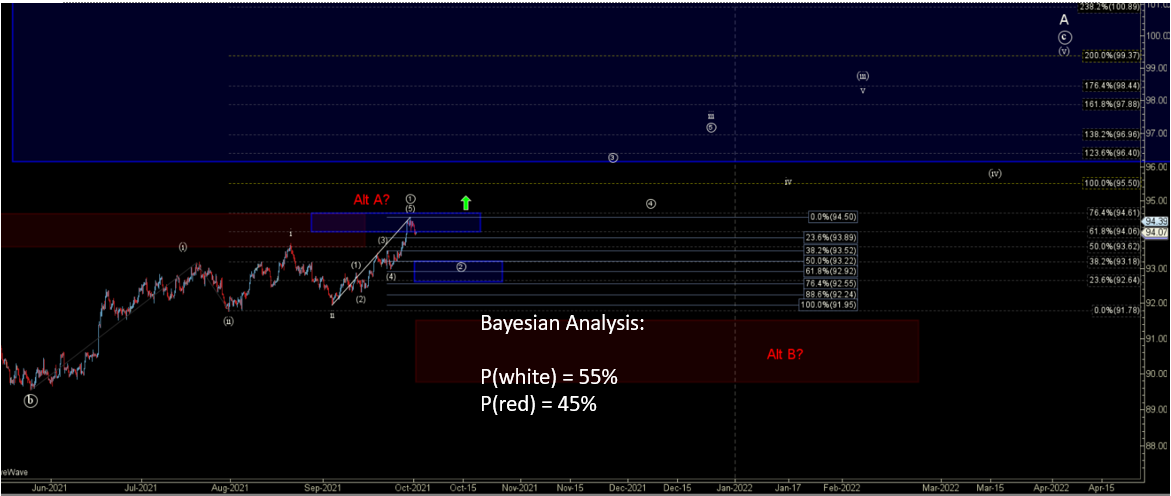

In the DXY (US Dollar Index), our BPs (Bayesian Probabilities) have correctly got the bullish direction higher. However, now things are at a critical juncture as to “more directly higher” vs. “a bearish swing lower first, and then higher”. Support in UUP is 24, resistance 25-26.