What to Expect When You are Expecting : A Fifth of a Fifth Wave

What to Expect When You are Expecting : A Fifth of a Fifth Wave

Frost & Prechter in Elliott Wave Principle have this to say about Fifth waves:

"5) Fifth waves — Fifth waves in stocks are always less dynamic than third waves in terms of breadth. They usually display a slower maximum speed of price change as well, although if a fifth wave is an extension, speed of price change in the third of the fifth can exceed that of the third wave. Similarly, while it is common for volume to increase through successive impulse waves at Cycle degree or larger, it usually happens below Primary degree only if the fifth wave extends. Otherwise, look for lesser volume as a rule in a fifth wave as opposed to the third. Market dabblers sometimes call for "blowoffs" at the end of long trends, but the stock market has no history of reaching maximum acceleration at a peak. Even if a fifth wave extends, the fifth of the fifth will lack the dynamism of what preceded it. During fifth advancing waves, optimism runs extremely high, despite a narrowing of breadth. Nevertheless, market action does improve relative to prior corrective wave rallies...."

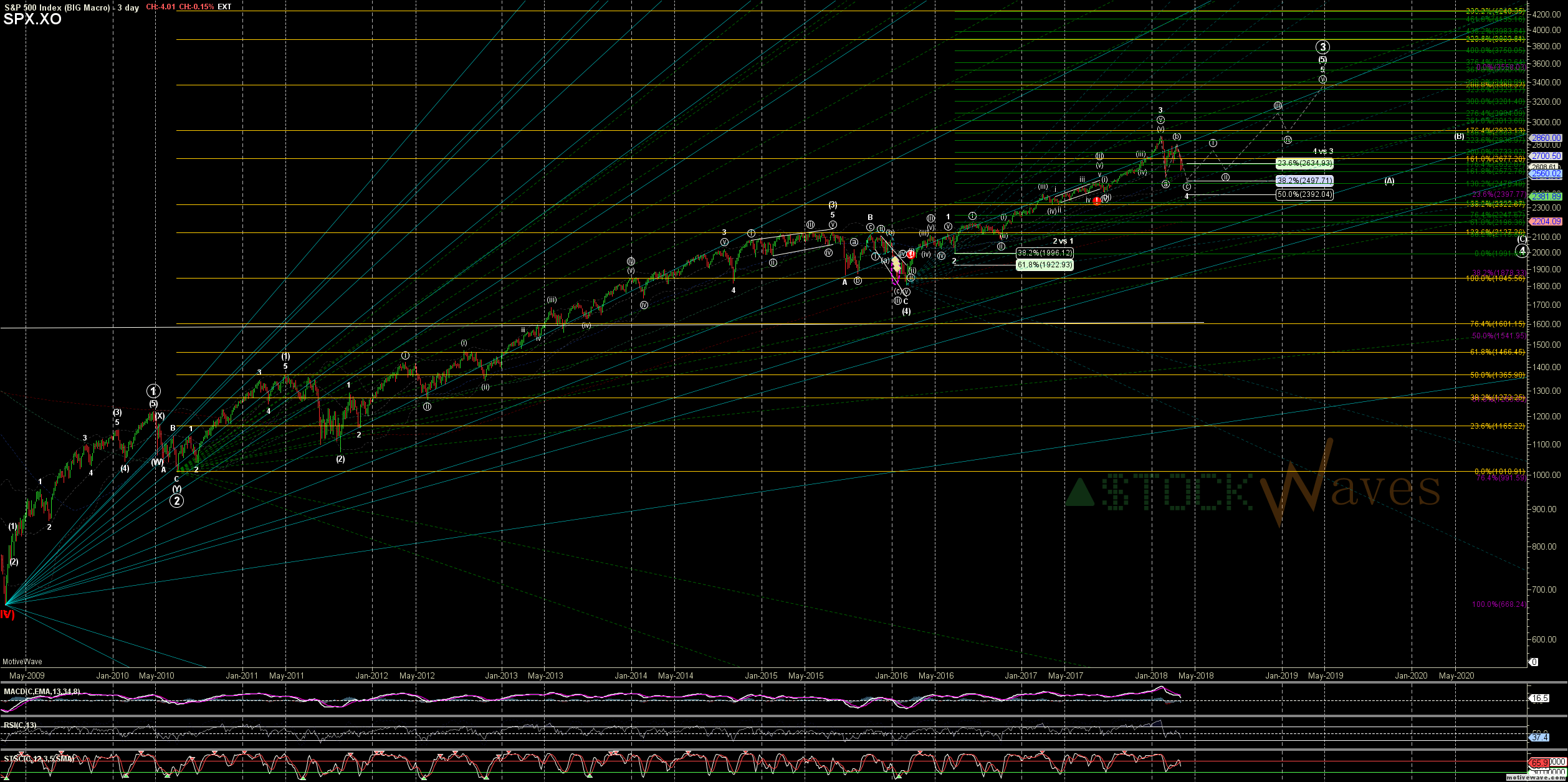

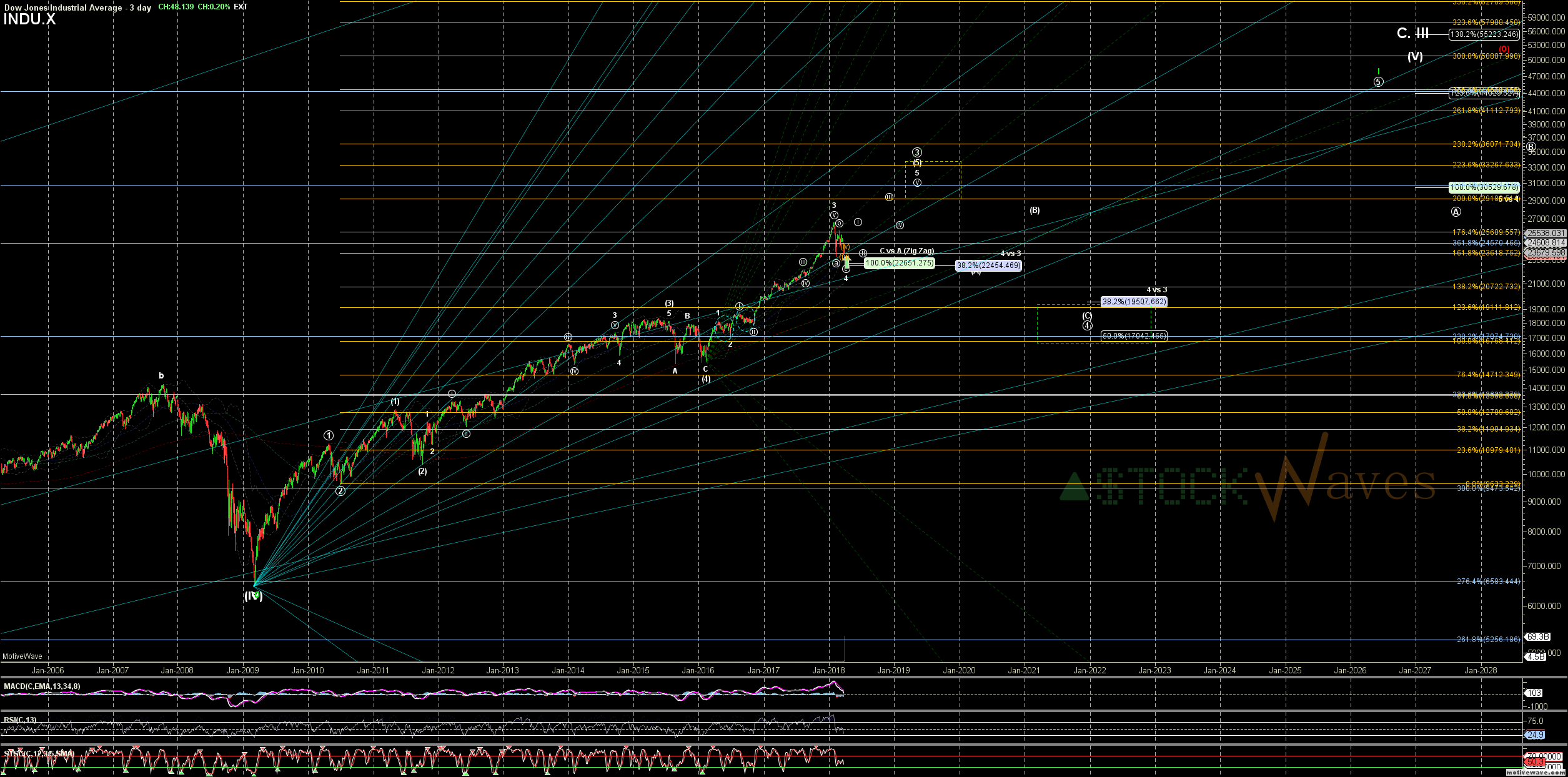

While at Primary degree we are still in the Circle 3 off the 2010 low. We are in the Intermediate (5) of that off the Feb 2016 low and looking for support to hold as Minor 4 and the 5th of that (5) to begin soon (a few weeks likely). So a 5 of (5) (fifth of a fifth) and that is INSIDE a larger super cycle (V) off the 2009 low. While I expect this 5th wave to rally for around 12 months it is VERY important to 1) have an awareness of where in the larger pattern that is "risk wise" & 2) understand what that landscape is likely to look like with regard to sentiment and behavior of the indices and their components.

Divergence & other tradition TA topping indicators - We are likely to have things flashing over-bought & #toppy during MOST of the move up to new highs. Follow up (ratchet method) support based on EW counts at smaller degrees and do not be afraid to trim and get back in.

Narrowing Breadth - Not everything will extend the same way. We will be posting lists in the next 2 weeks in #StockWaves of setups in sectors and individual names with stronger potential. While some things might have some solid "blow-off" type extension potential we will focus MORE of rock solid counts for names we feel are likely to "carry" the market higher as #Leaders. Join #StockWaves!

Optimism Runs High - We will be entering peak "Exuberance" levels... I know just with the extended vth of 3 in Dec/Jan, many started to doubt that we would EVER see a correction again... that "Symptom" is likely to be even more pronounced... #CheckYourEmotions

Topping is a Process - Not everything is going to top in unison... As we near resistance and a potentially complete pattern #StockWaves will also be examining sectors and names looking for early signs of weakness (much like we did in Jan and many times in the past). Or for possible #Rotation to allow for extension(s). Again join #StockWaves!

Peak Greed - Risk management is ALWAYS important, but this 5th of (5) should be the final rally before a more significant downturn for P.4 that will easily be a 2 year bear market seeing prices 25-40% off the highs. Not quite 2008 but the feel of it will likely be very similar... Recognizing overall R:R and properly positioning ahead of that correction while "scalping extension(s)" will be crucial.

A final note on my 3369 SPX target. This is a near 200% (vs wave 1) for the 5th and between the 323.6% and the 338.2% extension off the "2" (green Fibs), but more importantly it is the yellow 200% extension for the P.3... with our recent top of 3 coming so close to the 176.4% it is more likley that this 5th will attempt to hit the next Fibonacci level at that degree, but if we see 5up completing just past 2900 that COULD be all of 5 of (5).