What Is The Best Buy In The Crypto World Right Now?

Produced by Ryan Wilday with Jason Appel and Avi Gilburt

On October 15th, 2021, the SEC approved the ProShares Bitcoin Strategy ETF (BITO). There has been a lot of pent-up demand for and excitement about a Bitcoin ETF since the heady days of 2017. That day finally arrived. The assumption was that an ETF would attract funds parked on the sidelines into the cryptocurrency asset class because it eases some of the regulatory issues and user experience challenges of trading Bitcoin spot.

Finally the day arrives, four years later than the market expected, but Bitcoin prices have dropped ever since. However, our team expects much higher Bitcoin prices, maintaining our expectation for Bitcoin to exceed $100,000. If you are an investor uninterested in using crypto exchanges but desiring crypto exposure in your stock account, should you add BITO to your portfolio?

Before purchasing BITO you need to understand how this ETF is constructed. It does not hold actual Bitcoin. Rather, it holds Bitcoin futures contracts, which trade on the Chicago Mercantile Exchange. While this does mean that the fund loosely tracks Bitcoin prices, it is affected by what is called roll decay.

Bitcoin futures trade in contango, which means next month is priced higher than the front month. Each time the fund rolls futures contracts near expiration, it sells a cheaper contract to buy one that is more expensive. That process of rolling drags on or decays the NAV of the fund, resulting in its slight underperformance versus spot Bitcoin.

I’ve read and heard that this decay can cost BITO investors 10‒15% per year on top of its 0.95% management fee. In reality, roll decay will fluctuate as the spread between futures contracts fluctuates.

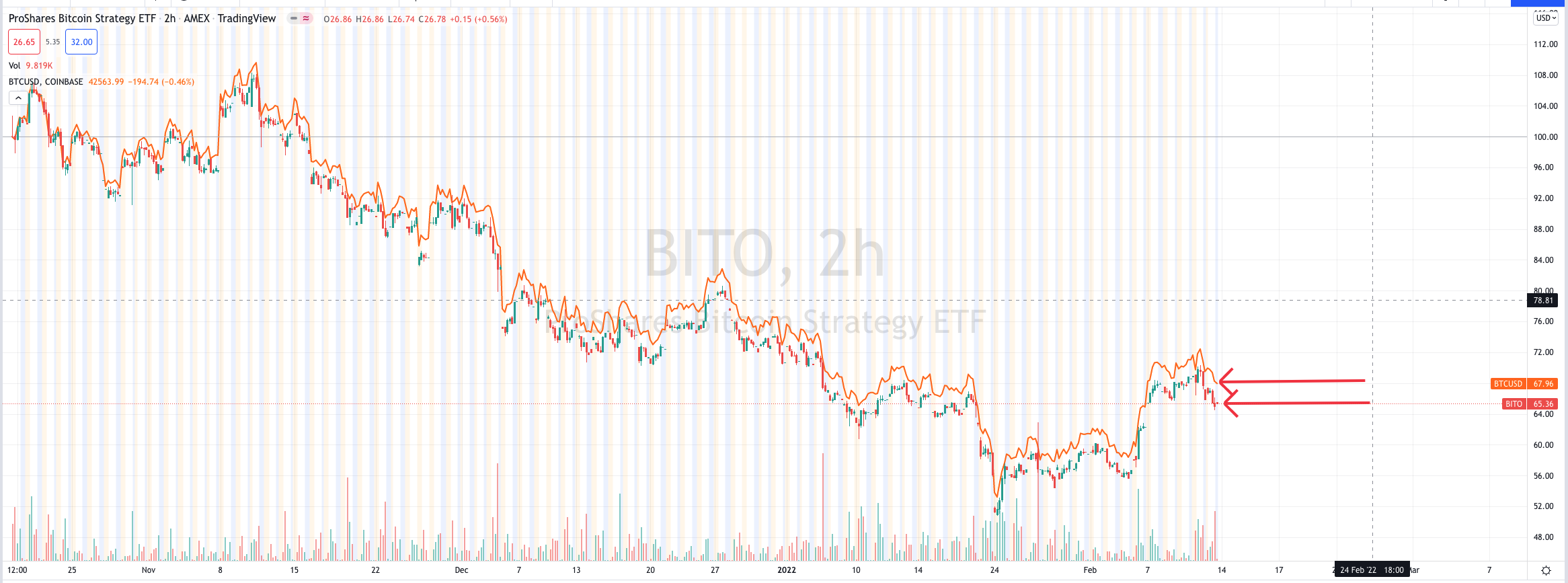

We can look at BITO’s first four months of trading. I took BITO, overlaid Bitcoin spot price in orange, and indexed them to 100 at the starting point. As of writing on February 14th, BITO had declined almost 35% while Bitcoin had declined a bit more than 32%. That is an annualized decay of roughly 9%, should this historic decay remain constant.

Given the heavy drag of roll decay, I want to consider strategies for capturing Bitcoin’s return in standard stock brokerage accounts. I won’t leave out the Grayscale Bitcoin Trust (GBTC) in this discussion. But first, let me recap on our team’s perspective for Bitcoin in the coming months.

Our Bitcoin Update

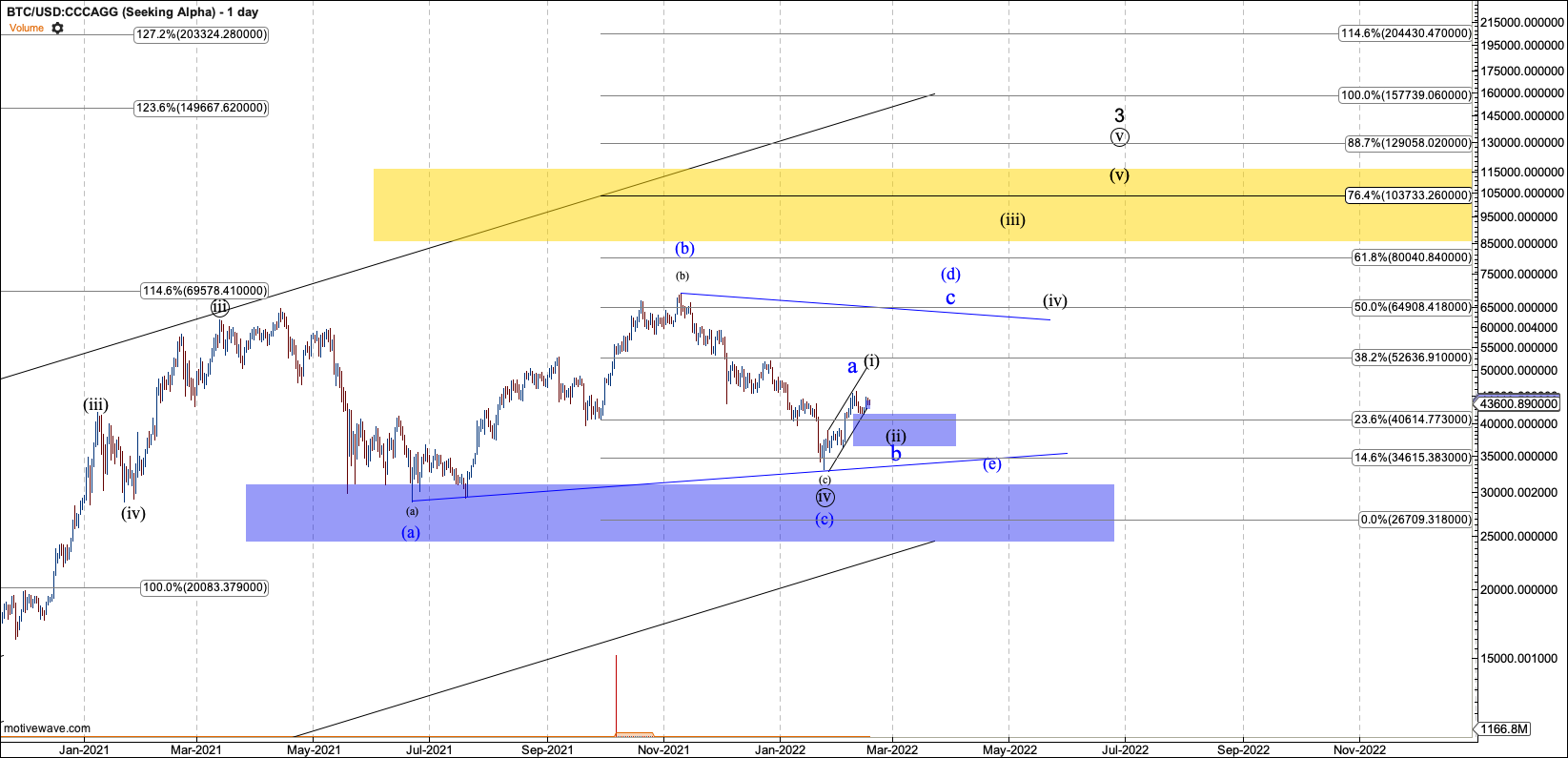

In February 2019, Avi and I made a prescient call for Bitcoin to reach $65,000. This level was achieved. However, the extension from late 2020 to early 2021 was larger than predicted by the Elliott Wave Theory and Fibonacci Pinball. This extension led to calls for over $100,000. The market has chosen to frustrate us a bit by remaining in corrective mode for almost a year now, after being rejected at its first attempt at a breakout in November of 2021.

But honestly, this correction is a very standard wave four flat. Wave fours are often extraordinarily choppy and range-bound. Because we are talking about volatile Bitcoin, that range involved a roughly 50% decline, and doubled off the low to make the first breakout attempt. However, since Bitcoin has not retraced 50% of its entire third wave in this cycle, our six-figure expectation is intact. Below $24,000 it would become questionable.

The question is whether we have bottomed. We have a nice 30% move off the lows, which has pushed through resistance. However, the structure is corrective off the lows, leaving some uncertainty about whether the low will hold. You’ll notice that I have added the blue triangle to my chart. If we have bottomed, the C wave was shorter than usual, compared to the A wave. This often indicates that a triangle is in play.

Regardless of whether the ultimate end to this wave four has been seen, a reversal appears to be in process, and so scaling into Bitcoin or assets with Bitcoin underlying is a reasonable strategy. The question, again, is what you should do with your stock portfolio. You have some options.

Should you use Grayscale?

Given the decay inherent in BITO, if I could buy only shares of BITO or GBTC, I’d prefer GBTC. As of Friday, February 11th, GBTC was trading at a 24% discount to the Bitcoin held in the fund. The issue with this preference is that discount continues to grow. By owning GBTC, I may well continue to underperform Bitcoin. But you can call me a sucker for an asset on sale.

Grayscale has expressed interest in converting GBTC from a trust fund to an ETF. That would instantly turn the 24% discount into 0% as market makers manage the NAV of the fund. Part of me prefers GBTC because there is a slim chance of catching that instant move to par.

That said, I am honest with myself. The SEC has declined application after application for spot Bitcoin ETFs, believing Bitcoin to be too vulnerable to manipulation. I find that position illogical, since the futures prices are based on a reference index price derived from exchange prices. In my heart of hearts I hope the SEC will realize its folly. Of course, my hopes for bureaucratic repentance are probably in vain.

So we have established that buying BITO shares guarantees you will underperform Bitcoin. And buying GBTC shares likely results in similar or worse underperformance compared to BITO, with a very slim chance of outsized performance in the event GBTC is turned into a spot ETF. So what should investors do?

The Third ‘Option’

My answer to this dilemma is a third strategy. While BITO is a clearly inferior product to a spot ETF, it has given investors a meaningful gift they can make use of: standardized OPTIONS based on the fund. A carefully executed BITO option selling plan can counter the underperformance of the fund. A BITO option plan might sell put options in order to get paid to enter the shares. And one might sell call options out of the money to obtain income, in order to claw back some of the underperformance versus spot.

But be warned. I’ve only just started to deploy this strategy in my portfolio and have not fully systematized it. I’ll discuss my experience so far.

Let’s look at the put side of the trade. BITO closed today, February 14th, at $26.53. The $26.50 put, expiring on March 11th, sold at $1.90 or $190 in premium. That would be a 7% premium and would go a long way towards making up for the underperformance of the fund.

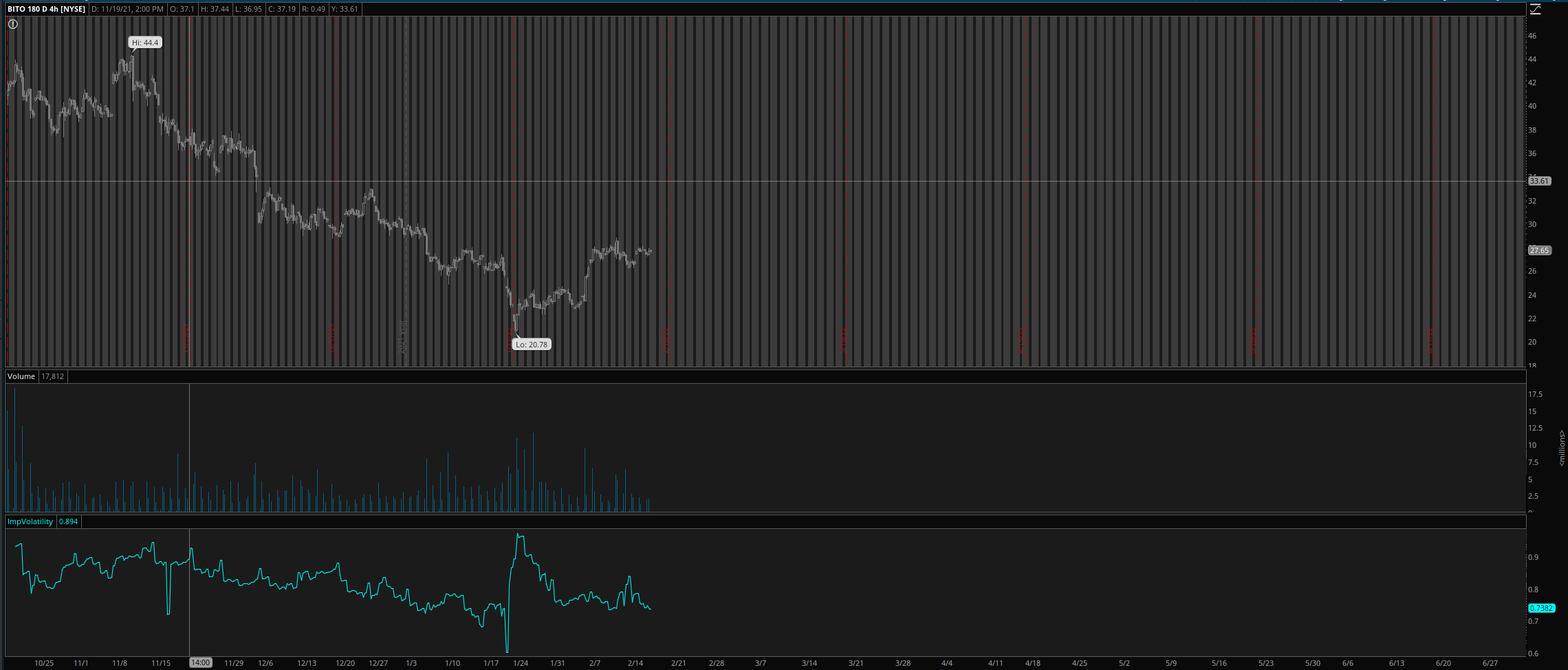

On the other end, if we want to sell calls, the $34 calls (10 deltas) sell for $22 (.8%). If by chance you were able to sell them every 30 days, and all else was constant, you could net a 9% return, making up for the underperformance. As of writing, 30-day options are selling at 63%, which is low for options with a Bitcoin underlying. Typically implied volatility in Bitcoin-related options fluctuates between 60% and 90% over the course of a year. Therefore, the premium harvest numbers discussed are conservative.

I chose 10-delta calls because they have a theoretical 10% probability of expiring in the money, causing you to sell your shares at a profit. The opportunity cost of losing your shares profitably but before the ultimate top in the market is one risk of using this strategy.

Bitcoin-based options have a unique characteristic compared to other options. In stock index options, implied volatility tends to swell as prices drop and fear sets in. In many commodity options, including metals, option implied volatility increases during strong rallies as FOMO sets in.

However, Bitcoin-related options tend to be bi-directional. Implied volatility, particularly in calls, tends to rise when Bitcoin rallies. Implied volatility, particularly in puts, also tends to rise when Bitcoin prices are shrinking. Per the range above, options tend to be fairly priced in the 75% region, underpriced in the 60% range, and overpriced at 90%. If you factor implied volatility into your premium harvesting, you can improve results. And, to a degree, inflated implied volatility can be used to indicate the risk of the market turning.

Price chart of BITO, with implied volatility at the bottom:

Conclusion

Unfortunately, the SEC hasn’t given US investors uninterested in using crypto exchanges a very direct way to invest in Bitcoin prices. BITO is a faulty product that decays as the fund managers have to roll Bitcoin futures in contango. GBTC, on the other hand, has a high expense ratio with an unpredictable fluctuation in discount and premium. However, for those investors with some experience of options, or the willingness to learn, BITO options provide an opportunity to take back some of the underperformance, hard-coded into the fund’s structure.