What Got Into GBTC?

One the paradoxes we learn from Elliott Wave is some forms of strength are dangerous. Key to this thesis is that generally a solid, healthy third wave starts after a healthy and deep wave 2, and deep '2 of the third' knocks most weak hands off the train. The reason this works is no market goes higher without new bids. And, if everyone is on the train, who can bid it higher? To the contrary you need scared bulls that got off too early, and rush back on at the top of the third, before the chop in wave 4 begins. It is the stranded bulls that push markets higher. Certainly the larger wave two from May 2019 to December did its job, as bearish sentiment set in, or traders were chopped to death by the wild swings. But Elliott showed us the market follows a fractal pattern, where smaller impulsive waves also hold a five wave pattern. The same necessity about the wave two also applies to hourly and nano structures just as they do for daily and weekly charts. So, this principle equally applies to our smaller 1-2 setup off the December low.

This understanding of the Elliott Wave theory is why I wanted to see GBTC top and get a deep pullback before it hits $10.45. That level is the .618 extension. While we can sometimes see the first of the third rally to the .764 and stay healthy we are also past that level at $10.87. Time and time again, as I was new at the theory I ignored the importance of this level to my own monetary detriment. You see, often cutting through that level without a strong pullback leads the market to burn out. Instead of holding an impulsive structure often markets in this situation push through to 'bearish symmetry, where the rally of wave 2, proves to be a C, and we never see that fourth and fifth necessary for an impulse. Per my first paragraph, this is a market skipping an important step in knocking weak hands off the train. And when this happens, often the wave 1 proves to be an A and is invalidated by the market breaking new lows. This means, I have the necessary material to suggest a bearish count to you in all intellectual honesty, though from here I would need $8.30 to make it high probable.

Please keep that bearish potential in mind, but I am not going to present that to you now. Instead I am wearing my rosy glasses today, in the context of what I call a solid leading diagonal completing in Bitcoin. Certainly, with even as much premium as GBTC carries, if Bitcoin is going to six figures GBTC should explode from here. I can't take a bearish view as long as Bitcoin is over $6925.

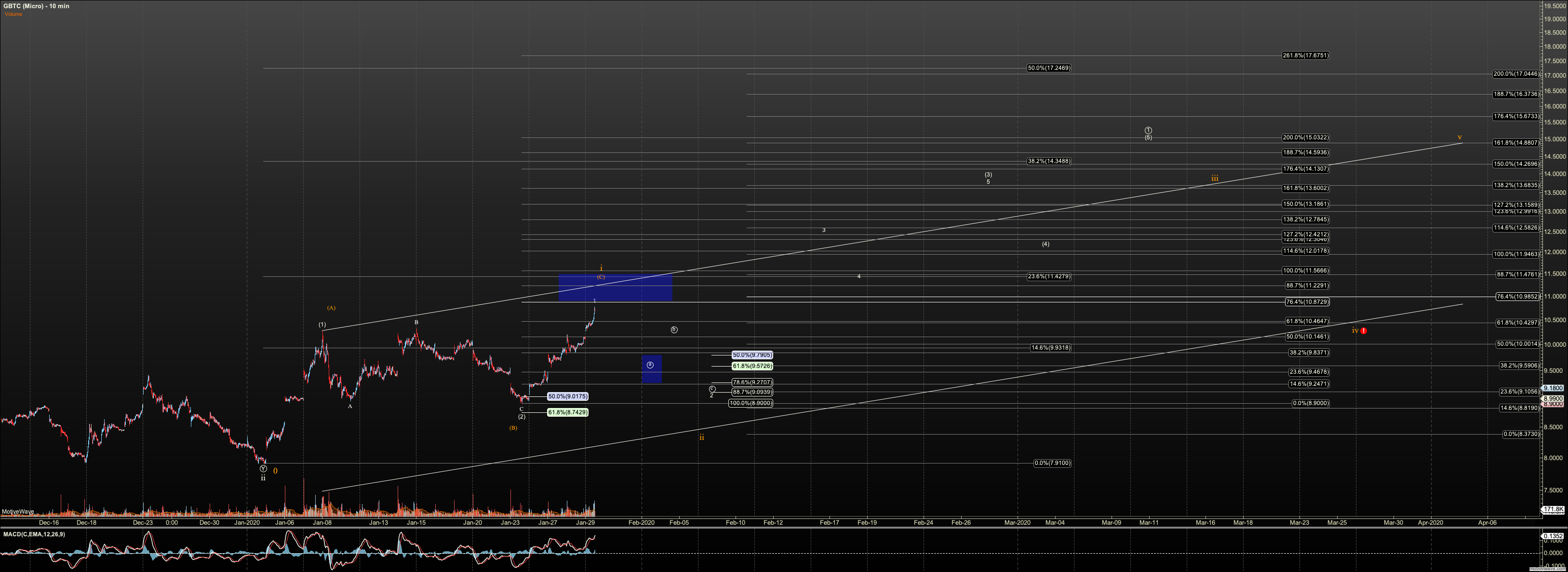

So, I am going to present to you a two alternates. At the very least, this move higher pushes me into a space of ambiguity and this is where alt counts come in play. They are litmus tests for scenarios as they are also used to be eliminated later by market action so in the end of the day we are on top of it. Tactics in trading alts is an art in itself but until $8.30 all my alts are bullish, so you might simply count your risk from here $2.60 per share and scale in any opportunity this market gives. But note below, that if we break over $11.77 from here, I have to move to my most aggressive alt. You'll need to decide whether to chase, or wait and add at the 4th and 5th pullbacks. I am likely to do a bit of both.

And, finally before I begin, note two things. This move in GBTC today is all on the back of increased premium as BTC stood still. You can see from my premium chart that it declined all through January and 'pumped' in the last week. That is cause for caution as GBTC traders may wake up and realize they are long GBTC at much higher prices over the Bitcoin contained within. Further, though I am not sure if legal, if institutions are able to borrow GBTC, they could conceivably short it for an arb trade with low risk. That will push premium back to home base. I'll have to study the legality of that out of cuoriousity.

Secondly, I do not count my primary invalid, just on life support. But honestly, if we do not start to correct tomorrow, even a bit, I need to jettison it. It has pushed a little over the line; not enough to say its invalid, but certainly pushing the limit. Primary is on the 'micro' chart in white, co residing with my first alternative in orange.

ALTERNATES

Alt 1 is simply a diagonal in orange. In this count the ABC structure is wave 1 of said diagonal as diagonals most often start with three wave structures. This means a few things. Normal targets for diagonals are lower than impulses as you can see by the downshift of the orange count. Secondly, we can get a deep pullback here. We don't need to hold $9.63 the current support for the nano 2 of three pullback but can cut to $8.30 if the market wants to. That doesn't mean we will but it is common. Thirdly, we can push higher here directely, comfortably to $11.77 and a bit beyond before said pullback in wave 2.

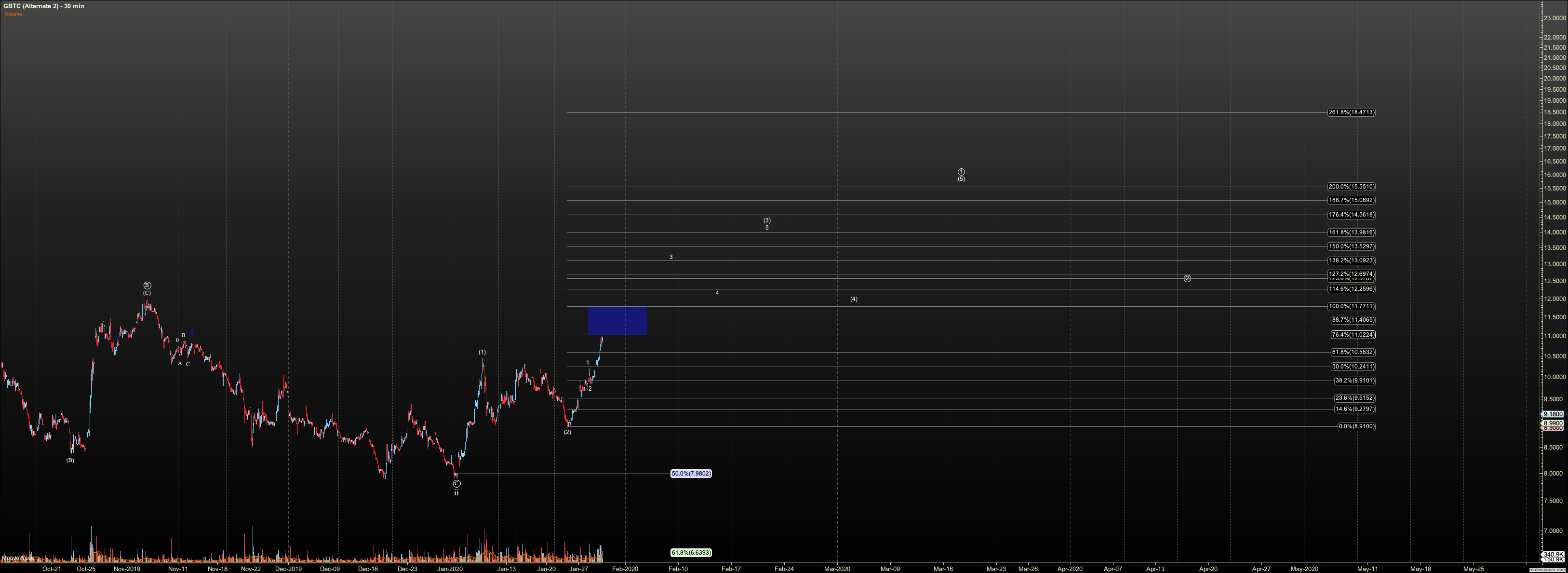

The last alternate is directly bullish is called 'alternate 2'. and will be my primary if we see a sustained move through $11.77. This is where our 1-2 of the third is behind us and one of the tiny pullbacks this week. I really dislike this count per the reasons shared in the first and second paragraphs. Was that enough of a 2 to knock players off the train? Certainly not. It was done in a couple hours. However, perhaps the premium drain we saw into January is what did the magic. Further, GBTC today is behind BTC's extensions off the 2019-2020 by one fib. Perhaps that premium drain was the knock down, and now it is time for catch up. I can't say for certain. These are only my meditations at the moment. But price is king and I must follow.

That is it for now. Each of these counts are likely to see nano revisions and at the earliest point I'll eliminate options. Let me know if questions.