Week's End and an A.I. Caution

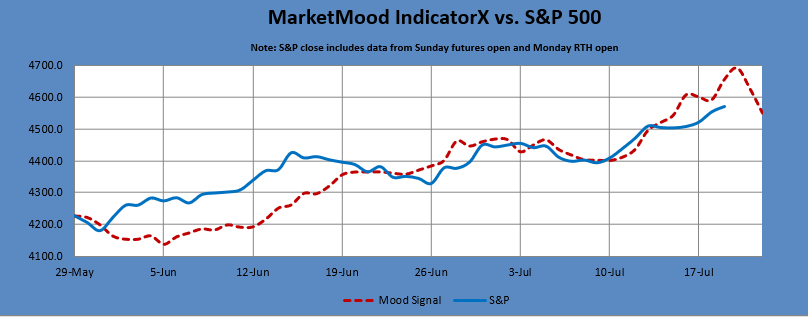

I mentioned in a previous post that I recently started getting a second opinion about the way I code daily sentiment from top internet search trends, the input source for the MarketMood Indicator. I still do it the way I've always done it and that's what I post in my daily MMI reports. However, each day since July 7, my new A.I. friend and I have been having a debate about the way it thinks each trend should be coded. When we finally reach a consensus on what a related article's dominant themes are, something I might not totally agree with but can live with, that becomes the way that item is coded in the A.I version of MMI or MMI-X.

Within diagonals (and apparently also in b waves if the current wave type is not a diagonal), flips or signal inversions are difficult to determine ahead of time (they are fairly straight forward otherwise). So far, there have been no flips observed with MMI-X. A divergence between the two models when I first began doing this actually helped me to spot a MMI flip on July 10 which I had previously missed and promptly corrected.

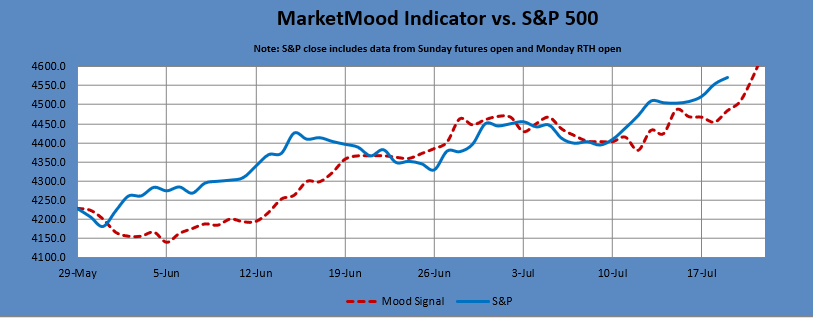

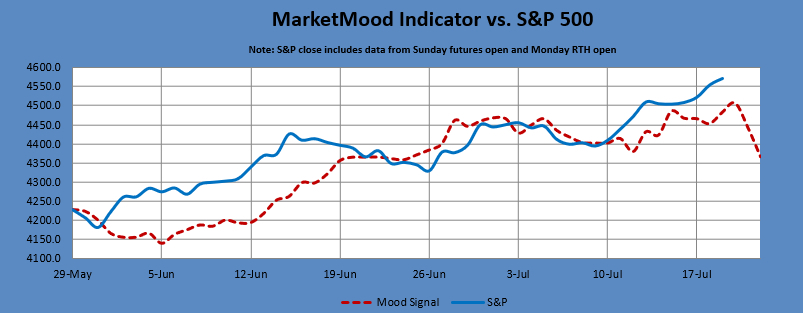

There is “no call” in either MMI or MMI-X for Friday or Saturday (meaning there will be no call for Monday RTH open), however the charts imply that extra attention is warranted Friday-Monday (please don't consider this a Sharp Drop Alert, it isn't). The latest MMI chart is pointing straight up into the weekend (see 1st MMI chart below). The latest MMI-X chart (below) shows at least a local top Thursday or Friday. It’s interesting to note that MMI currently has a pending flip which will complete on a nearly unchanged day today or tomorrow. The 2nd MMI chart is what would result following such a nearly unchanged day. Such a flip would bring the two into alignment.

MMI vs. S&P 500 base case:

MMI-X vs. S&P 500:

MMI vs. S&P 500 alt case: