Dr. Cari Bourette is a contributing analyst at ElliottWaveTrader.net, with her work featured in our flagship service, "Avi's Market Alerts." Members can view her daily Market Mood column here. Dr. Cari, as she is known in our Trading Room, has a unique method for measuring market sentiment, and obtaining actionable market data from that sentiment. She has developed a way to provide daily S&P 500, crude oil, gold, and USD forecasts based on her proprietary Market Mood Indicator. Dr. Cari has a PsyD in Clinical Psychology, MS in Geoscience, MS in Counseling, and BS in Physics. Her sentiment analysis is based on research going on since 2006 into converting social mood information into numerical data, and, in turn, converting Internet search trends to market forecasting. The results of her research and details on her methodology have been published in numerous publications, including Technical Analysis of Stocks & Commodities Magazine (Oct 2017).

Developed by Dr. Cari Bourette, a contributing analyst at ElliottWaveTrader.net, the MarketMood Indicator (MMI) converts data on the focus of U.S. society -- often referred to as "socia l mood" -- into expected stock market movement. It is based on Socionomics, the theory that includes the idea that changes in social mood almost always precede changes in the markets. The MMI takes the themes of top internet search trends and scores them according to 4 primary mood qualities: Vulnerable, Expansive, Manic, and Controlled. These 4 scores are input into the MarketMood model, which converts them into expected stock market movement in S&P 500 points as well as Gold, Oil & USD points.

Research leading to the development of the MMI has been going on since 2006 by Dr. Bourette and a small team of researchers. In an article titled, "Daily Stock Market Movement from Oscillating Social Mood Factors," published Dec 27, 2011 by Berkley Press, in affiliation with Western Kentucky University, Dr. Bourette provides a detailed description of the 8 categories scored at data collection and the 4 primary mood qualities whose relative presence are the inputs to the MarketMood model. Other articles on the MarketMood Model have appeared in Technical Analysis of Stocks & Commodities Magazine (Oct 2017 and the Socionomist (Mar 2012).

The premises upon which the MMI is built are likely different from some that you currently hold about how the universe operates. Repeated exposure to the idea that themes in internet search trends about such things as Beyoncè and Game of Thrones that can be somehow quantified and converted to meaningful, seemingly unrelated data about what markets are likely to be doing 3 days later may cause some confusion and disorientation. At best, however, besides assisting in your trading strategy, it may expand the frontiers of Socionomics and the boundaries of what we currently know about the connection of what we think about today and what is happening in our lives tomorrow.

How MMI Works

This is a brief, but somewhat technical summary of the process of obtaining a stock market forecast for three days from now from hot internet search trends.

1). Get themes from Google Hot Trends (see example below of Hot Trends from February 15). In the example below, Alexander Hamilton themes are hiphop music, entertainment, historic, man, and leader. Vanity themes are woman, singer, minister, died, and nostalgia.

2). Code these themes into the 8 categories of MoodCompass nomenclature. Multiply by the number of searches (in this case 1 million each), and add them together. Simplify. The coding for Alexander Hamilton themes (after simplifying) was 2E 2W 2SW SE NW. The coding for Vanity themes was 4W NE 3NW. Adding these together: 2E 6W NE 2SW SE 4NW, simplified to 2E 6W SW 3NW.

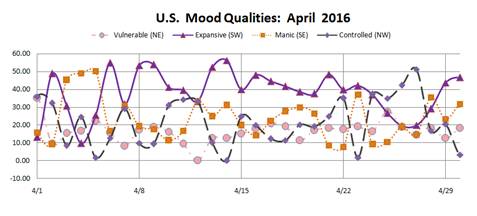

3). Normalize—convert to relative percentages of NE, SW, SE, and NW (this is MoodCompass shorthand for the four primary mood qualities, Vulnerable, Expansive, Manic, and Controlled). In this example: NE 6.25%, SW 31.25%, SE 6.25%, and NW 56.25%. This becomes the input to the MarketMood model. This model analyzes the relative positions of each of these four basic mood qualities, as well as changes since the previous day. The daily changes in these four basic mood qualities for April 2016 are shown below:

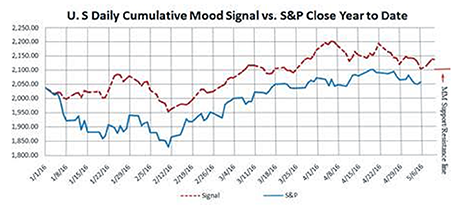

4). MarketMood model output: The MMI outputs an expected market change in S&P points. The chart below shows a daily cumulative "Mood Signal" vs. S&P Close. While the correlation is significant at the .0001 level, the daily direction is much more useful for trading than the amount of forecasted change for each individual day, as the movement in a single day can vary substantially from the model output for that day.

5). Daily Forecast. Finally, there's the daily forecast. At market close, the forecast for the next day's close becomes finalized, and the likely forecast for two days beyond that is obtained. It is possible (1 in 10 chance) that the direction for those days could change by tomorrow's close due to the next day's mood or market activity. On Thursdays, the forecast for Monday open is available, as it uses the combined output for Saturday and Sunday, and the assumption that weekend close = Monday open. On Fridays, the forecast for Monday close is available.

I live Finance. 80hrs a week corp finance. I trade as a hobby and in my opinion this is the best site in the world for someone to learn about markets... i rue the day when it is no more or its core is changed. there is NO BETTER SITE IN THE WORLD to get the off-cuff input/feedback/knowledge across ALL MARKETS like this site... Thank you to the analysts here who grind out thousands of charts each week."GibsonDog" - Trading Room

My faith in God and my faith in Avi and his team. God lead me to this service over 10 years ago. For a decade I have heard Avi point his bat at this very moment in time calling this S&P level. Though the years I have witnessed him point his bat months, even years before metals hit their highs and lows with almost perfect big picture accuracy. Against every other analysts opinion. I have seen him bullied relentlessly on his public articles on SA and stick to his guns and proven so correct with no one ever apologizing or admitting he called it."sdmavrick" - Seeking Alpha

My AUM has grown exponentially because of you and I can't thank you enough. My biggest regret is not signing up sooner! You've done more good than you will ever know."AAMilne" - Trading Room

I’ve subscribed for 5 years now and I have to say I see that you’ve been right on this the whole time. Who would’ve thought gold and silver would’ve rallied with rates this high for this long and the markets continued higher as well. Always thought your charts were good but always thought in the back of my mind that rate cuts and other news actually led. So now that I’ve admitted defeat u are free to gloat. Well deserved"Lil_G" - Seeking Alpha

I worked on trading desks at top investment banks for 10 years, then traded on my own for another 8. I've seen 100s of research from the best analysts in the business. Avi and EWT is the only one I'm willing to pay for right now."tzeyi" - Seeking Alpha

“I was 100% in equities and been killing it for 2 years, but I heeded your warning and took everything off the table. I've been cautiously trading your recommendations and now when everyone I know is getting wrecked, I'm still profiting. Thank you so much for what you do, my family and future are safe because of it.”"DoctorBeat" - Trading Room

This service has not only made me money in trades but equally important it got me out of the market before the meltdown."BigDaddyTuna" - Trading Room

"Your service and insight is phenomenal, and has definitely changed my outlook on the market. I’ve been actively working on recruiting new members to your service. It’ll save their financial life.""Bidking82" - Trading Room

"Today, I achieved my highest weekly profit ever ....I see this as a testament to the power of the guidance available here. I ignored all narratives and traded the charts with discipline. I set clear parameters for each trade, immediately placing OCO (One Cancels the Other) orders with both stops and limits. I made some adjustments as the charts evolved, but kept the orders in place, and allowed the process to unfold. Sincere thanks to all the analysts and members who help make this such an incredible community—especially Avi, Zac, Mike, Levi, and Garrett. I'm incredibly grateful!""Dre-" - Trading Room

CNBC had a stat this morning that over the last 20 years 86% of money managers/hedge funds have underperformed the market. They couldn't figure out why that’s the case given how 'smart' these people are. . . . I know my performance since joining the site has skyrocketed!"HenryH" - Trading Room

We use cookies to enhance your browsing experience and analyze our traffic. By clicking "Accept All" you consent to our use of cookies. Privacy Policy