Weed Through The Confusion

So, someone in the room became quite upset with me today because I have been taking a bullish perspective on the metals up here. But, for those that have followed me long enough, you know that I do not have a bias, per se, other than what the market tells me to have.

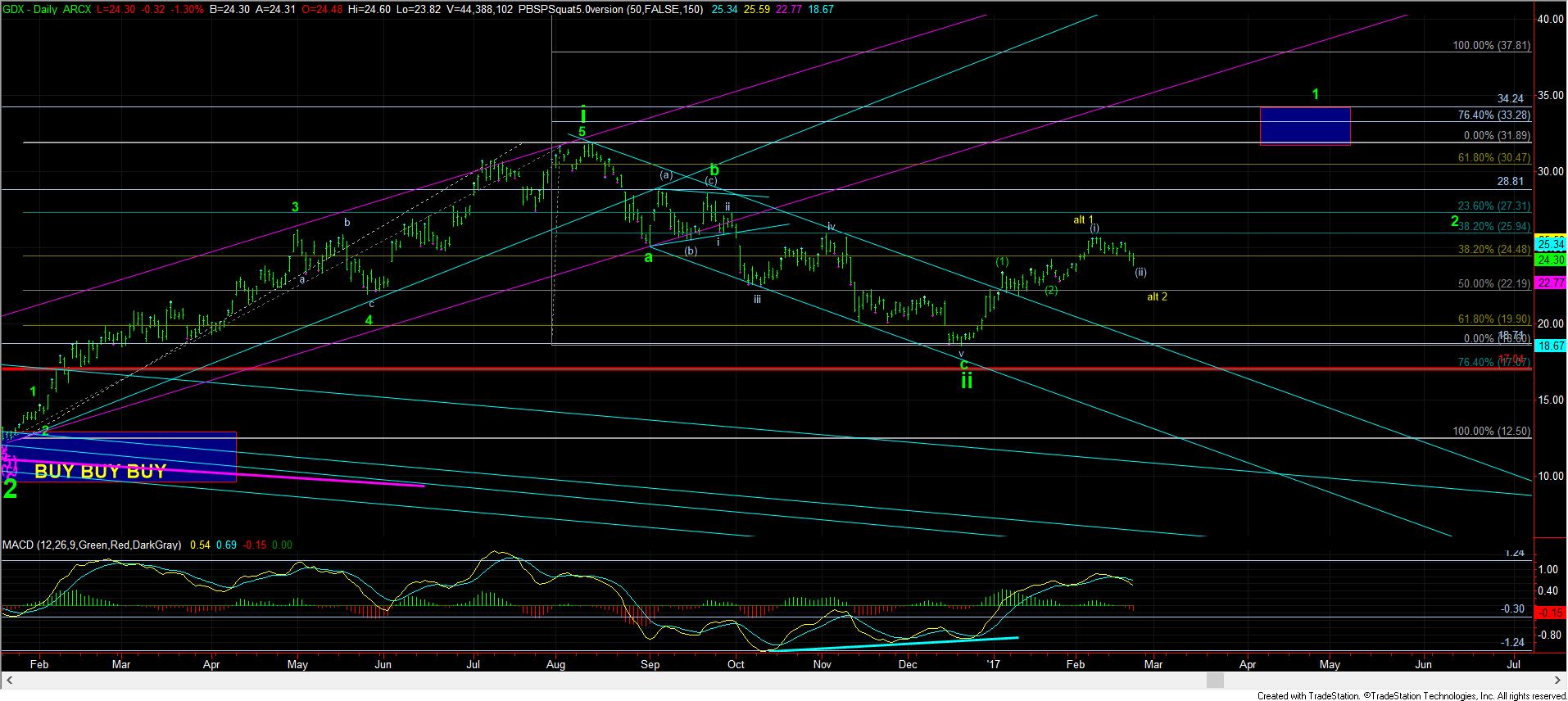

Therefore, based upon the larger degree perspective, with seeing 5 waves up from the 2015 lows, and then another 5 waves up from the December 2016 lows, I am on the hunt for the heart of a 3rd wave in this complex. When we are looking for a heart of a 3rd wave to take hold, they OFTEN do not provide much in the way of pullbacks. For that reason, I have always defaulted to a more immediate break-out scenario potential, since, otherwise, you can be left in the “dust” (pun intended), wondering where your pullback went.

Along those lines, the market has been consolidating near the highs for quite some time now. And, as I noted last week, when the market has made a number of attempts to break out, and is unable, it often falls back into more of a correction, in order to take another running start at the heart of the 3rd wave. So, with the inability to break out when it had a break out set up last week, I noted towards the end of the week that I would be hedging my account in consideration of that potential, and while we were still right at the highs.

While some of you may want me to tell you EXACTLY what the market is going to do at any point in time, I am sorry to disappoint you by telling you that I, or any other human being for that matter, am unable to do so. Rather, I can show you where we have set ups to break out or break down, but I cannot provide you any certainty. For that reason, I will inevitably be wrong at times.

Yet, as long as you understand how I approach the market, you can then make decisions for your own account. When you understand that I will default to the more bullish scenario when we have a potential 3rd wave set up, it provides you certain information. But, it does not mean the market will certainly break out immediately, just that it has the potential to do so.

Right now, as long as the GDX remains over 23.30 and GLD still does not break below 116.76, as noted today, then we have a set up in place to begin the heart of a 3rd wave higher. However, should those regions break support, then it opens the market up to a deeper pullback, which can see the GDX drop towards 22, and GLD back down to 114. As to silver, it seems to be in its own world, and as long as it remains over 17.60, I have to remain quite bullish that chart. A break of that level will open it to a potentially deeper pullback as well.

Moreover, when GLD and GDX are able to break out over their respective .764 extensions with strong volume, coupled with silvers break out over 18.20, then we should be in the heart of the 3rd wave higher.

I hope this clears up my thinking and how I approach this market, and gives you insight into being able to deal with these gyrations in your own account.