We MAY Have A Bottom In Metals

In a number of the charts I track, I am starting to see some potential for having bottomed. Yet, others are no where near as clear.

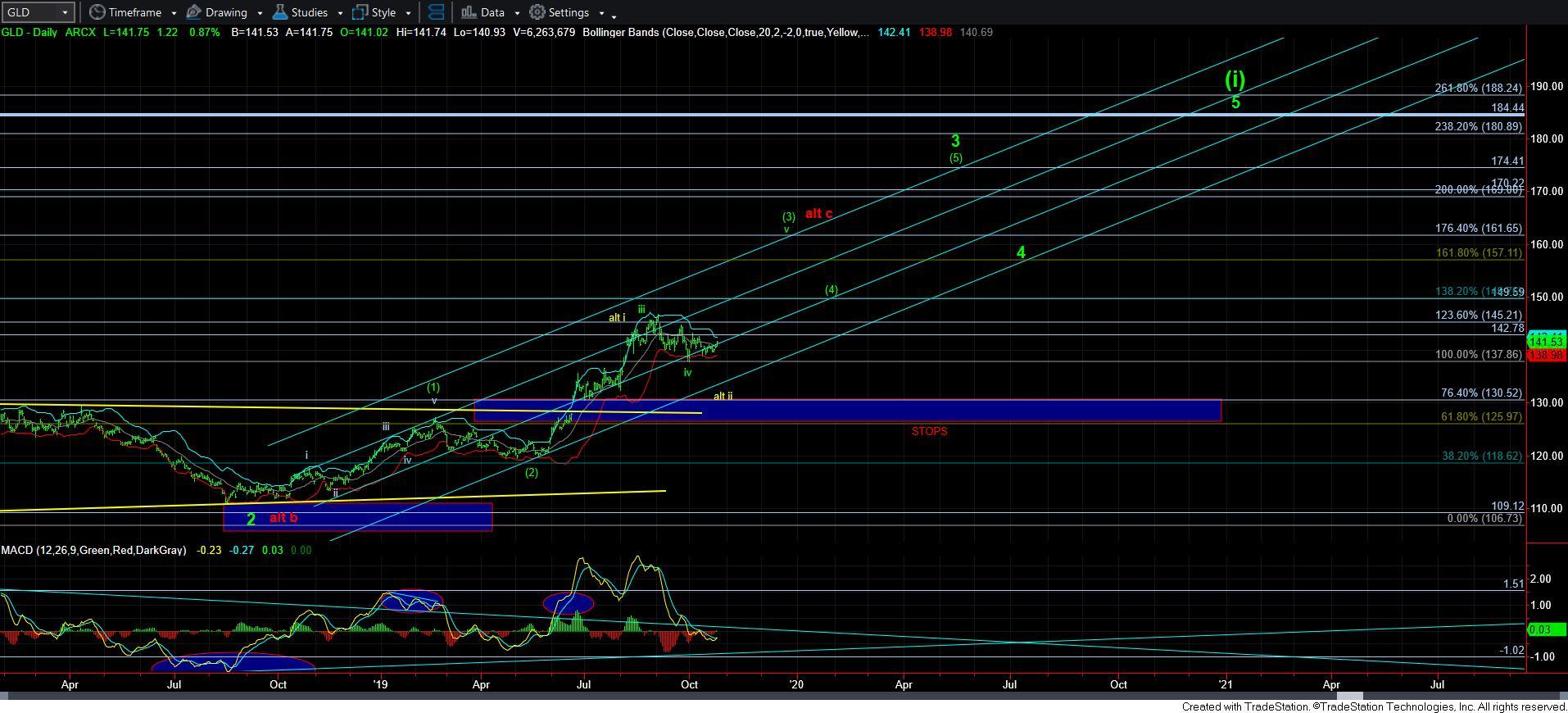

As an example, at this point in time, I am having a difficult time in finding an ideal impulsive continuation structure off the recent lows in GLD. While there is still some potential, I am going to need to see continuation in this move up towards the 143/44 region to give me another micro 5-wave structure off the low struck on October 11.

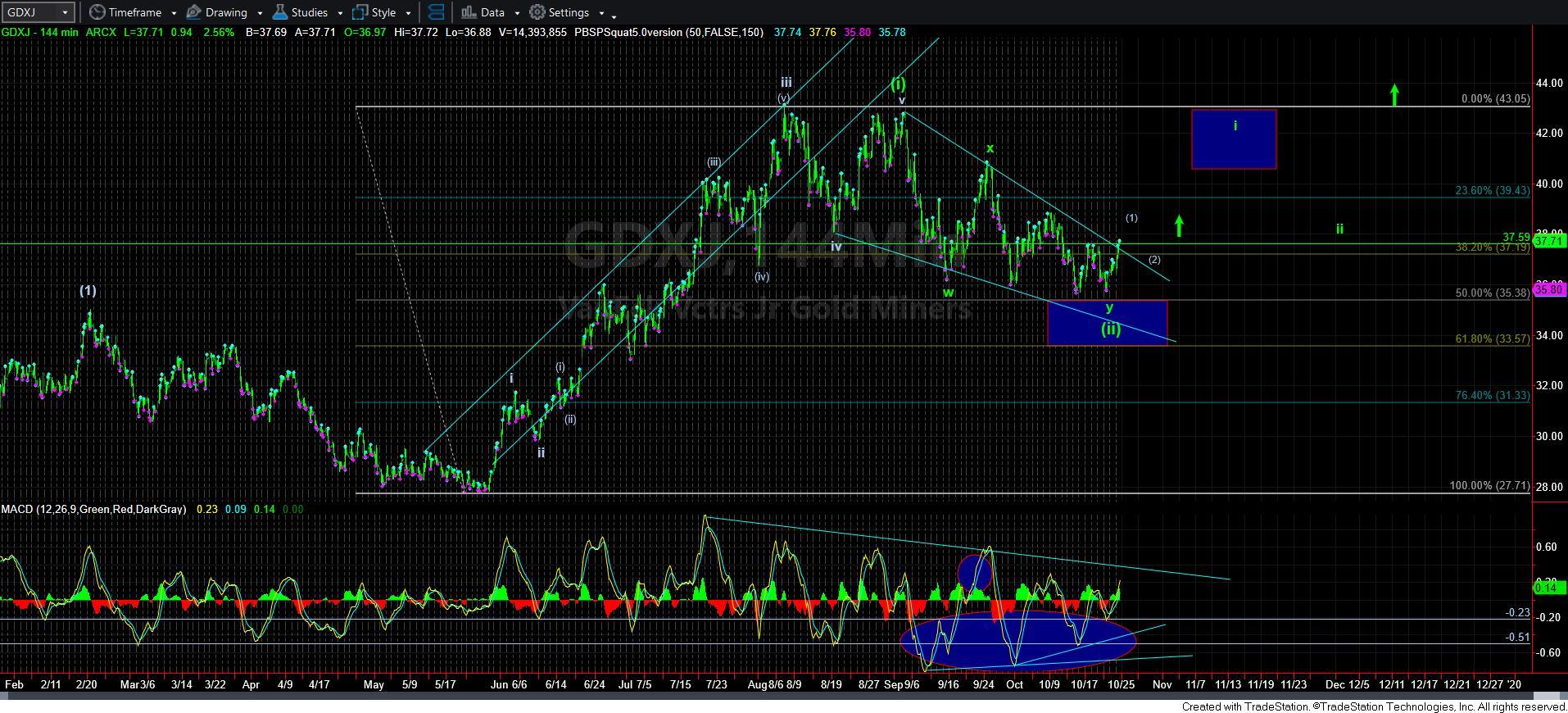

In other charts, we have potential double bottoms, which can substantiate the final lows we wanted to see, even if it was not a technical “lower low.” The example of that potential is seen in the GDXJ.

And, then we have charts like silver which are really in between and are quite amorphous, which I can potentially count as having bottomed.

So, where does all this leave us?

Well, to be honest, it is pretty much in the same place as we have been before. I still want to see a much bigger 5-wave structure developing off a low over the next week or two, followed by a corrective 2nd wave pullback. Should we see that, then I will be going on high alert for a break out and strong continuation rally in the metals complex. Until such time, I am going to give the market room to run, but I am watching this with a bit of a skeptical eye. Once I see a more convincing 5-wave structure off the lows in all the charts, then we can begin to prepare for the next major rally phase in the complex.

I am hoping I have a bit more information by the weekend to be able to provide more exacting guidance. For now, I am simply looking for impulsive structures off lows.