Watching 2400 Temporary Floor Being Established

E-mini S&P 500 Futures: Keep It Simple Stupid – Watching 2400 Temporary Floor Being Established

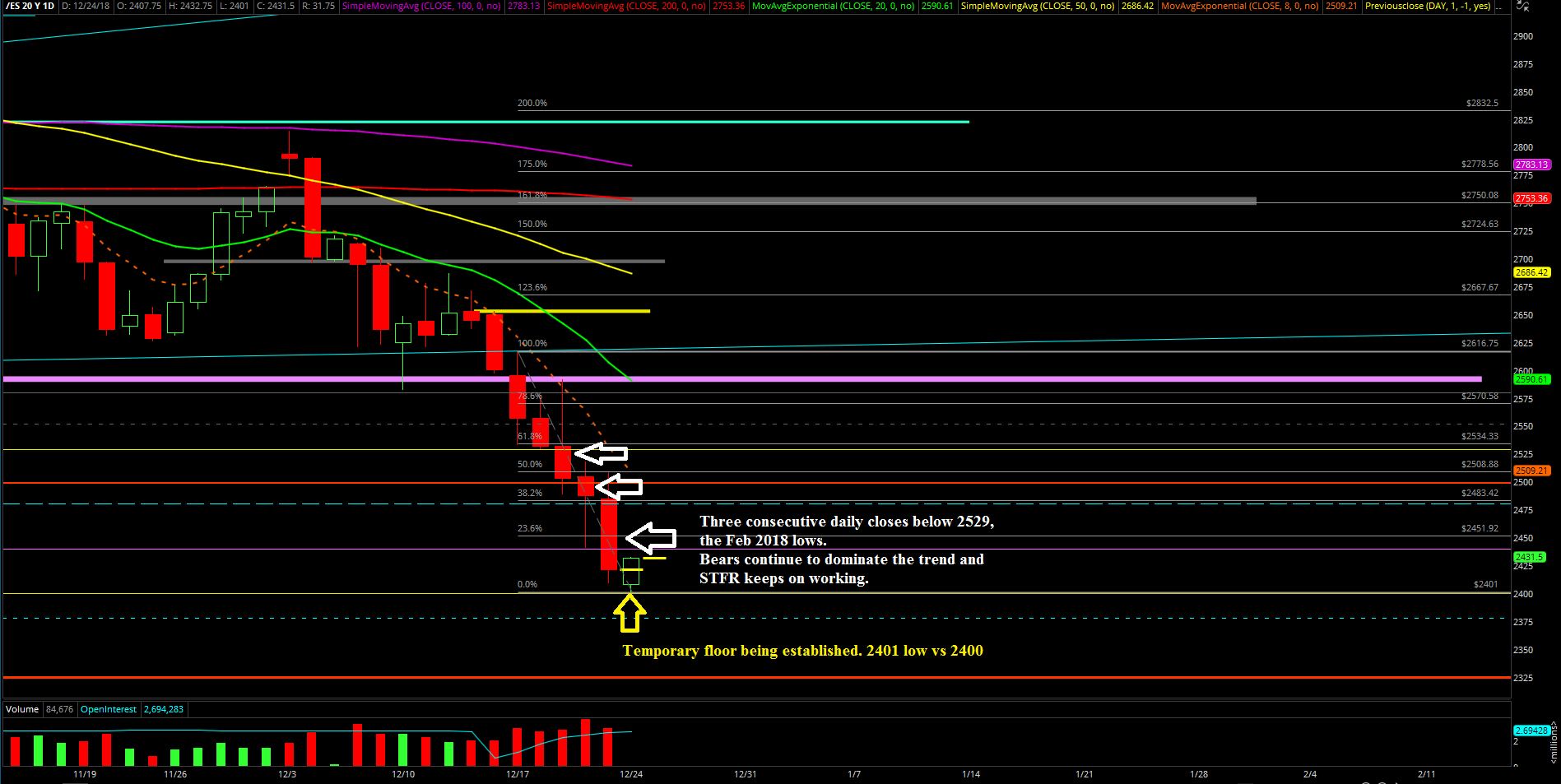

The third week of December could be summed up concisely as a breakdown continuation setup that followed through from the prior week by decisively breaking below the 2529 Feb low. This gave the bears a clear opening for the bear train acceleration towards 2480/2440/2400 as the STFR crowd took over with complete domination. Every deadcat bounce got pinned down quickly as the lower highs and lower lows continued into the weekly closing print.

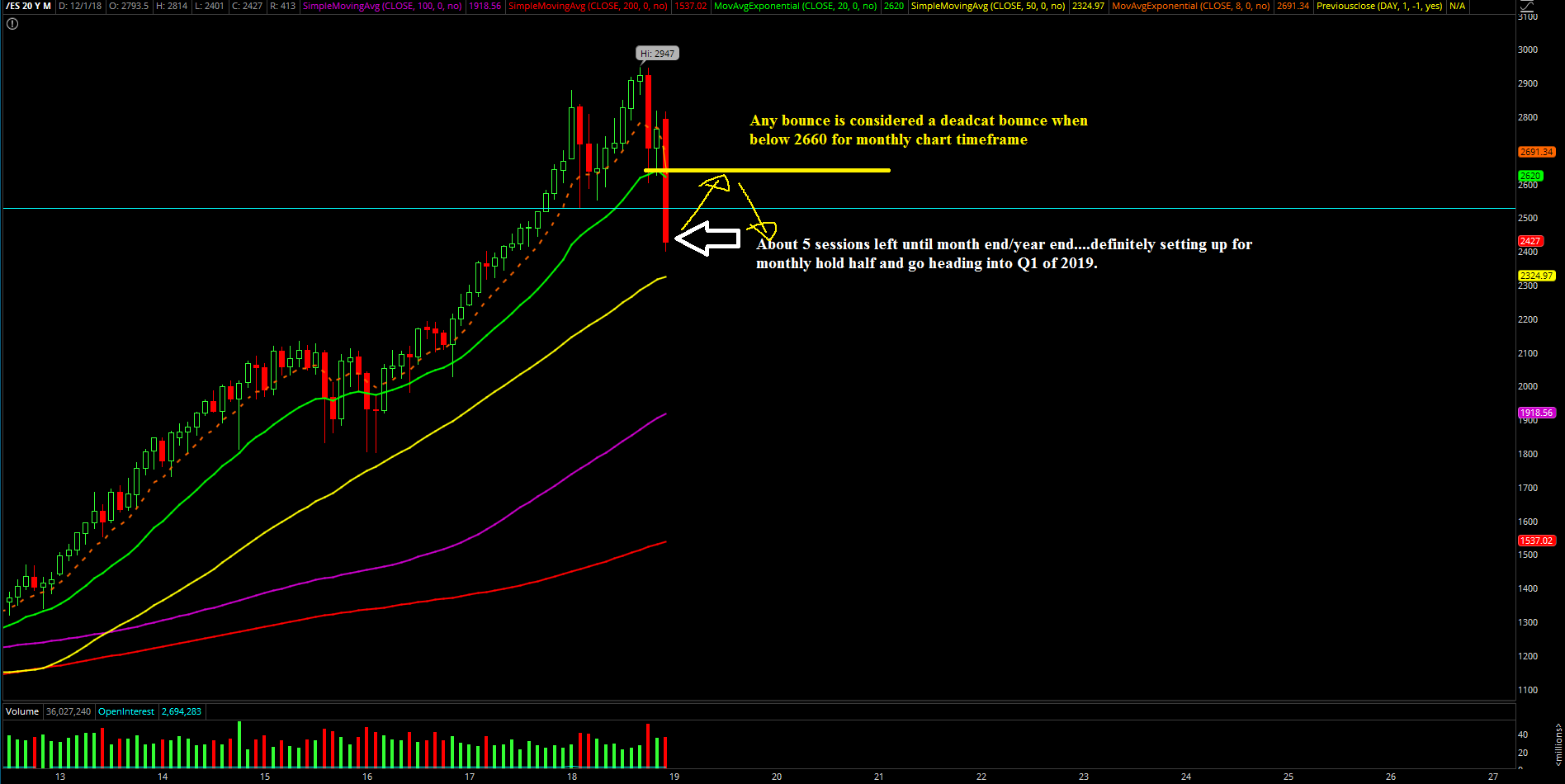

The main takeaway from the week was the three consecutive daily closes below 2529 that indicates a decisive breakdown of the year’s range. Also, the ongoing monthly timeframe chart that is setting up for our ‘hold half and go’ pattern based on current momentum heading into January or Q1 of 2019. It’s fairly clear now that every bounce that remains below 2660 on the monthly timeframe chart is being treated just a deadcat bounce. (there are lower resistance levels if looking at 1hr/daily/weekly, see charts)

What’s next?

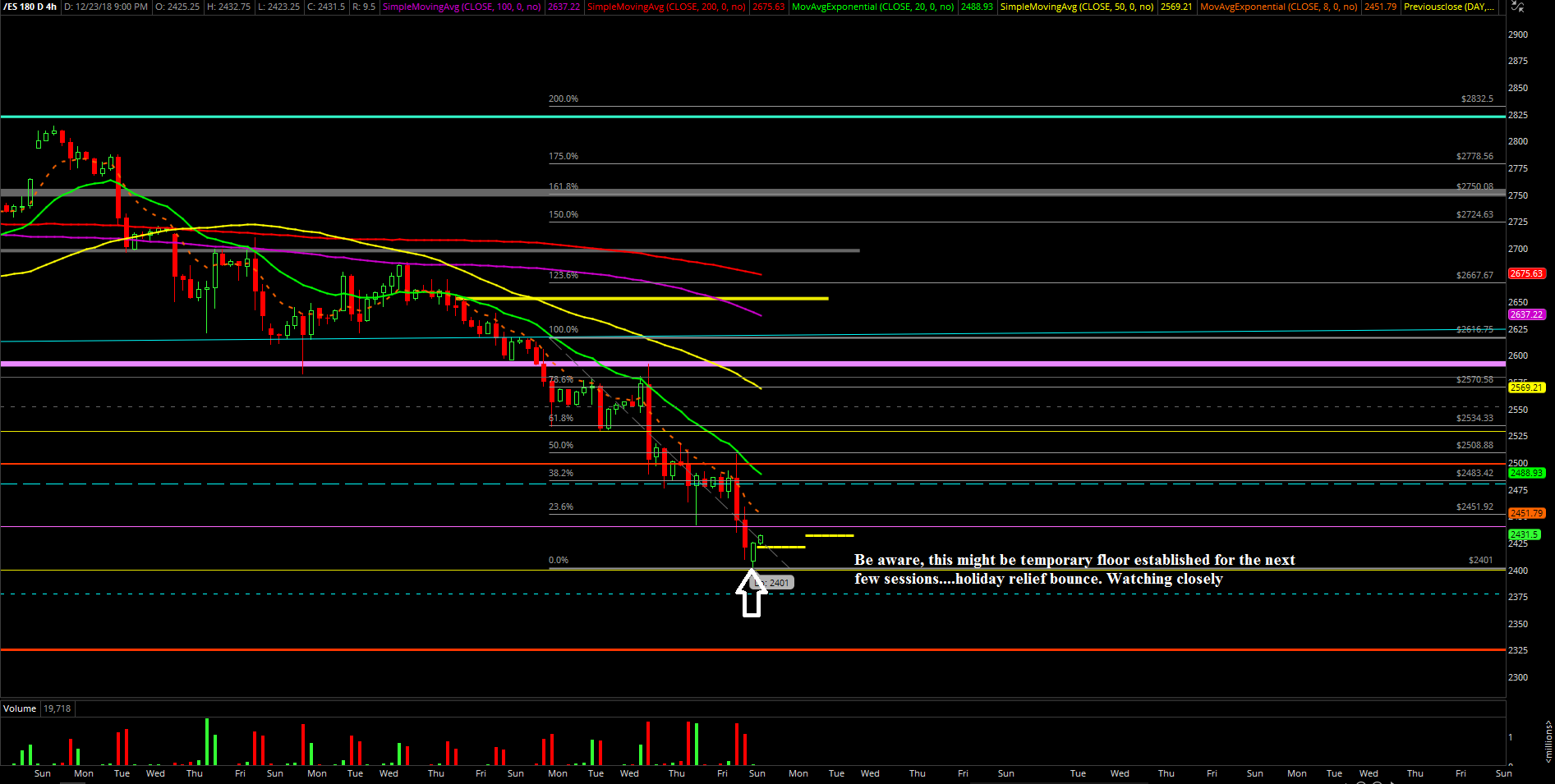

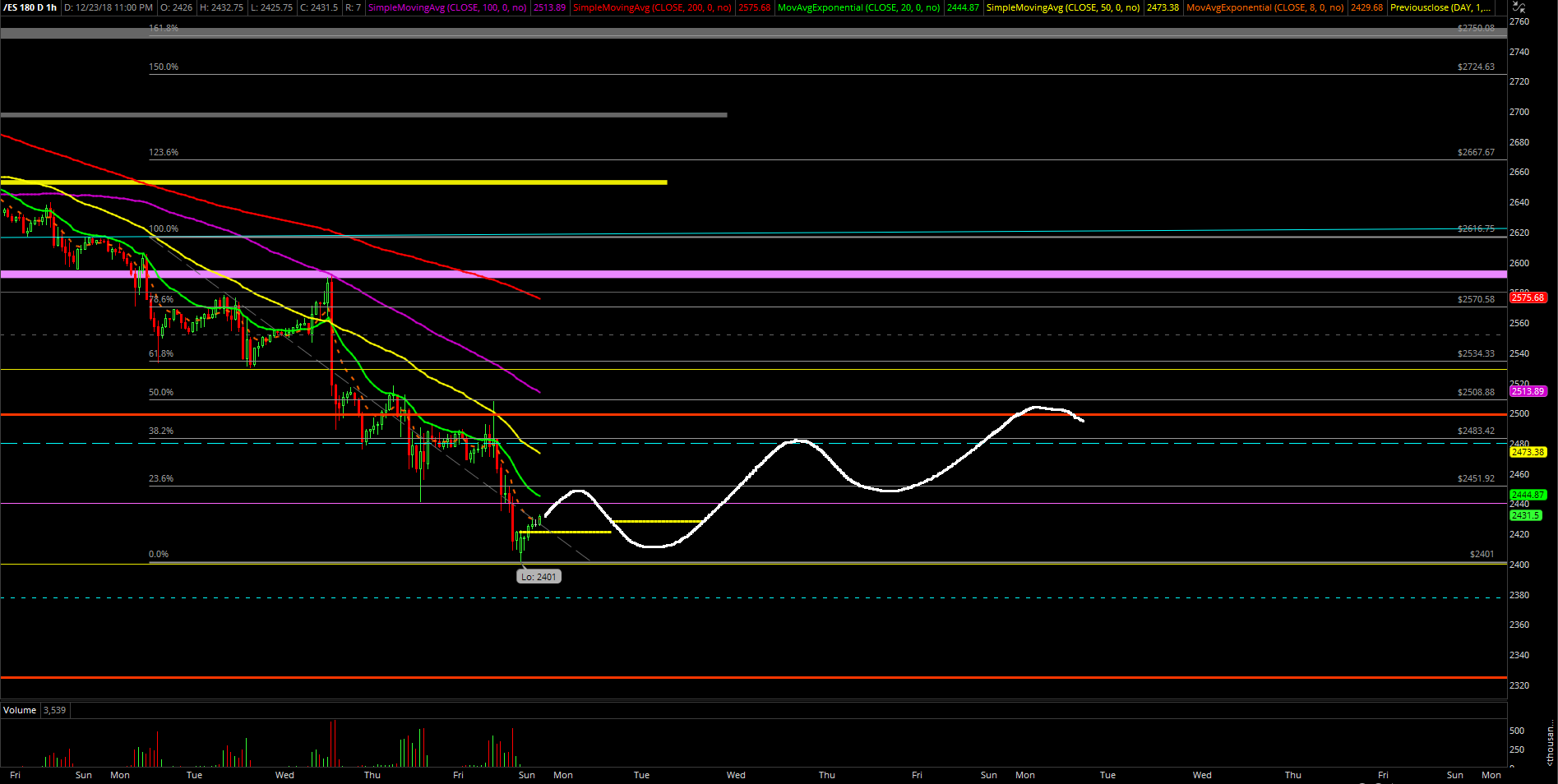

Friday closed at 2421.25 around the low of the week so the bears accomplished their goal with the downside follow through and being able to wrap it up on momentum. As of writing, the Sunday night low of 2401 is being treated as a temporary floor vs. the key 2400 level so we’re watching this ongoing temporary floor being established going into this shortened holiday week. During times like these, short-term traders need to focus on being objective by mainly trading the morning range only and not get caught up by the potential afternoon stuckfest trap. Generally speaking, the higher probability setups are almost always during the morning already and it’s even more pronounced during low liquidity days like the holidays.

We’re expecting the market to follow the 1hr white line projection with a deadcat that could morph into a bigger deadcat depending on how things go. If not, the market could technically continue the lower highs and lower lows breakdown as institution players liquidate more positions and head for the exits. The next key support levels are located at 2380/2325 (with a minor at 2355) if 2400 temporary floor does not hold. Adjust and adapt if price action morphs into something entirely different. Note: tomorrow is a half day session closing at 1PM EST.

---

We want to take a moment and wish you all a merry Christmas and happy holidays !