Wake Up And Smell The Dividend Cash Flow

Wake Up And Smell The Dividend Cash Flow

Summary

- Cash flow is always king, whether interest rates are high or low.

- Your dash for temporary shelter could cost you dearly.

- 2023 will be another record year for dividends. Do you have a bucket handy?

- Up to 9% returns to protect your lifestyle from inflation and taxes.

Cash flow is the movement of money in and out of an entity, be it a person or a company. When cash inflow exceeds outflows, positive cash flow is achieved, allowing for expenses to be covered and savings for future needs.

Basic expenses such as food, clothing, shelter, healthcare, and lifestyle enhancements like entertainment and travel must be taken into account when planning expenses. Inflation and taxes must also be factored in, and income must be cash flow positive after all these costs.

Short-term treasuries are currently popular, but they may not provide long-term shelter against inflation. Investing in undervalued companies with excellent long-term income opportunities is recommended by experts

Pick #1: USA - Yield 9.2%

The Liberty All-Star Equity Fund (USA) is a diversified closed-end fund (‘CEF’) that invests in a range of desirable but typically low-yielding stocks. The fund combines five different investment strategies, blending value and growth techniques to generate shareholder income.

USA's distribution policy aims to pay out 10% of its NAV, distributed quarterly at 2.5% per quarter. Despite its active management, USA has a low expense ratio of 0.93%, making it a relatively affordable option for investors.

With 147 holdings, including Financials and Information Technology sectors, the fund is well-positioned to benefit from the current bull market. USA's $0.15/share quarterly distribution represents a 9.2% yield.

During the last bull run, USA outperformed the S&P 500 index, a trend that could continue in the next bull market. USA's variable distribution policy, which adjusts dividends to market conditions, ensures that the fund doesn't overpay or underpay under any circumstances. By investing in USA, investors can benefit from technology's continued growth while collecting large distributions.

Pick #2: Realty Income - Yield 5.1%

Realty Income Corporation (O) is a Real Estate Investment Trust ('REIT') that makes investments in single-tenant properties with "triple-net" leases. Tenants are responsible for the majority of property-level expenses under these leases.

O is a Dividend Aristocrat that has trademarked the phrase "The Monthly Dividend Company" and has lived up to it with 636 consecutive monthly dividends. Since going public in 1994, the company has paid out monthly dividends for 53 years and increased its dividend 121 times. O is a prime example of how compounding can be used to apply to both income and accumulated price gains.

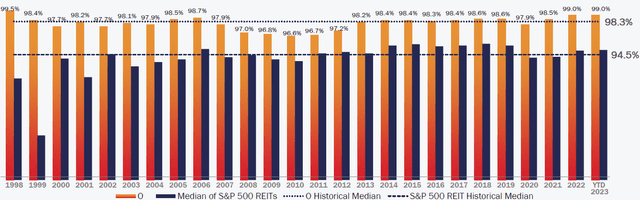

O has steadily amassed a portfolio of more than 12,000 properties through its diligent underwriting, giving the highest priority to stable, long-term leases backed by high-quality real estate. As a result, despite recessions, high inflation,and other difficulties, O has been able to maintain above-average occupancy rates and steady income. O's financial situation doesn't change much during recessions thanks to its long-term leases. Source

Realty Income Q1 Presentation

In 2023 and 2024 combined, only 6.1% of O's portfolio is experiencing lease expirations, putting the company in a good position to weather a recession within the next year. O is one of the highest-quality REITs in the market, with an A- or better credit rating and a long history of success. It is a great dividend growth option to hold through any economic environment.

Conclusion

If you run a business, do you want your employees to sit idle or do the bare minimum? Of course not. The same goes for investing. Simply relying on savings accounts and guaranteed instruments won't cut it. As Robert G. Allen, a bestselling finance author, famously said, “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.”

Guaranteed investments may provide the illusion of safe returns, but taxes and inflation eat away most of the returns. Money market funds won't protect you from a bear market. If you smell insufficiency, your retirement planning needs a pivot. Buy dividends while they're cheap before the Fed changes course. Don't settle for fake comfort; invest wisely.