WTT: OML for more Prolonged (B) Wave upside.

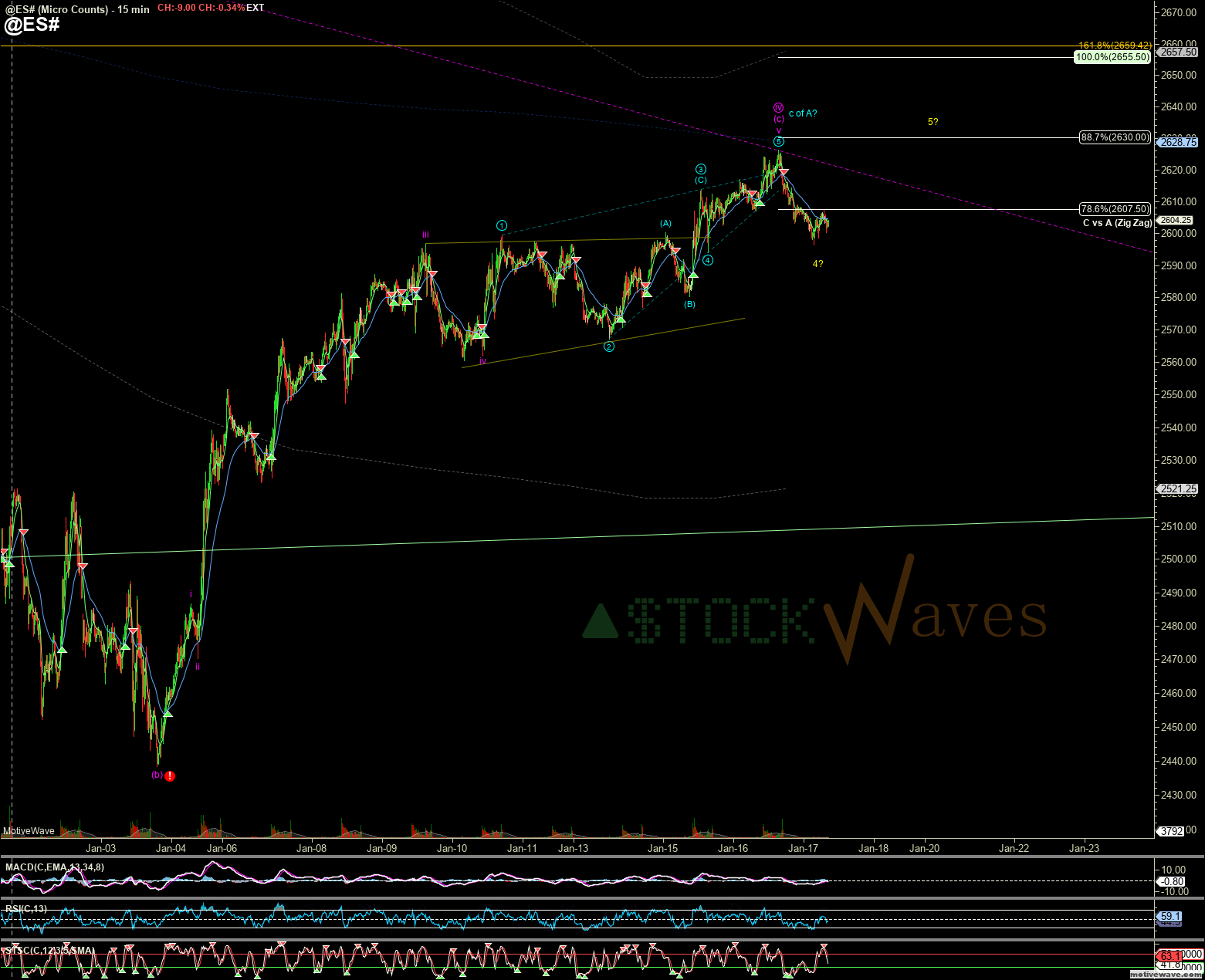

CAN still get another 4-5 even if this fades down to 2570 region again. (ES 15min)

But ideally we topped. (at least "locally").

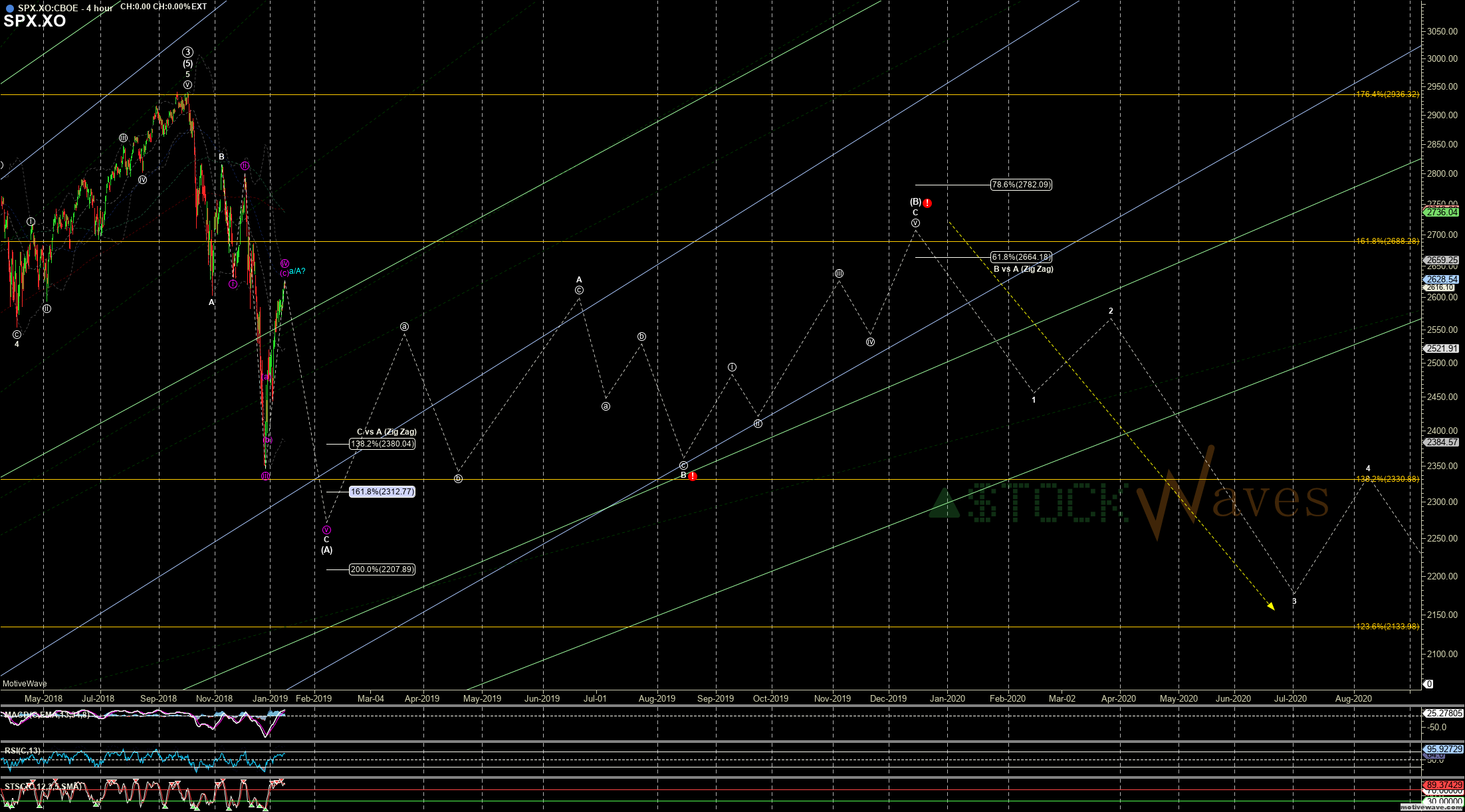

Minimum "normal" fade even for a blue B of (B) is <2500. That is ~5% down from here.

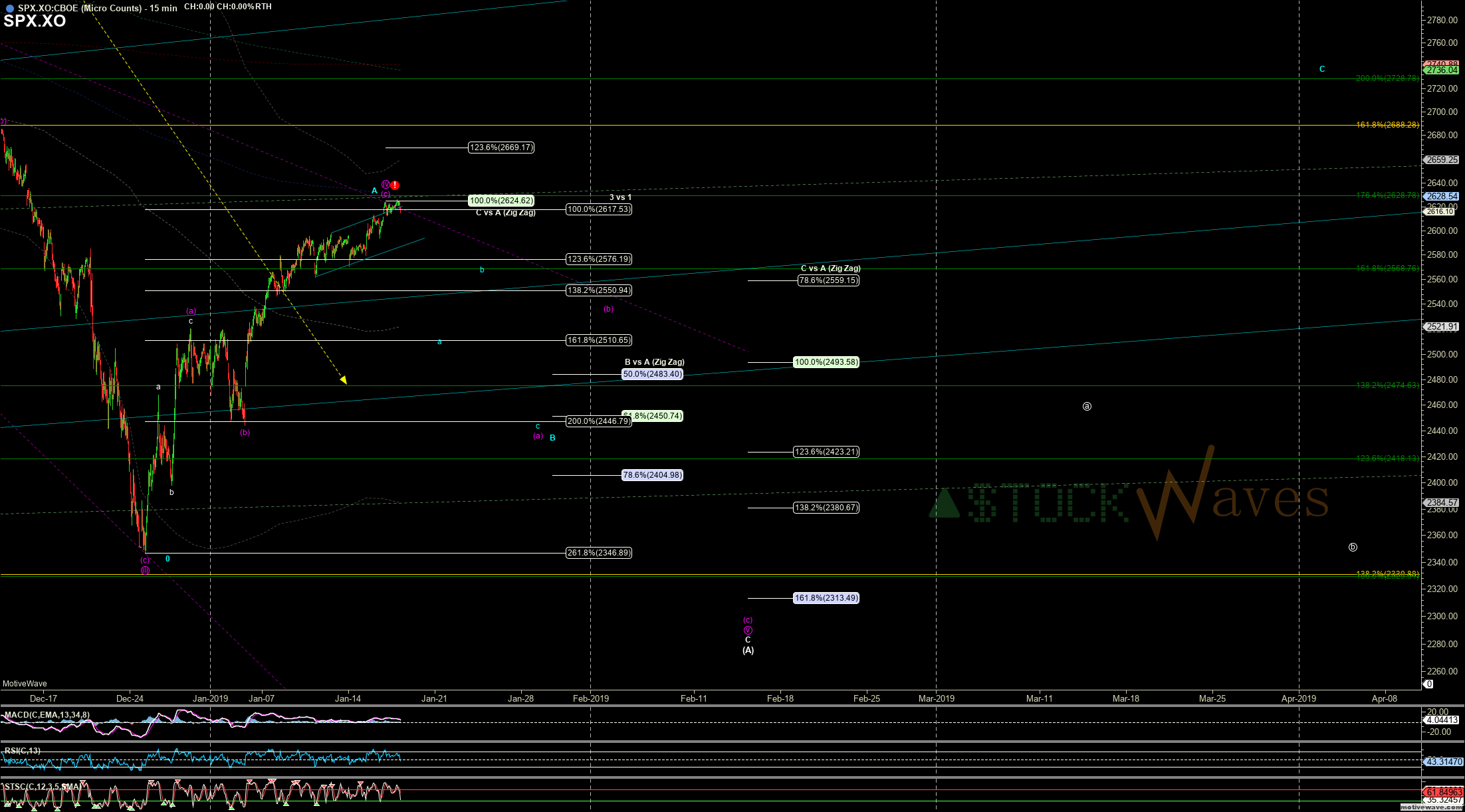

I do NOT expect ANY of the potential moves down EVEN IF to new lows to be straight impulses. ALL will be 3-wave "ABC" moves. That means plenty of sharp b-wave bounces that can wreak havoc on any volatile/leveraged/short-term/directional positions. It also means that both the blue and purple counts over-lap with each other and remain valid down toward that region and even as a potential C wave up starts... (SPX 15min). What we must be on the look-out for is the "start" of the blue C wave up to be only an abc bounce as purple (b) setting up a final potential "FLUSH".