WING: Ain’t No Stopping Us Now

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

Apparently we love wings - lots of wings. So much so that WingStop opened a new store every day in the last quarter. That’s some forward impetus that does not yet show signs of slowing. Let’s look into some of the highlights from their earnings release a few weeks back. Then, we’ll listen to sentiment as it speaks via the charts.

It would seem apparent that the fundamental growth story is aligning with the trajectory traced by sentiment. Simply stated, WING looks to continue its upward track. But we need to define our risk versus our potential reward. What’s more, there is an alternative path possible to discuss and be aware of in the near term. Please follow along as we key in on some pertinent details.

WING Earnings Release And Forward-Looking Statements

(The entire release is available here: Quarter 2 news release)

Yes, WING is priced as a formidable growth story. And, as of now, they are backing up their valuation with continued performance. We can study the structure of price on the chart to further add crowd behavior to our picture. Why do this? Let’s briefly look at some foundational principles that help guide us in mass psychology as displayed in the markets.

How Do We Derive Risk Versus Reward?

Avi Gilburt has authored numerous articles regarding the origins of Elliott Wave Theory. It has been an in-depth study and observation over the years that have led us to where we find ourselves today. The following is a brief excerpt from one of those introductory pieces.

Now, let me tell you one detail first and then you will see how it relates after. Elliott Wave Theory might sound complex at first. But like assembling a Banker’s Box from a flat pack, once you understand the steps, it becomes intuitive and empowering. Here is Avi’s excerpt:

“As I have mentioned in prior articles of our Elliott Wave Intro series, Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of ‘news’.

And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics. Therefore, these primary trend and counter-trend movements in the market generally adhere to standard Fibonacci extensions and retracements.

Since the market is “fractal” in nature, it means that these movements are variably self-similar at different degrees of trend. In other words, these impulsive and corrective movements of the market are occurring at all degrees and in all time frames. That means that the smaller components, or sub-waves, have the same basic shape, form, and pattern as the larger components. So, waves 1, 3 and 5 all have to develop as 5-wave structures.

While this may have begun to sound more complex, I do want to note that the main rules of Elliott Wave analysis are really quite simple.” - Avi Gilburt

When one first reads this, it may momentarily make your eyes cross. Allow me to elaborate via the aforementioned example: have you ever assembled a Banker’s Box? You know, it’s the box that comes flattened and has 8 steps proposed visually that show you the sequence of tearing pre-cut perforations, fold this, wrap under that. The first time I looked at the directions I sat down for a minute, briefly befuddled. Then, like some sort of ancient puzzle box, I followed the instructions and Shazam! I made a box. Now when I look at the Banker’s Box, it no longer evokes feelings of feebleness. It’s actually empowering. Where there was once a flat piece of cardboard forming 2 dimensions of doubt, I can now make a fantastic, 3 dimensional, sturdy and useful box.

You too can learn Elliott Wave Theory. When it is correctly applied, it becomes an amazingly powerful utility in your arsenal. Let us show you how we can use this to identify key price levels for WING along with risk versus possible reward.

The Theory In Action

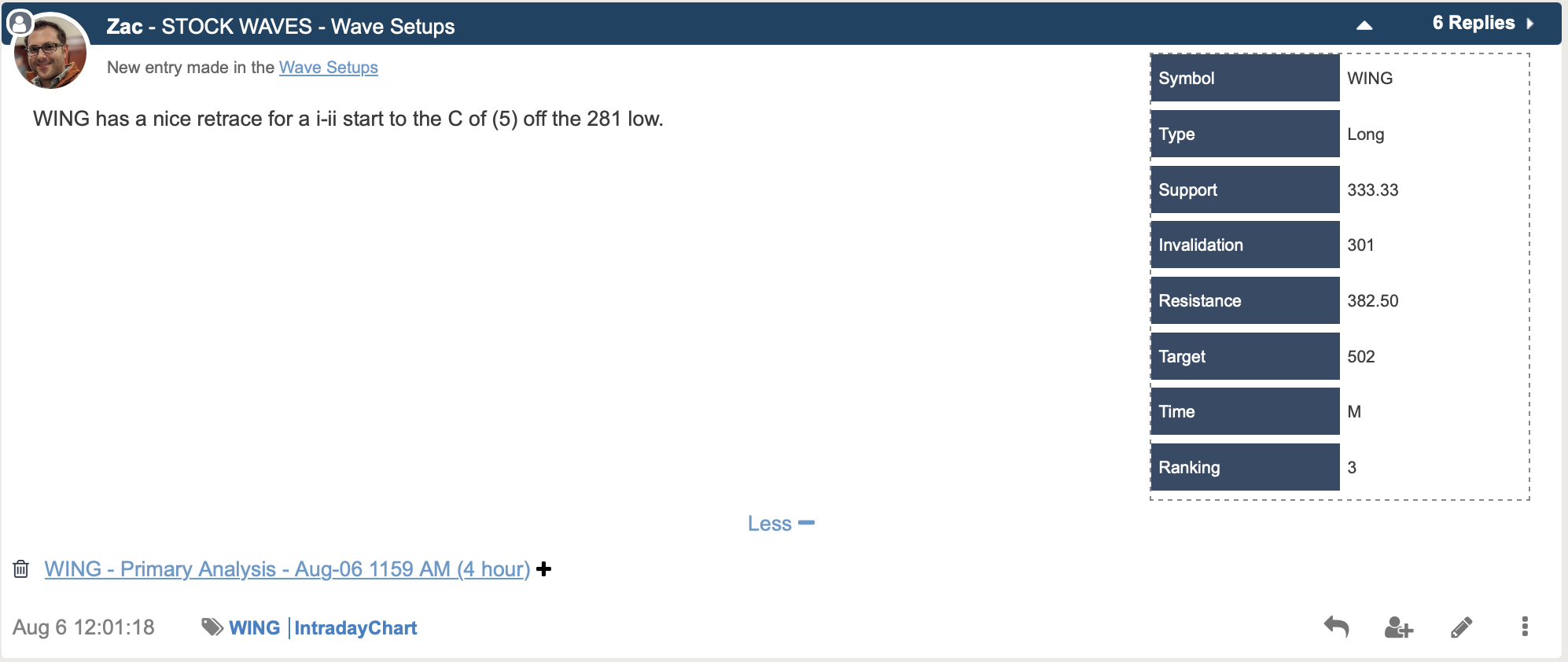

Below, you can see the Wave Setups table recently shared by Zac with our members.

The invalidation for this current setup is at the 301 area. If price should elect to break under that level it does not necessarily indicate that the higher targets are wiped from the board. Rather, it says that this was a corrective bounce and the the ‘B’ wave needs a deeper retracement before initiating the ‘C’ of (5) higher.

Should this take place, then we might stand aside until ‘B’ bottoms and we see the initial lesser degree wave ‘i’-‘ii’ of ‘C’ form (note: wave labels like ‘i’-‘ii’ refer to smaller-degree sub-waves within the larger impulse). At the moment though, our primary path shows that ‘i’-‘ii’ as being formed. The recent price action over the last few days would suggest this has merit.

What Truly Leads The Markets?

Fundamentals are important. However, they typically will frame a thesis for a 3- to 5-year time period. As well, we have observed that fundamentals rarely lead the stock price on a chart.

So, if it isn't fundamentals that lead, what is the driving force of important turning points in the markets? Sentiment. Simply put, fear and greed that battle against one another until the force of one overpowers the other. We are seeing this play out before our eyes in WING stock.

Sellers will simply exhaust themselves at bottoms, and buyers famously flame out at tops. All of us have likely observed fundamentals that get strenuously stretched to what appear to be absurd valuations to both extremes. Markets seem to be what we deem 'irrational' at these points. This is because markets are not logical, thinking entities. They are fluid, dynamic and non-linear in nature. Markets are sentiments in action before our very eyes.

Yes, there are nuances to the analysis. Once familiar with our methodology, our members discover a powerful ally on their side to provide guidance and risk management in their trading/investing.

We have an extensive Education library available at Elliott Wave Trader. As well, we want to teach others this methodology. Three times a week we have beginner and intermediate-level videos where we show the exact way we count the waves and give in-depth analysis techniques. This methodology, if you give it the chance, will change the way you invest forever.