VXX Levels To Watch

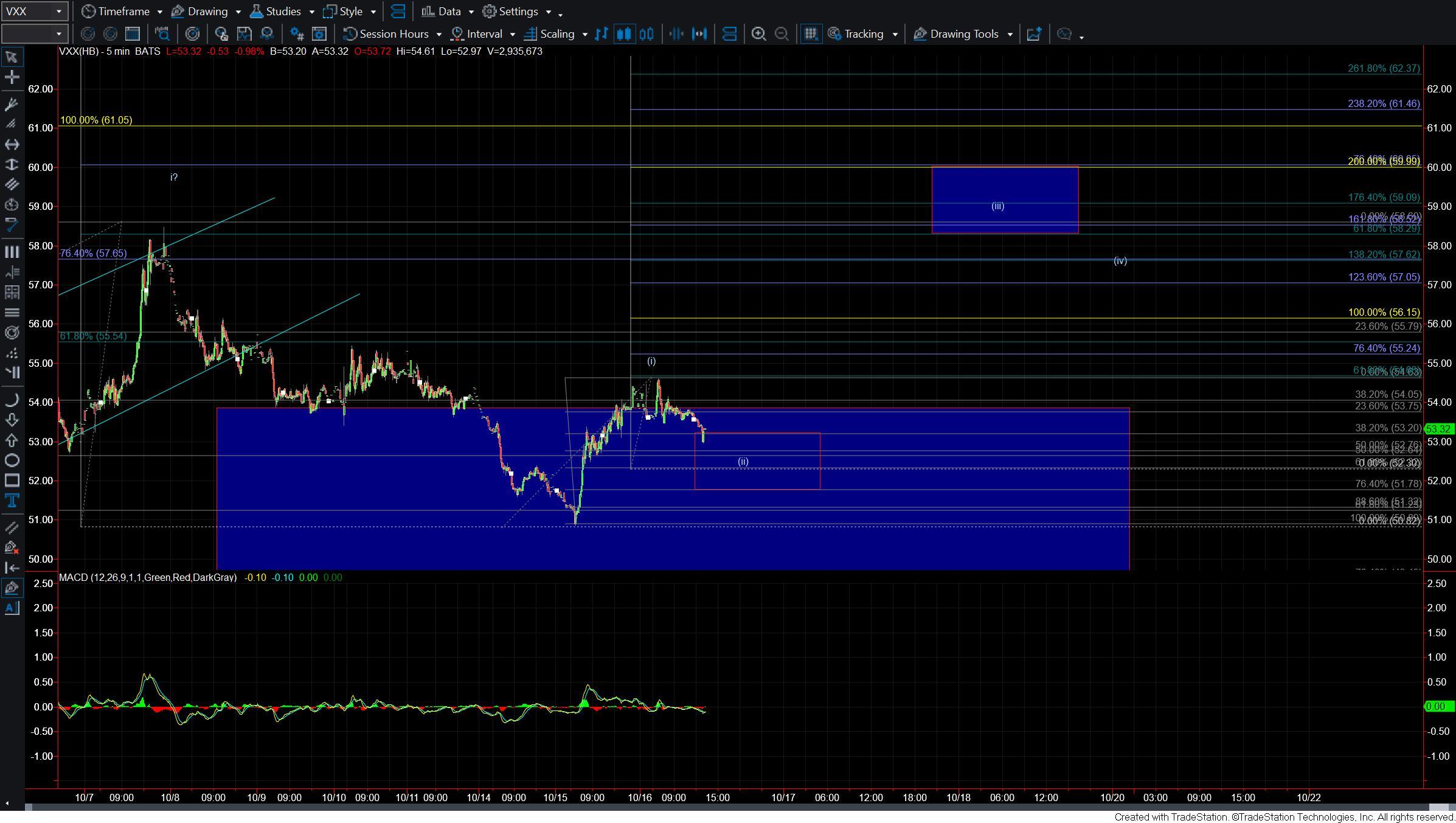

Here are the price levels to watch over the next several days in the event that the VXX does indeed hold the 50.62 level and push higher.

The initial pivot on the smaller timeframes is going to come in at the 55.24 level. If we can break through that level then the 56.15 level will act as the next key pivot/resistance level. If we see a sustained break of that level then we are on track to move into the 58.29-29.99 zone for the micro wave (iii).

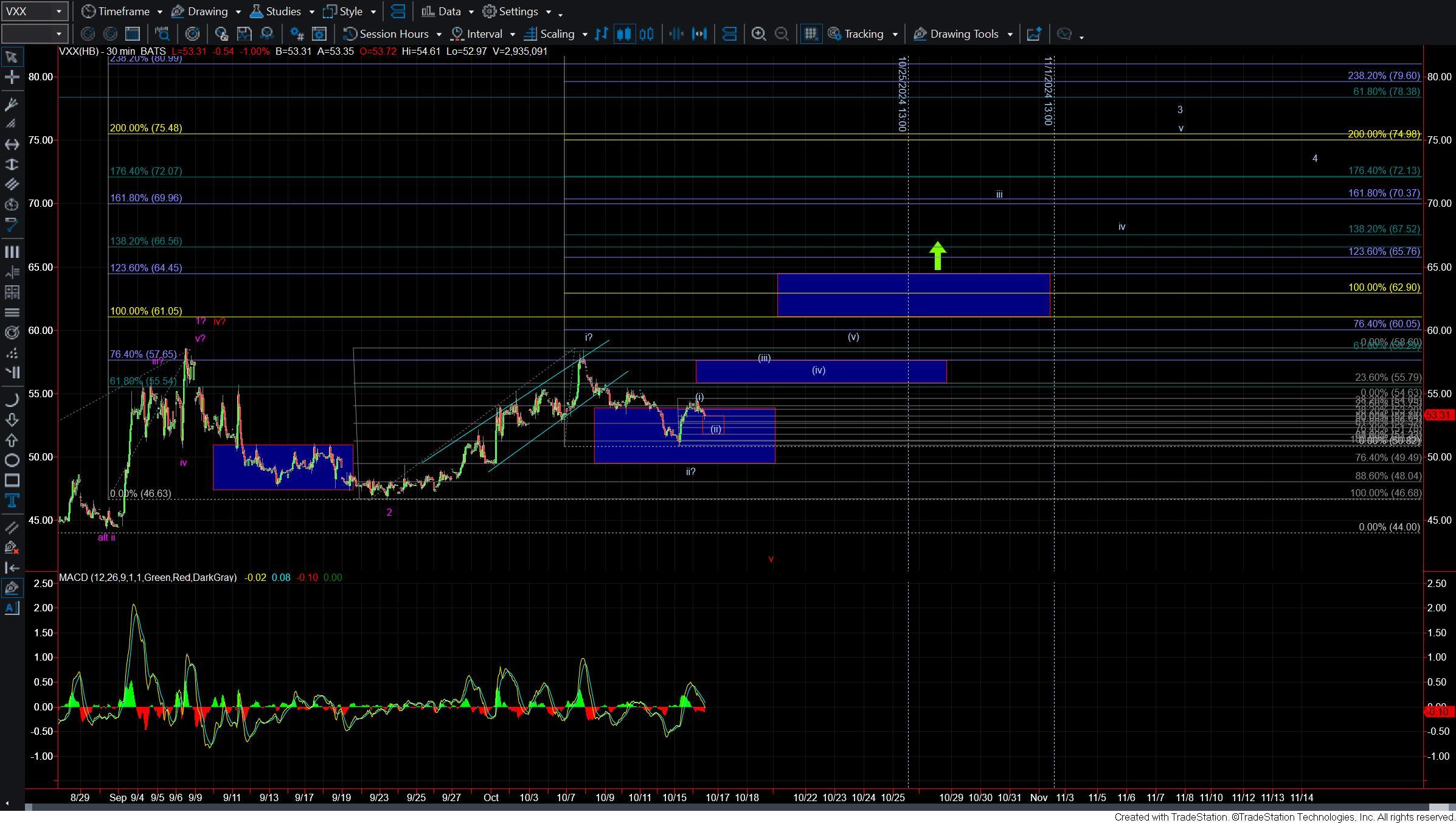

If we can get into those levels then because we are dealing with a potentially nested count we should come to a point where the larger degree timeframes take over and we can look more toward those levels rather than focus on the smaller degree timeframes. So zooming out to the 30minute chart the next key pivot will be the 61.05 level and if that breaks 64.45 would be up next. Through those levels then we can start to see an acceleration phase take shape and take us up into the 70-75 zone. From there we would want to hold over the 64.45 to continue to path higher and ultimately back over the 95 level.

If we break under the 50.62 level then it reopens the door to see another lower low under the 46.68 level and ultimately follow the red path. For now however and as long as we are over support I still prefer the more bullish interpretation of this chart.