Using Dips As Opportunities To Reload

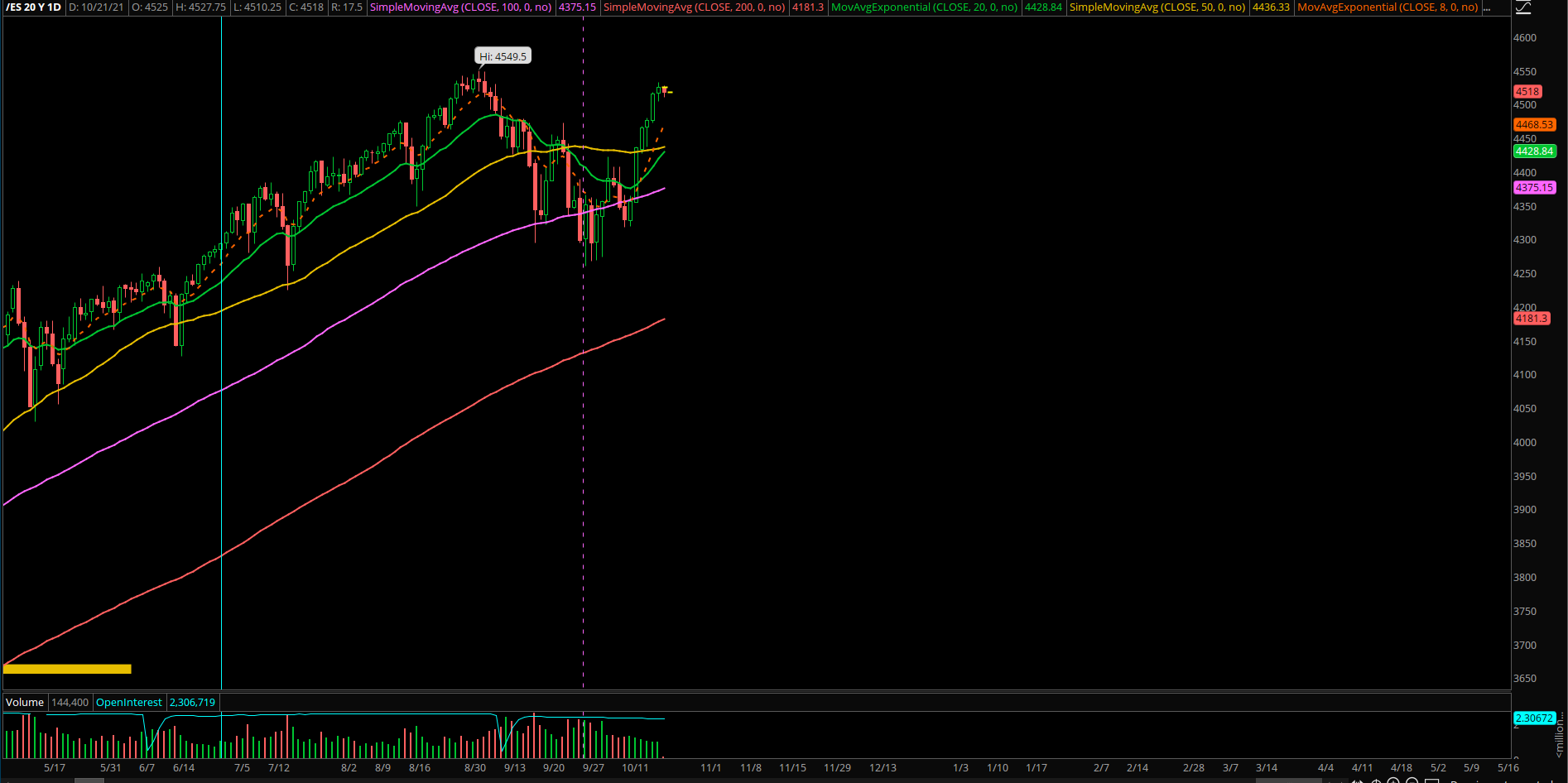

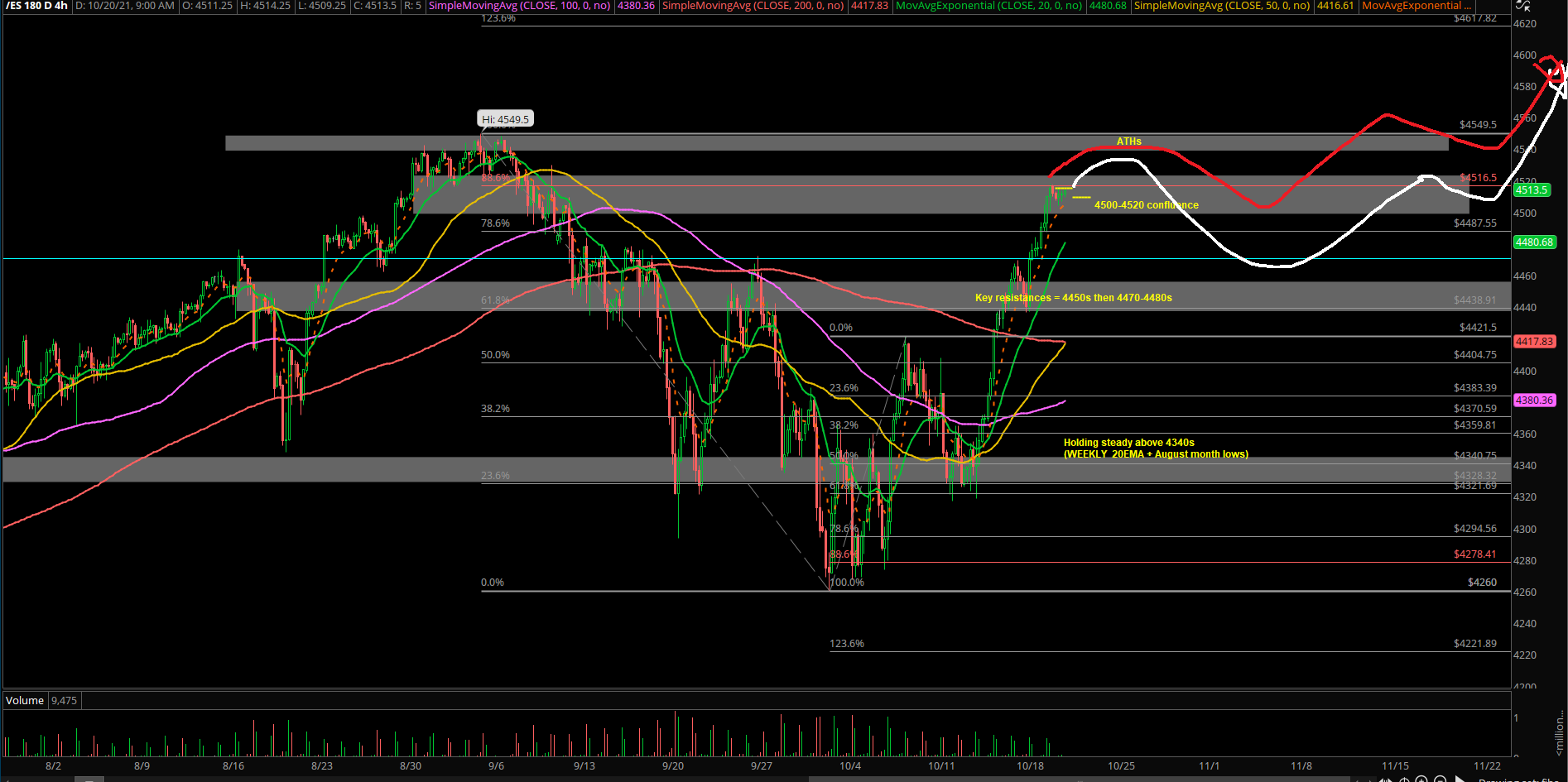

The market's high-level consolidation continues, with the Emini S&P 500 (ES) trading inside yesterday’s range of 4532-4504.

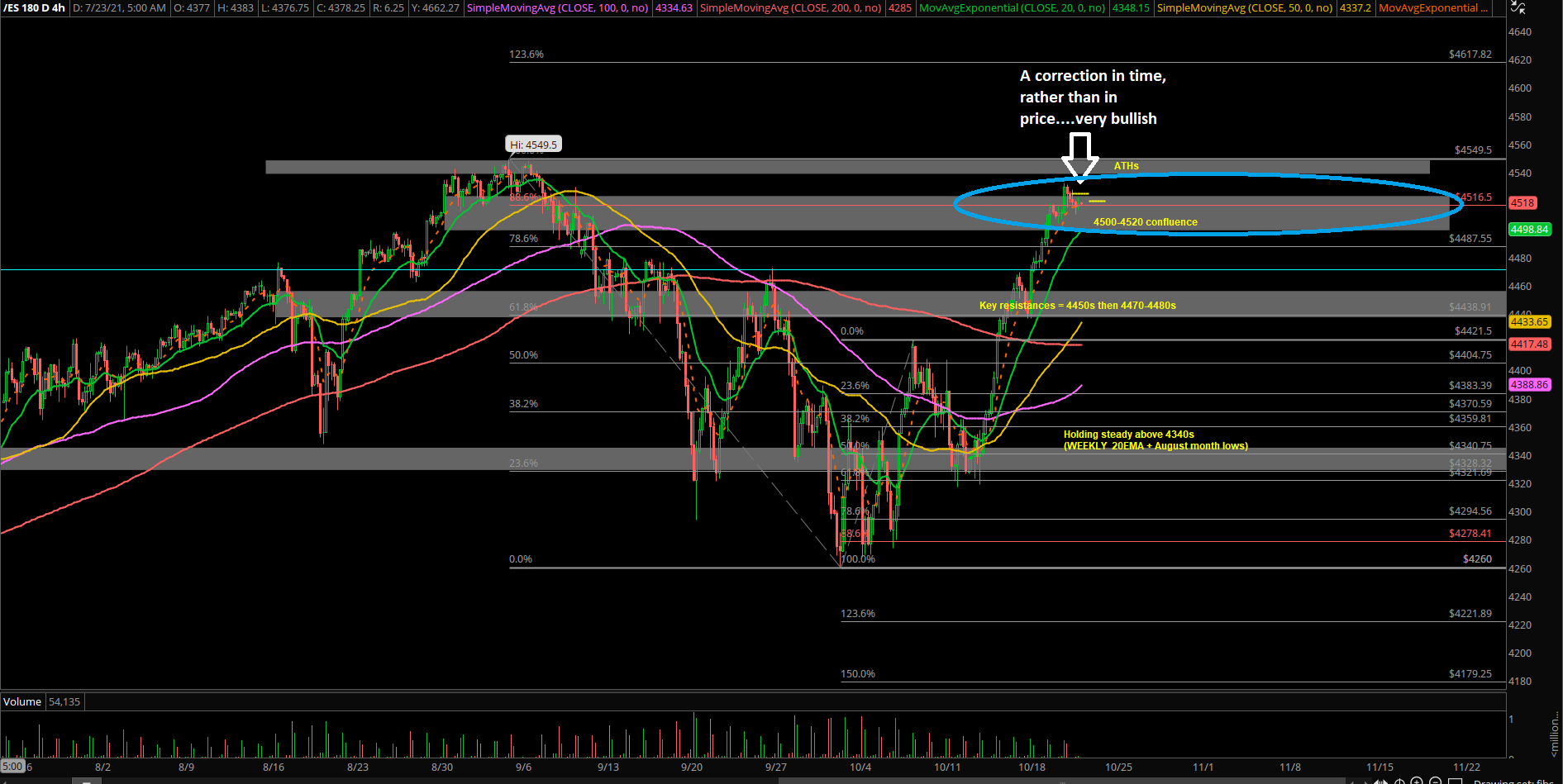

This means that the market chose to do a correction in time rather than in price, by resetting the short-term technicals horizontally and letting moving averages catch up (4hr 20EMA)

At this point, given the context and how we’re going into the end of the week and month, I'm expecting more of the same: very shallow or no dip as we grind higher. The 4500 level needs to hold given the formation here.

Failure to hold 4500 creates an opening down to 4485/4465/4450.

Either way, dips are opportunities to reload for cheaper as we head into new end-of-month ATHs.

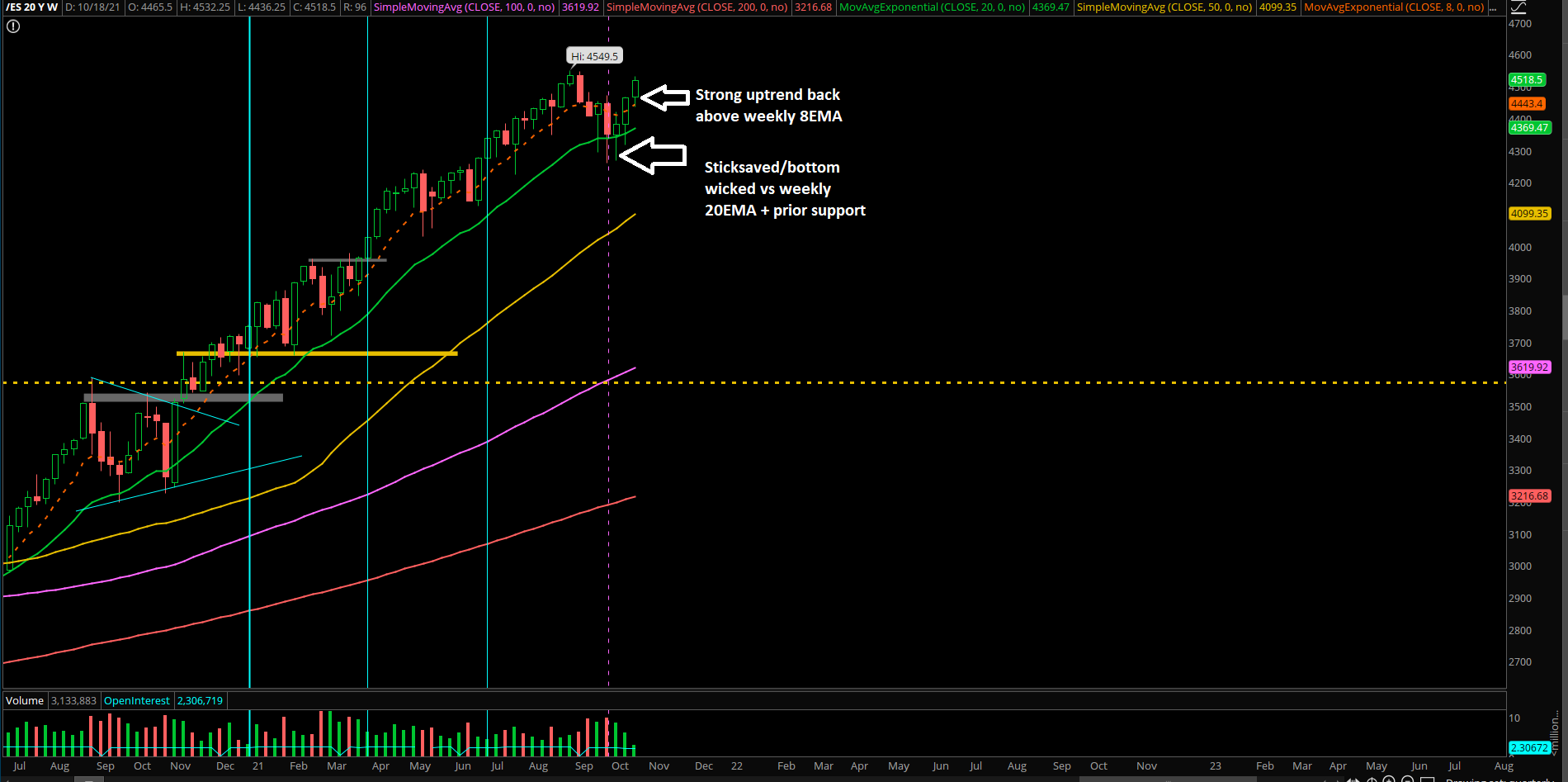

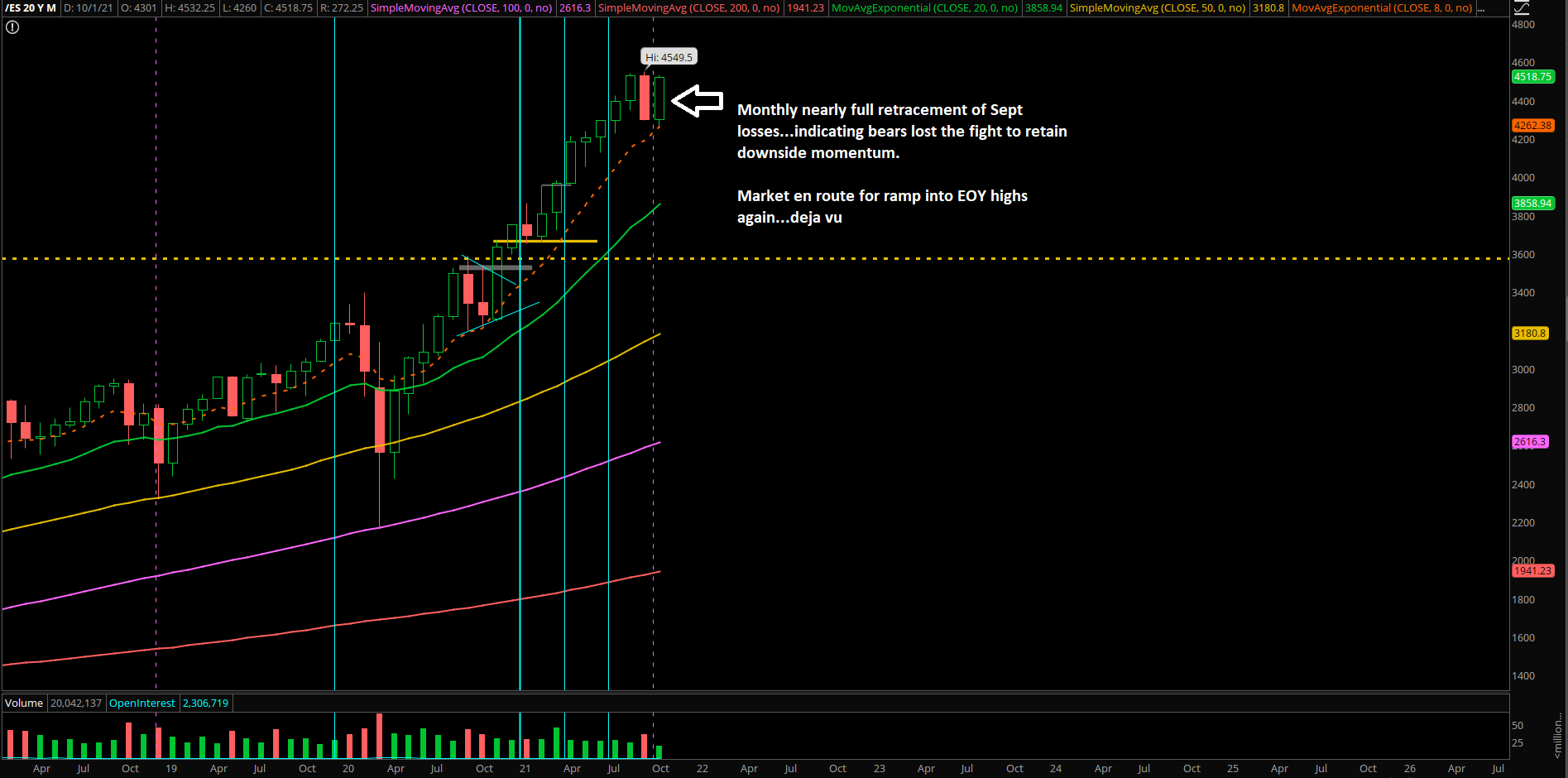

If you notice, the ES monthly candle is very strong. It backtested into monthly 8EMA support earlier this month and now it’s near ATHs again. This is a very similar setup in NQ as well, so it means that the market has stabilized and looking to wrap up October at monthly highs and sets up November-December for the EOY ramp/chase.

This means that the goal for the end of month is crystal clear for both sides: Bulls have to keep doing what they’re currently doing, and gummy bears need to do some significant damage to the charts.

Otherwise, there are no real bears yet.

Short-term wise, going into today, we're using 4504-4500 as support given the overnight+yesterday’s context. Grind up bias when above, 4520/4535/4550 next targets. We need to be aware that price could keep doing these shallow dips and bull flagging higher into ATHs.

Looking at our charts, the market is deciding between yesterday’s 4hr white vs red line projection to follow through.

Context wise our view remains unchanged from the past few reports: We’re continuing to treat Q4 lows as in from the ES double bottom in the 4260s alongside with last week’s confirmed daily higher lows/squeeze setup.