USD Moves Lower - Market Analysis for May 3rd, 2020

Last week I noted that the US Dollar may not be far away from a sharp reversal after grinding higher into the end of the week. This week we saw just that as the US Dollar moved lower throughout the week and closed just over the key 98.84 level.

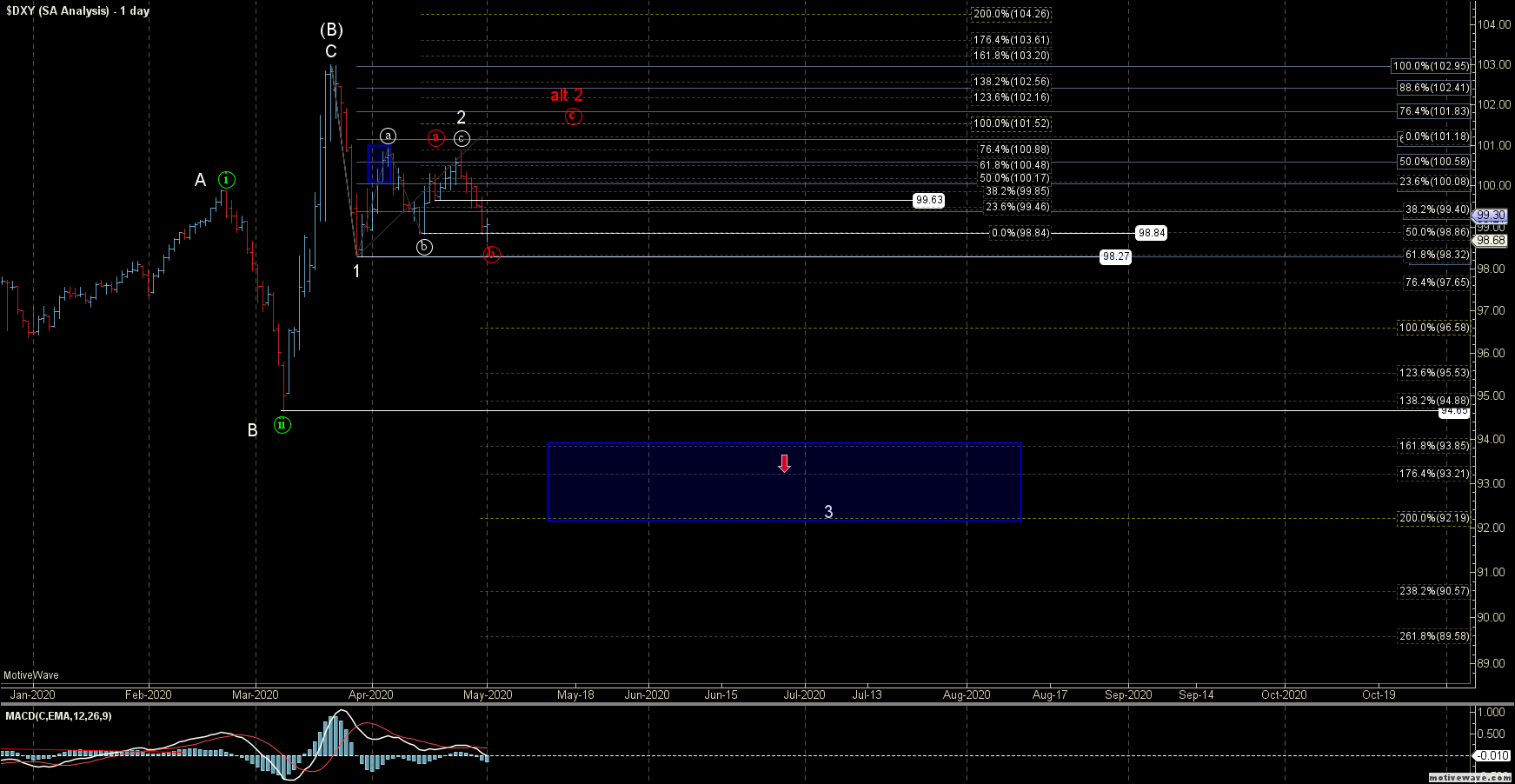

So, on the smaller timeframes, I can now count this in two different ways. The first would suggest that we have already put in a top for all of a wave 2, which I am showing in white suggesting that we have already begun a larger wave 3 to the downside.

The second path, in red, would signal that we still have another minor degree wave ((c)) up yet to come to finish off a larger wave 2.

The white path further triggers with a break below the 98.27 low, whereas the red count would still be in play with a move back up over the highs that were struck last week.

From a larger degree perspective, nothing has changed from the previous analysis or to the two larger degree counts that I have been watching. Those are still shown in white and in green, with the white count being my primary count at this point in time and the green being my alternate.

As I noted previously the alternate green path would see the US Dollar much higher over the coming years. The price action of the past several weeks has made this green path as less probable but still viable at this point in time. So as long as we are holding over the 94.65 low I still have to allow for this potential and will leave it on the charts at this point in time. It would, however, take a break back over the 102.95 level to signal that we have broken out in this path and unless and until that does occur I am still leaning towards this topping in the white wave (B).

With what I am counting as five down off of the 102.95 high we do now have initial confirmation that we have topped in the white wave (B) will come. Because we have three waves up off of the 98.27 low it does make it more likely that topped in all of wave (B) rather than bottoming in a wave ((ii)) per the green path. We still need a break back under the 98.29 low followed by a break of the 94.65 low to give us the next level of confirmation that we have indeed topped int eh white path.

So while we are not quite out of the woods just yet as far as a runaway dollar is concerned, the action over the past few weeks is still giving us an early signal that the larger degree pattern that we had been watching over the past several years may finally be getting close to triggering. If this is indeed the case we should see the US Dollar to move lower over the course of the next several years.