UPS: Delivering A Dividend Cut Soon?

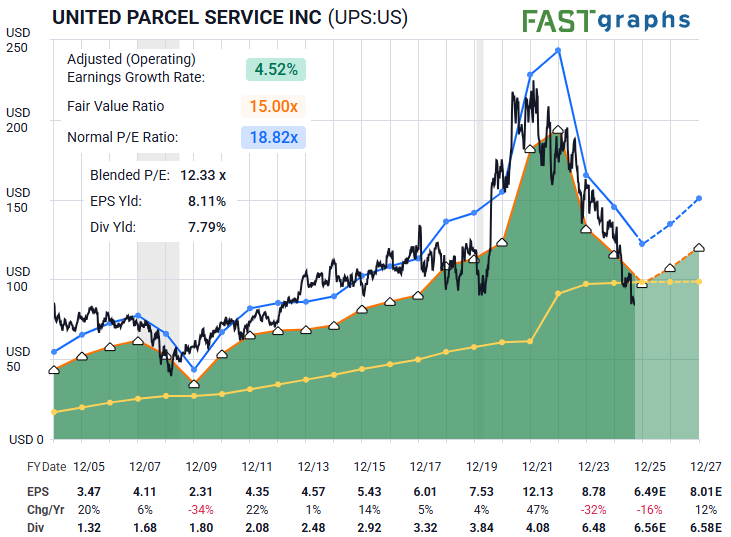

A $71 billion market capitalization company with a near 8% dividend yield - this is UPS here and now? Indeed it is. And that is certainly a tempting payout, particularly for such a well-established blue chip. But before we become eagerly enthusiastic about these headline stats, let’s take a longer look at the likelihood that the dividend can realistically continue at its current payout. As well, what is sentiment telling us here regarding a probable path going forward for the stock?

Lyn Alden recently posted this for our members concerning UPS:

“UPS is getting interesting from a fundamental perspective, as plenty of bad news has been priced in, bringing into value territory. If it shows evidence of a technical bottom, it could certainly be worth a position.

However, the dividend should be considered unsafe at the current time. I wouldn't invest in it primarily for reliable income. Earnings and free cash flow are both on the precipice of not fully covering their dividend, meaning that there's little margin of error at this point. I'd treat it more as a trading stock than an income stock.” - Lyn Alden

Suppose we simply ‘ignore’ the potential payout of the dividend for the moment. Instead, what about an analysis of crowd behavior via the structure of price on the chart? Zac Mannes shared this chart a few days back. It shows the entire move up from the 2009 low.

What can we glean from this and how might it shape the probabilities over the next several months? There are two salient points to keep in mind. Price has completed a five wave rally up from the multi-year low struck back in 2009. Since markets typically advance in five waves and then correct in three wave structures, we would now anticipate a multi-month A-B-C pullback.

If you zoom into the nearer term price action, you can see that the stock has corrected back to the low shown as Primary Wave 4 back in the Covid Crash panic of 2020. This is a frequent characteristic of human behavior patterns. So, supposing the stock is to find an important low in this region, what might we anticipate next?

Lyn also commented that many times a dividend cut by a company can actually mark a key low as well. Ergo, the supposition that UPS may be forced to make that decision over the next weeks to months. Their payout ratio is ranging from 87%-94% at the moment. In other words, UPS is paying out nearly everything it earns, leaving little margin for error. This is a situation ripe for activists to champion some sort of strategic shift in the company’s playbook.

Do you know what would show us a true shift, perhaps even quicker than other forms of analysis? Crowd sentiment will turn and this will be made manifest in what we see on the chart.

Should price find a low here in this $80 area then the next near term resistance to conquer would be first at $93 and then $102. UPS may be ready to deliver some alpha — ironically, a dividend cut could be the catalyst that marks the sentiment low and sets up the next rally.