Two Spring Scenarios - Market Analysis for Mar 30th, 2021

As mentioned in the Big Picture Outlook video for March, a big market move for April and May appears likely and the direction of that move all depends on what happens in March. If there was a clear rally all the way through March then the outlook for April and May was primarily bearish. If there was a rally in March that failed by the end of the month, the outlook would be primarily bullish. The last two weeks have been somewhat ambiguous as to which scenario had supremacy. With one day left in the month it is looking less and less likely that we will get a clear resolution to whether we had a failed rally or not, although it is of course possible. For now, the best I can do is go over the two scenarios with another month of data added now for June.

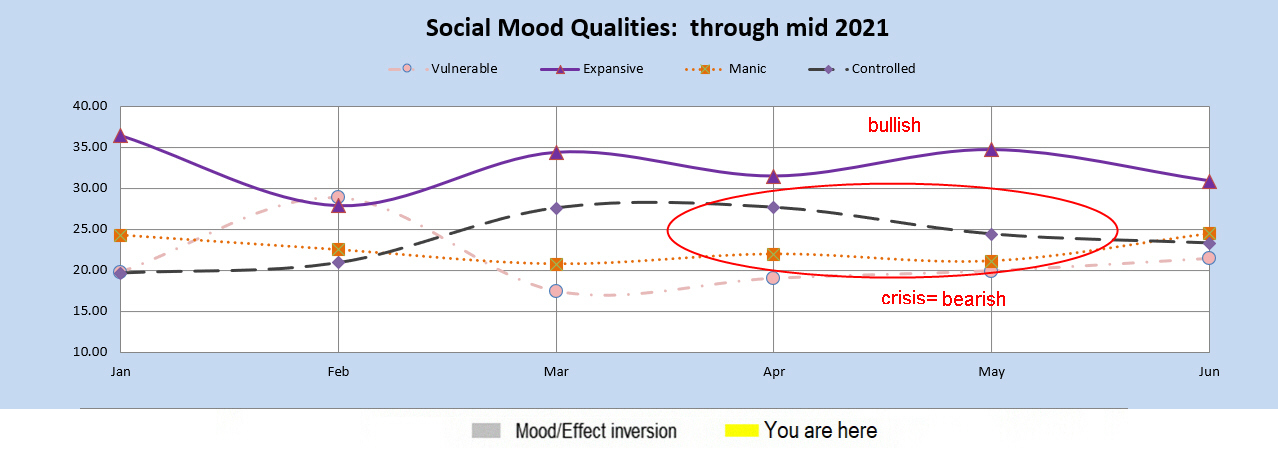

First let’s look at our social mood chart. In scenario one, Expansive on top and Vulnerable on the bottom usually marks the classic bull market pattern. However, for April and May, Controlled in parallel with Manic marks a new global crisis which should get resolved in June. While this could be a totally new crisis, from current headlines it could represent new Covid concerns, shutdowns, etc., especially outside of the U.S.

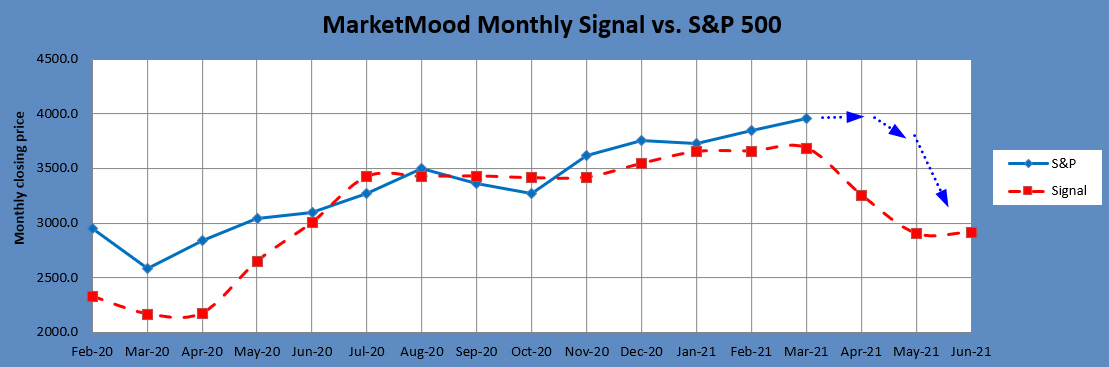

The MMI stock market outlook chart in this case is shown below with an estimate of market movement:

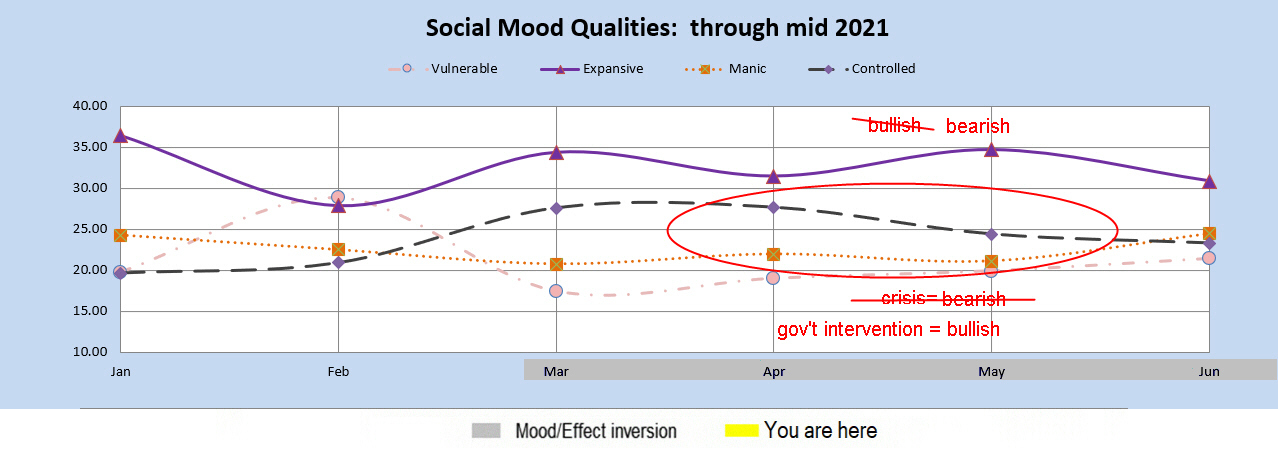

The alternative scenario, with an inversion or “flip” taking place in March would invert the effect of the mood pattern as shown below. In this case we have the classic bear market pattern replacing the bull market pattern and we have government intervention replacing global crisis. In the U.S. there is already discussion of a huge infrastructure bill which would fit with government intervention. There are also local programs and ripples underway from the earlier stimulus bill recently passed.

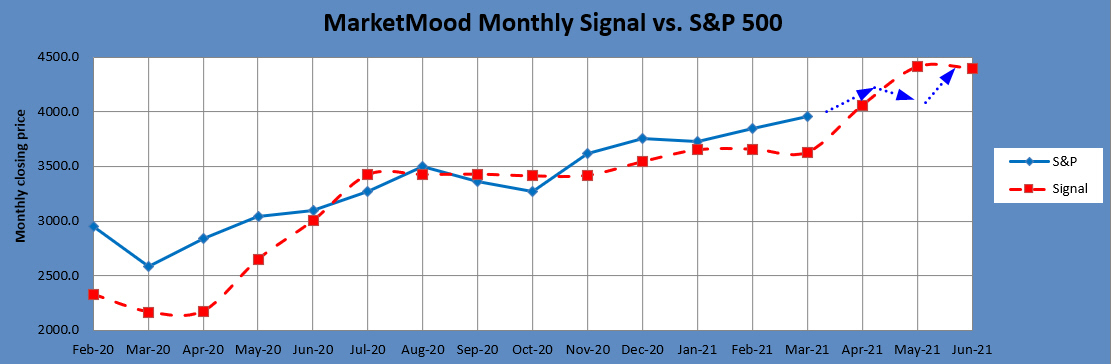

In this scenario, the MMI market outlook chart and added market movement estimate look like this:

As of this moment, either of these scenarios could make sense from what the mood pattern is portraying, and without a crystal ball, we don’t know if there will be a global crisis in April and May or major government stimulus. Until either scenario is confirmed, I have to lean slightly towards scenario one as the odds generally are against an inversion, although the market has given room for the possibility of such an inversion with the meandering over the last two weeks.

Without clear direction in the monthly charts, all is not lost as there are a myriad of indicators derived from the daily MMI signals to give us short, medium, and long-term market outlooks. The long-term outlook has been bullish since early November, and the medium-term outlook is currently right on the fence. The daily charts are showing a local top right now, but of course that could be irrelevant in a few days. As far as trading, it all depends on your timeframe. MMI is telling day traders to look down and long-term traders to keep looking up. It’s not quite sure at the moment what to tell swing traders so it waits for clarity. And for now, I wait as well for clarity on the monthly outlook.