Two Bargain Income Prospects: Up To 17% Yield

Bargain Alert! Up To 17% Yield Dirt Cheap

Summary

- Earning your initial few dollars is the most difficult.

- Many individuals make the mistake of not having their money work for them.

- Today, we'll explore two fantastic income prospects for your portfolio.

Earning money in the stock market can be an intimidating endeavor for new retirees and young investors. Many are advised to invest in stocks that don't pay dividends, and hope they will appreciate over time. But this strategy can lead to the emotion-driven cashing out during a recession, creating irreparable losses.

The first $100,000 is the hardest to save, but investing for income can help propel you towards the next $100,000 and beyond.

Consider investing for income in securities that pay you to own them. Dividend income can be reinvested to generate bigger paychecks. Your $50,000, $100,000 or $1,000,000 can now begin to pay you and aid you in building a bigger portfolio of investments that will generate income through the snowball effect.

Two outstanding opportunities for income investing are available. Let's explore them.

Pick #1: ECC - Yield 16.9%

Eagle Point Credit Co LLC (NYSE:ECC) is a Closed-End Fund (‘CEF’) that invests in Collateralized Loan Obligations (‘CLOs’). CLOs are corporate loans that are securitized and sold in pieces to different investors. This structure offers diversification, built-in buyers for loans, and increased capital for lending.

The lesson from the Great Financial Crisis is that securitization is only as good as the underlying loans. ECC invests primarily in senior secured loans to B-rated companies, which historically average about 69% recovery in case of bankruptcy. ECC invests in the equity tranche, which carries the highest risk while offering the highest reward in the CLO structure. Source.

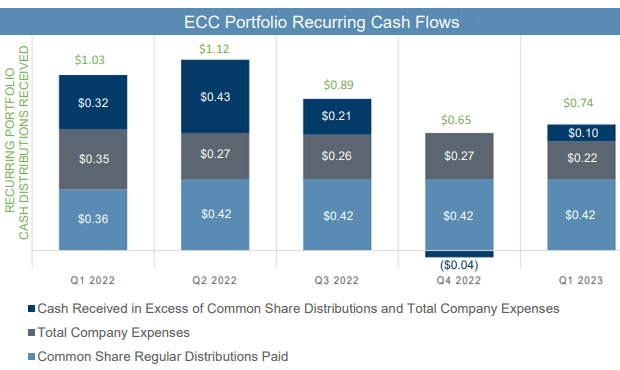

ECC Q1 2023 Presentation

The CLOs that ECC invests in are benefiting from low loan prices and a benign credit environment. Borrowers have benefited from low-interest rates in 2021, and EBITDA interest coverage is extremely high. Corporate liquidity remains much higher than it has been historically. CLOs and ECC are benefiting from these factors, providing investors with a healthy double-digit yield.

Pick #2: AWP - Yield 11.9%

The interest rates have put pressure on real estate across the board, causing the valuations of REITs to decrease due to higher interest expenses. However, many REITs have prepared well for monetary tightening. Core property REITs issued $115 billion in bonds between 2019 and 2021, clearing their debt maturity decks in a low-yield environment. As central banks pivot this year, the most common debt structure chosen by REITs, the 5-10 year fixed-rate notes, is expected to bring tailwinds to the sector. Most well-managed REITs have little variable debt or debt maturing this year, with 2026-2031 being the years when most REITs will experience a material change in their interest rates. Global REITs have proven to outperform over the long term despite temporary price collapse during market crises, making them solid buys today.

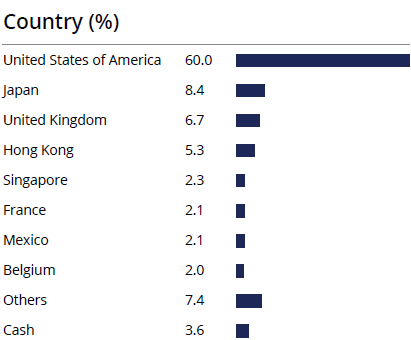

The abrdn Global Premier Properties Fund (AWP) is a CEF that invests in global REITs and maintains ~40% exposure to non-U.S. REITs. Source.

AWP has taken advantage of depressed REIT prices and maintains $68.9 million in portfolio leverage, representing approximately 15.8% of gross assets. The CEF also maintains lower leverage than peers, providing adequate room for expansion in the future as bargain opportunities arise in the REIT sector.

AWP's $0.04/share monthly distribution calculates to an impressive 11.9% annualized yield, making it a compelling opportunity to buy or add to a portfolio.

Conclusion

Investing in income-generating assets is a sure way to build wealth and secure your retirement. Unlike holding onto non-performing assets, generating income from your investments gives you a steady stream of cash flow that you can rely on.

It's like owning a factory that prints dollar bills instead of a collection of baseball cards that may or may not appreciate in value. With an income-generating portfolio, you can enjoy your retirement without worrying about market fluctuations.

Start laying the groundwork for your portfolio today and reap the benefits in the future. Invest in your future and enjoy the simple things in life.