Two +12%-Yield Picks To Consider

Buffett Says Make Money In Your Sleep, +12% Yields For A Dream Retirement

Summary

- Money is one of the biggest factors causing Americans to lose sleep.

- Despite its importance in modern society, there are things of higher importance than money.

- Two +12% yields to increase your financial independence and automate your income production.

Getting a good night's sleep is essential for overall health and well-being. According to the American Academy of Sleep Medicine, economic and health-related worries have caused nearly 90% of Americans to lose sleep at night. The legendary investor Warren Buffett likes to get at least 8 hours of sleep every night and emphasizes the importance of automating income needs for better well-being.

"When forced to choose, I will not trade even a night’s sleep for the chance of extra profits" - Warren Buffett.

As an income investor, I appreciate the predictability and repeatability of my income without direct involvement. Diversifying my portfolio with dividend payers during market volatility has been comforting. Here are two picks to consider to make money in your sleep.

Pick #1: BRSP - Yield 12.2%

BrightSpire Capital Inc. (BRSP) is a commercial mREIT that is currently trading at a 35% discount to its book value.

The mREIT has a significantly lower debt-to-equity ratio of only 2x, compared to its peers, Blackstone Mortgage Trust Inc. (BXMT) at 3.5x and Starwood Property Trust Inc. (STWD) at 2.5x. BRSP also has $1.99/share in unrestricted cash on hand, providing it with significant liquidity to weather uncertain markets.

BRSP’s $0.2/share dividend enjoys a 135% coverage and its debt is either limited recourse or non-recourse, meaning that the company cannot be forced to pay the lenders more than the collateral is worth.

BRSP’s main focus is senior mortgages, with mezzanine loans and preferred equity accounting for only 4% of its portfolio. The company has also proactively increased its exposure to multifamily properties, a sector with strong fundamentals.

In the current challenging environment for commercial real estate where office properties in major cities are experiencing rising default rates, BRSP's conservative leverage and liquidity positions position it well to manage the challenging environment and take advantage of attractively priced opportunities. As investors, we can have confidence in BRSP's prudent approach and capability to deploy capital in extraordinary lending environments while rewarding us with high yields.

Pick #2: ARI - Yield 12.4%

Apollo Commercial Real Estate Finance, Inc. (ARI) is a mREIT that originates mortgages for commercial real estate. Over the past month, ARI has started a rebound, but it continues to trade at a 30%+ discount to its Q1 book value of $15.72/share.

ARI has a portfolio with a carrying value of $8.5 billion, with about 2/3rds of that portfolio having originated post-COVID. ARI's portfolio is diversified and has an average loan-to-value of 58%. ARI's office portfolio is more conservative than its other segments, with a loan-to-value of only 50%, and 99% of the amount secured by first mortgages.

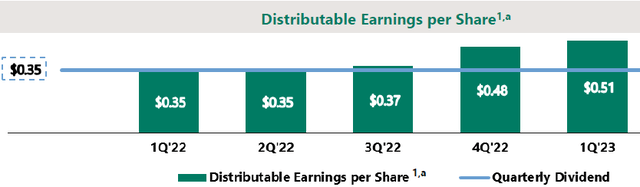

ARI’s distributable earnings per share increased 45% year-over-year and now comfortably covers the dividend with ample room to spare. Source.

ARI Q1 2023 Supplement

ARI has been benefiting directly from rising interest rates as 99% of its loans are floating-rate. With its international exposure, ARI will continue to benefit from rate hikes in the UK and EU, even if the Fed pauses this month.

We are happy to keep adding ARI while it is trading at such a large discount and collect our dividends.

Conclusion

Money is always a concern for human beings, and it influences many aspects of our lives. From securing a good job to ensuring the well-being of our loved ones, money plays a central role in most worries.

High Dividend Investing understands the value of time and sleep and offers an automated income method for investing. Our model portfolio, consisting of over 45 investments targeting a +9% overall yield, generating substantial passive income to help you achieve financial independence, regardless of age.

Stress can impair your health and well-being, so it's crucial to find efficient ways to handle financial stress. The income method has helped many sleep better at night, and it could do the same for you.