Trend Day Continuation Above 4185, Needs To Sustain

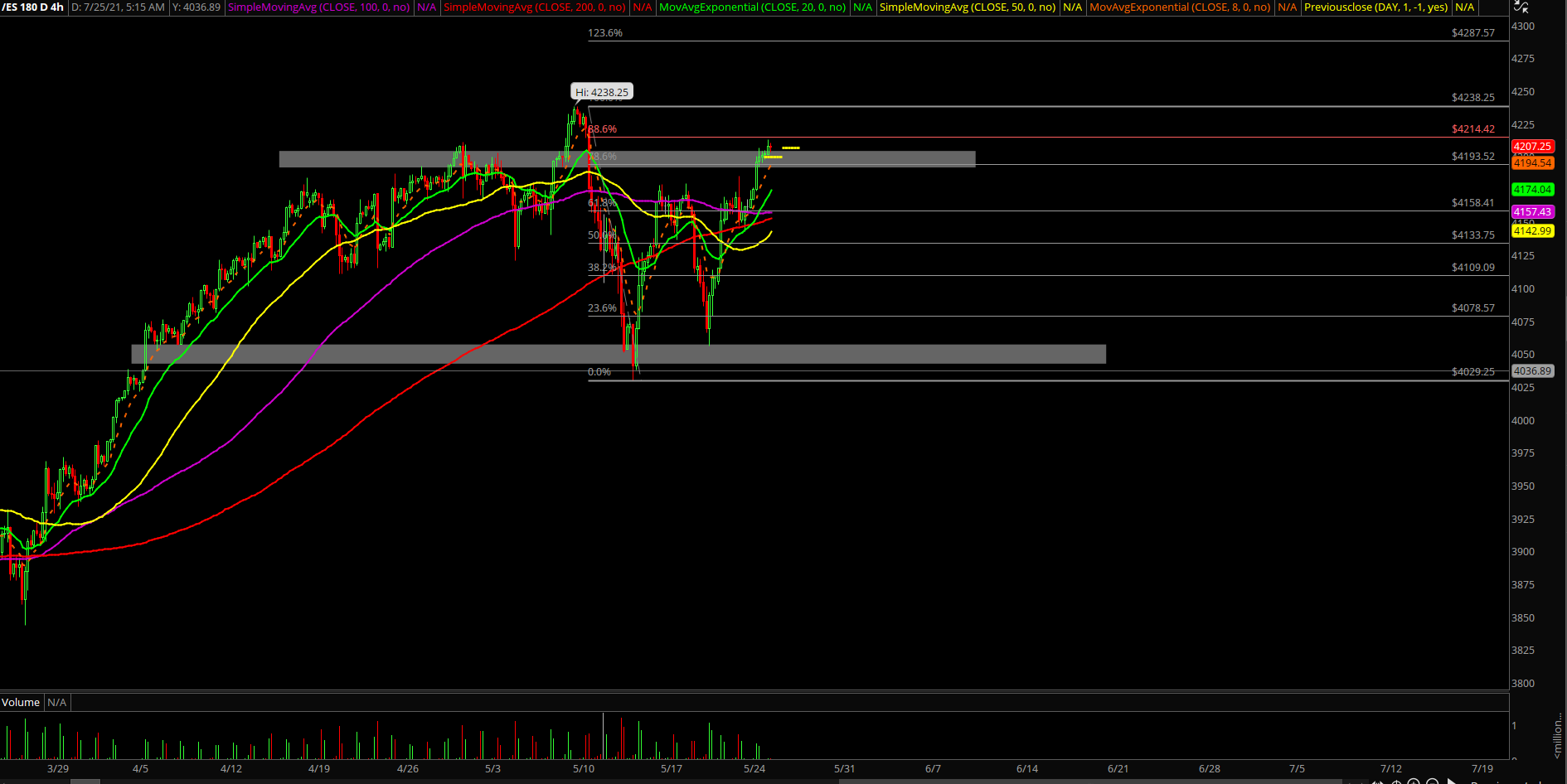

Yesterday played out as expected, as price action reclaimed 4185 on the Emini S&P 500 (ES) and produced an uptrend day into the 4200 key level.

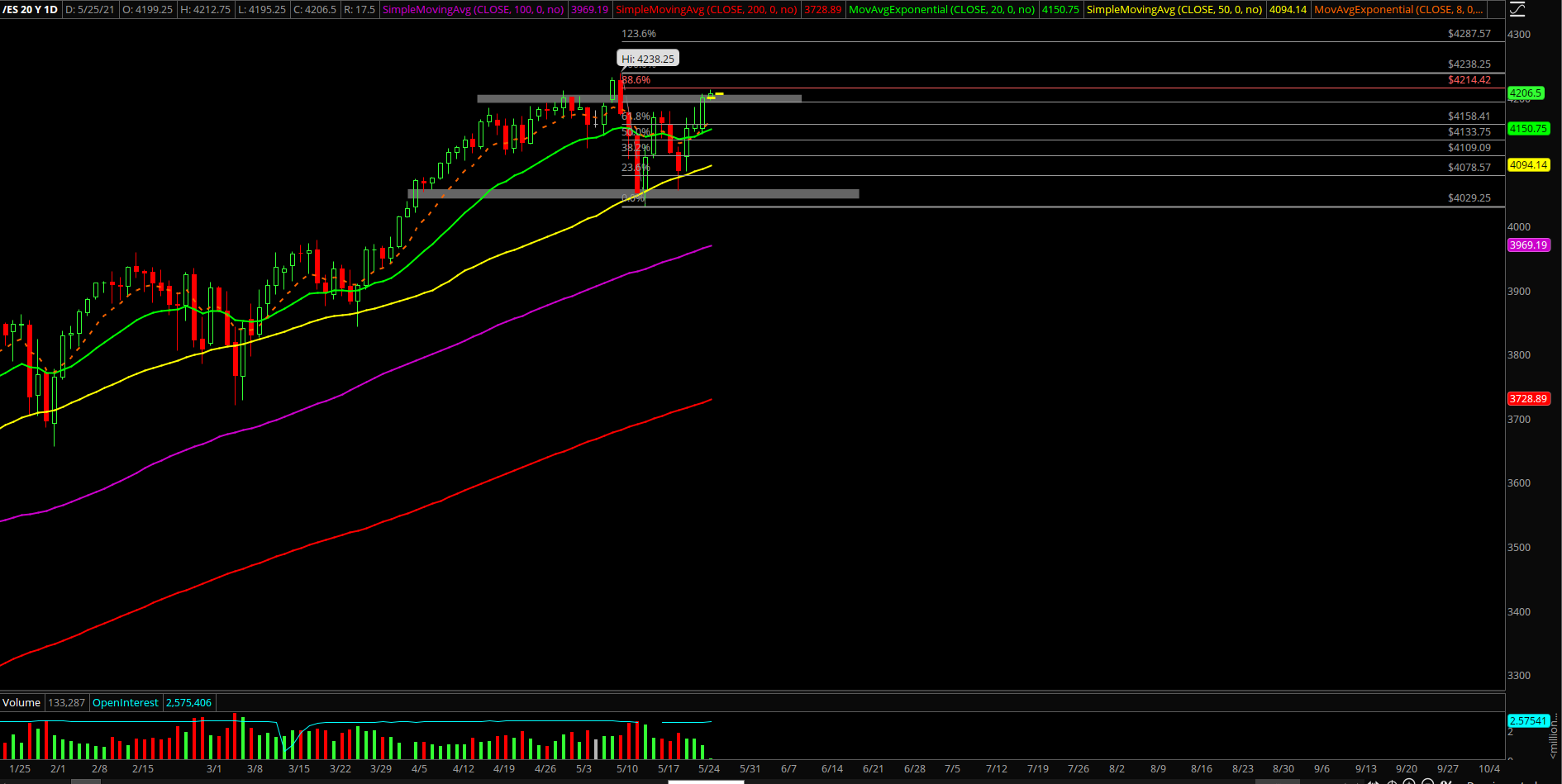

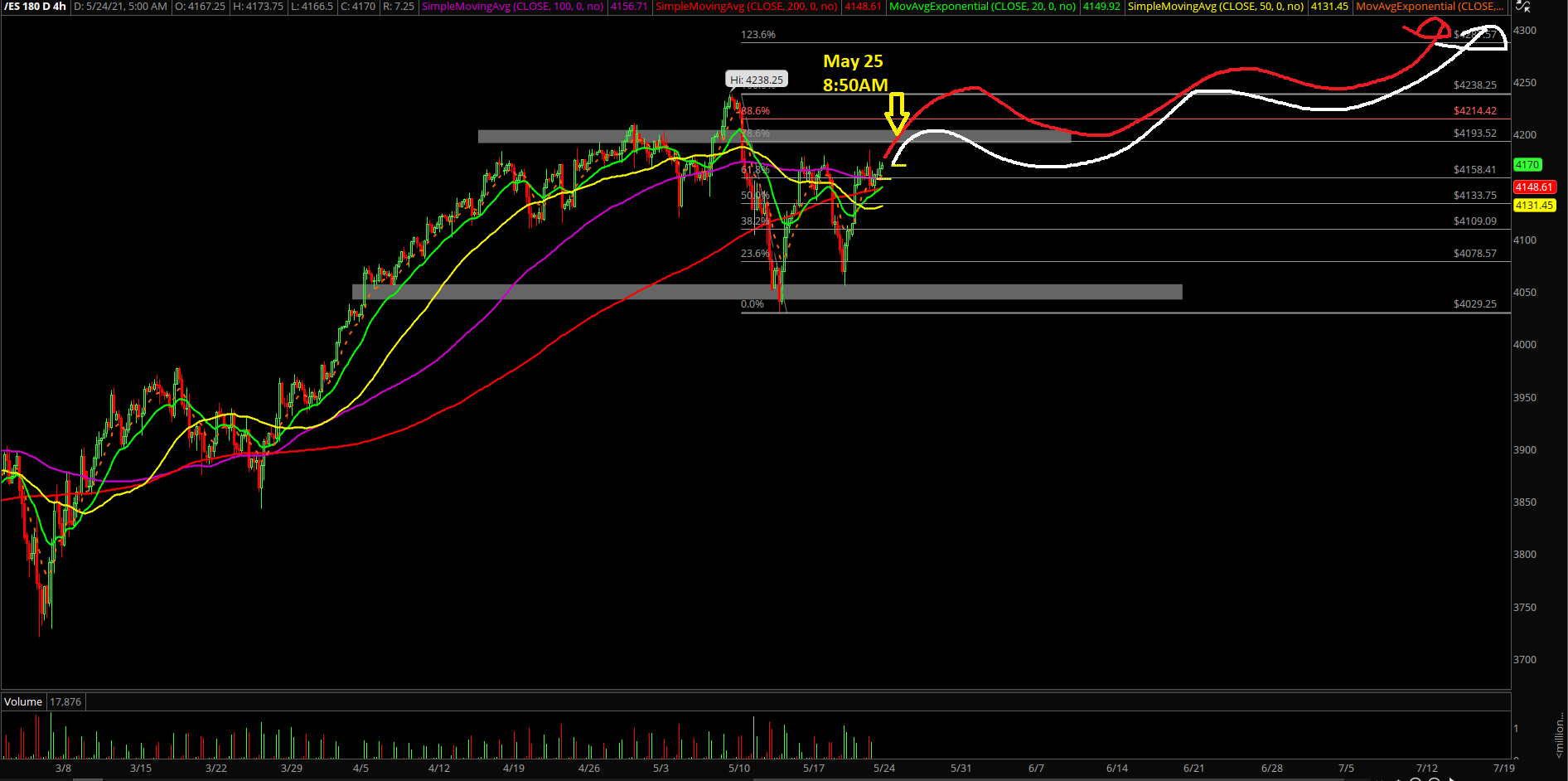

the market is following our projections chart. If you recall, last week’s range was 4185-4055 within the second week of May’s 4238-4029.

When yesterday’s morning action went above 4185, the breakout was easy to judge momentum.

Immediate supports have moved up significantly to 4185 and 4140 so manage risk exposure and know your timeframes

We maintain the same basis going into this week and June: ES 4238-4250 target when above our key trending supports. Every dip is an opportunity given the clear risk vs reward for the next 5-15 sessions. If below supports, adapt or die as price action is dynamic not static

Again, ES and NQ have formed their multi-day/week low given the context of ES 4029 vs 4055 lows and NQ 12915 vs 12954. We remain long and strong when above trending immediate supports.

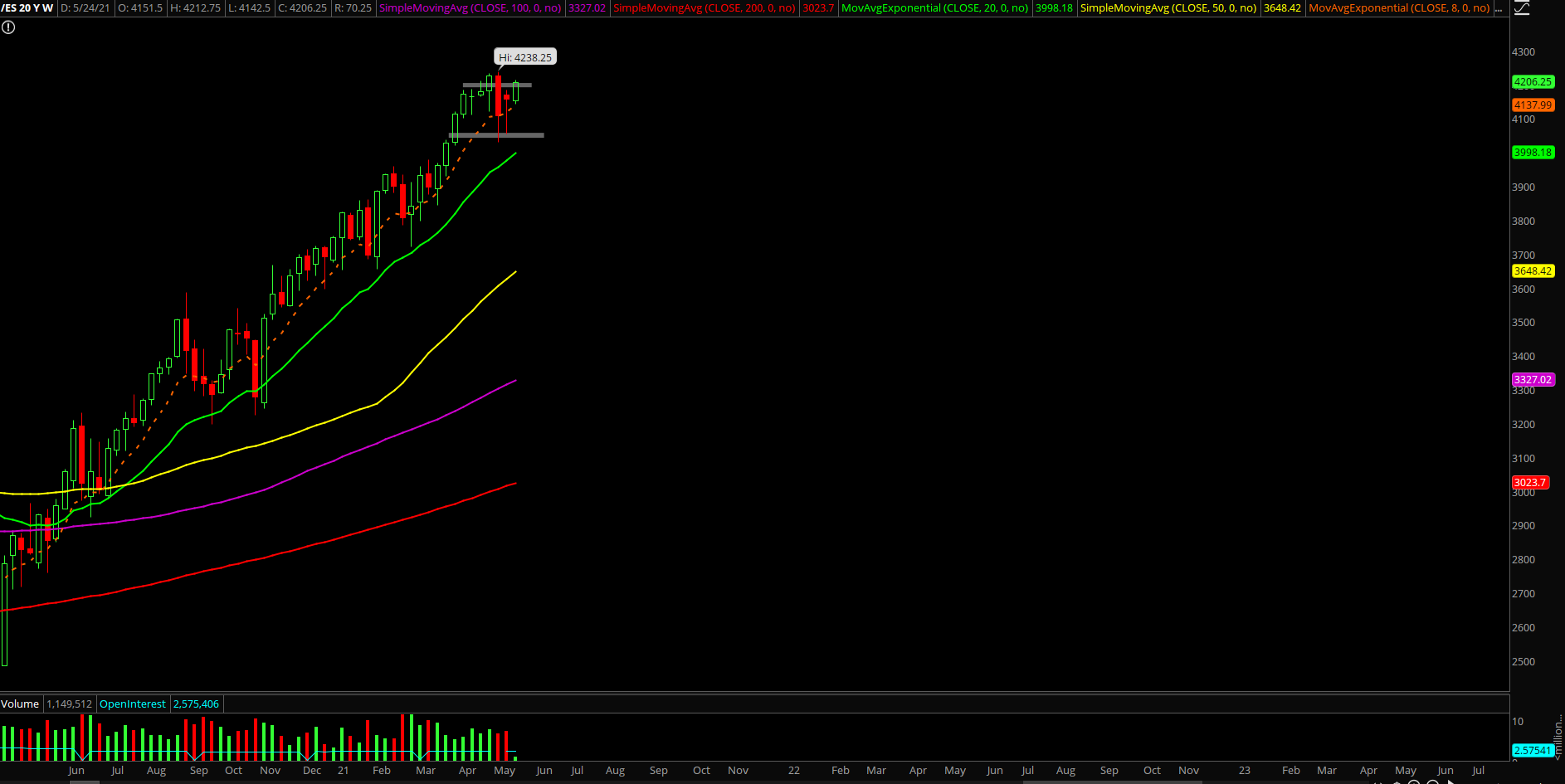

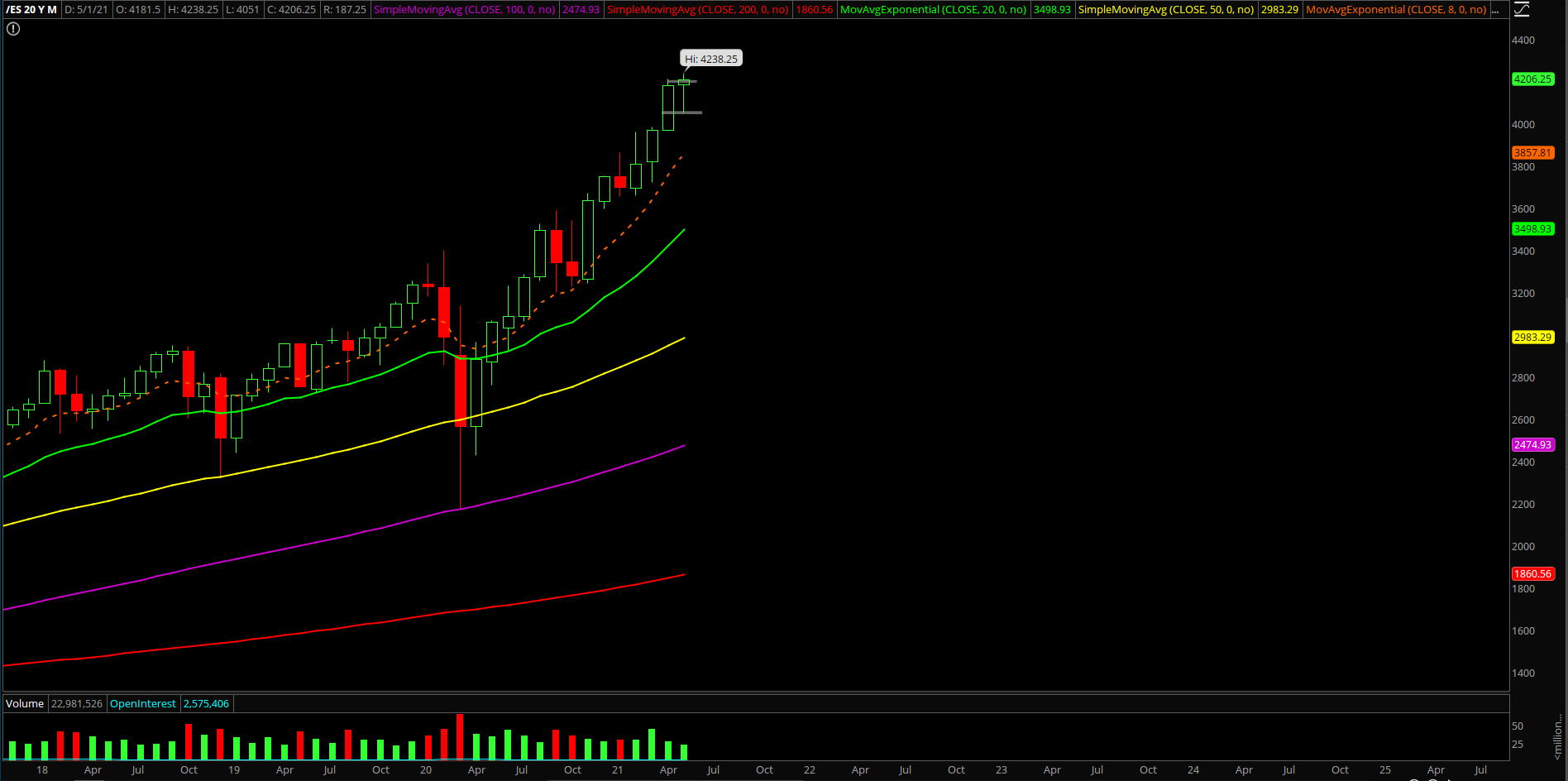

Bigger picture0wise, month of May is just a consolidation setup in a massive bullish trending monthly context. It’s resting/digesting before the market attempts higher highs into rest of this year (when above 3965 SHTF). Pull up our/your monthly chart and you can clearly see it.

Bonus note: RTY/small caps may be playing catch up as we noted in real-time via yesterday’s setup, see if it confirms an acceleration today/tomorrow. Need to see above 2245 to fast forward towards 2300. Otherwise, more consolidation/basing pattern and need more time.