Tradable Shot at SPY 300

Correctly stepping aside for the 2,000 Dow point fall on March 9, the Bayesian Timing System (BTS) got back in the long game at the LOD on March 9 to correctly sell in the morning on March 10. Then at the LOD in the afternoon on March 10, the BTS was back at it with a long signal.

At the close on March 10 it looked like the correct call, but as of premarket on March 11 price action is still positive for our indices’ signals, but definitely some volatility working against us. What does it all mean?

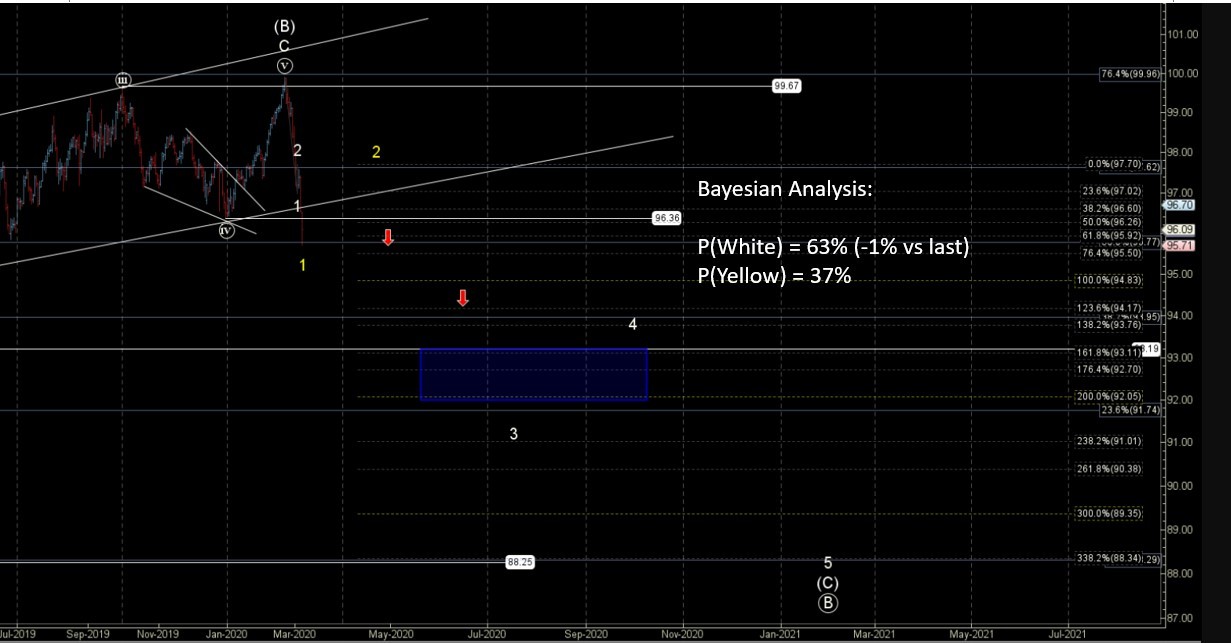

Not much has changed from the on-going dialogue. We are at an important bottoming region in the 270s, and the BTS has determined this risk-return set up is worth it. We have already discussed and know our risk, because if the 270s break, then we are looking at the low 260s.

So for now we control our emotions and trade the probabilities and real time trade signals. The BTS still sees a tradable shot at seeing the 300s again and even having "the bottom in." Here are paths that summarize this:

(1) [Probability=64%] SPY had "its bottom" on March 9 and generally pushes back to ATHs in the 340s, (2) [P=36%] SPY breaks the March 9 low and continues to the low 360s, where another attempt to base is likely (or worse).

We still need to see 285 hold for more than a few hours to get our sustainable push higher – this would target 310-315. If 295-305 is then held on a pullback from the 310s, then its off to the 340s.

There is still a vibration window (vw) showing up for late this week/early next week. A vibration window is a moment in time that serves as resistance or support in price, usually manifesting as a relative high or low in price. You know the drill for those and they have been very influential of late (and even properly calling for the volatility over the last week of February).

Bottom line: The BTS sees a base in the low 270s or low 260s, with the current signal supporting the former.

Intermediate-term our outlook is generally the same, with the BTS still expecting 340s to be seen again before either a sustainable bull or bear market really gets going.

Finally, for those that lean bull market for another few years, averaging in between 260-280 isn’t a terrible idea if you have longer-term cash to put to work.